It’s that time again. You’re staring at a screen, probably with a lukewarm coffee nearby, wondering if you’re about to accidentally trigger an IRS audit because of a typo. Filing your 1040 tax form online has become the default for nearly 90% of Americans, yet the process still feels like a digital maze designed by someone who enjoys bureaucratic puzzles. Honestly, it shouldn’t be this stressful.

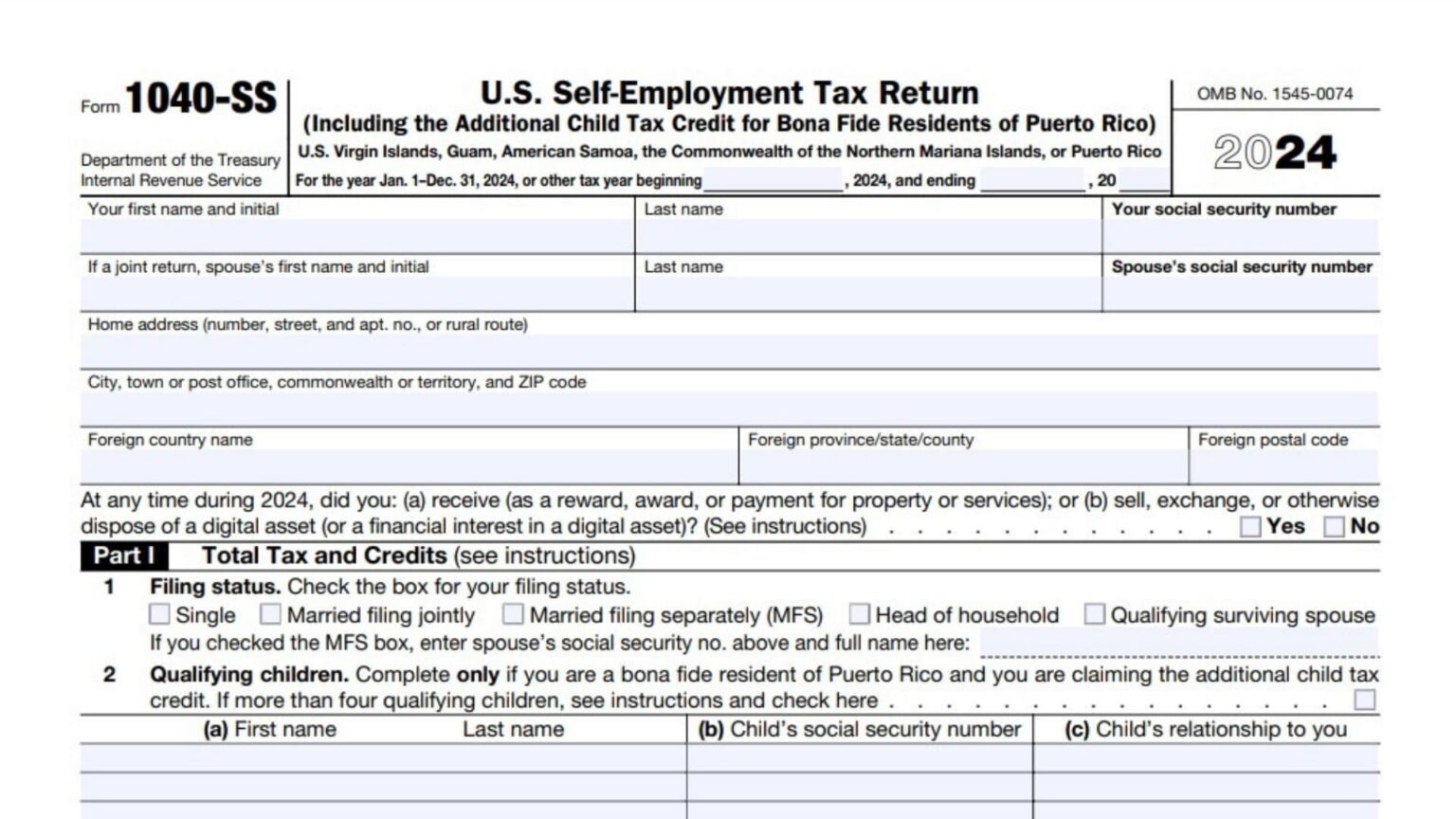

Tax season in 2026 looks a bit different than it did even a few years ago. We’ve seen the Direct File pilot program expand, more robust AI-assisted flagging systems at the IRS, and a massive shift in how gig economy income gets reported. If you’re still thinking about the 1040 as just a single sheet of paper, you’re basically living in 1995. It’s an ecosystem now.

Why the 1040 tax form online isn't just a "digital copy" anymore

Back in the day, you’d grab a physical packet from the local library. You’d fill it out with a blue pen, lick an envelope, and hope for the best. Now? Filing the 1040 tax form online means engaging with a massive data-sharing network. The IRS already knows most of what you’re going to tell them. They have your W-2s. They have your 1099s from that weekend you spent driving for Uber or selling vintage lamps on Etsy.

When you log in to a service like Free File or a paid preparer, the software isn't just "gathering" info. It's cross-referencing. This is where people get tripped up. They think, "Oh, I'll just leave off that $400 I made on a freelance gig." Bad move. The IRS’s Automated Underreporter (AUR) system is faster than ever. If the computers see a 1099-K attached to your Social Security number that doesn't appear on your online 1040, you’re getting a CP2000 notice in the mail. It's not an audit, technically, but it’s a headache you don't want.

The "Standard" isn't always standard

Most people—about 90% of us—take the standard deduction. For the 2025 tax year (which you’re filing in early 2026), those numbers have shifted again due to inflation adjustments. If you’re single, it’s $15,000. Married filing jointly? You’re looking at $30,000.

But here is the thing.

