Losing a job is a gut punch. One day you’re in the rhythm of a 9-to-5, and the next, you’re staring at a laptop screen wondering how the mortgage is getting paid. If you’re in Kansas, your first instinct is probably to head straight to the Kansas Department of Labor (KDOL) website. But honestly, the process of filing unemployment in ks can feel like trying to solve a Rubik's cube in the dark if you don't know the specific quirks of the Sunflower State’s system.

It’s not just about filling out a form. It’s about timing, specific phrasing, and staying on top of a "waiting week" that catches almost everyone off guard.

The "Waiting Week" and Why Your First Check Is Missing

Let's get the most frustrating part out of the way. Kansas law (K.S.A. 44-705) requires a mandatory "waiting week." Basically, this is the first week you are eligible for benefits, but the state doesn't pay you for it. You still have to file your weekly certification for that week, though. If you don't, you don't get credit for the wait.

Think of it as a deductible on your car insurance. You have to "pay" that first week of unemployment yourself. For claims filed between July 1, 2025, and June 30, 2026, the maximum weekly benefit amount is $637, while the minimum sits at $159. Missing out on that first week is a hit, but there’s a small silver lining: if you remain unemployed for three consecutive weeks after that waiting period, you might actually get paid for it later.

Getting Your Ducks in a Row Before You Click Submit

Don't just open the portal and wing it. The system will time you out, and losing your progress is enough to make anyone want to throw their router out the window. You’ll need your Social Security number—that's a given. But you also need your Kanas driver's license or a state ID.

If you aren't a U.S. citizen, have your Alien Registration Number ready.

The real headache is the employer history. You need the names, full mailing addresses, and exact start/end dates for every single employer you’ve had in the last 18 months. If you worked a temp job for three days, KDOL wants to know about it. They also want to know exactly why you left. "It wasn't a good fit" is a dangerous phrase. Be honest but specific. If you were laid off because the company downsized, say that. If you quit, you’d better have a "compelling reason" (like a safety violation or a drastic change in your contract), or you’re going to be fighting an uphill battle for eligibility.

The My Reemployment Plan (MRP) Trap

Here is something nobody talks about until they get a scary-looking email: My Reemployment Plan.

✨ Don't miss: Why Fairgrounds Square Mall PA Finally Went Dark and What’s Next

If you are identified as someone likely to exhaust their benefits, you'll be enrolled in this program. It’s mandatory. You usually get 14 days from the notice to complete a Job Search Plan on KANSASWORKS.com and upload a resume. If you ignore this, KDOL will cut off your benefits faster than you can say "Topeka."

- Create a KANSASWORKS account: This is separate from your unemployment login.

- Upload a "Searchable" Resume: It can't just be a private draft; employers have to be able to see it.

- Complete the Interest Profiler: They use a tool called the O*NET Interest Profiler to see what other jobs you might be good at.

How to Handle the Weekly Certification Without Losing Your Mind

Once your initial claim is in, you aren't done. You have to "certify" every single week, starting the Sunday after you file. The week runs from Sunday to Saturday.

Most people mess up the "gross wages" part. If you pick up a shift at a coffee shop or do a bit of freelance work, you have to report what you earned that week, not what you were paid. If you worked 10 hours at $15 an hour on Tuesday, you report $150 on Sunday, even if the check doesn't hit your bank account for another two weeks.

