You’re staring at a paper bill or a digital notification, and for whatever reason, the usual "Auto Pay" or "Slide to Pay" in the app just isn't an option this month. Maybe your bank account is in flux. Maybe you're a business owner who still lives and breathes by the paper trail of a physical check. Whatever the case, you need a verizon wireless payment address, and you need the right one.

Sending money to a massive corporation through the mail feels a bit like throwing a message in a bottle into the Atlantic Ocean. You hope it hits the right shore. Honestly, it’s a bit nerve-wracking because if that check lands in the wrong processing center, your service could be suspended while the "Big V" tries to figure out where your $120 went.

Why the Address Depends on Where You Live

Verizon doesn't have one giant mailbox in New Jersey where every check goes. That would be a logistical nightmare. Instead, they use a series of P.O. Boxes scattered across the country, mostly managed by major banks. This is what's known as a "lockbox" system.

When you mail a check, it goes to a regional center that can process it faster based on your billing cycle and location. If you live in California and send your check to the Newark, New Jersey address, it might take an extra three to five days just to clear the postal system. By then? You’re looking at a late fee.

The Most Common Verizon Wireless Payment Addresses

If you've lost your return envelope—the one with the little clear window—don't panic. For the vast majority of consumer accounts, the payment goes to one of these three hubs.

For residents in the Northeast, including states like New York, Massachusetts, or Connecticut, you’re almost certainly looking at:

Verizon Wireless, P.O. Box 15062, Albany, NY 12212-5062.

If you are located in the Mid-Atlantic or parts of the South, such as Virginia, Maryland, or North Carolina, the destination is usually:

Verizon Wireless, P.O. Box 660108, Dallas, TX 75266-0108.

Wait, Texas? Yeah. Even if you’re on the East Coast, Dallas is one of the massive financial processing hubs for Verizon’s billing partner banks. It’s a quirk of corporate finance.

For those in the West or Midwest—think California, Nevada, or Illinois—the address typically shifts to:

Verizon Wireless, P.O. Box 660105, Dallas, TX 75266-0105.

Notice the difference? It’s literally just the last two digits. Get those wrong, and your check might sit in a sorting bin for an extra 48 hours.

📖 Related: Is TRON Ares Good? The Truth About Justin Sun’s New Layer 2 Solution

Overnighting a Payment: The "Panic" Address

We’ve all been there. It’s Tuesday. Your bill was due Sunday. You’ve received that text saying "Your service may be interrupted." At this point, standard USPS mail is a gamble you’re going to lose. You need FedEx or UPS.

But here is the catch: You cannot send FedEx or UPS to a P.O. Box. Private couriers need a physical street address where a human being (or at least a sophisticated machine) can sign for the delivery. If you try to overnight a check to the Dallas P.O. Box, the courier will just hold it at their local facility until you provide a "real" address.

For emergency overnight payments via FedEx or UPS, use this physical location:

Verizon Wireless, Attn: Cash Management, 1100 Corporate Drive, LBX 660108, Radnor, PA 19087.

This is the heavy hitter address. It bypasses the standard mail sorting and goes straight to the processing floor. It's expensive to ship, but it's cheaper than a reconnection fee and the headache of a dead phone line.

What Most People Get Wrong About Mailing Payments

People think they can just write their phone number on a check and call it a day. That is a recipe for disaster. Verizon manages millions of accounts. There are probably five hundred people with your exact same name paying their bills this week.

