If you’ve ever glanced at a financial news ticker and seen a mention of "the banks" or "Wall Street performance," you were likely looking at a reflection of the Financial Select Sector Index. It’s the engine room. Honestly, most people think they understand how the stock market works by looking at the S&P 500, but the reality is a bit more granular. You have to look at the sectors.

The Financial Select Sector Index, often tracked by the massive XLF exchange-traded fund, is basically a concentrated bucket of the biggest financial names in the United States. We’re talking about the titans. JPMorgan Chase, Berkshire Hathaway, Visa, and Goldman Sachs. It’s not just a list; it’s a pulse check on the global economy. When credit is flowing, this index hums. When things get shaky—think 2008 or the regional banking jitters of 2023—this index becomes the focal point of every nervous investor on the planet.

What the Financial Select Sector Index Actually Tracks

Don't let the name confuse you into thinking it's just local banks with marble columns. The Financial Select Sector Index is far broader than that. It encompasses a massive range of business models. You've got diversified financial services, insurance providers, commercial banks, and capital markets players. It even includes consumer finance and real estate investment trusts (REITs) to a certain extent, though the GICS (Global Industry Classification Standard) reorganization a few years back moved many REITs into their own dedicated sector.

The index is managed by S&P Dow Jones Indices. It uses a modified market-capitalization weighting. Basically, the bigger the company, the more it moves the needle. But there’s a cap to prevent one single company, like Warren Buffett’s Berkshire Hathaway, from completely hijacking the entire index's performance.

The Heavy Hitters in the Mix

If you look at the top holdings, it's a "who's who" of American capitalism. Jamie Dimon’s JPMorgan Chase usually sits near the top. Then you have the payment processors. Visa and Mastercard are technical powerhouses that many forget are classified as financials. They don't lend money like a traditional bank; they provide the plumbing for global commerce.

✨ Don't miss: Crypto Market Outlook Q4 2025: What Most People Get Wrong

Then there are the investment banks. Goldman Sachs and Morgan Stanley. These firms don't care about your savings account as much as they care about multi-billion dollar mergers and initial public offerings. Their revenue is volatile. It's feast or famine. When the economy is booming and companies are buying each other, these stocks soar. When the IPO market dries up, they drag the index down.

Why Investors Obsess Over This Specific Index

Interest rates. That’s the short answer. The Financial Select Sector Index is arguably the most sensitive part of the market to what the Federal Reserve does in those closed-door meetings in D.C.

Normally, higher interest rates are good for banks. It’s called Net Interest Margin. They charge more on loans than they pay out on deposits. Profits go up. But there's a tipping point. If rates go too high, too fast, people stop borrowing. Businesses stop expanding. Defaults rise. It's a delicate balancing act that makes trading the financial sector feel like tightrope walking.

The Dividend Factor

Many people flock to the financial sector for the income. These aren't tech startups burning cash. These are mature, cash-generating machines. Companies like Bank of America or Wells Fargo often pay out consistent dividends. For a retiree or a conservative fund manager, the Financial Select Sector Index represents a way to capture that yield without betting everything on a single bank that might have a bad quarter.

Misconceptions About the "Select" Label

People see the word "Select" and think it means some human committee is picking "the best" banks. It's not that deep. "Select" refers to the fact that it is a subset of the S&P 500. To be in this index, a company must first be a member of the S&P 500. This is a huge filter. It means you won't find tiny, risky "penny stock" banks here. You only get the institutional giants that have passed the rigorous liquidity and profitability standards required by S&P.

Is it "safe"? Nothing in the market is safe. But it is "stable" in the sense that these companies are "Too Interconnected to Fail"—a phrase that replaced "Too Big to Fail" in modern regulatory speak.

The Tech-Financial Blur

One of the weirdest things about the Financial Select Sector Index lately is how much it looks like a tech index. Look at S&P Global or MSCI. These are data companies. They sell information. They aren't lending money to buy houses. Yet, they are a massive part of the financial sector. This shift toward "fintech" and data services has actually made the index less sensitive to traditional loan defaults and more sensitive to the overall health of the global markets.

🔗 Read more: Seven Eleven Stock Ticker: Why You Can’t Just Buy 7-11 on the NYSE

Performance Cycles and What to Watch

Financials tend to be "cyclical." They follow the economy. If you think a recession is coming, you usually run away from this index. Why? Because banks are the first to feel the pain when people can't pay their bills.

However, they are also often the first to rebound. They are the "early cycle" winners. When the Fed starts cutting rates to stimulate the economy, financial stocks often lead the charge. It’s a lead-lag relationship that professional traders spend their entire careers trying to time.

The Regulatory Shadow

You can't talk about the Financial Select Sector Index without talking about the government. Since the 2008 financial crisis, banks have been under a microscope. The Dodd-Frank Act and the subsequent Basel III requirements changed the game. Banks now have to hold way more capital. This makes them safer, sure, but it also limits how much profit they can squeeze out of every dollar.

It’s a trade-off. You get a more resilient index, but you might lose some of those 20% annual growth spurts we saw in the late 90s.

