You’re staring at that little slip of paper and everything looks like a random string of computer code. It happens. Whether you’re trying to set up a direct deposit for a new job or you’re finally biting the bullet and automating your electric bill, you need those digits. Specifically, you need to know exactly which set of numbers is the chase bank account number on check and which one is just there for the bank's internal routing.

It's easy to mix them up.

If you get it wrong, your money goes into a digital void, or worse, someone else’s account. Honestly, looking at a check feels a bit archaic in 2026, but the banking system still leans heavily on these MICR lines—that's the "Magnetic Ink Character Recognition" technology for the nerds out there. These characters are printed in a specific font that machines can read at lightning speed.

📖 Related: USAA Military Pay Date: What Most People Get Wrong About Early Deposits

Chase, being the massive entity it is, follows a pretty standard layout, but there are a few quirks you should probably know before you start typing numbers into a sensitive financial portal.

The Three Main Groups: Decoding the Bottom Row

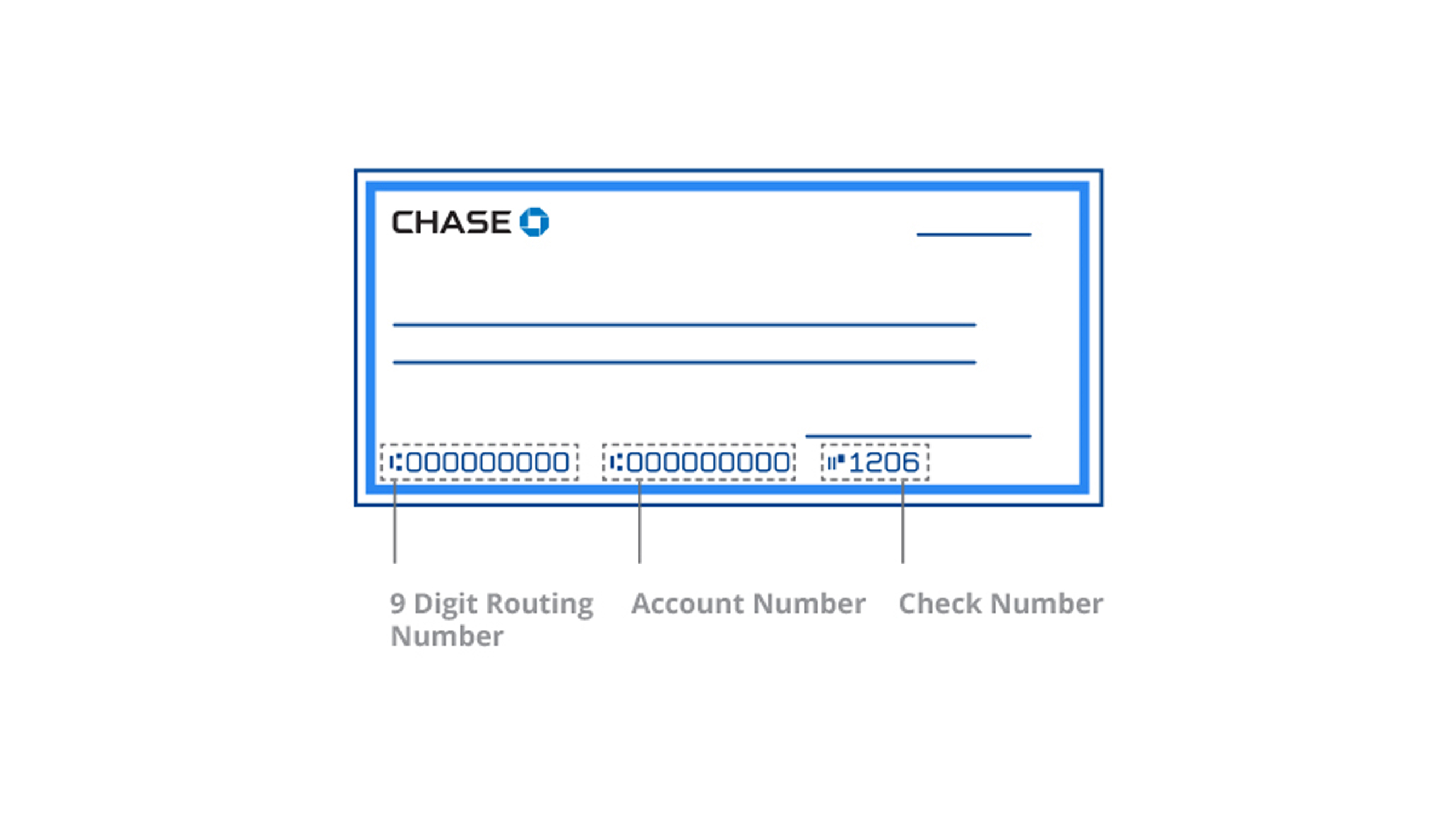

When you look at a Chase check, your eyes should go straight to the bottom. There’s a long string of numbers there. Usually, people assume it’s just one long ID, but it’s actually broken into three distinct sections.

The first nine digits on the far left? That’s the routing number. Think of the routing number as the address for the bank itself. It tells the financial system, "Hey, this money belongs to JPMorgan Chase." Every Chase check across the country uses a specific routing number based on where the account was opened. If you opened your account in New York, that number is going to be different than if you opened it in California.

