You're probably looking for a Wells Fargo sample bank statement because you're trying to figure out if your mortgage application is going to get flagged or maybe you just need a template to organize your own messy finances. Honestly, bank statements are the unsung heroes of the financial world. They’re boring, sure. But try getting a car loan or a rental agreement without one.

Wells Fargo, being one of the "Big Four" banks in the US, has a very specific look to their documents. If you’ve seen one, you’ve seen them all, but if you’re looking at a sample for the first time, the layout can be a bit overwhelming. It isn't just a list of what you spent at Starbucks. It's a legal snapshot of your "financial health" according to the bank’s algorithms.

What’s Actually Inside a Wells Fargo Sample Bank Statement?

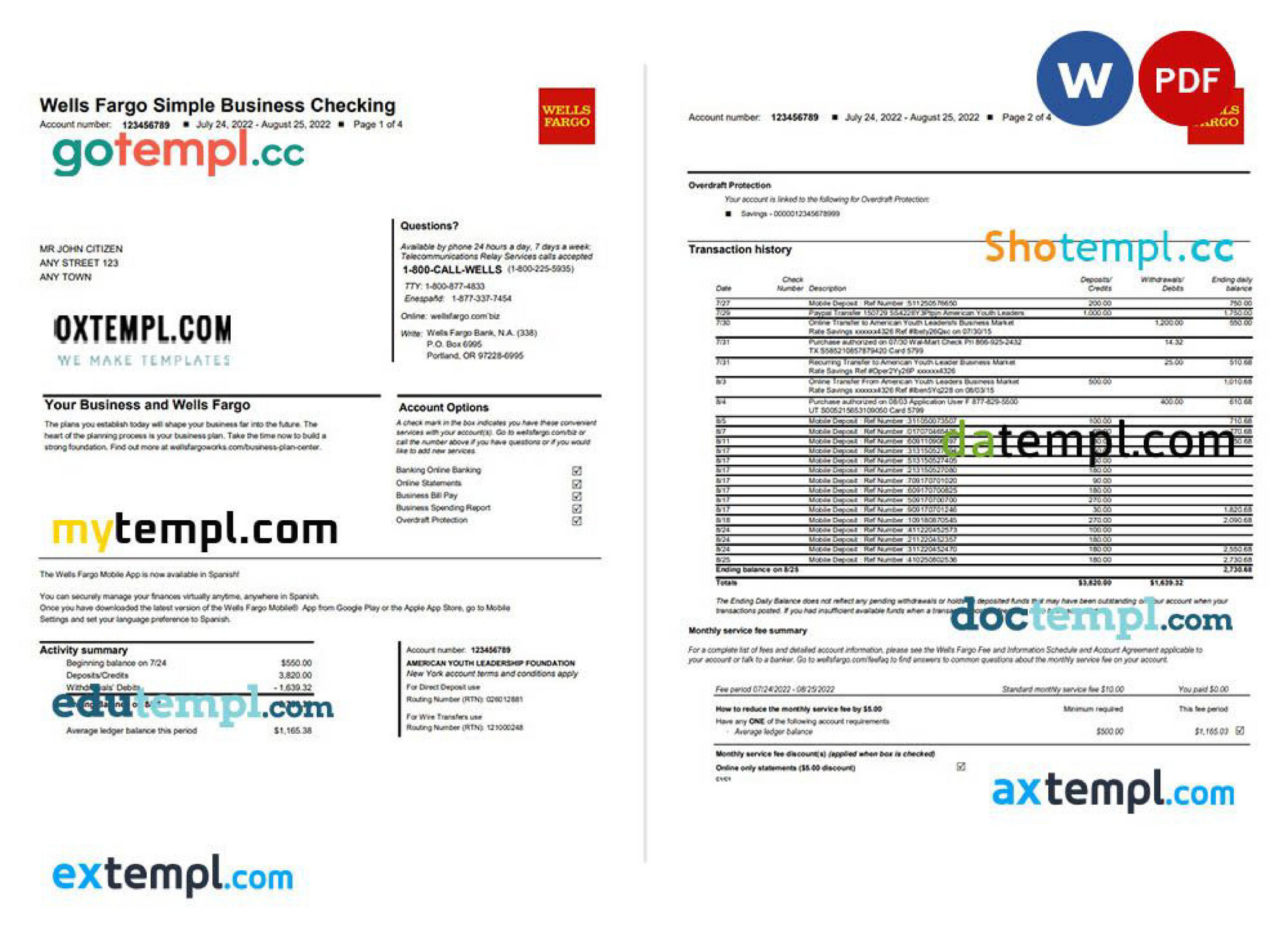

When you pull up a Wells Fargo sample bank statement, the first thing that hits you is the header. It’s clean. It has that iconic stagecoach logo, usually in the top left or center. Right next to it, you’ll find the account summary. This is the "TL;DR" of your month. It shows your beginning balance, total deposits, total withdrawals, and that final ending balance that either makes you smile or cringe.

Below that, things get granular.

You’ll see a section for "Deposits and Additions." This includes your direct deposits, mobile check loads, and those Zelle transfers from your roommate who finally paid for the pizza last night. Then comes the "Withdrawals and Debits" section. This is usually the longest part. It lists every ACH transfer, every ATM withdrawal (and those annoying out-of-network fees), and every debit card swipe.

