You've finally reached the age where the IRS decides to give you a break—or at least, that’s how they market it. If you’re 65 or older, you’ve likely heard about the "senior version" of the standard tax form. It’s called Form 1040-SR 2024. Most people think it’s some magical shortcut that automatically lowers their tax bill or changes the math of their retirement.

It doesn't.

Honestly, the math is identical to the standard 1040. The real difference is much more low-tech than you’d expect. The IRS essentially took the regular form and printed it in a giant font with more white space so you don't need a magnifying glass to find Line 15. But while the form itself is just a "large print" version of the classic, the rules surrounding it for the 2024 tax year have some specific quirks that can actually save you money if you know where to look.

Don't let the big font fool you into being lazy.

Why Form 1040-SR 2024 exists (and why it’s not for everyone)

The IRS introduced this form back in 2019 because of the Bipartisan Budget Act. It’s specifically designed for people who were born before January 2, 1960. If you hit that cutoff for the 2024 tax year, you’re eligible. But here’s the kicker: just because you can use it doesn't mean you must.

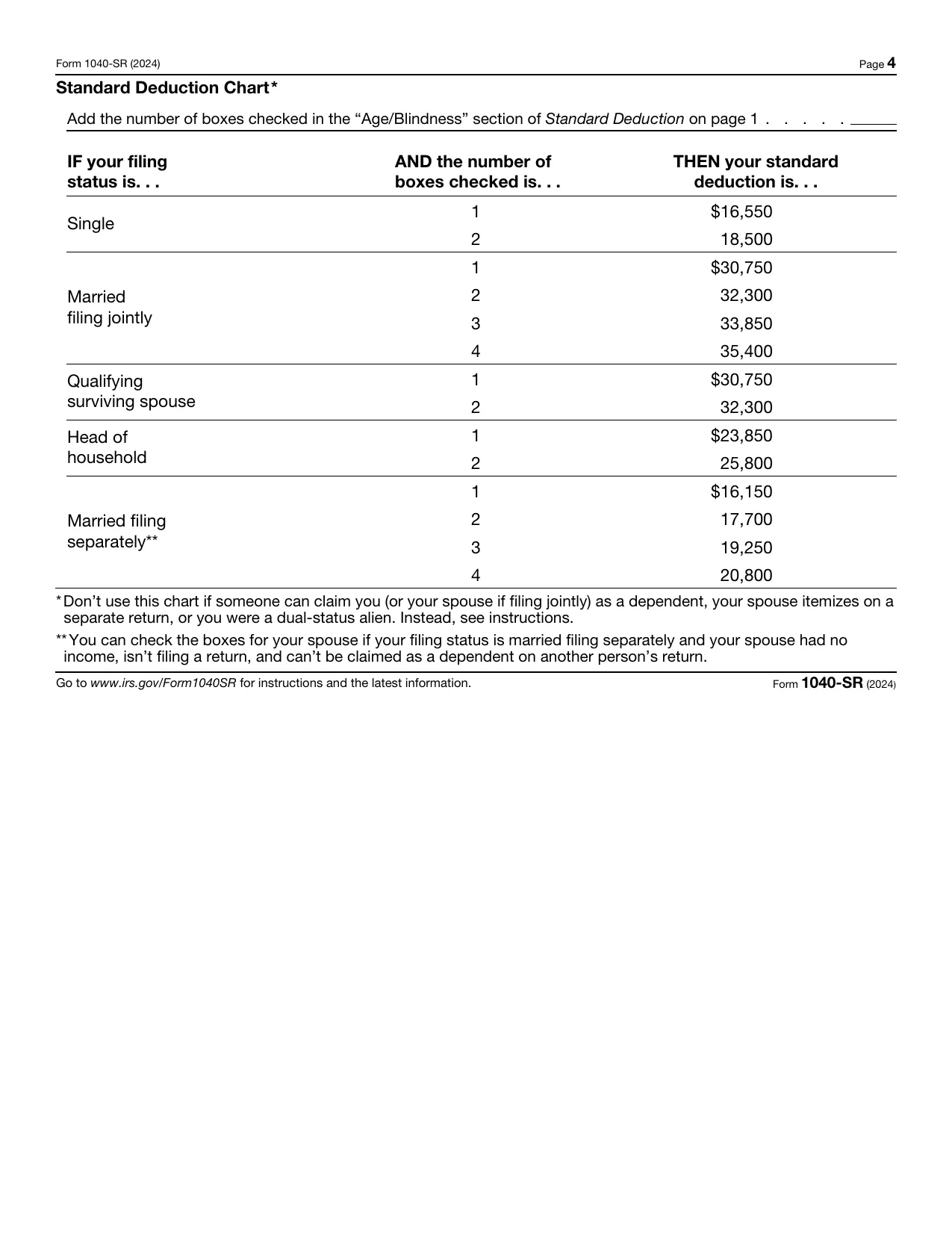

I’ve talked to seniors who get stressed out because their tax software prints a 1040 instead of a 1040-SR. Relax. It’s fine. They are interchangeable. The 1040-SR 2024 is technically "Form 1040-SR, U.S. Tax Return for Seniors." It includes a handy standard deduction table right on the form. This is huge because, as a senior, your standard deduction is higher than it is for the "young folks."

For 2024, if you’re 65 or older and single, you get an extra $1,950 on top of the base $14,600 standard deduction. If you’re married filing jointly and both of you are 65+, that’s an extra $3,100. That’s not chump change. It’s real money that stays in your pocket instead of going to Uncle Sam.

