You’ve probably seen the signs on the windows of local diners in Orlando or small retail shops in Jacksonville. They usually mention "hiring now" or "competitive pay." But what actually counts as competitive in Florida right now? It's changing. Fast. If you feel like your paycheck or your payroll is in a constant state of flux, you aren’t imagining it. Florida minimum wage is currently on a collision course with a $15.00 flat rate, and we are right in the thick of that transition as we kick off 2026.

Most folks think these raises just happen because some politician in Tallahassee had a whim. Nope. This was a slow-burn movement started years ago by voters who went to the ballot box and decided the state's economy needed a fundamental shift. It’s a constitutional amendment. That means it’s baked into the Florida Constitution, making it much harder to mess with than a standard law.

The Reality of the $15 Goal

Back in 2020, while the world was distracted by, well, everything else, Florida voters passed Amendment 2. It was a big deal. It set a schedule to raise the minimum wage by $1.00 every single year on September 30th until it hits that $15.00 mark.

Right now, as of January 2026, the standard minimum wage in Florida is $14.00 per hour.

It’s been at this level since the last hike in late 2025. Come September 30, 2026, it jumps again to $15.00. This is the "end game" of the current amendment's scheduled increases. After we hit $15.00, the state won't just stop. Instead, starting in 2027, the wage will be adjusted annually based on the Consumer Price Index (CPI). Basically, it’ll be tied to inflation. If bread and gas get more expensive, the wage is supposed to nudge up to keep pace.

📖 Related: The One Thing Book Gary Keller: What Most Productivity Hacks Get Wrong

Think about that for a second. In just a few years, Florida went from a state where $8.50 was the norm to one where $15.00 is the floor. It’s a massive jump.

The Tipped Employee Catch

Wait. There is a huge asterisk here. If you work front-of-house in the restaurant industry—maybe you’re a server at a spot on South Beach or a bartender in Pensacola—you aren’t seeing $14.00 on your base check.

Florida utilizes what’s called a "tip credit." Employers are allowed to count a portion of your tips toward your hourly wage. The credit is currently locked at $3.02.

So, do the math. $14.00 minus $3.02 equals **$10.98 per hour**. That is the actual cash wage an employer has to pay a tipped worker in Florida right now. If your tips don’t bring you up to the full $14.00 average for the week, the boss is legally required to make up the difference. Honestly, though? In this economy, if a server isn't making enough in tips to clear the minimum, there’s usually a bigger problem with the foot traffic or the menu.

Why the "Living Wage" Argument is Complicated

Is $14.00 or even $15.00 a living wage in Florida? Well, it depends on where you’re standing.

If you’re living in a rural part of the Panhandle, $14.00 goes a lot further than it does in Miami or Tampa. According to data from the MIT Living Wage Calculator, the actual "living wage" for a single adult with no children in the Miami-Fort Lauderdale-West Palm Beach area is significantly higher than $15.00. We are talking closer to $22.00 or $24.00 just to cover the basics like housing, food, and transportation.

Florida’s housing market has been on a tear. Rent prices in cities like West Palm Beach have outpaced wage growth for a long time. So while $14.00 is a record high for the state, for a lot of families, it still feels like they're treading water.

💡 You might also like: UGG Company Phone Number: What Most People Get Wrong

What Business Owners Are Actually Doing

I’ve talked to several small business owners who are feeling the squeeze. It isn’t just about the person making minimum wage. It’s the "ripple effect."

Imagine you have a loyal employee who has worked for you for three years. They worked their way up to $16.00 an hour because they were reliable and skilled. Now, the new hire who just walked in off the street is legally required to make $14.00. That original employee is probably going to want a raise to maintain that "gap" between entry-level and experienced. This is called wage compression, and it’s the silent killer for small business budgets.

To stay afloat, businesses are getting creative:

- Shrinkflation on Services: You might notice your favorite local car wash has fewer staff members drying cars, or the portions at the local bistro got a tiny bit smaller.

- Tech Over Personnel: More kiosks. More QR code menus. If a machine can do it for a one-time cost, a lot of Florida owners are making that investment now to avoid the rising labor costs.

- Price Hikes: This is the obvious one. Your $12 burger is now a $16 burger.

It’s a tough balance. If you raise prices too much, customers stay home. If you don’t raise wages, you can’t find staff.

Legal Requirements and the "Gotchas"

You can't just ignore this. The Florida Department of Economic Opportunity (DEO) and federal Department of Labor (DOL) don't play around.

Every Florida employer is required to display a poster that outlines the current minimum wage. It has to be in a place where employees can actually see it—not buried in a drawer or behind a stack of boxes in the breakroom. If you’re an employee and you realize you’re being paid $12.00 an hour right now, you’re being underpaid. Period.

There’s also the issue of "wage theft." This isn't just paying the wrong hourly rate. It’s making people work off the clock, or misclassifying a regular employee as an "independent contractor" to avoid paying minimum wage and taxes. Florida law allows employees to sue for back pay, and the penalties can be double the amount owed, plus attorney's fees. It can bankrupt a small shop.

Misconceptions About the "Training Wage"

Some people think there is a "training wage" in Florida where you can pay teenagers or new hires less. Federal law does allow a lower youth minimum wage for workers under 20 during their first 90 days, but Florida's rules are strict. Generally, you’re better off assuming the state minimum applies to everyone. Don't try to get cute with the numbers; it usually backfires.

