You’re staring at a screen, probably trying to set up a direct deposit or finish a wire transfer, and you need that specific nine-digit string of numbers. It’s annoying. You know it’s a Truist routing number PA situation, but you might be seeing three different numbers online and wondering which one won't bounce your paycheck.

Honestly, banking mergers are a mess for the average person. When BB&T and SunTrust smashed together to form Truist a few years back, they didn't just change the signs on the buildings in Scranton or Philly. They inherited a labyrinth of legacy routing numbers that still function today. If you’re in Pennsylvania, the number you use depends entirely on where your account was originally "born"—not necessarily where you live now.

Let's clear the air. Routing numbers are basically the GPS coordinates for your money. If you get one digit wrong, your mortgage payment doesn't just disappear; it wanders into the digital void of the Federal Reserve's ACH system until someone manually flags the error. It's a headache you don't want.

The Specifics for Pennsylvania Accounts

If you opened your account at a branch in Pennsylvania, or if your legacy BB&T/SunTrust account was based there, you are likely looking for one specific number. For most standard checking and savings transactions—think ACH transfers, Venmo links, and employer direct deposits—the Truist routing number PA is 031201467.

Wait.

Before you copy-paste that and close this tab, there’s a nuance. That specific number is the legacy BB&T routing code. Because BB&T had a massive footprint in the Commonwealth compared to SunTrust, it became the "surviving" number for the region. However, if you are handling a domestic wire transfer, things change.

Banks often use a different transit number for wires than they do for electronic "paper" checks or ACH. For Truist, the universal wire transfer routing number is often different from your local branch's ACH number. Usually, for a domestic wire, Truist directs users toward 053100465.

💡 You might also like: Peoples Funeral Home Obituaries Jackson MS: What Most People Get Wrong

Why the split? It’s about how the Federal Reserve processes the data. ACH is a "batch" system—it’s like a bus that picks up everyone's transactions and drops them off at once. Wires are like a private taxi. They need a different lane.

Why the Location of Your "Home" Branch Still Matters

You might live in Pittsburgh now, but if you opened that account back when you were in college in Virginia, your Truist routing number PA search might actually lead you to the wrong place.

Banks don't update your routing number just because you moved. It stays tied to the region of the branch where the account was first minted. This is a relic of 20th-century banking that the digital age hasn't quite killed off yet. If you moved from Maryland to Pennsylvania and kept the same account, you’re still a Maryland account holder in the eyes of the routing system.

Check the bottom left corner of your checks. Seriously. It’s the most foolproof way to verify. The first nine digits are your routing number. If you don't have paper checks (because who does in 2026?), log into the Truist mobile app. Click on your account, go to "Account Details," and it will list both your routing and account numbers clearly.

The Merger Hangover

The Truist merger was one of the largest in U.S. history. When you have billions of dollars moving through legacy systems, you can't just flip a switch and give everyone a new number. That would break every automated bill pay in the country.

So, Truist kept the old numbers active. If you were a legacy BB&T customer in PA, your number didn't change. If you were SunTrust (though they had almost no PA presence), you might have been migrated. This "grandfathering" of numbers is why you see so much conflicting info on third-party finance sites.

Wire Transfers vs. ACH: Don't Swap Them

People do this all the time. They use their ACH routing number for a high-stakes wire transfer—like a house down payment—and then panic when the money doesn't show up in two hours.

- ACH (Automated Clearing House): Used for payroll, utility bills, and person-to-person transfers like Zelle or Venmo. Use the 031201467 number if your account is PA-based.

- Wire Transfers: These are immediate and irrevocable. Truist typically uses a centralized number for these to ensure they hit their main processing hub in North Carolina before being routed to your specific account.

