You're staring at a blank tax form. It’s frustrating. Most of the "help" online is just generic advice that doesn't show you where the actual numbers go. If you've ever tried to hunt down a completed 1099 form example, you know the struggle of finding something that isn't just a blurred-out stock photo from 2014.

Tax season creates this weird, low-level anxiety. For freelancers and business owners, the 1099-NEC is the big one now. It used to be the 1099-MISC, but the IRS changed the rules a few years back. Now, if you paid someone more than $600 for services, you're on the hook for a 1099-NEC. It's basically a snitch sheet for the government to make sure people are reporting their side hustle income.

📖 Related: Dow Jones Industrial Average: What Most People Get Wrong About the 49,000 Milestone

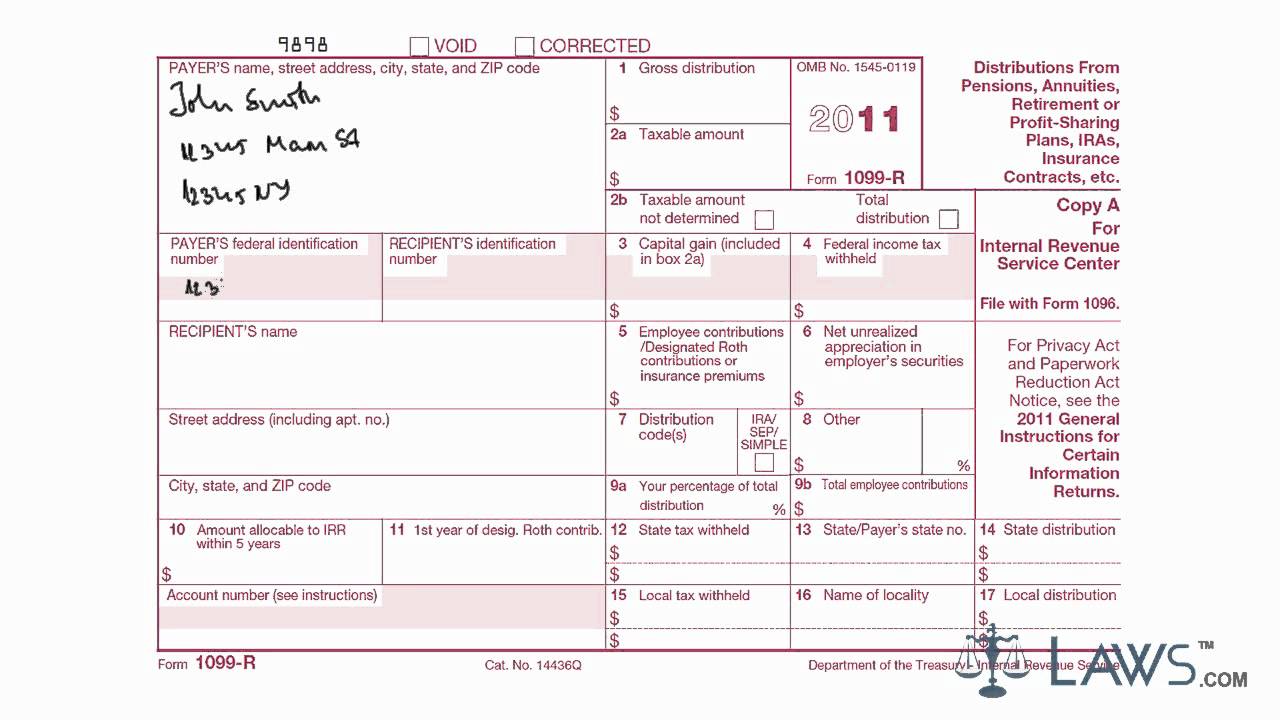

Honestly, the forms look intimidating because of all the tiny boxes and legal jargon. But once you see a filled-out version, the logic starts to click. You’ve got a payer (the person with the money) and a recipient (the person who did the work). That’s the core of it. Everything else is just "where" and "how much."

Why the 1099-NEC is the one you probably need

Let’s get specific. Before 2020, almost everyone used the 1099-MISC for everything. Now, the IRS wants non-employee compensation separated. This means if you hired a graphic designer to refresh your logo or a contractor to fix the office sink, you’re looking for a 1099-NEC.

Imagine a guy named Carlos. Carlos runs a small landscaping business. He hired a freelance web developer, Sarah, to build his site. He paid her $2,500 over the course of the year. Carlos is the Payer. Sarah is the Recipient.

In a real-world completed 1099 form example for this duo, Carlos would put his name, address, and EIN (Employer Identification Number) in the top left box. Sarah’s info—her name, address, and Social Security Number (or her own EIN)—goes in the box below that. The magic happens in Box 1. That’s where the $2,500 goes. It’s labeled "Nonemployee compensation." Simple, right? Well, usually.

The IRS gets a copy. Sarah gets a copy. You keep a copy. If you miss the deadline—which is usually January 31st—the penalties start racking up. It's not a "maybe I'll do it later" kind of situation. The IRS is surprisingly efficient at matching these forms to tax returns.

Breaking down the boxes on a completed 1099 form example

Let's walk through the actual fields.

First, the Payer's TIN. This is either your SSN if you're a sole prop, or your EIN. If you're running a business, you really should have an EIN. It's free and keeps your personal identity a bit safer.