Looking Toward September 2026

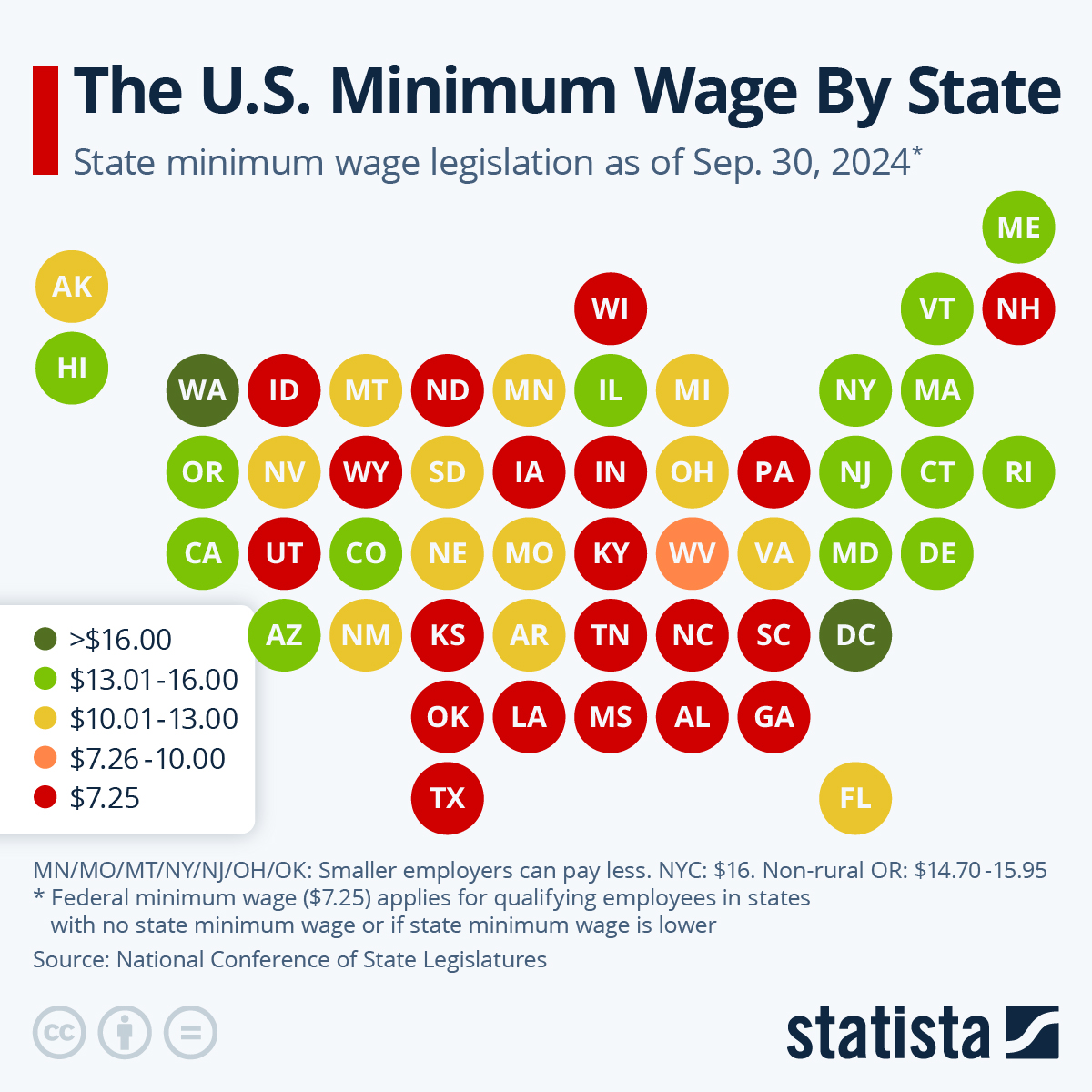

We are months away from the final jump to $15.00. When that happens, Florida will have one of the highest minimum wages in the South. In fact, compared to neighbors like Georgia or Alabama—which still follow the federal minimum of $7.25—Florida looks like an outlier.

This creates a weird dynamic at the state lines. If you live in Southern Alabama, you might be tempted to drive across the border into the Florida Panhandle for a retail job that pays nearly double what you’d get at home. This "labor migration" is something economists are watching closely. It’s putting pressure on businesses in neighboring states to hike their own wages just to keep their staff from fleeing to Florida.

Practical Steps for Workers and Owners

If you’re working a minimum wage job in Florida right now, check your paystub. Seriously. With the annual increases happening every September, it’s easy for a payroll system to "miss" the update if it’s handled manually. Make sure you’re seeing that $14.00 (or $10.98 for tipped staff). If you aren't, talk to your boss. Most of the time it’s an honest mistake, but you’re entitled to that money.

💡 You might also like: DJIA Stock Prices Today: Why the 49,000 Level is Getting Weird

For the business owners out there, 2026 is the year to audit your labor efficiency. You know that $15.00 is coming in September. Don't wait until August to figure out your pricing strategy.

- Audit your payroll: Ensure you are compliant with the current $14.00 rate to avoid back-pay issues.

- Analyze your margins: If labor is 30% of your costs, a $1.00 increase is a significant hit. Can you automate a task? Can you cross-train employees to make them more versatile?

- Review the Tip Credit: If you run a restaurant, ensure your record-keeping for tips is bulletproof. If the DOL audits you and you can't prove your staff made enough in tips to cover the credit, you're on the hook for the full wage.

The transition to a $15.00 floor is a massive social and economic experiment. Whether you think it’s a necessary move for dignity and a living wage, or a burden that will hurt small shops, it is the law of the land in the Sunshine State. Understanding the schedule and the specific rules for tipped workers is the only way to stay ahead of the curve.

Keep an eye on the calendar for September 30th. That’s the day the next shift becomes official. Florida’s economy is evolving, and whether you're the one signing the checks or cashing them, you've got to be ready for the new reality of the local labor market.