Imagine opening your mail and seeing a tax return the size of a postcard. No stacks of receipts. No frantic calls to an accountant to ask if your home office chair is a "deductible expense." No weeping over the difference between long-term and short-term capital gains. That's the dream of a flat tax, a system where everyone, from the billionaire CEO to the person bagging your groceries, pays the exact same percentage of their income to the government.

It sounds fair. It sounds easy.

But honestly? It’s one of the most polarizing topics in economics. While the concept of a flat tax is straightforward, the reality of implementing it involves a massive tug-of-war between simplicity and social equity. In the United States, we currently use a progressive tax system—the more you make, the higher the percentage you pay. A flat tax flips that on its head by stripping away the "brackets" and usually getting rid of almost all deductions, credits, and loopholes.

What is Flat Tax and How Does It Actually Work?

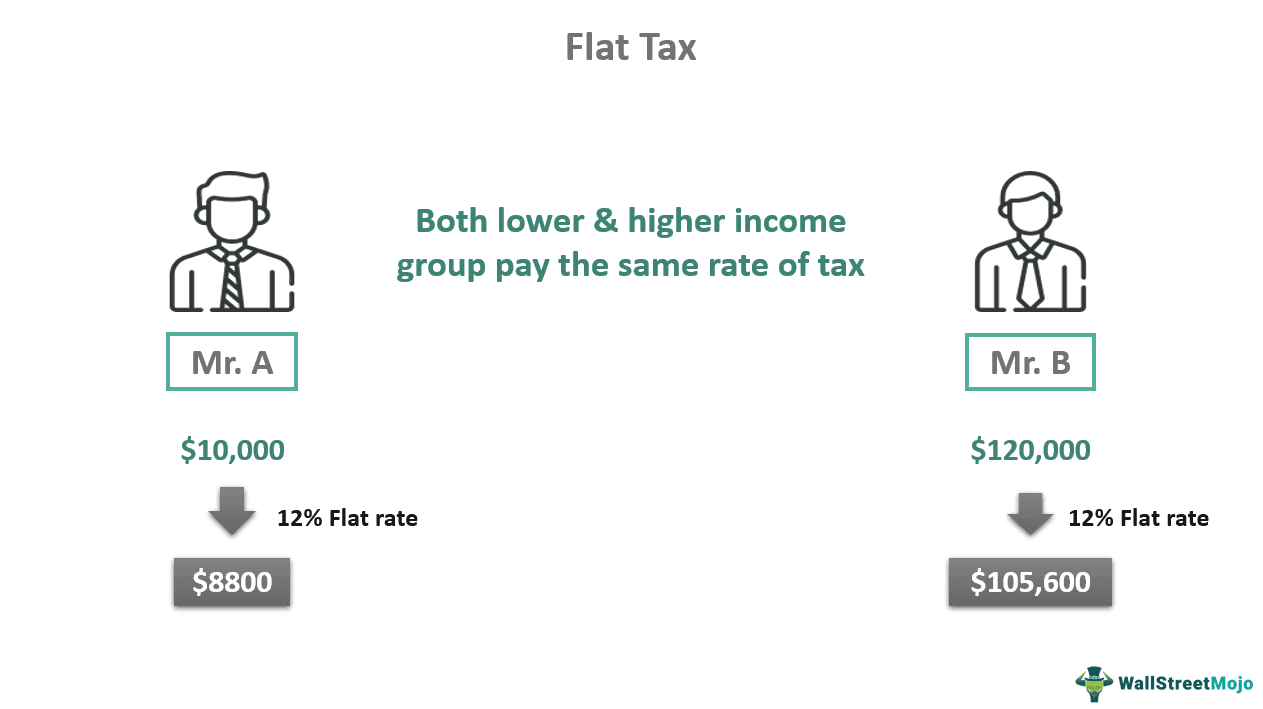

At its core, a flat tax is a single-rate tax system. If the rate is 15%, you pay 15%. Period. If you earn $50,000, you send $7,500 to the IRS. If you earn $500,000, you send $75,000.

Most people think of income tax when they hear this, but the most famous proposal in American history is the Hall-Rabushka model. Developed by Robert Hall and Alvin Rabushka of the Hoover Institution in 1981, this version suggests taxing all income only once, at a single source. They argued that by eliminating the "double taxation" on dividends and capital gains, the economy would explode with new investment.

Think about the sheer volume of the U.S. tax code. It's thousands upon thousands of pages long. A flat tax would essentially set fire to most of those pages. You wouldn't need to track whether your "business lunch" was 50% or 100% deductible because deductions simply wouldn't exist anymore.

The Places That Actually Tried It

This isn't just a theoretical classroom debate. Several countries, mostly in Eastern Europe and the former Soviet Union, jumped on the flat tax bandwagon in the 1990s and early 2000s.

Estonia led the pack in 1994. Russia followed suit in 2001 with a 13% flat tax. At the time, Putin’s government was struggling with massive tax evasion. People just weren't paying. By simplifying the system to a low, flat rate, compliance actually skyrocketed. When the tax is low and easy to calculate, people find it's less of a headache to just pay it than to try and hide their money in the shadows.

