You probably noticed it the moment that first January paycheck hit your bank account. It wasn't what you expected. Maybe the net pay dropped by twenty bucks, or maybe it jumped up just enough to make you suspicious of the tax man. Honestly, most of us treat our paystubs like a mystery novel we’re too tired to finish. We see the "Federal Tax" line, shrug, and move on. But with the 2025 tax brackets adjusting for inflation, using a federal withholding calculator 2025 is basically the only way to make sure you aren’t accidentally giving the IRS an interest-free loan—or worse, setting yourself up for a massive bill next April.

Taxes are annoying. Everyone knows that.

What people don't always realize is that the IRS actually wants you to get it right. They aren't trying to trick you into a massive refund. In their eyes, the perfect tax year ends with you owing zero dollars and getting zero dollars back. It means you lived your life with every cent you actually earned. But life is messy. You get a raise. You get married. You have a kid. You start a side hustle selling vintage lamps on Etsy. Every single one of those things changes the math.

The 2025 Shift: What Changed?

The IRS bumped up the federal income tax brackets for 2025 by about 2.8 percent. That sounds like a small number, but it’s a big deal for your "take-home" pay. This adjustment is designed to prevent "bracket creep," which is a fancy way of saying "earning more money because of inflation but getting taxed like you're rich."

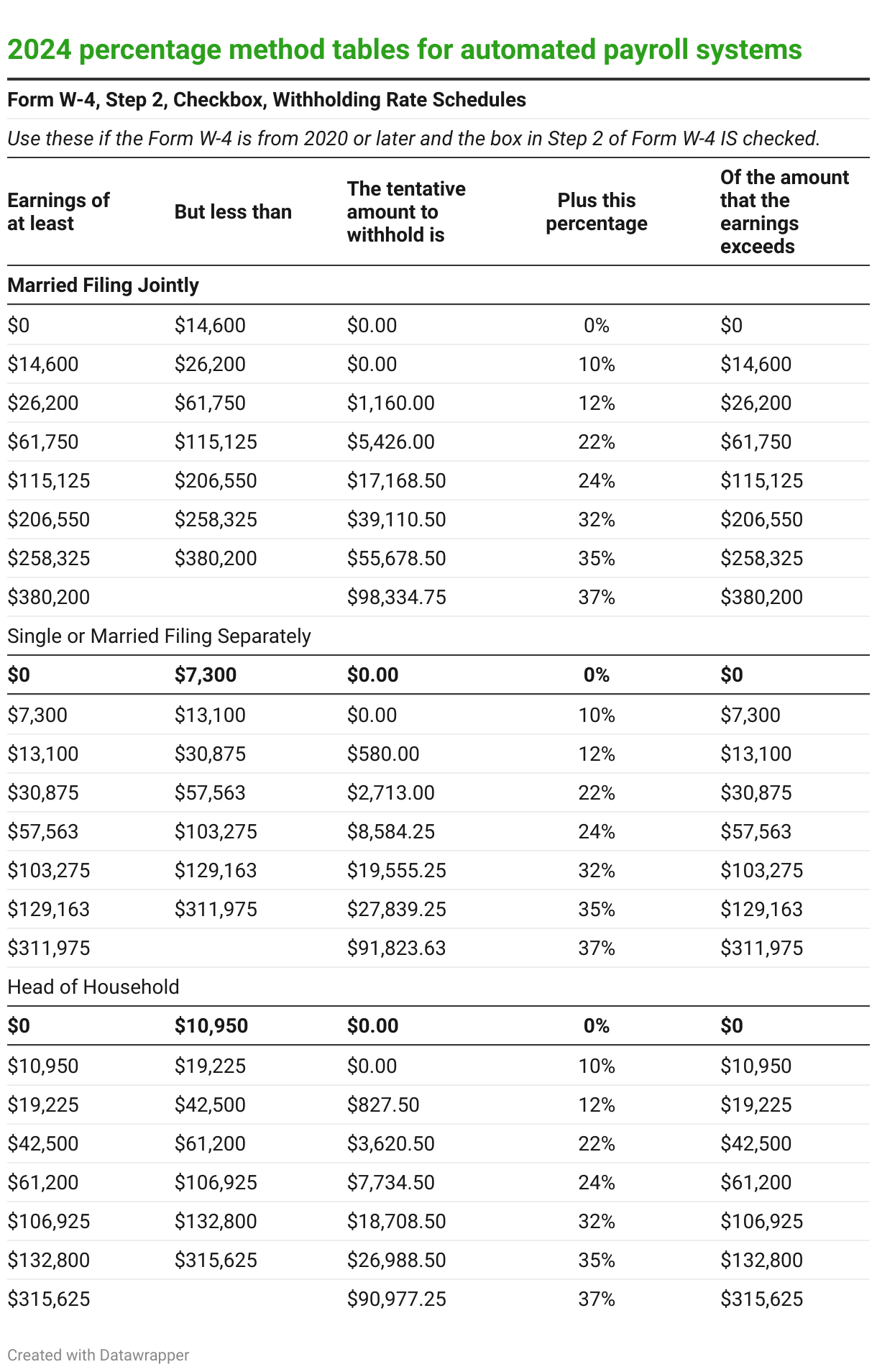

Because the standard deduction rose—to $15,000 for single filers and $30,000 for married couples filing jointly—the math in your payroll department's software had to be updated. If you haven't touched your W-4 since 2020, your withholding is almost certainly wrong. Not "jail time" wrong, but "why is my refund so small" wrong. Or "why do I owe $2,000" wrong.

🔗 Read more: Gavin Newsom and Bed Bath & Beyond: What Really Happened

Most people think the federal withholding calculator 2025 is just for nerds or CPAs. It’s not. It’s for anyone who wants to control their cash flow.