The Standard Deduction Trap

Most people just take the standard deduction and call it a day. It’s easy. It’s safe. But for 2024, the IRS has seen a massive uptick in people reaching the age where they have significant medical expenses.

If you spent a fortune on dental implants, hearing aids, or long-term care insurance premiums this year, you might actually be better off itemizing on Schedule A rather than using the standard deduction table on the 1040-SR. You have to beat that $16,550 threshold (for singles) to make it worth it. If your medical bills alone are $10,000 and you have property taxes and mortgage interest, do the math. Don't just default to the "senior" shortcut because it's printed on the page.

Real nuances in Social Security taxation

This is where things get messy. Form 1040-SR 2024 has a specific line for Social Security benefits (Line 6). A common myth is that Social Security isn't taxable. I wish that were true.

The reality? Up to 85% of your benefits could be taxable depending on your "combined income." This isn't just your AGI. It’s your adjusted gross income + tax-exempt interest + half of your Social Security benefits.

👉 See also: What Dollar Bill is Benjamin Franklin On: Why a Non-President Is Our Biggest Bill

- If you’re an individual and that total is between $25,000 and $34,000, you might pay tax on up to 50% of your benefits.

- Over $34,000? You're looking at 85%.

I’ve seen people get hit with a massive, unexpected tax bill because they took a large withdrawal from their traditional IRA to buy a camper or help a grandkid with college. That withdrawal pushed their combined income up, which triggered a tax on their Social Security. It’s a double whammy.

The RMD headache for 2024

We have to talk about Required Minimum Distributions (RMDs). For 2024, if you turned 73 during the year, you have to start taking money out of your traditional IRAs and 401(k)s.

Wait.

The SECURE 2.0 Act changed the ages. It used to be 70 ½, then 72, now it’s 73. It’s confusing. If you don’t take your RMD, the penalty is 25%. That’s a quarter of your money gone just because you forgot a deadline. If you correct the mistake within two years, the penalty might drop to 10%, but why give the IRS anything?

When you fill out your Form 1040-SR 2024, those RMDs count as taxable income on Line 4 or 5. If you don't need the money to live on, consider a Qualified Charitable Distribution (QCD). You can send up to $105,000 (for 2024) directly from your IRA to a charity. It satisfies your RMD requirement but doesn't count as taxable income. This keeps your AGI lower, which can help lower your Medicare premiums. It’s a brilliant move that too many people overlook.

📖 Related: IBIT ETF Price Today: What Most People Get Wrong About BlackRock's Bitcoin Giant

Schedule R: The "Secret" Credit

There is a specific credit called the Credit for the Elderly or the Disabled. You use Schedule R with your 1040-SR. Honestly, it’s hard to qualify for because the income limits are incredibly low. If you're single, your AGI has to be under $17,500. Most people with even a modest pension and Social Security will blow past that. But if you had a very low-income year or your primary income is non-taxable disability, check it out. It could be worth up to $1,125.

Digital vs. Paper: A word of caution

The IRS loves the 1040-SR because it’s easier for their scanners to read when people file on paper. But filing on paper is a gamble. It takes months to process. If you’re expecting a refund, file electronically. You can still use the 1040-SR format in basically every major tax software like TurboTax, FreeTaxUSA, or H&R Block.

Also, if your income is $79,000 or less, use the IRS Free File program. Don't pay a tax prep company $150 to fill out a form that’s literally designed to be simple.

Common mistakes to avoid this year

People get tripped up on the "blindness" box. On the 1040-SR 2024, there’s a checkbox for being 65+ and another for being legally blind. If you qualify for both, your standard deduction goes even higher. Don't skip these boxes. They are tucked away at the top of the form near your name and address.

Another one? Interest income. If you moved money into a High-Yield Savings Account (HYSA) or bought CDs when rates were high in 2023 and 2024, you’re going to have 1099-INT forms flying into your mailbox. Unlike your Social Security, 100% of that interest is taxable. If you forgot about a $500 interest payment from an old savings account, the IRS will find it. Their computers are better at matching 1099s than you are at remembering them.

Actionable steps for your 2024 return

Don't wait until April 14th to figure this out. The 1040-SR is simple, but the documentation behind it isn't.

First, gather your 1099-SSA (Social Security Statement) and all 1099-R forms for pension or IRA distributions. These are the backbone of your return.

Second, calculate your "combined income" now. If you’re hovering near the $25,000 or $32,000 (married) thresholds, you need to be careful with any last-minute capital gains or IRA withdrawals.

Third, check your medical expenses. If you had a major surgery or moved into an assisted living facility that provides medical care, your itemized deductions might crush the standard deduction provided by the 1040-SR 2024.

Fourth, if you are over 73, double-check that you’ve taken your RMD. If you have multiple IRAs, you can take the total RMD amount from just one of them. However, if you have a 403(b), you usually have to take an RMD from each specific account. This is a nuance that trips up retired teachers and healthcare workers every single year.

💡 You might also like: Why Campbell’s Soup Camden New Jersey History Still Defines the City

Finally, consider the state impact. States like Florida or Texas don't have income tax, so your 1040-SR is the end of the road. But if you live in a state like Vermont or West Virginia, they might tax your Social Security even if the federal government doesn't.

Using the Form 1040-SR 2024 is a smart move for clarity, but the real "win" is in the credits and deductions you find before you ever pick up a pen. Keep your records organized, watch those RMD deadlines, and don't be afraid to itemize if your health costs were a burden this year. It's your money. Keep more of it.