You’ve been waiting. Months of paperwork, doctor appointments, and stressful phone calls with the Social Security Administration (SSA) have finally led to this moment. Then, a thick envelope arrives. You tear it open, expecting a clear "yes," but instead, you're staring at a dense, multi-page document filled with bureaucratic jargon and specific dollar amounts that don't seem to add up at first glance.

This is your Notice of Award.

Most people call it an award letter. If you’re looking for an ssi award letter sample, you probably aren't just curious about the font or the header; you're trying to figure out if what you received is normal, or if you're about to get the money you desperately need. It’s a dense read. Honestly, it's kinda overwhelming. But understanding every line of that letter is the difference between getting your backpay on time and accidentally triggering an overpayment notice six months down the road.

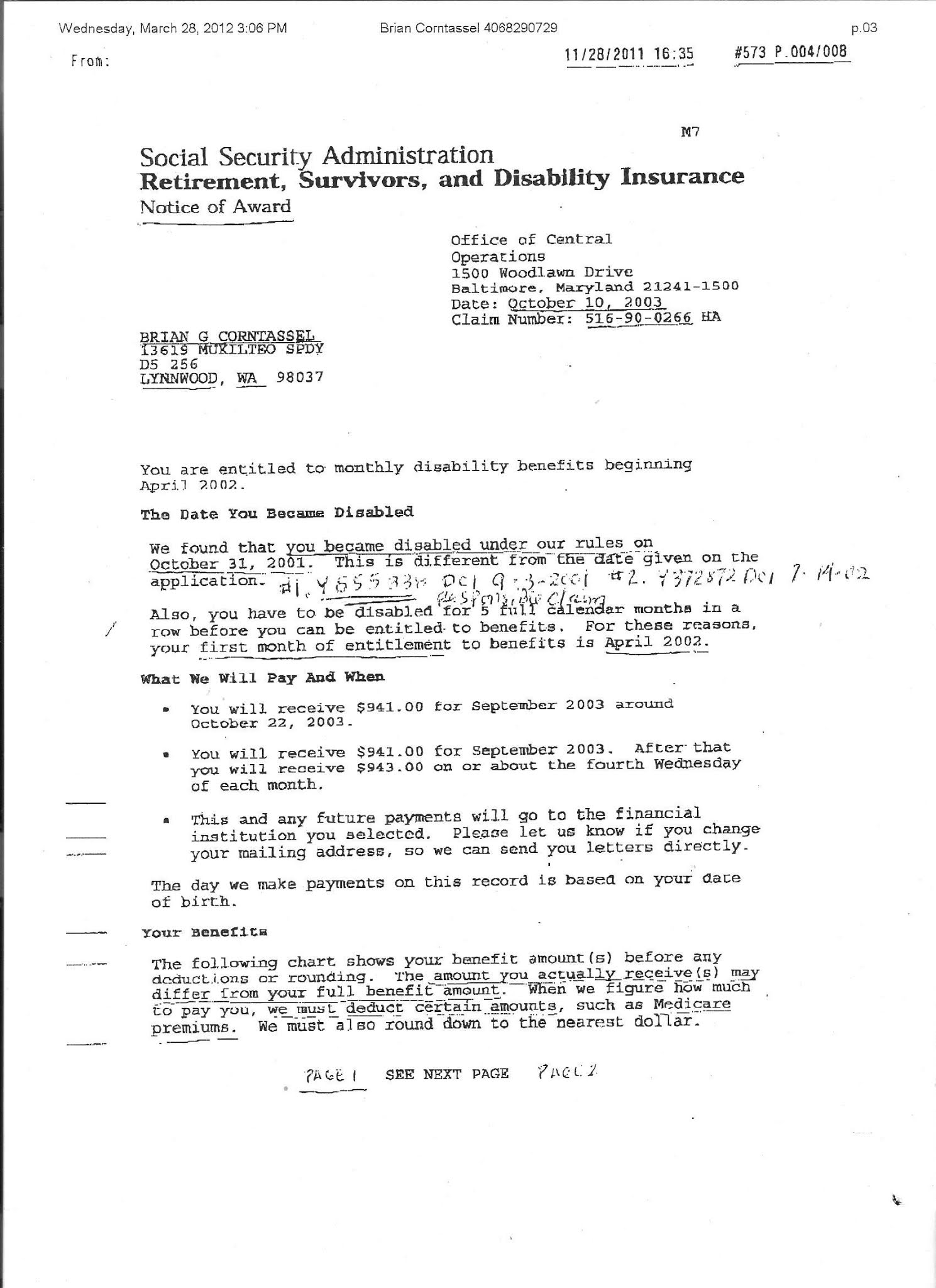

What a real SSI award letter actually looks like

A legitimate ssi award letter sample isn't a single page with a gold star on it. It’s usually a packet. The first page is the "big news" page. It explicitly states that you are entitled to Supplemental Security Income and lists the month your payments begin. If you see the words "Notice of Award" in the top right or left corner, you've cleared the biggest hurdle. You're in.

But don't stop there.

The middle sections are where things get messy. Social Security doesn't just give you one flat rate and walk away. They break down your monthly payment amount for every single month from the date you first applied (your protective filing date) up to the present. This is because SSI rates change slightly almost every year due to Cost of Living Adjustments (COLA). For example, the maximum federal benefit in 2024 was $943 for an individual, but if your backpay stretches back to 2023, those earlier months will be calculated at the 2023 rate of $914.

📖 Related: Travis Kelce Funko Pop: What Most People Get Wrong

You’ll also see a section regarding "Living Arrangements." This is huge. If the SSA thinks you're living in someone else's house without paying your fair share of food and shelter, they might slash your benefit by one-third. It’s called In-Kind Support and Maintenance (ISM). If your letter shows a lower amount than the federal maximum, check this section immediately. It basically means they think you’re getting "free" help, and they’re counting that help as income.

The backpay breakdown nobody explains well

Backpay is usually the first thing people look for. In a standard ssi award letter sample, there will be a specific paragraph detailing your "past-due benefits."