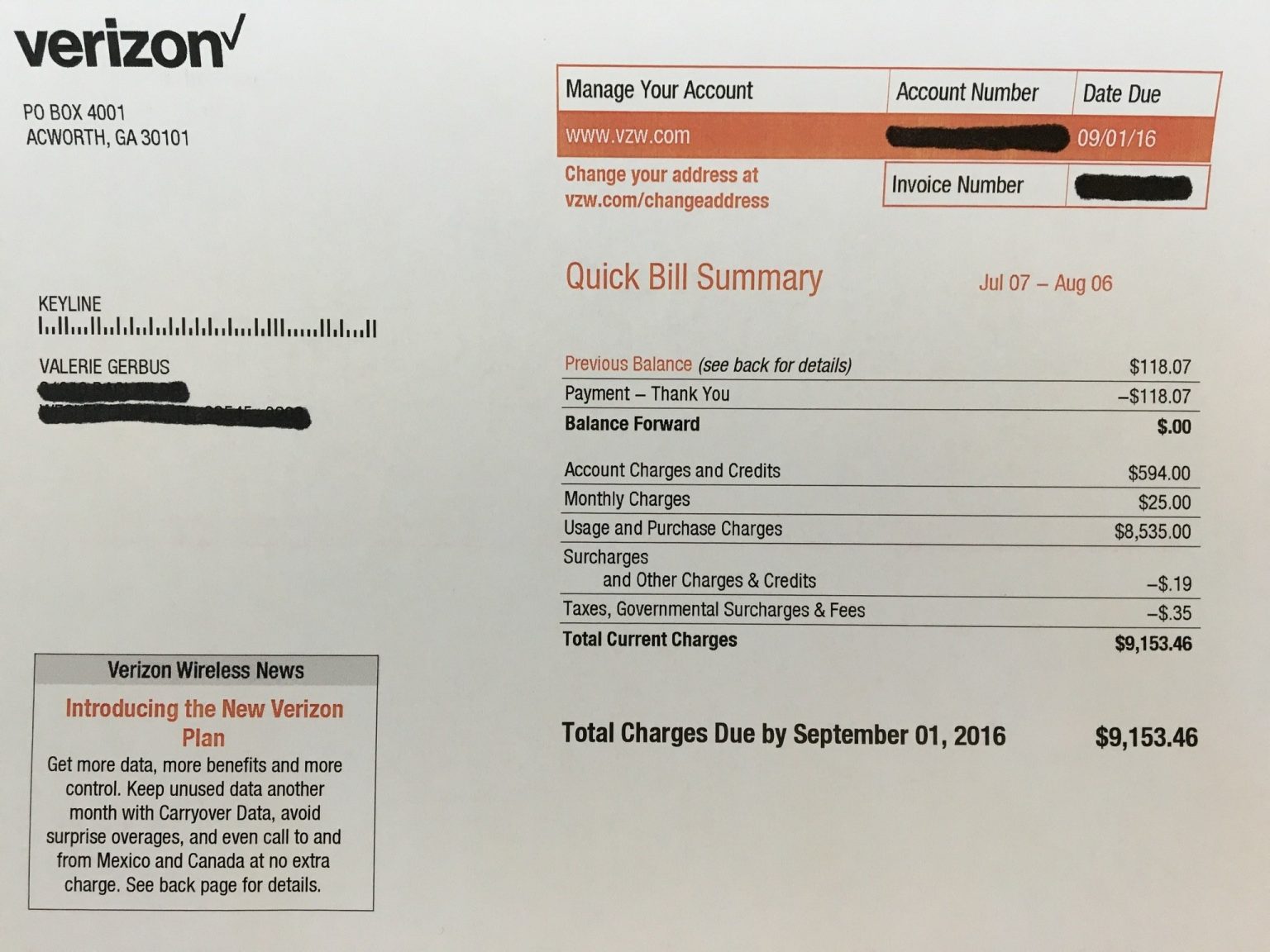

Always include your full 10-digit account number. It’s usually located at the top right of your bill. Better yet, write it in the "Memo" line of your check and on the back of the check where you’d normally endorse it. If the check gets separated from your letter or billing slip, that account number is the only thing keeping your money from being "unidentified funds."

Another weird tip: Avoid staples. Don't staple your check to the payment stub. The high-speed scanners at the lockbox facilities hate staples. They can jam the machine or tear the check, which leads to manual processing. Manual processing means delays. Use a paperclip if you must, but honestly, just folding them together inside the envelope is plenty.