Then comes the middle section. This is your chase bank account number on check.

It’s usually between 9 and 12 digits long. This is your personal identifier. While the routing number is shared by millions of people, this one is yours alone. It’s the "house number" to the routing number’s "street address."

Finally, there’s a short little number at the very end. That’s just the check number. It’s the same number you see in the top right corner. Banks use it to keep track of which specific check has been cashed so you don't accidentally pay for the same grocery trip twice.

Why Placement Can Be Sneaky

Sometimes, people get confused because the order isn't always identical across every single bank. However, for Chase, the layout is almost always Routing Number - Account Number - Check Number.

Wait.

There is one exception. On some "business" style checks or larger ledger checks, the check number might actually appear before the account number in that bottom string. If you’re looking at a standard personal checkbook you got in the mail, stick to the "middle is account" rule. But if you’re using a high-security business check, look for the set of numbers that matches the check number printed in the top right. Once you identify the check number, the other set of digits in that cluster is your account number.

What if You Don't Have a Physical Check?

Let’s be real. Most of us don't carry checkbooks anymore. If you’re frantically searching for your chase bank account number on check but you can’t actually find a check, you aren't stuck.

You can hop onto the Chase Mobile app. It’s probably the fastest way. Once you log in, tap on the specific account (like "Total Checking"). Usually, the app hides the full number for security—you'll just see the last four digits. You have to tap "Show details" or "Account services" to reveal the full string.

Another trick? Look at your monthly statement.

Chase PDF statements, which you can download from their website, always have the account number listed at the top. Usually, it’s near the summary of your balance. It’s arguably safer to pull it from a statement than to try and squint at the bottom of a tiny piece of paper anyway.

A Quick Note on Security

Never, and I mean never, send a photo of your check to someone you don't 100% trust. That MICR line at the bottom contains everything a bad actor needs to initiate an ACH transfer out of your account. It’s basically giving someone the keys to your front door. If you’re setting up a legit service like PayPal or a payroll system, they’ll often ask for a "voided check." This just means you write "VOID" in big letters across the front so no one can actually cash it, but they can still read the routing and account numbers.

🔗 Read more: Patrick Whitesell Net Worth: Why the Endeavor Power Player Is Worth Billions in 2026

Common Mistakes When Reading the Numbers

People often include the symbols. See those weird little dash-looking things or the vertical bars with dots? Those are called "transit symbols" and "on-us symbols."

Don't type those.

When a form asks for your chase bank account number on check, they only want the digits. If you include the symbols, the system will likely kick back an error message, or worse, it might process the first few numbers and leave off the rest, causing the transaction to fail.

Another classic blunder is mistaking the "Check Number" for part of the account number. If your check number is 1001, and you include "1001" at the end of your account number, that deposit is going nowhere. Always double-check by looking at the top right corner of the check. If those digits match the ones at the end of the bottom line, exclude them from your account number.

Understanding the "Electronic" Difference

Here is something that trips up even the pros. Sometimes, the routing number you see on your check isn't the one you should use for a wire transfer.

Chase is huge.

They have different routing numbers for "paper" transactions (checks) and "electronic" transactions (wires). If you are setting up a domestic wire transfer, you might need to check the Chase website or app to see if there is a specific "Wire Routing Number." Using the one from your check for a wire can sometimes lead to delays, though for standard direct deposits, the one on the check is usually just fine.

Practical Steps to Get it Right

If you’re sitting there with a pen and paper ready to fill out a form, follow this workflow to ensure you’re using the correct chase bank account number on check:

- Locate the three blocks of numbers at the very bottom of your check.

- Identify the first 9 digits. This is the routing number. It always starts with a 0, 1, 2, or 3.

- Look at the top right corner of your check to find the check number.

- Find that same check number at the bottom (usually the last 3 or 4 digits).

- Isolate the numbers in the middle. These are the ones nestled between the routing number and the check number. This is your account number.

- Verify against your app. If you have a smartphone handy, open the Chase app and compare the last four digits shown there to the last four digits of the middle number on your check. If they match, you're golden.

Once you have the number, store it in a secure password manager like 1Password or Bitwarden. You shouldn't have to go hunting for a physical checkbook every time you need to pay a new vendor.

One final tip: If you’ve recently opened your account, make sure you aren't looking at a "starter check." These are the temporary checks the banker prints for you in the branch. Sometimes the alignment on these can be slightly wonky compared to the professional ones you order later. The numbers are still the same, but the spacing might look a little different. Just stay focused on the middle block and you’ll be fine.

The banking world is moving toward "open banking" and API-linked accounts where you just log in with your Chase credentials to link things, but until that's universal, the chase bank account number on check remains the most reliable way to move your money where it needs to go. Keep that checkbook in a safe place, or better yet, shred the ones you don't need once you've digitized the information.

Double-check your work. Then check it again. It’s your money, after all.

Actionable Next Steps:

- Confirm your routing number: Use the Chase online routing number lookup tool to ensure the 9-digit code on your check matches your specific region, especially if you moved states since opening the account.

- Set up a "Vault" entry: Add your full account and routing numbers to a secure, encrypted password manager so you don't have to carry physical checks for information purposes.

- Enable Alerts: Once you link your account to a new service using these numbers, turn on "Transaction Alerts" in the Chase app so you get a notification the moment a deposit or withdrawal hits, ensuring the numbers you entered were correct.