Here is the kicker: SSI backpay is almost always paid in installments. You won't get a $20,000 check on day one.

Usually, the SSA sends the first installment (which is capped at three times the maximum monthly benefit) shortly after the letter arrives. Then you wait six months for the second, and another six months for the third. There are exceptions for "dedicated accounts" for children or if you need the money for life-threatening debts or medical equipment, but for most adults, the award letter will outline this staggered payment schedule. It’s annoying. It feels like they're holding your money hostage, but it’s just the way the law is written.

Why your "Amount Due" might look wrong

You might see a line that says something like, "We are withholding $2,500 to pay your representative." If you hired a disability attorney or a non-attorney advocate, the SSA pays them directly out of your backpay. This is standard. By law, they usually take 25% of the backpay, capped at a certain amount (which increased to $9,200 in late 2024). If that number looks off, you need to call your lawyer immediately, though the SSA is generally pretty precise with these calculations.

The difference between SSI and SSDI award letters

People mix these up constantly. An ssi award letter sample is specifically for the needs-based program. If your letter mentions "Work Credits" or "Primary Insurance Amount (PIA)," you’re actually looking at an SSDI (Social Security Disability Insurance) award letter.

SSI letters focus on:

- Your income (or lack thereof).

- Your resources (bank accounts, cars).

- Who you live with.

- Whether you're a U.S. citizen or in a specific non-citizen category.

If you are "concurrent," meaning you qualify for both, you’ll actually get two different letters. It’s a mountain of mail. Keep both. The SSI letter is often more volatile because your payment can change every single month if your bank balance fluctuates even slightly.

👉 See also: Covers for Christmas Lights: Why Your Holiday Display Looks "Off" and How to Fix It

What happens after the letter arrives?

The letter isn't the end of the road. It's the beginning of a new set of rules.

Within the text of your ssi award letter sample, there's always a "Reporting Responsibilities" section. Read it twice. You have to tell them if you move. You have to tell them if someone moves in with you. You have to tell them if you win $50 on a lottery ticket. SSI is a strict program. Unlike SSDI, where you can often have a million dollars in the bank and still get your check, SSI cuts you off if you have more than $2,000 in countable resources ($3,000 for couples).

