Ever sat at a bar and argued about how big California actually is? People love to toss around the "if California were a country" line like it’s some kind of trivia trump card. Well, as of early 2026, that trivia isn't just a fun fact anymore—it’s a massive geopolitical reality that's making some world leaders look over their shoulders.

Honestly, it’s kinda wild. When you look at the GDP of US states compared to countries, you start to realize the United States isn't just one giant economy. It’s a collection of several mini-superpowers masquerading as states. We aren't talking about small-fry nations either. We're talking about states that produce more value than Japan, India, or the United Kingdom.

The California vs. The World Heavyweight Match

Let's get into the big one. For years, California hovered around the 5th or 6th spot globally. But things shifted. According to IMF and Bureau of Economic Analysis data from late 2025, California has effectively leapfrogged Japan to claim the title of the 4th largest economy in the world.

Think about that for a second.

California’s nominal GDP is sitting pretty at roughly $4.1 trillion. That puts it behind only the U.S. as a whole, China, and Germany. Japan, which struggled with a weakening yen and sluggish growth throughout 2024 and 2025, slipped to around $4.28 trillion globally, but California's growth rate—a spicy 6% in some quarters—has made the gap between the Golden State and a literal G7 nation almost non-existent.

- California: ~$4.1 Trillion

- Japan: ~$4.28 Trillion

- India: ~$4.13 Trillion

It’s a three-way race right now. India is growing faster than almost everyone, but California’s tech and entertainment sectors are basically money-printing machines. If you're wondering how a single state pulls this off, it's not just Hollywood. It’s the sheer concentration of venture capital in Silicon Valley and a massive agricultural sector that feeds half the country.

Texas Is Chasing Down the G7

If California is the tech-heavy giant, Texas is the industrial titan. If Texas were a country, it would currently rank as the 8th largest economy on Earth. It recently blew past Russia and Canada.

📖 Related: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

Texas has a nominal GDP of about $2.7 trillion.

It’s hilarious to think that the Lone Star State is economically more powerful than a nuclear-armed nation like Russia (which sits around $2.5 trillion) or our neighbors to the north in Canada ($2.3 trillion). Texas isn't just about oil anymore, though that’s still a huge chunk of the pie. The "Texas Triangle" (Dallas-Houston-Austin) has become a secondary Silicon Valley. Companies are fleeing high-tax states for Texas, and the numbers show it.

Honestly, the rivalry between California and Texas is basically a proxy war for the future of the global economy. One is betting on high-regulation, high-tech, and green energy; the other is betting on deregulation, manufacturing, and traditional energy. Both are winning.

The Mid-Tier States That Outpunch Nations

It’s not just the top two. The depth of the US economy is sorta terrifying when you look at the "smaller" players.

Take New York. With a GDP of roughly $2.3 trillion, New York would be the 10th or 11th largest economy in the world. It’s neck-and-neck with Brazil and Italy. While Wall Street is the obvious driver here, the state has been diversifying into biotech and upstate tech manufacturing.

Then there’s Florida. Florida’s economy is basically a $1.6 trillion monster. That makes it larger than Spain or Indonesia. Most people think of Florida as "the place where people go to retire," but it has turned into a massive hub for finance and aerospace.

👉 See also: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

- Florida GDP: $1.61 Trillion

- Spain GDP: $1.58 Trillion

- Mexico GDP: $1.49 Trillion

You read that right. Florida produces more economic value than the entire country of Spain.

Why the Comparison Isn't Always Apples-to-Apples

I’ve gotta be real with you—these rankings can be a bit deceptive. Comparing a state to a country is fun, but countries have responsibilities states don't.

France or the UK have to pay for their own militaries, manage their own currency, and handle complex international treaties. California just has to worry about its own budget (though that’s a headache in its own right). Also, when you look at Purchasing Power Parity (PPP), things change.

In nominal terms, US states look like world-beaters because the dollar is so strong. But if you adjust for the cost of living, a country like India looks way bigger than California because a dollar goes much further in Mumbai than it does in San Francisco.

Still, in terms of raw "who has the most money to spend on the global market," the US states are dominant.