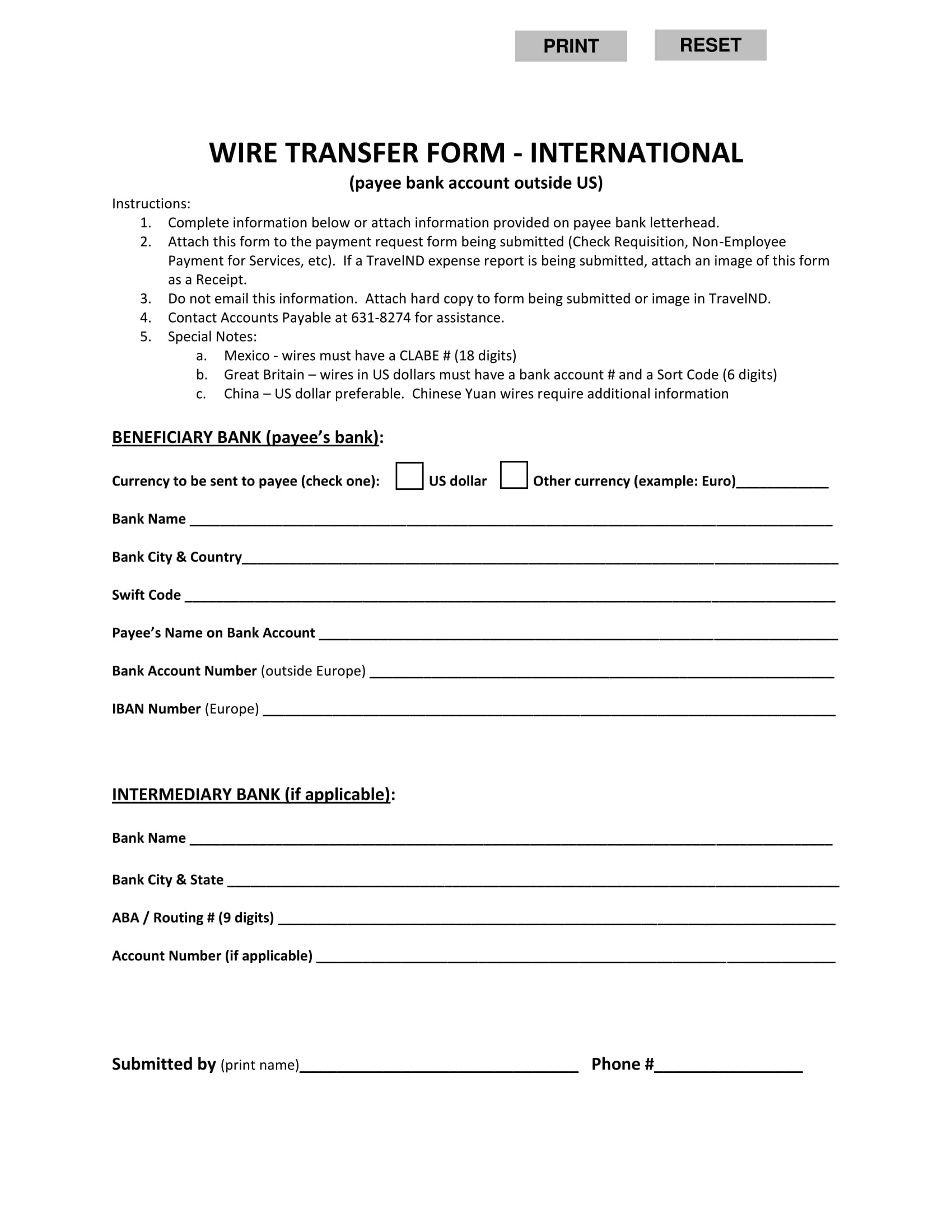

If you’re receiving a wire from overseas (International), you don't just need a routing number; you need a SWIFT code. For Truist, that’s generally BTRUUS33. But again, check with your specific branch if the amount is significant. International banking involves intermediary banks that can take a "toll" out of your transfer if the routing isn't precise.

Security and Your Routing Number

Is your routing number a secret? Not really. It’s printed on every check you’ve ever handed to a stranger. It’s public information.

The real danger is the combination of your routing number and your account number. With both, someone can theoretically initiate an "ACH pull"—basically telling a system they have permission to take money from you. Truist has gotten better about this with multi-factor authentication, but you should still be wary of where you enter this data.

🔗 Read more: McDonald's Snack Wraps Are Actually Coming Back in 2025: Here is the Real Plan

Only enter your Truist routing number PA on secure, encrypted portals. If a site looks like it was built in 1998 and is asking for your banking info, run.

Common Myths About Banking Numbers

Some people think the routing number identifies you personally. It doesn't. It identifies Truist. Think of it like a zip code. Everyone in your neighborhood has the same zip code, but you have a unique street address (your account number).

Another myth: "I can use any Truist routing number since it’s all the same bank."

Sorta, but no.

While the money might eventually find its way to you if you use the Georgia routing number for a PA account, it will likely be delayed. The system will have to "re-route" the transaction internally. In the world of high-speed finance, "eventually" can mean three to five business days. In 2026, that feels like an eternity.

Verifying Your Specific Code

If you are still unsure, there are three definitive ways to check without calling a help desk and sitting on hold for twenty minutes:

- The Checkbook: As mentioned, it’s the most reliable source. Bottom left.

- Truist Online Banking: Once logged in, click the "Account Services" tab. They usually have a "Display Routing Number" toggle.

- The Federal Reserve E-Payments Directory: You can actually search the official Fed database. It’s dry and boring, but it’s the "source of truth" for every bank in America.

What to Do Next

If you’ve confirmed you’re using 031201467 for your PA-based account, your next step is to run a "test" transaction if you’re setting up something big. Send $1 first. It sounds paranoid, but verifying that the $1 hits your account is better than sending a $5,000 rent payment into the abyss.

Once the test clears, you're good to go. Update your payroll provider or your mortgage lender. If you ever close this account and open a new one in a different state, remember that this number will change. Your routing number is a creature of geography, and in the banking world, geography is destiny.

Double-check your account type too. Sometimes business accounts and personal accounts at Truist use different routing streams, especially if the business was part of a specific commercial banking acquisition. When in doubt, the mobile app "Account Details" screen is the final word. Use it.

✨ Don't miss: Which of the Following Statements About Convenience Checks Is True? Why Most People Get It Wrong

Actionable Steps:

- Open your Truist mobile app and navigate to Account Details to confirm your specific region's code.

- Distinguish between ACH and Wire instructions before sending the info to a third party.

- If you are a business owner, verify if your account requires a specific commercial routing number which can differ from retail codes.

- Save the routing number in a secure password manager so you don't have to look it up—or risk finding an outdated one—every time you need it.