Think about it this way. If you get a $3,000 refund every year, you're essentially letting the government hold $250 of your money every single month. That’s grocery money. That’s car payment money. By adjusting your withholding, you can put that $250 back in your pocket starting next month.

Why the W-4 is a Total Headache

Back in the day, you just claimed "allowances." You'd put "1" or "0" and call it a day. Then, the Tax Cuts and Jobs Act changed everything, and the IRS released a new W-4 form that looks more like a mini tax return than a simple HR document.

It asks about your spouse's job. It asks about your dividends. It asks about your mortgage interest.

It’s invasive.

But the reason it’s so detailed is that the old system was wildly inaccurate for multi-income households. If you and your spouse both work and you both just check "Married" on your W-4s without using the "Two Earners" worksheet or an online federal withholding calculator 2025, you will almost certainly under-withhold. You'll end up in a higher tax bracket than either of your employers realizes, and come April, you'll be staring at a balance due that ruins your spring break.

When You Absolutely Must Use a Calculator

There are specific "trigger events" in life where you’d be crazy not to check your numbers.

- The Mid-Year Raise: Congrats on the bump! But a 10% raise might push a portion of your income into a higher bracket.

- The Side Gig: If you're 1099-ing it on the side, your employer has no idea you have extra income. You might need to withhold extra from your W-2 job to cover the taxes on your side business.

- Unemployment: If you spent part of 2025 on unemployment benefits, those are taxable. Most states don't withhold enough (or any) by default.

- New Humans: Having a baby or adopting adds a dependent. That’s a $2,000 Child Tax Credit (for most). If you don't update your withholding, you're waiting until next year to see that money.

Let's look at a real-world scenario. Imagine Sarah. Sarah is a graphic designer making $75,000. In June, she gets a new job making $90,000. If she just fills out her W-4 the same way she always has, she might not account for the fact that she already earned $37,500 at a lower effective rate earlier in the year. The federal withholding calculator 2025 helps her calibrate for those final six months so she doesn't get a "surprise" at the end of the year.