Sometimes, people rush through the 1040 tax form online and miss the "above-the-line" deductions. These are the gems. You don't have to itemize to claim them. Student loan interest? Check. Educator expenses if you’re a teacher buying your own Sharpies? Check. Health Savings Account (HSA) contributions? Double check. These reduce your Adjusted Gross Income (AGI), which is the most important number on your return. Lower AGI means lower taxes. Simple.

👉 See also: How Much Do Chick fil A Operators Make: What Most People Get Wrong

The IRS Direct File vs. The Big Tax Giants

There has been a lot of drama lately. The IRS launched "Direct File," which is their own internal way to file a 1040 tax form online for free. It started small, but for the 2026 season, it’s grown significantly.

So, why isn't everyone using it?

Well, it’s still kinda limited. If you have complex investments, rental property, or heavy business expenses, Direct File might tell you to kick rocks. It’s mostly for the "simple" folks. Meanwhile, the big players—TurboTax, H&R Block—are leaning hard into "AI Tax Experts." They want to justify those high fees by promising they’ll find "hidden" credits. Sometimes they do. Often, they’re just putting a shiny interface on top of the same math the IRS tool does for free.

Navigating the 1040 Schedules

You can't just talk about the 1040 without mentioning its siblings: the Schedules.

- Schedule 1: This is for "Additional Income." If you won money at a casino, received jury duty pay, or have a side hustle, this is your home.

- Schedule 2: This is where the "Additional Taxes" live. Think Alternative Minimum Tax (AMT) or self-employment tax.

- Schedule 3: These are your non-refundable credits.

When you file a 1040 tax form online, the software usually hides these schedules in the background. You just answer questions like "Did you have any hobbies that made money?" and the software spits out a Schedule 1. It’s helpful, but it also makes taxpayers "tax illiterate." You should always view the actual PDF of your return before you hit "Submit." Look at where the numbers are going. If you see a big number on Line 8 of Schedule 1 and you don’t know why, find out.

Digital Security: Don't get "Phished"

I can't stress this enough. Every year, the IRS issues warnings about the "Dirty Dozen" tax scams. Since you're looking for the 1040 tax form online, you are a prime target for SEO-optimized scam sites.