✨ Don't miss: Keller Williams Integrity First Realty Explained: What Really Happens Inside

However, it's not a permanent love affair.

Russia eventually moved back toward a progressive system for high earners in 2021. Slovakia and several others have also walked back their flat tax policies. Why? Because while it helps with administrative ease, it often fails to generate enough revenue to sustain a modern welfare state during economic downturns. It turns out that "simple" doesn't always mean "sufficient."

Why Your Neighbor Probably Hates the Idea

The biggest argument against a flat tax is "vertical equity."

Basically, $1,000 means a lot more to someone making $30,000 than it does to someone making $300,000. If you take 15% from a low-income family, you might be taking away their ability to pay rent or buy healthy food. If you take 15% from a millionaire, they might just buy a slightly smaller yacht.

This is why most flat tax proposals include a "personal allowance" or a floor. For example, you might pay 0% on the first $30,000 you earn, and then a flat 17% on everything above that. This makes the tax technically "progressive" at the bottom end, even if the rate is flat above the threshold.

🔗 Read more: BP PLC Historical Stock Prices: What Really Happened to Your Investment

The Pros: What Supporters Love

- Insane Simplicity: You could file your taxes in ten minutes.

- Economic Growth: Economists like Arthur Laffer argue that high marginal tax rates discourage people from working harder or investing. A flat tax removes that "penalty" for success.

- No More Lobbying: Large corporations spend millions lobbying for specific tax breaks. If there are no breaks to be had, that special interest influence vanishes.

The Cons: What Critics Fear

- The Shift to the Middle: In many simulations, a revenue-neutral flat tax (one that collects the same amount of money as our current system) would actually lower taxes for the super-rich and the very poor, but increase them for the middle class.

- Loss of Incentives: Do you like the Mortgage Interest Deduction? How about the Child Tax Credit? Under a true flat tax, those are gone. The housing market could take a hit if the tax benefits of owning a home disappear overnight.

- Budget Deficits: If the rate is set too low to be "fair," the government ends up with a massive hole in its budget.

Misconceptions That Just Won't Die

You've probably heard someone say a flat tax would "kill the IRS." That's just not true. You still need an agency to verify that people are reporting their income accurately. You still need enforcement. The IRS might get smaller, sure, but it wouldn't disappear.

Another myth is that a flat tax is always "fair." Fairness is subjective. Is it fairer for everyone to pay the same proportion, or is it fairer for everyone to feel the same burden? A 20% tax feels like a paper cut to some and a broken leg to others.

The Reality of the "Postcard" Return

Steve Forbes made the flat tax the centerpiece of his presidential campaigns in 1996 and 2000. He waved around a literal postcard to show how simple life could be. While he didn't win, the idea stuck in the American psyche.

The problem is the "transition cost." If the U.S. switched to a flat tax tomorrow, what happens to all the investments people made based on the old rules? What about the municipal bond market, which relies on being tax-exempt? The sudden shift would create a shockwave through the financial system that most politicians are too terrified to trigger.

Actionable Steps for Navigating Tax Debates

If you are following the news or looking at how tax policy affects your own wallet, don't just look at the percentage rate. That's a rookie mistake.

📖 Related: Why Most People Mess Up Their Tax and Dividend Calculator Results

1. Look for the "Exemption Level"

Whenever a politician mentions a flat tax, immediately ask: "What is the 0% threshold?" If there is no floor, the tax will be devastating for low-income earners. A flat tax with a high exemption (e.g., $50,000) is actually a very different animal than a "pure" flat tax.

2. Audit Your Deductions

To see how a flat tax would hit you personally, look at your last tax return. Find your "Effective Tax Rate"—that’s the actual percentage of your total income you paid after all deductions. If a proposed flat tax rate is 17% and your current effective rate is 12%, you’re going to lose money, even if the system is "simpler."

3. Watch the "Consumption Tax" Pivot

Often, people confuse a flat tax with a FairTax or a National Sales Tax. They aren't the same. A flat tax is still an income tax. A consumption tax is a tax on what you spend. Knowing the difference helps you spot when a policy is shifting the tax burden from savers to spenders.

4. Consider the Compliance Cost

Even if your tax bill stays the same, think about what you spend on software like TurboTax or hiring a CPA. For many Americans, the "hidden tax" is the $300 to $1,000 spent just to figure out what they owe. A flat tax would eliminate that cost almost entirely.

The debate over the flat tax isn't really about math. It’s about philosophy. It's a question of whether the tax code should be a tool for social engineering—encouraging homeownership, green energy, and marriage—or if it should simply be a neutral way to keep the lights on in Washington. Until we agree on that, the "postcard" return will likely remain a dream.

Check your current effective tax rate against any proposed flat-tax legislation. Calculate your total income, subtract only the proposed personal exemption, and multiply by the proposed rate. If that number is higher than your current total tax liability, the "simplicity" of the flat tax might come with a very high price tag for your household budget.