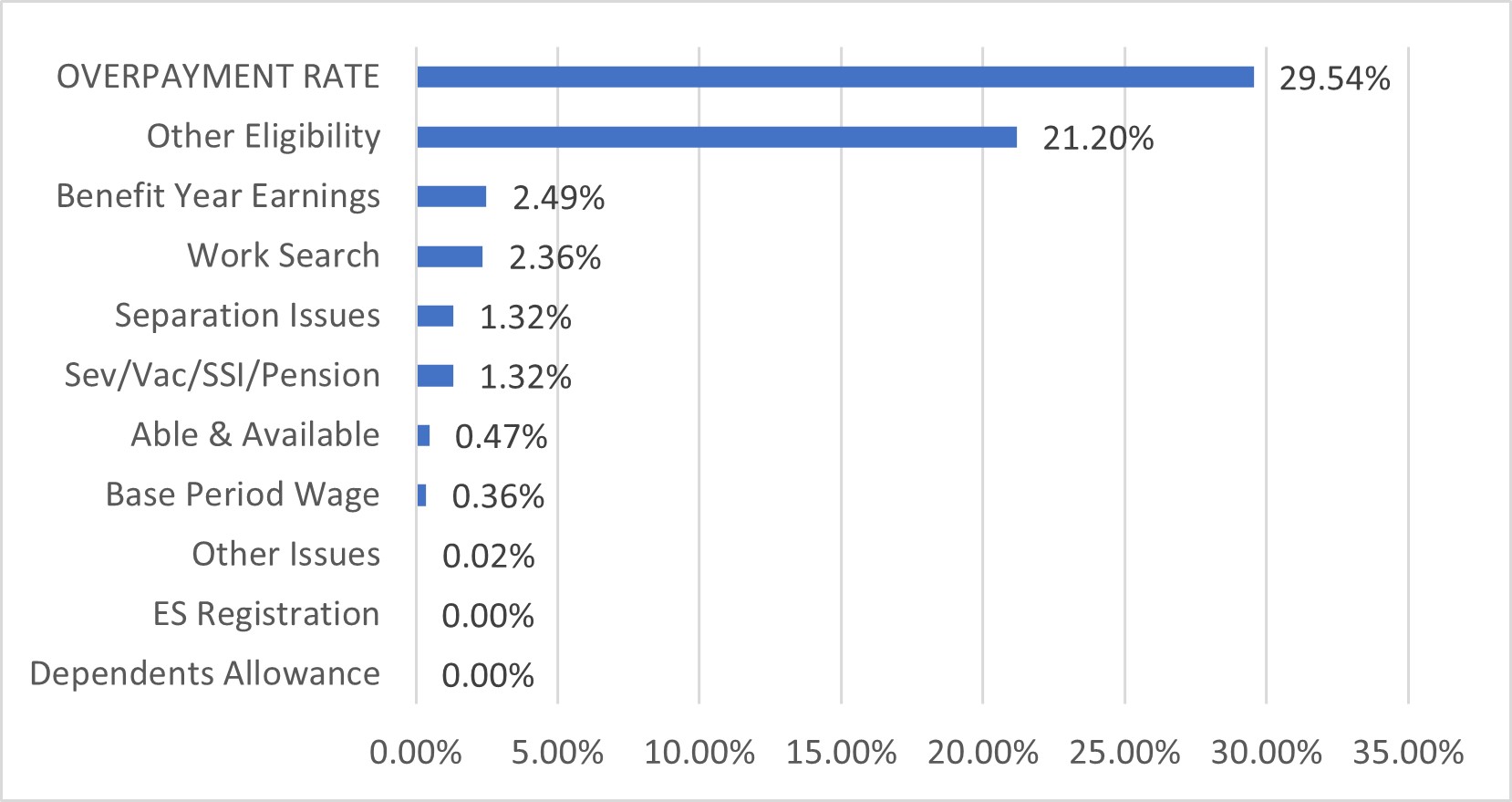

Also, watch out for the work search requirements. You generally need to make at least three job contacts per week. Keep a log. Write down the date, the company name, the person you talked to (or the website you used), and the result. KDOL does audits, and if you can't prove you've been looking, they might ask for their money back.

Dealing with the Portal and Technical Glitches

The website you’ll likely use is GetKansasBenefits.gov. It’s functional, but it’s a bit of a throwback to 2010. If you forget your 4-digit PIN, don't try to guess it five times. You'll get locked out. If that happens, you have to call the Contact Center.

The phone lines are notoriously busy. If you have to call, do it at 7:59 AM. Seriously. By 8:15 AM, the hold times are often over an hour.

Actionable Next Steps for Kansans

- File immediately: Your claim starts the week you file, not the day you lost your job. Don't leave money on the table by waiting until Monday.

- Download the Handbook: The KDOL website has a "Claimant Handbook" PDF. It is boring, but it contains the specific definitions for "misconduct" that could save your claim during an appeal.

- Check your email daily: Not just your inbox, but the spam folder too. MRP notices and identity verification requests often end up there.

- Set a Sunday Alarm: Make filing your weekly certification a ritual. If you miss two weeks in a row, your claim becomes "inactive," and you have to go through the hassle of reopening it.

- Prepare for Taxes: Unemployment is taxable income. You can choose to have 10% withheld for federal taxes and 5% for state taxes. It’s better to take the hit now than to owe the IRS a grand next April.

If you get a "Monetary Determination" letter in the mail that says $0, don't panic yet. It might just mean they haven't verified your out-of-state wages or your military service yet. Check the wage list on the back of the letter. If a job is missing, that’s when you need to file an appeal or a request for reconsideration.