You open your mailbox, and there it is. That familiar, thin envelope from the Fulton County Tax Commissioner. If you're like most of us living in Atlanta, Sandy Springs, or Milton, your heart probably sinks just a little before you even see the number. It’s not just about the money. It’s the sheer confusion of how they even got to that total.

Honestly, the tax bill Fulton County sends out every year is less of a simple invoice and more of a complex puzzle involving three different government layers, a dozen potential exemptions, and a valuation process that sometimes feels like it was decided by a dartboard.

Let's be real: 2026 has been a bit of a rollercoaster for property owners. Between the ongoing drama at the Rice Street jail and the ever-shifting millage rates, your bill this year might look a lot different than it did two years ago.

Why Your Bill Feels Like a Moving Target

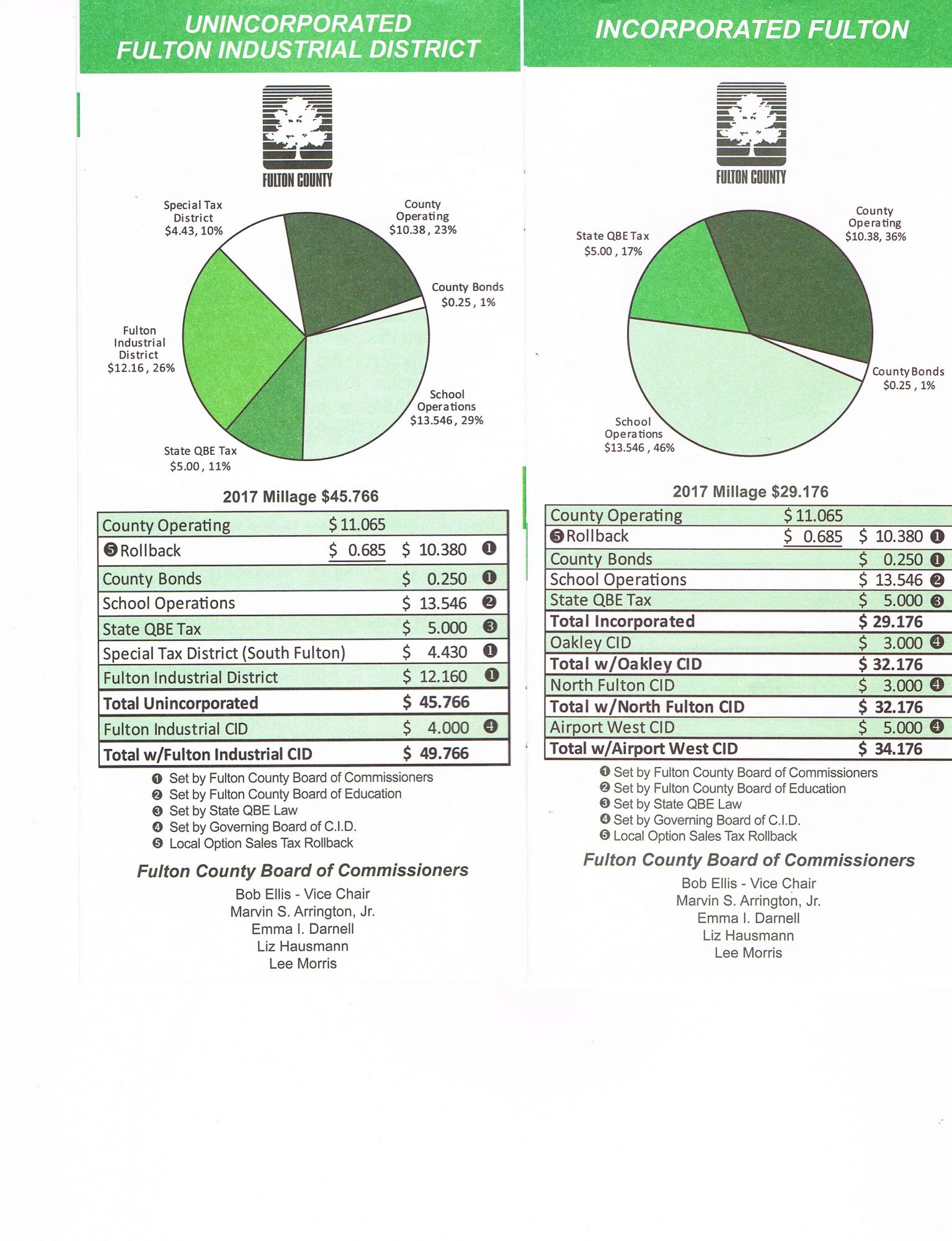

The biggest mistake people make is thinking their tax bill is just one "price" for living in the county. It’s actually a cocktail. You’ve got the county’s general fund, the school board’s massive chunk, and then whatever your specific city wants for police and parks.

Right now, the big talk in the Commissioner's office is the "jail tax." As of early 2026, the Board of Commissioners has been wrestling with a budget that includes a massive $19.5 million increase specifically to comply with federal orders to fix the Fulton County Jail. This isn't just bureaucracy; it's a "consent decree," which is basically a fancy legal way of saying the feds are forcing the county to spend money they don't necessarily have.