Then comes the Recipient's TIN. You get this from a Form W-9. Never, ever pay a contractor without getting a W-9 first. It is a nightmare trying to track people down in January to get their tax ID when they’ve already moved on to other projects. If they refuse to give it? You’re technically supposed to start "backup withholding," which means taking 24% out of their pay and sending it to the IRS yourself. Nobody wants to do that.

Box 1: Nonemployee Compensation. This is the big one. This includes fees, commissions, prizes, and awards for services performed as a non-employee. If you paid for parts and labor, you generally put the whole amount here.

Box 4: Federal income tax withheld. Usually, this is $0. Most freelancers handle their own taxes. But if you did have to do backup withholding, this is where that amount lives.

📖 Related: 44 Euro to USD: Why Small Transfers Can Cost You More Than You Think

Box 5 through 7: State information. Not every state requires this on the federal form, but many do. You’ll put the state abbreviation, the state's ID number, and how much was paid in that specific state.

Common mistakes people make with the 1099-MISC

While the NEC is for contractors, the 1099-MISC still exists. It’s for things like rent, prizes, or legal settlements. If you pay a landlord more than $600 in rent for your office space, you don't use the NEC. You use the MISC. Box 1 of the MISC is specifically for rent.

A lot of people accidentally put rent on an NEC. Don't do that. The IRS computers will flag it because the tax rates and treatments for "active" business income (NEC) versus "passive" rent income (MISC) are different.

Also, don't 1099 a corporation. If you paid "Design Lab Inc." for work, you usually don't need to send them a 1099. There are exceptions for lawyers and medical providers, because the IRS likes to keep an extra close eye on them, but for your average S-Corp or C-Corp, you're off the hook.

The W-9: The secret to a perfect 1099

You can't have a completed 1099 form example without talking about the W-9. It’s the source document. Think of it as the "cheat sheet" the contractor gives you so you can fill out the 1099 correctly.

I’ve seen business owners try to guess if someone is an LLC or a Sole Proprietor. Don't guess. If the W-9 says they are an LLC taxed as a C-Corp, you stop right there—you don't owe them a 1099. If they check "Individual/Sole Proprietor," you definitely do.

A nuanced point: if you paid a contractor through a credit card or PayPal, you actually don't file a 1099-NEC. This is a huge point of confusion. In those cases, the payment processor handles the reporting via a 1099-K. If you double-report it by sending an NEC as well, the poor contractor looks like they earned twice as much money as they actually did. That leads to an audit, a very angry contractor, and a lot of paperwork to fix it.

Where do you actually get the forms?

You can't just print a PDF from the IRS website and mail it in. Well, you can for the recipient's copy, but the "Copy A" that goes to the IRS uses special red drop-out ink. Their scanners are picky.

You have a few real options:

- Buy a pack from an office supply store (Staples, Office Depot).

- Use an e-file service like Track1099 or Tax1099.

- Use your accounting software (QuickBooks, Xero, etc.).

E-filing is the way to go. It’s usually a few dollars per form, and they handle the mailing to the contractor and the digital filing with the IRS. It's much cheaper than the gas money and time spent driving to the post office to send certified mail.

A visual walkthrough of the data flow

Imagine you’re looking at a screen. You have your bank records on the left and a blank 1099 on the right.

- Check the total: You see you paid "Blue Sky Consulting" $4,200 total in 2025.

- Check the W-9: You see Blue Sky is owned by John Smith, a sole proprietor.

- Payer Info: You enter your business name and EIN.

- Recipient Info: You enter John Smith’s name (and business name if he uses one) and his SSN.

- Amount: You type 4200.00 into Box 1 of the 1099-NEC.

- State: If you're in a state with income tax, like Georgia or California, you fill out the bottom boxes with your state's tax ID.

That is your completed 1099 form example in action. No fluff. Just the data.

Important deadlines and penalties

The IRS doesn't play around with these dates. For the 1099-NEC, the deadline is January 31st for both the recipient copy and the IRS filing. This is different from the 1099-MISC, which sometimes gives you until March if you're filing electronically.

If you're late, the fines start at about $60 per form. If you completely ignore the requirement and they catch you, it can jump to over $600 per form for "intentional disregard." If you have 10 contractors, that’s a $6,000 mistake.

Actionable Next Steps

To get this right, you need to move now, not on January 30th.

Audit your payments. Go through your Venmo, PayPal, bank statements, and credit card bills. Identify anyone you paid more than $600 for services who isn't an employee.

Collect W-9s immediately. Send an email to any contractor you worked with this year. Tell them you need a signed W-9 to process their year-end tax documents. Most pros will send it over in five minutes.

Determine your filing method. If you have more than 10 forms to file, the IRS actually requires you to e-file now. Even if you have just one, e-filing is safer. Pick a platform by mid-January and upload your data.

Verify the 1099-K crossover. Check if you paid people via "Third Party Settlement Organizations." If you paid a freelancer $1,000 through Upwork, Upwork handles the reporting. You don't. If you paid them $1,000 via a direct bank transfer (ACH), you are responsible for the 1099.

Taking these steps ensures you don't end up as a cautionary tale in an IRS audit. Keeping clean records throughout the year is the only way to make the 1099 process painless. Check your math, verify your TINs, and get those forms out by the end of January.