Tax season is a special kind of stress. You open your paycheck, look at the gross pay, look at the net pay, and honestly, it feels like a heist. Where did those hundreds—or thousands—of dollars go? Most people just shrug and assume the government is right, but that’s a dangerous game to play with your bank account. If you’ve been searching for a federal taxes on income calculator, you’re likely trying to figure out if you're being over-withheld or if you're going to owe a massive check to the IRS come April.

It's not just about the numbers. It’s about control.

Most "quick" calculators you find online are, frankly, a bit too simple. They ask for your salary, maybe your filing status, and then spit out a number. But the IRS doesn't just look at your salary. They care about your 401(k) contributions, your Health Savings Account (HSA) allocations, and whether you’re claiming the standard deduction or itemizing. If a calculator doesn’t ask about your "above-the-line" deductions, it’s probably lying to you.

The Brutal Reality of Marginal vs. Effective Rates

You’ve probably heard people say, "I don't want a raise because it'll push me into a higher tax bracket."

That is one of the biggest myths in American finance. Seriously.

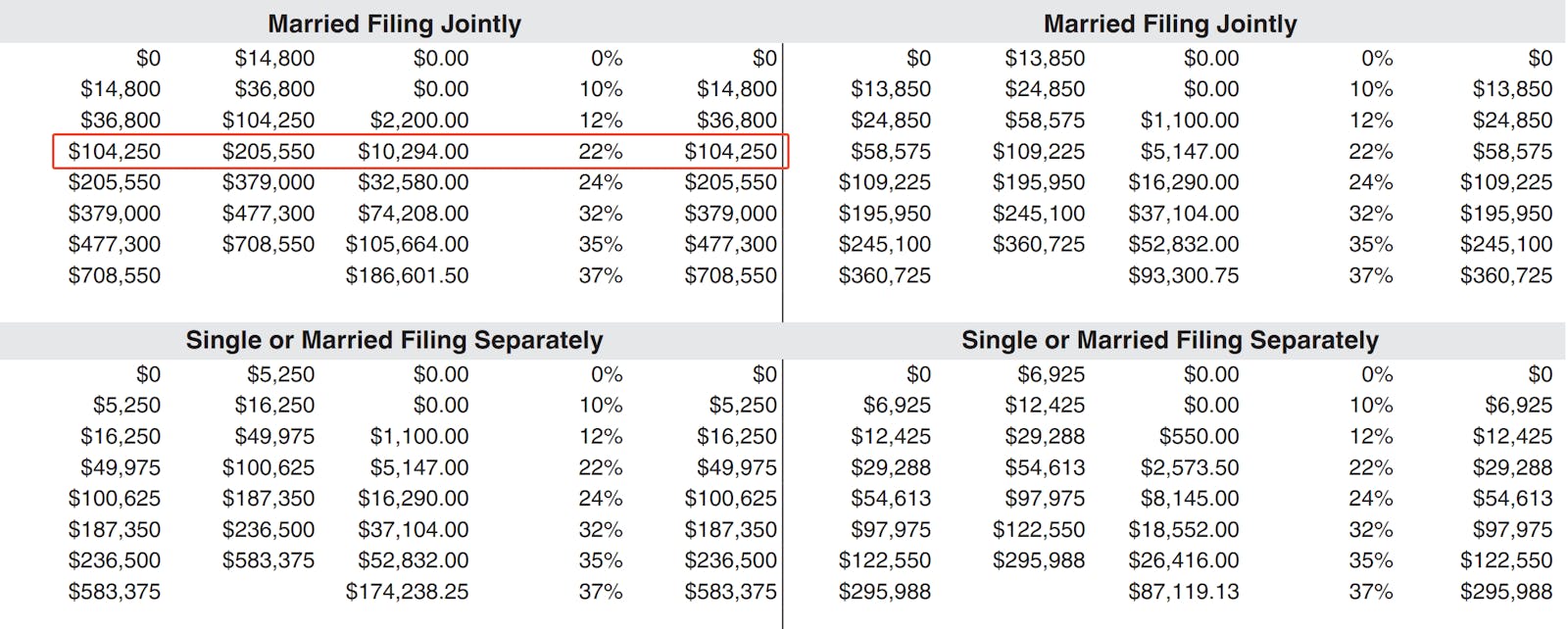

The U.S. uses a progressive tax system. Think of it like a series of buckets. If you’re a single filer in 2025 or 2026, your first $11,925 (roughly, depending on inflation adjustments) is taxed at 10%. The next chunk is taxed at 12%. Only the money inside the higher bucket gets taxed at the higher rate. When you use a federal taxes on income calculator, you need to look for two specific numbers: your marginal rate and your effective rate.

Your marginal rate is the tax on the very last dollar you earned. Your effective rate is the actual percentage of your total income that went to Uncle Sam. Most people have a marginal rate of 22% or 24%, but their effective rate might only be 14% or 15%. Understanding that gap is the difference between panic and a plan.

Why the Standard Deduction is Your Best Friend

For the vast majority of Americans—somewhere around 90%—itemizing is a waste of time. Ever since the Tax Cuts and Jobs Act (TCJA) of 2017, the standard deduction has been high enough that most people don't need to track every single Goodwill receipt or mortgage interest statement.

✨ Don't miss: Deep Wave Short Hair Styles: Why Your Texture Might Be Failing You

For the 2025 tax year, the standard deduction is projected to be around $15,000 for individuals and $30,000 for married couples filing jointly.