The Problem with "Set it and Forget it"

Complacency is the enemy of financial health. Tax laws change. In 2025, we’re seeing the tail end of several provisions from previous years, and the IRS is getting stricter about underpayment penalties. If you owe more than $1,000 when you file, and you didn't pay in at least 90% of your current year's tax or 100% of last year's tax, the IRS might tack on an underpayment penalty. It’s basically a fine for not giving them their money fast enough.

Using a federal withholding calculator 2025 prevents this. You punch in your most recent paystub, your spouse’s paystub, and any other income. It tells you exactly what to put on Line 4(c) of the W-4.

Line 4(c) is the "extra withholding" line. It’s the secret weapon of tax planning.

Step-by-Step: Getting the Most Out of the Tool

Don't just guess. To get an accurate result from any calculator—whether it's the official IRS Tax Withholding Estimator or a third-party tool—you need your ducks in a row.

First, grab your most recent paystub. You need the "Year to Date" (YTD) totals, not just the numbers for one pay period. This is crucial. The calculator needs to know how much has already been taken out to tell you what needs to happen for the rest of the year.

Second, find your 2024 tax return. It’ll help you estimate your itemized deductions if you don't use the standard deduction. If you’re a homeowner in a high-tax state like New Jersey or California, your SALT (State and Local Tax) deductions and mortgage interest might still be higher than the 2025 standard deduction of $15,000/$30,000.

Third, be honest about your "Other Income." This is where people mess up. Did you sell some stock? Did you win a little at the casino? Did you get a bonus? All of it counts.

Common Pitfalls to Avoid

I've seen people use a federal withholding calculator 2025 and still get it wrong. Why? Usually, it's because they forget about "Pre-tax" vs. "Post-tax" deductions.

Your 401(k) contributions? Those lower your taxable income. If you tell the calculator you make $100,000 but you put $20,000 into a 401(k), the calculator needs to know that your taxable gross is actually $80,000. If you don't account for that, you'll withhold way too much money and your paychecks will be unnecessarily small.

Health insurance premiums are usually pre-tax too. Check your stub for "Section 125" or "Cafeteria Plan" notations. These are your friends. They lower your tax bill.

The Philosophical Side of Withholding

Some people love a big refund. They call it a "forced savings account."

I get it. It feels like a lottery win in February. But from a purely financial standpoint, it’s a bad move. If you had that money in a high-yield savings account or even a basic index fund throughout the year, it would be earning interest for you, not for the Treasury Department.

On the flip side, some people try to owe as much as possible without hitting the penalty threshold. They want to keep their money until the very last second. That’s a risky game. One bad month or an unexpected bonus can push you over the edge into penalty territory.

Using a federal withholding calculator 2025 allows you to find the middle ground. Most experts suggest aiming for a refund of about $300 to $500. It’s a small enough cushion that you won't owe money if you made a tiny math error, but it’s not so much that you’re missing out on significant monthly cash flow.

Practical Actions for Today

Stop procrastinating. Tax season might feel far away, but every pay period that passes is a lost opportunity to fix your withholding.

- Check your "Status": If you got divorced or married in late 2024 or early 2025, your payroll department needs to know.

- Run the numbers: Use a trusted federal withholding calculator 2025. The IRS.gov estimator is the gold standard, though it can be a bit clunky.

- Download the W-4: Don't wait for HR to ask. Download the PDF, fill it out based on the calculator's results, and send it to your payroll admin today.

- Account for the "Kiddie Tax": If your children have significant investment income, that might affect your overall household tax picture.

- Re-check in August: Life changes. Running the calculator again in late summer gives you enough time to make "catch-up" adjustments before the year ends.

Adjusting your withholding is one of those boring "adulting" tasks that pays off immediately. You'll see the difference in your next paycheck. Whether you use that extra money to pay down debt, beef up your emergency fund, or just buy better coffee, it's your money. You earned it. You should keep it.

The 2025 tax year doesn't have to be a guessing game. Use the tools available, look at your paystub with a critical eye, and take control of your relationship with the IRS. It's much better to be the person who knows exactly what's happening than the person staring at a tax software screen in April, wondering where it all went wrong.