Tax season is usually a mess of acronyms and numbers that don't seem to make sense, but if you paid for college lately, you’re likely staring at a specific piece of paper from your school. It’s the Form 1098-T. Honestly, most people just glance at it, see a number in a box, and hope their tax software handles the rest. But if you actually look at a 1098 t form example, you'll realize it's basically the golden ticket to getting some of your tuition money back from the IRS via the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC).

Getting this right matters. If you mess up the numbers or claim a credit you aren't owed, the IRS isn't known for being "chill" about it.

What a Real 1098 t form example Looks Like in the Wild

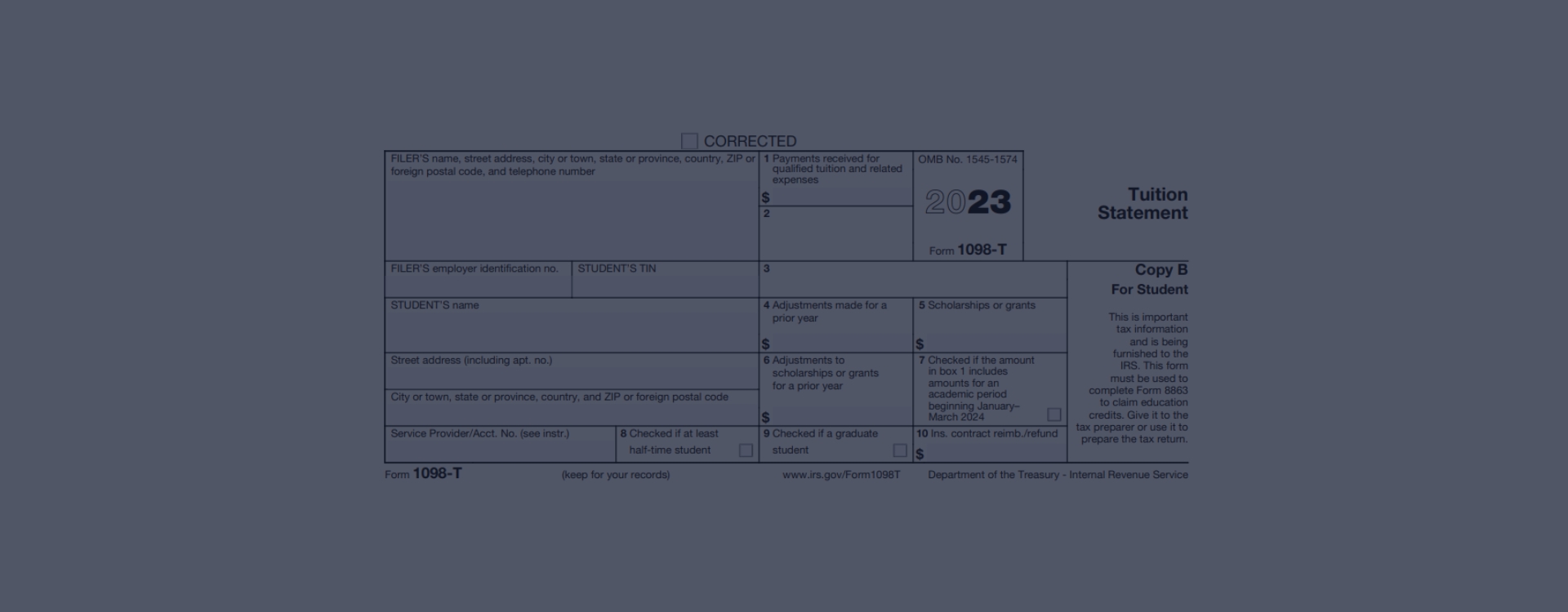

You won't find a one-size-fits-all version because every university uses slightly different software to generate these, but the layout is standardized by the IRS. Imagine a small, rectangular form. On the left side, you've got the filer’s information—that’s your college or trade school—with their address and Federal ID number. Right below that is your information. Your name, address, and social security number (or at least the last four digits) should be there.

The right side of the form is where the math happens. This is the part that actually impacts your bank account.

✨ Don't miss: Central Banking and the Enslavement of Mankind: What Most People Get Wrong About Money

The most important part of any 1098 t form example is Box 1. This box shows the "Payments received for qualified tuition and related expenses." Back in the day, schools used to have the option to report "amounts billed" in Box 2, but the IRS got tired of that confusion. Since 2018, Box 2 is actually empty or "reserved" on almost every form you'll see. If you’re looking at an old example online and it’s emphasizing Box 2, it’s outdated. Ignore it. You want Box 1.

Box 5 is the Sneaky One

While Box 1 is the money you paid, Box 5 is the money they gave you. This includes scholarships, grants, and sometimes third-party payments.