Wait. There’s more.

Wells Fargo statements often include a "Daily Ledger Balance" table. Most people skip this, but it’s actually the most important part if you’re worried about overdrafts. It shows exactly how much was in your account at the end of every single business day. If you spent $50 at 2 PM but your paycheck didn't clear until 6 PM, this table is where the bank proves why they charged you that $35 fee.

Security Features You Might Miss

If you are looking at a Wells Fargo sample bank statement to verify a document’s authenticity, look at the fonts and the spacing. Real statements don't use generic Calibri or Times New Roman for everything. They use proprietary layouts. The account numbers are almost always masked—usually showing only the last four digits. If you see a "sample" online that shows a full 10-digit account number, it’s probably a fake or a very outdated template.

Also, check the "Period Covered." A standard statement usually covers a 28 to 31-day cycle. If the dates don't align with standard business months or if the "Number of Days in Period" math doesn't add up, that’s a massive red flag for any underwriter.

🔗 Read more: The Walmart Shopper Criticizes Self Checkout Process and Surveillance Trend: Why People Are Fed Up

Why People Search for These Samples Anyway

Most people aren't just curious about graphic design.

Typically, small business owners look for a Wells Fargo sample bank statement to prep their bookkeeping. They want to know where the transaction codes are located. For example, Wells Fargo uses specific codes like "ATM" for withdrawals or "POS" for point-of-sale purchases. Knowing where these appear helps in automating spreadsheets or feeding data into software like QuickBooks.

Then there’s the darker side.

The internet is flooded with "editable" bank statement templates. People use these for "novelty purposes," which is usually code for trying to trick a landlord or a lender. Don't do that. Modern verification systems like Plaid or Finicity don't even look at the PDF anymore; they ping the bank's API directly. If your "sample" doesn't match the digital data, you're in for a world of legal hurt.

How to Get Your Own Real Statement (Not a Sample)

If you have a Wells Fargo account, stop looking for samples. You can get the real deal in about thirty seconds.

- Sign into the Wells Fargo Mobile app or online portal.

- Select your account (Checking, Savings, whatever).

- Look for "Statements and Documents."

- Pick the month you need and hit download.

It’s a PDF. It’s official. It’s encrypted.

If you’re a business owner needing a specialized Wells Fargo sample bank statement for training your staff, the bank actually provides "Guides to Your Statement" on their corporate site. These are official PDFs that have "SAMPLE" watermarked across them. They even have little call-out bubbles explaining what each section means. Use those. They are the only 100% accurate representations of what the bank currently issues in 2026.

The Problem With Online Templates

I’ve seen a lot of sites offering a "free Wells Fargo sample bank statement" in Word or Excel format. Be careful. These are almost always formatted incorrectly. The margins are off. The logo resolution is terrible. More importantly, they often lack the "Account News" or "Change in Terms" section that usually appears on page three or four.

Real statements are messy. They have fine print about interest rates (APYs) and disclosure language about the Dodd-Frank Act or Consumer Financial Protection Bureau (CFPB) regulations. If your sample is "too clean," it isn't real.

Decoding the Transaction Codes

If you're staring at a Wells Fargo sample bank statement and seeing a bunch of gibberish, you aren't alone.

- ACH: Automated Clearing House. This is usually your payroll or your utility bill.

- ODF: Overdraft Fee. The thing we all hate.

- POS: Point of Sale. You bought something in person.

- INT: Interest Earned. Usually about $0.01 unless you’ve got a high-yield account.

Basically, these codes are the bank’s shorthand. They keep the document from being fifty pages long. If you see "ATM" followed by a string of numbers, those numbers are the specific ID of the machine you used. It's incredibly detailed.

Actionable Steps for Managing Your Statements

Don't just look at the sample; use the information to secure your financial life.

First, turn off paper statements. Seriously. It’s 2026. Identity theft is rampant, and your mailbox is the weakest link. Wells Fargo gives you a small discount or waives certain fees sometimes if you go paperless. Plus, the digital PDF is the "source of truth" anyway.

✨ Don't miss: Converting US to Kuwaiti Currency: Why the KWD Stays the World's Strongest

Second, reconcile once a month. It sounds old-fashioned, like something your grandpa would do with a pencil and a leather ledger. But it works. Compare your receipts to the statement. Look for small $9.99 charges you forgot to cancel. Those "zombie subscriptions" are the silent killers of a good budget.

Third, keep a digital archive. Wells Fargo usually keeps about seven years of statements online. If you ever get audited by the IRS or apply for a high-level security clearance, you’ll need those. Download the PDFs and stick them in an encrypted cloud folder or a physical thumb drive in a safe.

Lastly, if you're looking at a Wells Fargo sample bank statement because you're a developer building a fintech app, use the official Wells Fargo Developer Portal. They provide sandbox data that is much more useful than a static image of a statement. It allows you to see how the data flows, not just how it looks on a piece of paper.

Financial literacy starts with being able to read the paperwork. Once you understand the layout of a major bank like Wells Fargo, you can pretty much read any financial document in the world. It's all just inputs and outputs. Keep your eyes on the "Daily Ledger Balance" and you'll never be surprised by a fee again.