Tax season is usually a headache. For most people, it's that looming cloud of paperwork and the fear of making a mistake that triggers a fine from the IRS. But honestly, if you're over 65, the biggest mistake you’re probably making isn't a math error. It's paying a hundred bucks—or more—to a software company when you don't have to. Free tax filing seniors programs exist specifically because the government realizes that a lot of folks on fixed incomes shouldn't be drained by filing fees.

You’ve likely seen the commercials. Big tax prep companies promise "free" filing, but then you hit a screen that says your Social Security income or your modest pension "requires an upgrade." It's frustrating. It feels like a bait-and-switch.

The Reality of Free Tax Filing Seniors Programs

The IRS doesn't actually want you to struggle with this. They have a massive interest in you getting your return right the first time so they don't have to spend resources auditing a $25,000-a-year pension. That's where the Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs come in.

TCE is the big one for seniors. It’s managed by the IRS but often operated by the AARP Foundation’s Tax-Aide program. This isn't just some basic web form; it’s actual human beings who are IRS-certified volunteers. They specialize in questions about pensions, 401(k) distributions, and the weird tax nuances that come with Medicare premiums.

Most people don't realize that the TCE program is specifically prioritized for people aged 60 and older. If you're worried about the technology side of things, these volunteers handle the data entry for you. You just bring the shoebox of receipts and your forms.

Why AARP Tax-Aide is Different

Don't let the name fool you. You don't have to be an AARP member to use this. They’ve got thousands of sites across the country—libraries, community centers, even local malls. It’s a massive operation.

✨ Don't miss: Getting a Mortgage on a 300k Home Without Overpaying

The volunteers go through rigorous training every single year. They have to pass a test that is frankly harder than what some seasonal employees at big-box tax chains have to take. They understand the Standard Deduction for Seniors, which is a crucial detail many people miss. If you are 65 or older, you get an extra bump on your standard deduction. For the 2024 tax year (the ones you're filing in early 2025), that extra amount is $1,950 for single filers. If both you and your spouse are over 65, that’s an extra $3,100 off your taxable income.

If you use a "free" version of a popular app, it might not automatically prompt you for that. A human at a TCE site will.

IRS Free File vs. The "Big Guys"

There is a lot of confusion about IRS Free File. Basically, the IRS partnered with a bunch of software companies to provide their full-scale products for free to people under a certain income threshold. For 2024, that limit is generally $79,000 in Adjusted Gross Income (AGI).

If you're a senior living primarily on Social Security, your AGI might be much lower than you think. Social Security isn't always fully taxable. In fact, if your only income is Social Security, you might not even be required to file, though you probably should if you want to claim certain credits or get back any money that was withheld.

The problem? You have to go through the IRS.gov website to get the real free deal. If you go directly to the software company's website, they might steer you toward the paid version. It’s a sneaky tactic. Always start at the IRS Free File lookup tool.

🔗 Read more: Class A Berkshire Hathaway Stock Price: Why $740,000 Is Only Half the Story

Military Seniors and Retiring Professionals

If you’re a retired veteran, MilTax is your best friend. It’s a Department of Defense program that provides 100% free tax software and consultations. It’s built to handle the complexities of military retirement pay and survivor benefits.

The "Standard Deduction" Trap

Most seniors should not itemize. Ever since the tax laws changed a few years back, the standard deduction became so high that it’s almost impossible for a retiree with a paid-off mortgage to beat it with itemized deductions.

But here is where it gets tricky: Qualified Charitable Distributions (QCDs).

If you have an IRA and you're over 70½, you can send money directly from your IRA to a charity. This is a huge win for free tax filing seniors who want to lower their tax bill. The money goes to the charity, it satisfies your Required Minimum Distribution (RMD), and—here is the kicker—it doesn't count as taxable income.

If you just take the RMD as cash and then write a check to the charity, you might pay taxes on that money. A volunteer at a TCE site will know how to report a QCD so the IRS doesn't think you owe money on that distribution. A basic "free" algorithm on a website might miss it if you don't check the exact right box.

💡 You might also like: Getting a music business degree online: What most people get wrong about the industry

How to Prepare for Your Appointment

Don't just show up. You need a "tax envelope" or a folder. This is where most people fail and end up having to make two trips.

You absolutely need:

- A government-issued photo ID (Driver's license or passport).

- Social Security cards for everyone on the return. (Yes, even if you’ve had the same spouse for 50 years, the volunteers need to see the card to prevent identity theft).

- Your 1099-R forms (for pensions and IRAs).

- Your SSA-1099 (the pink-ish form Social Security sends in January).

- A copy of last year’s return. This is the most important document because it shows the "carryover" items that might affect this year.

Common Misconceptions About Senior Filing

I hear this all the time: "I don't need to file because my income is too low."