The "Lower" Half Still Wins

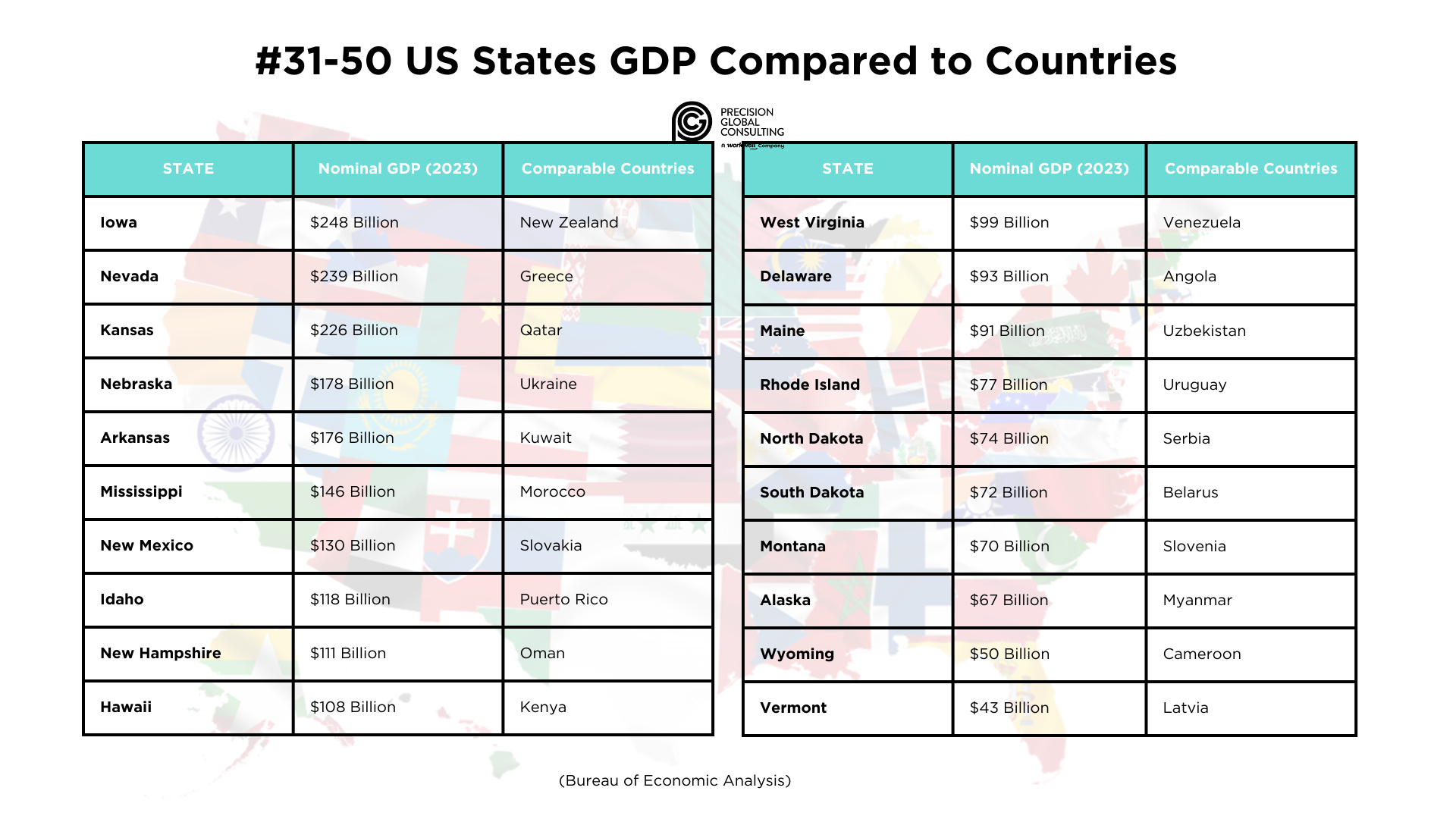

Even the states we don't think of as "rich" would be significant players on the world stage.

✨ Don't miss: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

- Illinois is roughly the size of the Netherlands' economy.

- Pennsylvania is on par with Turkey or Saudi Arabia.

- Ohio is roughly equivalent to Switzerland.

It's a weird reality. You could take almost any "average" US state and it would be a top 50 economy globally. This isn't just about bragging rights; it's why the US has such a massive influence on global trade. When Georgia (the state) decides on a new port expansion, it has ripple effects that hit the GDP of European nations.

What This Means for You

If you’re an investor or a business owner, this data tells a specific story: Domestic diversity is your friend. You don't necessarily need to "go global" to find diverse markets. Moving a business from the tech-heavy ecosystem of Washington state to the manufacturing hub of South Carolina is, in economic terms, like moving between two different medium-sized European countries.

Actionable Insights to Take Away:

- Watch the "Big Four": California, Texas, New York, and Florida. They are the engines. If one of them hits a recession, it’s not just a local problem—it’s a global event on the scale of a European country failing.

- Don't Ignore Growth States: North Dakota and Kansas had some of the highest growth rates in 2025. They might be small, but they are becoming specialized hubs for energy and agriculture.

- Diversify Regionally: If your business is tied entirely to one state's economy, you’re exposed to that state’s specific regulatory and tax climate. Treat US states like different countries in your portfolio.

- Track the Dollar: Since these comparisons rely on nominal GDP, a weaker dollar makes the states look "smaller" compared to international rivals. Keep an eye on Fed rates if you're tracking these rankings for investment purposes.

The world is changing, and the lines between states and nations are getting blurrier every year. California might not have a seat at the UN, but when it speaks, the global economy listens just as closely as it does to Japan or Germany.

Next Steps for Deep Research:

- Check the Bureau of Economic Analysis (BEA) for the most recent quarterly state-level updates.

- Compare these figures against the IMF World Economic Outlook to see how currency fluctuations are impacting the rankings in real-time.

+(8).png)