You’d think a company that moves $50 billion worth of trucks and SUVs in a single quarter would have the smoothest credit profile on the planet. Honestly, you’d be wrong. Dealing with the ford motor company credit rating is a bit like watching a long-distance runner who’s constantly swapping shoes mid-race. One minute they’re sprinting toward an upgrade, and the next, a global trade tariff or a battery plant delay trips them up.

It is January 2026, and the narrative around Ford’s financial health is getting spicy. We aren't just talking about boring spreadsheets here; we're talking about the survival of an American icon during the most chaotic transition in automotive history.

Where Does Ford Stand Right Now?

Let's get the raw numbers out of the way first. As we kick off 2026, the ford motor company credit rating sits primarily at BBB- with S&P Global and BBB (low) with Morningstar DBRS. For those who don't spend their weekends reading bond prospectuses, that is "Investment Grade." It’s the safe zone. It’s the "you can put this in your retirement fund" territory.

But it’s a thin safety net.

Just last year, S&P Global shifted the outlook for Ford Motor Credit—the arm that actually lends people money to buy the cars—to Negative. Why? Because the world is getting expensive. While Ford is making money hand over fist on F-150s, they are also bleeding cash in the "Model e" electric vehicle division. In 2025, that segment was projected to lose over $5 billion. You read that right. Five billion dollars.

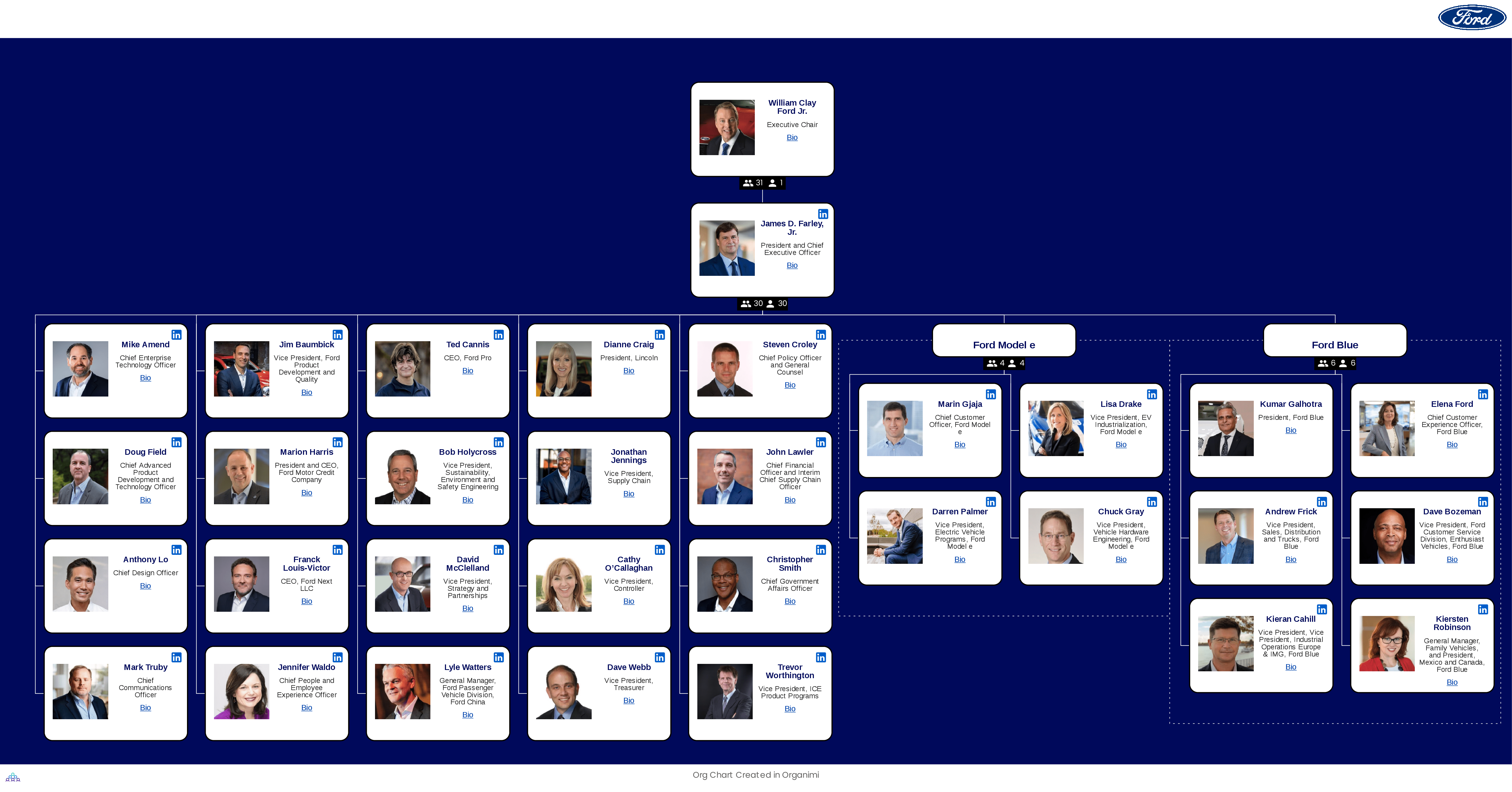

It’s a weird paradox. You have the "Ford Pro" commercial side and the "Ford Blue" internal combustion side essentially acting as the wealthy parents, paying the bills for the "Model e" teenager who’s currently trying to find themselves at an expensive liberal arts college.