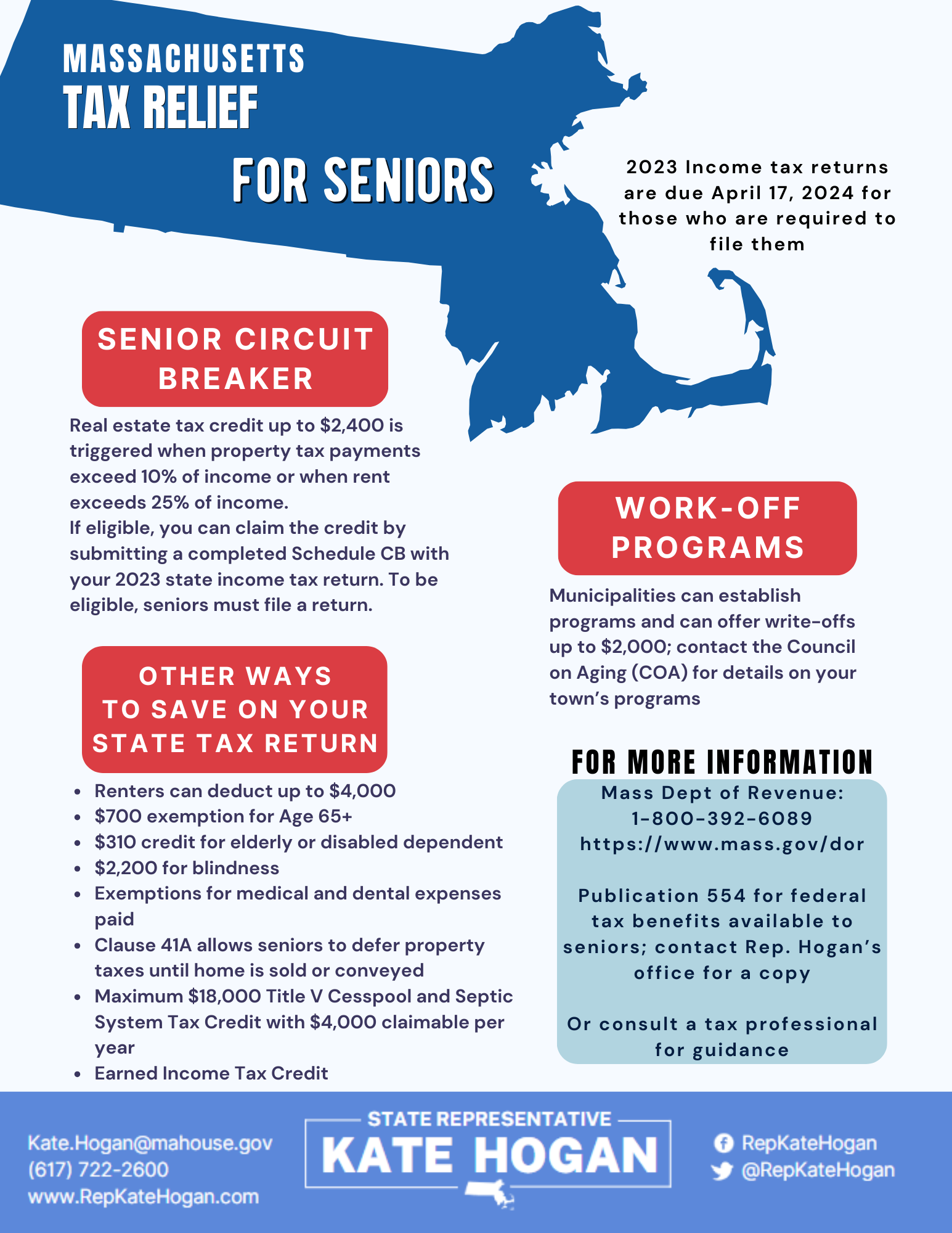

Maybe. But what about the Credit for the Elderly or the Disabled? What about state-specific property tax credits? In many states, even if you don't owe federal tax, filing a return is the only way to trigger a "circuit breaker" credit that refunds part of your property taxes. If you don't file, you're literally leaving money on the table.

Also, scammers love tax season. They target seniors specifically. If you get a phone call from "the IRS" saying you owe money and must pay via a gift card, hang up. The real IRS initiates contact through the U.S. Mail. Using a verified program like AARP Tax-Aide or VITA gives you a layer of security because you're working with vetted, local people in a secure environment.

Where to Find Help Right Now

The IRS has a "VITA Locator Tool" on their website. You just type in your zip code. It'll show you the nearest library or church hosting a clinic. Most of these start up in late January and run through April 15. Some require appointments; others are "drop-off" where you give them your papers and come back in a week to sign.

Actionable Next Steps for Filing

- Check your AGI: Look at your 2023 tax return. If your income is under $79,000, you qualify for IRS Free File software.

- Locate a TCE Site: Use the AARP Foundation Tax-Aide locator or the IRS VITA tool. Do this in February. If you wait until April, the appointments are gone.

- Consolidate 1099s: Keep a dedicated folder for every piece of mail that says "Important Tax Document." By mid-February, you should have them all.

- Ask about the QCD: If you gave money to a church or charity directly from your IRA, make sure you have the acknowledgement letter. Tell your preparer immediately.

- Direct Deposit: Bring a voided check. Even if you don't think you're getting a refund, it's better to have your bank info on file so the IRS can send any future stimulus or credits directly to you rather than mailing a check that could get lost.

Tax prep shouldn't be a profit center for corporations when you've already spent decades paying into the system. Use the resources that were built for you. There is no shame in getting expert help for free—it’s actually the smartest financial move you can make this quarter.