👉 See also: Venezuela Currency to INR Explained: Why the Exchange Rate Is So Confusing

How to Actually Use This Information

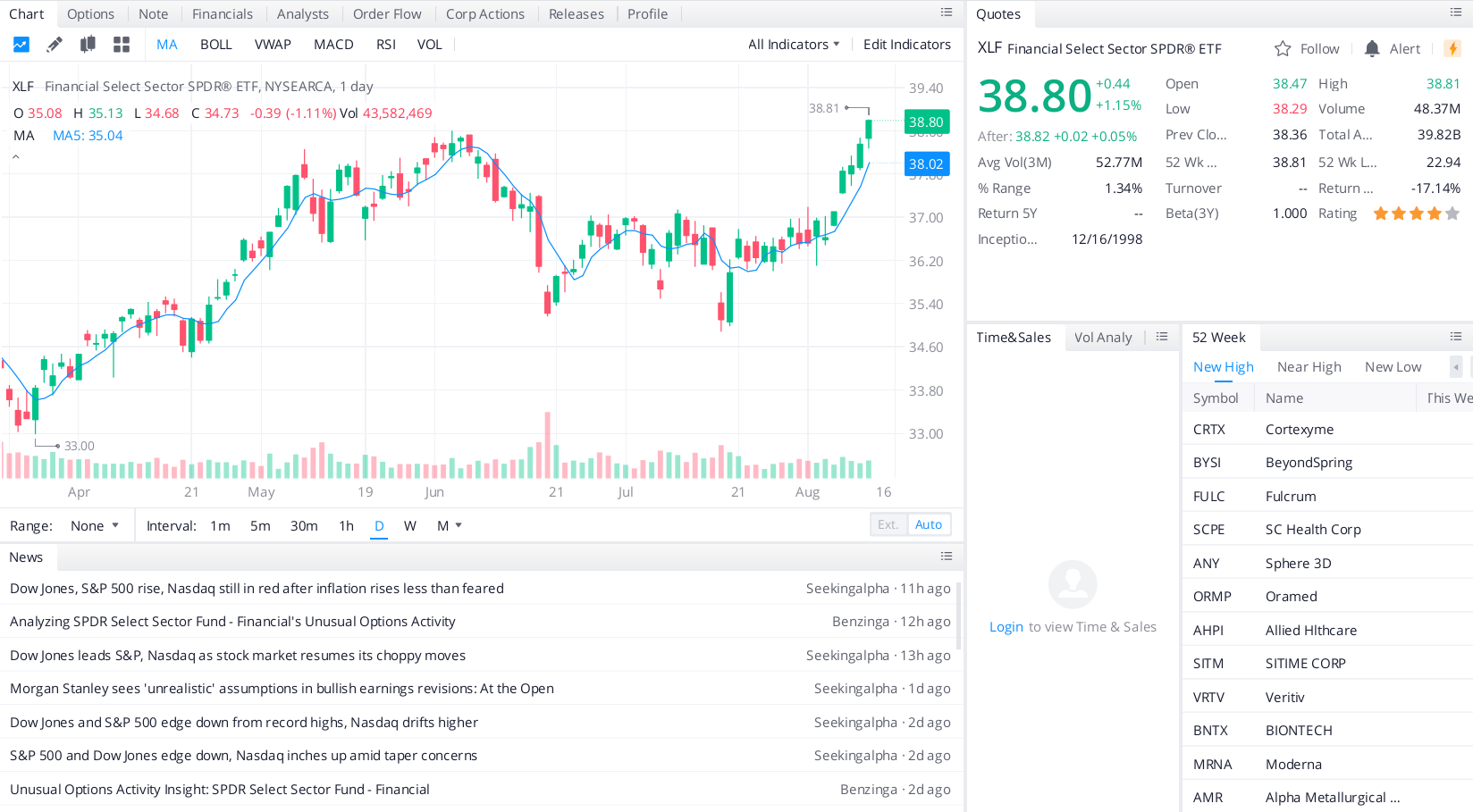

If you're looking to gain exposure, the most common route is the XLF (Financial Select Sector SPDR Fund). It's one of the most liquid ETFs in existence. You can buy and sell it in seconds.

But don't just buy it because it's cheap. Look at the yield curve. Look at the "spread." When the 10-year Treasury yield is much higher than the 2-year yield (a steep curve), banks are usually printing money. When the curve inverts (the 2-year is higher), it’s usually a signal that the Financial Select Sector Index is about to have a very rough year.

Actionable Strategy for Investors

- Check the Fed Dot Plot: Before putting money into the financial sector, see where the Federal Reserve expects interest rates to go. If they are planning a long series of hikes, look for banks with high deposit stickiness.

- Monitor the "Big Four" Earnings: JPMorgan, Bank of America, Citigroup, and Wells Fargo report early in the earnings season. Their results act as a bellwether for the entire Financial Select Sector Index. If they complain about "loan loss provisions" increasing, it’s a red flag.

- Diversify Beyond Banks: Remember that this index includes insurance. Companies like Chubb or Progressive behave differently than Goldman Sachs. If the market is volatile but people are still paying their car insurance premiums, the insurance side of the index can act as a stabilizer.

- Watch the P/E Ratios: Financials often trade at lower Price-to-Earnings ratios than Tech or Healthcare. A P/E of 12 might look like a bargain, but in the financial world, that might actually be "fair value." Don't fall into the trap of thinking a bank is "cheap" just because its multiple is lower than Apple's.

- Evaluate Capital Returns: Look at share buybacks. The biggest companies in the Financial Select Sector Index are notorious for buying back their own stock. This reduces supply and can drive up the price even if the business isn't growing at a massive clip.

The financial sector is the bedrock. It’s not always flashy, and it certainly isn't as "cool" as AI or biotech, but it is the infrastructure that allows everything else to happen. Understanding the Financial Select Sector Index isn't just about picking stocks; it's about understanding the flow of money itself.

Keep an eye on the macro trends. When the housing market shifts or the Fed changes its tone, the financials will be the first to tell you exactly how much pain—or gain—is coming to the rest of your portfolio.