When you sit down with a federal taxes on income calculator, the very first thing it should do is subtract that deduction from your gross pay. If it doesn't, the math is already wrong. Your "taxable income" is what's left over. That’s the number that actually matters. Everything else is just noise.

The FICA Ghost in Your Paycheck

Federal income tax isn't the only thing eating your check. People often confuse "federal taxes" with "payroll taxes." They are different beasts.

FICA stands for the Federal Insurance Contributions Act. It covers Social Security and Medicare.

- Social Security is a flat 6.2% on income up to a certain cap ($176,100 in 2025).

- Medicare is 1.45% on all earnings, with an extra 0.9% "Additional Medicare Tax" if you’re a high earner.

If you’re self-employed? You’re paying both the employer and employee share. That’s 15.3%. It’s a gut punch. A good federal taxes on income calculator should distinguish between the income tax you owe the IRS and the payroll taxes that fund the social safety net. If you’re looking at your W-2 and the numbers aren't adding up, check the FICA boxes. That’s usually where the "missing" money is hiding.

The Problem With Withholding

Your employer is basically guessing how much you owe.

When you started your job, you filled out a W-4. If you haven't touched it in three years, it's probably outdated. If you got married, had a kid, or bought a house, your withholding is likely wrong.

🔗 Read more: December 12 Birthdays: What the Sagittarius-Capricorn Cusp Really Means for Success

The IRS actually has its own internal federal taxes on income calculator called the "Tax Withholding Estimator." It’s incredibly detailed—maybe too detailed for a Tuesday night—but it’s the most accurate way to ensure your 2026 tax return isn't a disaster. If you withhold too much, you’re giving the government an interest-free loan. If you withhold too little, you’re looking at an underpayment penalty. Neither is ideal.

Credits vs. Deductions: Don't Mix Them Up

This is where the real money is made (or saved).

A deduction lowers the amount of income you're taxed on. A credit is a dollar-for-dollar reduction in the tax you actually owe.

Take the Child Tax Credit (CTC). If you owe $5,000 in taxes and you have one qualifying child, that $2,000 credit (subject to phase-outs) drops your bill to $3,000. That is way more powerful than a $2,000 deduction.

When using a federal taxes on income calculator, you have to be honest about your eligibility for:

- The Earned Income Tax Credit (EITC): This is for lower-to-moderate-income working individuals and couples.

- Education Credits: Like the American Opportunity Tax Credit (AOTC).

- Energy Credits: If you finally installed those solar panels or bought an EV, your federal tax liability could plummet.

Small Biz and Side Hustle Complications

If you have a 1099 or a side gig, a standard federal taxes on income calculator might steer you wrong.

You have to think about "Qualified Business Income" (QBI) deductions. This allows many sole proprietors and S-corp owners to deduct up to 20% of their qualified business income from their taxes. It’s a massive benefit, but it’s complicated. It has phase-outs based on your total taxable income and the type of business you run.

💡 You might also like: Dave's Hot Chicken Waco: Why Everyone is Obsessing Over This Specific Spot

Also, remember that as a freelancer, nobody is withholding for you. You are your own payroll department. If you aren't setting aside at least 25-30% of every check for federal and self-employment taxes, you're going to have a very bad time in April. Use a calculator that specifically accounts for the 1040-ES (Estimated Tax) requirements.

States Matter, Too

Unless you live in one of the nine states with no income tax (like Florida, Texas, or Washington), your federal calculation is only half the story.

Some states, like California or New York, have high, progressive brackets that mirror the federal system. Others, like Indiana or Pennsylvania, have a flat tax where everyone pays the same percentage regardless of what they make.

While a federal taxes on income calculator tells you what goes to Washington D.C., you need a localized view to understand your actual "burn rate" for living expenses. Don't forget that local city taxes (like in NYC or Philly) can add another 3-4% on top of everything else.

Why 2026 is a "Cliff" Year for Many

The tax world is about to get weird.

Many provisions of the 2017 Tax Cuts and Jobs Act are set to expire at the end of 2025. If Congress doesn't act, tax rates for almost everyone will go up in 2026. The standard deduction could shrink, and the 24% bracket might jump back up to 28%.

When you use a federal taxes on income calculator today, make sure it’s looking at the correct year. Using 2024 math for a 2026 budget is a recipe for a financial hangover. The uncertainty is high, but the best way to handle it is to stay "over-withheld" by a small margin. It’s better to get a $500 refund than to realize you owe $2,000 you don't have.

Actionable Steps to Take Right Now

- Find your last pay stub. Look at the "Year to Date" (YTD) federal withholding.

- Use a reputable calculator. Don't just use the first one you see. Look for one that asks for "Adjusted Gross Income" (AGI) rather than just "Salary."

- Check your W-4. If you're consistently getting a $5,000 refund, you’re losing out on monthly cash flow. Adjust your withholding to bring that closer to zero.

- Maximize "Above-the-Line" Deductions. Contributions to a traditional 401(k) or a traditional IRA (if you qualify) lower your taxable income before the tax brackets even touch it.

- Audit your credits. Search the IRS website for "Credits and Deductions for Individuals" to see if you qualify for things like the Saver's Credit or the Premium Tax Credit for health insurance.

Tax planning isn't just for the wealthy. It's for anyone who wants to stop guessing where their money went. Get a handle on your numbers now, and you won't be one of the people frantically googling "IRS payment plan" on April 14th.