The letter will also mention your "Redetermination" or "Continuing Disability Review" (CDR). This is the SSA’s way of saying, "We’ll check back in a few years to see if you’re still disabled." Depending on your condition, this could be every three years or every seven years. If your letter says "Medical Improvement Expected," be ready for a review sooner rather than later.

Spotting a fake or "scam" award letter

In 2026, scammers have become incredibly good at mimicking government documents. A real ssi award letter sample will always come from the Social Security Administration, not a "Benefits Processing Center" or some other vague entity. It will contain your partial Social Security number (usually just the last four digits) and a specific office address you can verify.

Real letters never:

- Ask you to pay a "processing fee" via gift card or wire transfer to get your backpay.

- Threaten you with immediate arrest.

- Use overly emotional language like "URGENT: FINAL WARNING."

- Feature grainy, low-quality logos that look like they were copied from a 1990s website.

If you’re suspicious, log into your "my Social Security" account on the official ssa.gov website. You can download a "Benefit Verification Letter" there. It’s a condensed version of your award letter that proves you’re receiving benefits. It’s the gold standard for proving income to landlords or for low-income energy assistance (LIHEAP).

📖 Related: Why the AMC Theatres Stitch Popcorn Bucket is Still Making Everyone Obsessed

Managing the "Resource Limit" once you're approved

Once you see that "Approved" status in your ssi award letter sample, you have to be careful about the backpay hitting your account. The SSA gives you a "grace period" for backpay. Usually, you have nine months to spend that lump sum before it starts counting toward your $2,000 resource limit.

Don't just stick it in a savings account and forget about it.

If you still have $5,000 of backpay in your checking account ten months from now, the SSA will stop your checks and demand you pay back the "overpayment." This is a trap that catches thousands of people every year. Use the money for things that don't count as resources:

- Pay off debt.

- Repair your car.

- Buy a home (the home you live in doesn't count as a resource).

- Put it into an ABLE account if your disability began before age 26 (this limit is expanding in many states).

Specifics for children's SSI awards

If you're looking at a ssi award letter sample for a child, the wording changes. It talks about "deeming." This is the process where the SSA looks at the parents' income and "deems" a portion of it to the child. The award letter will show exactly how much of the parents' income resulted in a reduction of the child's benefit.

It also mentions "dedicated accounts." If a child receives a large amount of backpay, the law requires the parent to put that money into a separate bank account used only for specific disability-related expenses. You can't use a child's SSI backpay to pay the family's rent if that money is mandated for a dedicated account. You have to keep receipts for everything. Everything. The SSA will audit that account.

Actionable steps for your SSI award letter

If you’ve just received your letter or you're using an ssi award letter sample to prepare, follow these steps to ensure you actually get paid:

- Verify the Bank Info: Look for the section on Direct Deposit. If the routing number is wrong, your backpay is going into a void. Fix it via the 800-number or your online portal immediately.

- Calculate the "Third": If your payment is roughly $300 lower than the maximum, look for the "In-Kind Support" section. If you are actually paying rent to your roommates or parents, submit a rental agreement to the SSA to get your benefit bumped up to the full amount.

- File the Letter: Keep the original paper copy. Digital copies are great, but for some reason, state Medicaid offices and HUD housing authorities often demand the physical "Notice of Award" to prove your status.

- Set a "Resource Alarm": Mark your calendar for nine months from the day your backpay arrives. That is your deadline to spend the money down below the $2,000 limit.

- Check for Medicaid Eligibility: In most states, getting an SSI award letter means you are automatically eligible for Medicaid. However, in "Section 209(b)" states, you might have to file a separate application. Check your letter to see if it mentions "Medical Assistance."

The award letter is a contract between you and the government. They agree to pay you, and you agree to follow their very specific, often frustrating rules. Understanding that ssi award letter sample before the money hits your account is the best way to make sure you keep the benefits you worked so hard to get.

Stay on top of the reporting requirements and keep a folder of every communication you have with your local office. It feels like overkill until the day you get a letter saying you owe them money. At that point, your records are your only defense.