What does that mean for you? Well, the proposed budget for 2026 includes a potential millage rate hike of about 4%. If you own a home with a fair market value of $400,000, you're looking at an extra $60 to $70 just for the county portion. That might not sound like a ton, but when you add it to rising school taxes and city fees, it starts to sting.

Commissioner Khadijah Abdur-Rahman has been pretty vocal about fighting this, arguing that people are already stretched thin. But the reality is that the county is between a rock and a hard place—fix the jail or face massive federal fines.

The "Invisible" Numbers: Assessments vs. Rates

People get these two mixed up constantly.

- The Assessment: What the Board of Assessors thinks your house is worth.

- The Millage Rate: The "tax rate" set by the politicians.

If your house value goes up (which it probably has, given the Atlanta market), your tax bill Fulton County issues will go up even if the millage rate stays exactly the same. It's the "backdoor tax hike" that drives everyone crazy.

Last year, they held the line at 8.87 mills. But in 2026, with the jail upgrades and the new judicial officers being appointed to handle the case backlog, that "flat" rate is under heavy fire.

The New Senior Relief You Probably Missed

There is a bit of good news, but only if you’re paying attention. Starting with the 2026 tax year, there’s a new senior homestead exemption for the school district portion of your taxes.

🔗 Read more: Apollo Tyres Share Price: What the Charts Aren't Telling You

If you are 70 or older and have lived in your home for at least five of the last six years, you might be eligible for a 50% reduction in the school tax portion of your bill. But here is the catch: it isn't automatic. You have to apply. Even if you already have a "regular" homestead exemption, you have to file specifically for this new one. The deadline? April 1, 2026. If you miss that date, you’re essentially handing the county a donation you didn’t need to give.

How to Fight Back (The Appeal Secret)

Most people think appealing their assessment is a huge, legal headache. It sort of is, but it’s often worth it.

When you get your Notice of Assessment (usually in late spring), you have exactly 45 days to say, "No, you're wrong." If you don't file by that deadline, you're stuck with whatever number they gave you.

Here’s a tip from the pros: When you appeal, you can choose to be billed at 85% of the new value while the fight is going on. This is huge if you can't afford a massive spike all at once. If you win the appeal, you’ve already paid the lower amount. If you lose, you’ll just get a "corrective" bill later for the difference.

- Evidence is king. Don't just say "taxes are too high." They don't care.

- Show them the cracks. Did your neighbor’s house sell for less? Do you have a foundation issue the county doesn't know about? Take photos.

- The 3-Year Freeze. This is the "Holy Grail" of Fulton taxes. Under Georgia law (O.C.G.A. 48-5-299(c)), if you win a reduction at the Board of Equalization, the county generally can't raise your assessment for the next three years. It "freezes" your value.

Paying the Bill Without Losing Your Mind

Arthur Ferdinand, the long-standing Tax Commissioner, is known for being... efficient. He collects a higher percentage of taxes than almost anyone in the country. That’s great for the county's credit rating, but it means he doesn't play around with deadlines.

The main tax bill Fulton County residents receive is usually due October 15. If you’re in the City of Atlanta, that portion might be due as early as August 15.

Payment Methods that Actually Work:

- Online: It’s the fastest, but watch out for the 2.5% "convenience fee" on credit cards. On a $5,000 tax bill, that’s $125 just for the privilege of using plastic. Use an e-check if you want to keep that money.

- The Drop Box: There are boxes at the Government Center on Pryor Street and the North/South Service Centers. Just don't wait until 4:59 PM on the due date.

- The Mail: It must be postmarked by the due date. Not "in the system," but actually stamped.

If you miss the deadline, the interest starts at 1% per month. Then comes the 5% penalty every 120 days. Before you know it, a "oops, I forgot" turns into a "how do I save my house from a tax lien" situation.

Actionable Steps for 2026

Stop treating your tax bill like a static expense. It’s a variable you can influence.

1. Check your exemptions immediately. Go to the Fulton County Board of Assessors website. If you don't see "Homestead" listed on your property, you are literally throwing money away. If you turned 65 or 70 recently, there are specific "Senior" tiers that can slash your bill by thousands.

2. Mark April 1 on your calendar. That is the hard deadline for all new exemption applications.

3. Watch for the May Assessment. When that letter comes in May 2026, don't just file it away. Compare it to your neighbors on the "SmartFile" portal. If your value jumped 20% but the house next door stayed flat, you have a "Uniformity" claim for an appeal.

4. Budget for the 4% increase. If the jail funding passes as expected, your October bill will be higher. If you pay through an escrow account with your mortgage company, they might not adjust your monthly payment until after they pay the bill, which could lead to a "shortage" and a nasty jump in your mortgage payment next year. Call your lender and tell them to look at the new Fulton millage rates early.

The system is designed to be confusing, but once you realize that the tax bill Fulton County issues is based on data that is often 12-18 months old, you can start to find the errors. Don't just pay it because you have to; pay it because you've verified it's actually what you owe.