So, you’re looking for a penny stock list today. Honestly, I get it. The lure of turning a few hundred bucks into a house deposit is basically the modern-day version of the gold rush. But let’s be real for a second: most people treat penny stocks like a trip to the casino, and that’s exactly why they lose their shirts. If you’re staring at a screen waiting for a ticker to "moon," you’re already behind the curve.

Penny stocks—generally defined by the SEC as shares trading under $5.00—are a wild west of volatility. Today, January 17, 2026, the market is humming with specific themes. We aren't in the "AI hype only" phase of 2024 anymore. Now, it’s about actual infrastructure, clinical milestones, and whether a company can survive a higher-for-longer interest rate environment without diluting its shareholders into oblivion.

The Reality of a Penny Stock List Today

When you pull up a penny stock list today, you’re going to see a lot of noise. You'll see tickers like Bitfarms Ltd. (BITF) trading around $2.80 or Argo Blockchain (ARBK) sitting near $4.34. These aren't just random letters; they are proxies for the Bitcoin market. As Bitcoin retakes the $95,000 level this morning, these miners are the first place speculative "hot money" flows.

But here is the catch: Bitfarms is energy-intensive. They use hydro-power in Canada to keep costs down, but their margins are still at the mercy of the "hash rate." If you’re buying BITF today, you aren’t just buying a stock; you’re betting on the global hash rate and the price of BTC staying above $90k.

It's risky. Kinda terrifying, actually.

Then you have the biotech side of the list. Take BioXcel Therapeutics (BTAI), which is currently a massive talking point for day traders. It’s sitting under $2.00, but they are staring down a critical late-stage clinical milestone this year. In the biotech world, a "penny stock" is often just a multi-billion dollar idea that hasn't been approved by the FDA yet. Or, it's a company that's three months away from running out of cash.

Why Liquidity Is Your Only Friend

You've probably heard the term "liquidity" a thousand times. In the world of micro-caps, it is the difference between a profit and a permanent loss.

I’ve seen traders "gain" 50% on paper, only to realize there are no buyers when they try to sell. You’re stuck in a burning building and the door is locked. That’s why, when looking at a penny stock list today, I ignore anything trading less than 500,000 shares a day.

Look at Expion360 (XPON). They do lithium-iron-phosphate batteries. Cool tech? Sure. But with a market cap under $10 million, the price can move 10% because one guy in his basement decided to sell. You want volume. You want stocks like Cognition Therapeutics (CGTX), which actually has enough daily trading activity to let you enter and exit without moving the price yourself.

🔗 Read more: JCP Associate Kiosk: How to Actually Get Your Schedule and Pay Stubs Without the Headache

Separating the Gems from the Junk

Most "hot" lists are just promotional fluff. To find something worth your time today, you have to look for a catalyst.

A catalyst is a reason for the stock to exist tomorrow.

- Earnings Surprises: Ironwood Pharmaceuticals (IRWD) has been a standout recently, showing that even stocks in the $4.00 range can have massive projected EPS growth (some analysts are eyeing 300% for the upcoming cycle).

- Contract Wins: Small-cap AI plays like BigBear.ai (BBAI) live and die by government contracts. If they aren't winning deals with the U.S. military, they're just a cash-burning shell.

- Sector Rotations: Right now, there’s a quiet rotation into "undervalued" health tech. Community Health Systems (CYH) is trading around $3.12. It’s not flashy. It doesn't have "AI" in the name. But it has actual revenue and real hospitals.

The Danger of the "Pump and Dump"

We have to talk about the elephant in the room. Social media is a breeding ground for scams. If you see a ticker being spammed on X (formerly Twitter) or Discord with "TO THE MOON" emojis, run.

These are often "reverse mergers" or companies with "going concern" warnings in their SEC filings. A "going concern" is auditor-speak for "this company might go bankrupt in twelve months." If you don't read the 10-K filings, you're just gambling. Honestly, most penny stock traders don't even know what a 10-K is. Don't be that person.

Practical Steps for Navigating Today's Market

If you are actually going to trade from a penny stock list today, you need a system. Stop guessing.