Here’s the kicker: If the number in Box 5 is bigger than the number in Box 1, you might actually owe taxes on that "free" money. Most students think scholarships are always tax-free. They aren't. If you used scholarship money to pay for room and board—which the IRS considers "non-qualified" expenses—that money counts as taxable income.

I’ve seen students get hit with a surprise tax bill because they had a full ride that covered housing. The 1098-T acts as a paper trail for the IRS to make sure you aren't double-dipping. You can't take a tax credit for tuition that was paid for by a Pell Grant. That’s just the way the math works.

Why Your 1098-T Might Look "Wrong"

Sometimes you'll look at your bank statement and see you paid $10,000, but your 1098 t form example only shows $5,000 in Box 1. You aren't necessarily being cheated.

📖 Related: Exactly How Much is One Share in Amazon Right Now and Why it Changes

Schools often operate on a different calendar than the IRS. The IRS cares about the calendar year (January to December). Your school cares about semesters. If you paid for your Spring 2026 semester in December 2025, that money should have showed up on your 2025 form, not the 2026 one.

Check Box 7. This box is a simple checkbox that says "Check if the amount in box 1 includes amounts for an academic period beginning January – March 2027" (or whatever the following year is). If that’s checked, it explains the timing mismatch.

The "Hidden" Expenses Not on the Form

Don't rely solely on the 1098-T. It’s a common mistake.

The form only tracks what you paid to the school. It doesn't know about the $600 you spent on a laptop required for your computer science class or the $300 in textbooks you bought from a random website. Those are often "qualified expenses" for the American Opportunity Tax Credit, but they will never, ever show up on a 1098 t form example. You have to keep those receipts yourself.

A Real-World Scenario: The Graduate Student

Let's look at a specific case. Sarah is a grad student. She gets her 1098-T and sees $12,000 in Box 1. She also sees $4,000 in Box 5 because she’s a teaching assistant and got a small grant.

When she files, she subtracts the $4,000 from the $12,000. Her "adjusted" qualified expenses are $8,000. Since she’s a grad student, she’s likely going for the Lifetime Learning Credit rather than the AOTC (which is usually for the first four years of post-secondary education).

The LLC gives her a credit worth 20% of her first $10,000 in expenses. So, $8,000 times 0.20 equals a $1,600 reduction in her tax bill. That’s a massive win. Without that form, she’s just guessing.

What if You Don't Get One?

It happens. Not everyone gets a form.

If you’re an international student, or if your tuition was entirely waived, or if you’re taking "informal" classes that don't lead to a degree, the school might not send one. Also, check your school's online portal. Most colleges stopped mailing paper forms years ago to save on postage. They’ll hide it under a tab labeled "Tax Documents" or "Student Account" in your student dashboard. Log in. It's probably sitting there as a PDF right now.

✨ Don't miss: Calculate Annualized Return Calculator: Why Your Portfolio's Raw Gains Are Probably Lying to You

Specific Boxes You Need to Know

- Box 1: Payments received. This is the big one. It’s what you (or your parents/loans) actually paid.

- Box 4: Adjustments for a prior year. If the school found an error from last year’s reporting, they’ll put the correction here. This can be annoying because it might mean you need to amend a previous tax return.

- Box 5: Scholarships or grants. This reduces the amount of expenses you can claim for a credit.

- Box 6: Adjustments to scholarships/grants from a prior year.

- Box 8: A checkbox for "at least half-time." This is vital. To claim the American Opportunity Tax Credit, you generally need to be at least half-time. If this isn't checked and you think you are half-time, call the registrar immediately.

- Box 9: Graduate student checkbox. This tells the IRS you might be ineligible for the AOTC but still eligible for the LLC.

Moving Forward With Your Data

Don't just hand the form to an accountant and forget it. Look at the numbers. Compare them to your own records. If the school reported $5,000 but you know you paid $8,000, ask them why. Usually, it's a timing issue, but sometimes schools make mistakes. They process thousands of these; errors aren't impossible.

Actionable Next Steps:

- Download the PDF: Go to your university's "Bursar" or "Student Account" portal. Search for "2025 Tax Forms."

- Match with Bank Statements: Verify that Box 1 actually aligns with the checks or transfers you made between January 1 and December 31.

- Gather Outside Receipts: Find your receipts for required equipment, books, and supplies. Remember, these won't be on the 1098-T but are still deductible/creditable.

- Check Your Eligibility: Determine if you're "Half-Time" and if you're in your first four years of college. This dictates which credit (AOTC vs. LLC) is more lucrative for you.

- Store Everything: Keep a digital folder with the 1098-T and your receipts for at least three years. The IRS can audit education credits long after you've graduated.

Understanding the layout of a 1098 t form example is basically just learning how to read a summary of your educational "investment" for the year. It’s your money. Make sure you’re getting back every cent you’re legally entitled to.