✨ Don't miss: ROST Stock Price History: What Most People Get Wrong

Only use trusted portals.

If a site asks for your Social Security number before it even explains its fee structure, run. If an "online filing service" promises you a refund that seems way higher than what you got last year without your income changing, they might be "ghost preparing." This is where they file a fraudulent return in your name, take a cut of the beefed-up refund, and then vanish, leaving you to explain the fraud to the IRS.

Actually, the best way to find a legitimate place to file is through the IRS.gov "Free File" lookup tool. If your AGI is $79,000 or less, you shouldn't be paying a dime to file your federal 1040 tax form online. Period.

The Gig Economy and Form 1040

Let’s talk about the 1099-K mess. For a while, the IRS kept delaying the $600 threshold rule. But for 2026, the clarity is finally here. If you use Venmo, PayPal, or CashApp for business, and you hit the threshold, you're getting a form.

A lot of people freak out. "Is my birthday money taxable?" No. "Is the money my roommate sent me for rent taxable?" No.

But when you're filing your 1040 tax form online, you have to be careful. You’ll need to report that 1099-K income on Schedule C, but then you deduct your expenses to get to your net profit. If you just ignore the 1099-K because it was "just a side thing," the IRS computer will automatically flag your return as having underreported income.

🔗 Read more: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

Common Mistakes to Avoid

- Wrong Routing Number: You would be shocked how many people mistype their bank info. The IRS doesn't double-check this. If you send your refund to a non-existent account, it takes months to get it back as a paper check.

- Missing the Deadline: It’s usually April 15th. In 2026, it falls on a Wednesday. Don't wait until 11:58 PM. Servers crash.

- Filing Status Errors: Are you "Head of Household" or just "Single"? The tax brackets are different. If you pay more than half the cost of keeping up a home for a qualifying person, HOH is a huge win.

- The "Check" Box: Don't forget to check the box about virtual currency. If you sold $5 worth of Bitcoin to buy a coffee, the IRS wants to know. They aren't joking about crypto enforcement.

The Reality of Credits: EITC and CTC

The Earned Income Tax Credit (EITC) is one of the most powerful tools for low-to-moderate-income workers. Yet, the IRS estimates that 20% of eligible taxpayers don't claim it. When you're going through your 1040 tax form online, pay close attention to the EITC section. It’s a "refundable" credit. This means even if you owe zero taxes, the government will send you a check for the difference.

The Child Tax Credit (CTC) is the other big one. For 2026, the rules are relatively stable, but the phase-out ranges are strict. If you're a high-earner, don't expect the full credit. If you're filing online, the software calculates this instantly, but it’s worth doing a back-of-the-napkin calculation first so you aren't surprised by the final number.

Actionable Steps for a Smooth Filing

Don't just dive in. Prepare. Tax season is a marathon, not a sprint.

- Gather your "Information Returns" first. This means W-2s, 1099-NEC, 1099-INT (from your bank), and 1098-T (if you’re a student). Put them in one physical or digital folder.

- Create an IRS "ID.me" account. This is the gold standard for security. It lets you see your transcripts and any notices the IRS has sent you. It’s way better than waiting for the mail.

- Check your last year's return. Look at your 2024 (filed in 2025) return. If your income is similar but your refund is wildly different, stop. Figure out why before you hit send.

- Opt for Direct Deposit. It’s the only way to get your money in less than 21 days. Paper checks are a relic and a security risk.

- Review your AGI. Once you finish the 1040 tax form online, write down your Adjusted Gross Income. You will need this number to verify your identity next year.

Filing taxes is never going to be "fun," but it doesn't have to be a nightmare. By using the right online tools and actually understanding what those boxes on the 1040 mean, you take the power back from the IRS. You’re not just a number; you’re a taxpayer who knows their rights and their deductions.

Verify every entry. Double-check your Social Security number. Then, and only then, hit that transmit button. Your 2026 self will thank you when that refund hits your bank account without a "Letter of Inquiry" following it two weeks later.