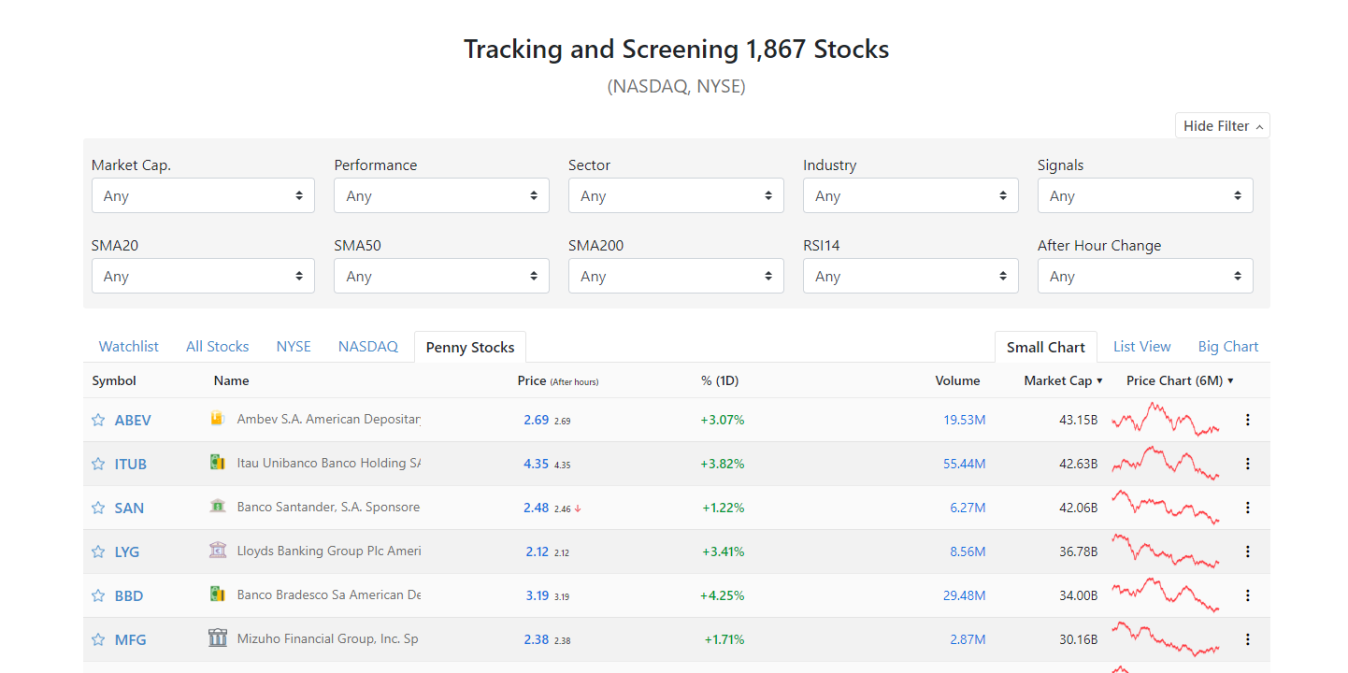

First, check the exchange. If it’s on the NASDAQ or NYSE, there are listing requirements. If it’s "OTC Pink Sheets," it’s the Wild West. Start with the major exchanges.

Second, use a screener with these specific filters:

👉 See also: Do They Make 1000 Dollar Bills? The Truth About High-Value Cash

- Price: $0.50 to $5.00

- Relative Volume: Over 2.0 (this means it’s trading twice its normal volume)

- Institutional Ownership: Anything over 5% is a good sign that the "smart money" hasn't totally abandoned ship.

The Actionable Bottom Line:

Identify three tickers today that are trading on the NASDAQ with a volume of at least 1 million shares. Cross-reference them with the latest SEC filings on EDGAR to ensure they haven't issued a "shelf registration" (which means they’re about to dump new shares on you to raise cash). Focus on companies like iHuman Inc (IH) or Waterdrop (WDH) that show high "Fair Value" upside but maintain a "Good" financial health label.

Stop looking for the "next big thing" and start looking for the next big business. Trading penny stocks successfully requires more research than trading Apple or Microsoft, not less. Check your position sizes—never put more than 1% to 2% of your total portfolio into a single sub-$5 stock. If you can't afford to see that money go to zero by Tuesday, you shouldn't be buying it on Monday.