The Pitfalls of Business vs. Consumer Accounts

If you’re on a "Verizon Small Business" or "Enterprise" plan, your verizon wireless payment address might be totally different from your neighbor’s consumer plan. Business accounts often route through different financial departments.

For example, many national business accounts are directed specifically to a center in Newark, New Jersey (P.O. Box 15124). If you’re a business owner, checking the "Remit To" section of your specific invoice is non-negotiable. Don't rely on a Google search for business addresses because those change based on the specific type of service contract you signed.

Is Mailing a Check Still Worth It?

Honestly? Probably not for most people.

The postal service has become increasingly unpredictable over the last few years. A letter that used to take two days might now take six. If you’re mailing a check because you don’t want to use "Auto Pay," consider using your bank’s online bill pay service instead.

When you use your bank’s bill pay, the bank often sends the funds electronically to Verizon. Even if the bank does mail a physical check on your behalf, they usually have a "delivery guarantee." If the check arrives late, the bank might even cover your late fee. It’s a safety net you don't get when you're the one licking the stamp.

Surprising Facts About Verizon's Billing

Did you know Verizon processes roughly $30 billion in wireless revenue every quarter? That’s a staggering amount of money moving through these P.O. Boxes and electronic portals. Because the volume is so high, their systems are incredibly rigid. They aren't looking for "intent to pay"; they are looking for cleared funds.

If you mail a check and it bounces, Verizon doesn't just ask for the money again. They often flag your account as "Cash Only." This means you won't be able to pay with a personal check—or even a credit card in some cases—for several months. You’d have to visit a Verizon store and pay with a money order or cold, hard cash.

Dealing With a Lost Payment

You sent the check. The money hasn't left your bank account. Your Verizon app says "Past Due."

Don't wait.

The moment you realize the check hasn't arrived by the five-day mark, call Verizon. If you can provide a check number and the date it was mailed, a customer service rep can sometimes place a "payment note" on your account. This won't stop the automated system from sending you late notices, but it might give a human agent a reason to hold off on a service suspension for a few days.

If the check is truly lost, you’ll need to place a "Stop Payment" at your bank. This usually costs between $20 and $35. It sucks, but it's better than having a random check floating around the mail system.

Actionable Steps for a Successful Payment

To ensure your service stays active and your payment actually lands where it belongs, follow this specific workflow.

✨ Don't miss: Is the Amazon Fire TV 32 inch Actually Any Good? My Honest Take

- Double-check your region. If you are in the West/Midwest, use the Dallas address ending in 0105. If you are in the South/Mid-Atlantic, use the Dallas address ending in 0108.

- Write clearly. Use black or blue ink. Avoid fancy gel pens that can smear if the envelope gets damp in the rain.

- Include the stub. If you have the bottom portion of your paper bill, send it. It has a barcode that machines read in milliseconds.

- Mail it 10 days early. Give yourself a massive buffer. Between USPS transit and Verizon’s internal processing, you need more than a week to be safe.

- Check your account online. Four days after mailing, log into the My Verizon app. If you don't see "Payment Received," start prepping your backup plan.

Sending a payment by mail is a bit "old school," and in 2026, it’s definitely the path of most resistance. But if it’s your only option, precision is your best friend. Get the P.O. Box right, keep your account number visible, and never, ever send cash.

If you're in a total bind, remember that most local Verizon "Corporate" stores (not the third-party authorized retailers) have kiosks inside that accept checks or credit cards in person. It’s a drive, sure, but the payment posts to your account instantly. Sometimes the peace of mind is worth the trip.

Next Steps for Your Verizon Account

- Verify your specific region by checking the "Remit To" section on your last PDF bill via the My Verizon app to ensure no local address changes have occurred.

- Update your check Memo line with your current 10-digit account number to prevent misapplied funds.

- Set a calendar reminder for seven days before your due date to account for the increasing variability in USPS delivery times.