The Ratings Breakdown

- S&P Global: BBB- (The bare minimum of Investment Grade)

- Moody’s: Ba1 (This one is actually still "Junk" or High Yield, keeping the pressure high)

- Fitch: BBB-

- Morningstar DBRS: BBB (low)

The big takeaway? Most agencies believe Ford is stable enough to pay its debts, but nobody is ready to call them a "Blue Chip" credit risk just yet.

The Factors Keeping the Ratings Experts Up at Night

If you ask an analyst at S&P why they haven't bumped Ford up higher, they’ll probably point toward the $55 billion in debt that was due for refinancing throughout 2025. That is a massive mountain to climb.

Refinancing debt in 2026 isn't as cheap as it was back in 2020. Interest rates have stayed stubborn, and every time Ford has to issue new bonds—like the $2 billion they put out in early 2025—they’re paying a higher "coupon" or interest rate.

🔗 Read more: Why 1209 Orange Street Wilmington DE 19801 USA is the World's Most Famous Office Building

Then you’ve got the trade stuff.

Nobody likes to talk about it because it’s political, but tariffs are a nightmare for the ford motor company credit rating. In late 2025, Ford took a hit of nearly $2 billion specifically due to adverse net tariff impacts. When you’re trying to convince a credit agency that you have "stable cash flow," losing two billion dollars to a policy change in Washington is a tough sell.

The "Novelis" Factor

Sometimes, it’s just bad luck. There was a massive fire at a Novelis plant (a key aluminum supplier) that created a $1.5 billion headwind for Ford’s earnings at the end of last year. Credit agencies look at these "one-time" events and try to see if they're actually one-time. If it's not a fire, it's a strike. If it's not a strike, it's a chip shortage. The agencies are looking for a year where nothing goes wrong. We haven't had one of those in a while.

Why Ford Pro is the Secret Weapon

If the electric vehicle losses are the "downer" of this story, Ford Pro is the superhero. This is the commercial side—the vans, the work trucks, the software that helps a plumber track his fleet.

In the third quarter of 2025, Ford Pro’s EBIT (Earnings Before Interest and Taxes) margin was sitting around 11.4%. That is incredible for the car business. They even have over 800,000 paid software subscriptions.

Why does a credit rating agency care about a plumber's software? Because it’s recurring revenue.

Selling a truck is a one-time thing. Selling a software package that the customer pays for every month? That’s the kind of stability that makes Moody’s and S&P feel warm and fuzzy inside. It balances out the cyclical nature of the "I want a new car" consumer market.

Comparing Ford and GM in 2026

It’s the rivalry that will never die. In 2026, the gap between the two is actually widening in the eyes of some investors.

🔗 Read more: How to Use Commerce in a Sentence Without Looking Silly

| Metric | Ford Motor Company | General Motors |

|---|---|---|

| Primary Credit Rating | BBB- / BBB (low) | BBB / BBB+ |

| Dividend Yield (Approx) | 4.2% | 0.7% |

| EV Strategy | "Model e" (Heavy losses) | Integrated (Taking charges) |

| Current Sentiment | Hold | Buy |

GM generally carries a slightly higher credit rating because they’ve been a bit more aggressive with their "capitulation" on EVs. They took a $1.6 billion charge to reassess their plans earlier than Ford did. Ford, on the other hand, is expected to record a massive $8.5 billion charge for canceled electric models.

While that sounds like a bad thing—and for the bank account, it is—the credit agencies actually kind of like it. It shows the company is willing to stop throwing good money after bad. It’s a "rip the Band-Aid off" moment that preserves cash in the long run.

What This Means for You (The Actionable Part)

Whether you’re an investor or just someone wondering if you should buy a Maverick, the ford motor company credit rating actually trickles down to your wallet.

When Ford’s credit rating is lower, it costs them more to borrow money. When it costs them more, it costs you more at the dealership. Ford Motor Credit has to maintain a certain profit margin, so higher corporate interest rates often lead to higher consumer APRs.

Watch These Three Things:

- The Q4 2025 Working Capital Reversal: Ford had some money tied up in inventory and production delays late last year. If that cash "unlocked" in early 2026 as expected, their liquidity (which is currently around $54 billion) will look even better.

- Hybrid Sales Growth: Hybrids are Ford’s bridge. They saw a 55% surge in hybrid sales recently. If this continues, they can keep their factories running and their credit metrics stable without needing to rely purely on money-losing EVs.

- Refinancing Costs: Watch the "coupon" on their next bond offering. If they can issue debt at lower rates than they did in 2025, it’s a massive signal that the market trusts them more than the rating agencies do.

The "Stable" trend from Morningstar DBRS suggests that we shouldn't expect a major upgrade or a scary downgrade in the next six months. Ford is essentially in a "proving period." They have the cash. They have the trucks. Now they just need to show that they can handle the global trade winds without getting blown off course.

Actionable Next Step: If you are monitoring Ford's debt for investment purposes, check the Fixed Income section of Ford's Investor Relations website for the "Ford Interest Advantage" notes. These floating-rate demand notes often offer yields 0.25% higher than the average money market fund, which is a practical way to benefit from their current credit position without buying long-term bonds._