You probably noticed it. That weird shift in your take-home pay back in January? That wasn't a glitch in the payroll software. It was the IRS shifting the goalposts. Every single year, the federal government tweaks the numbers to keep up with inflation, and the federal tax tables 2024 are actually some of the most aggressive adjustments we've seen in a decade.

Inflation has been a beast. Because of that, the IRS bumped the brackets up by about 7%. If you didn't get a 7% raise this year, you might actually find yourself in a lower effective tax bracket than you were in 2023. It’s a weird silver lining.

Most people think tax brackets work like a giant bucket where all your money gets taxed at one high rate. That is just wrong. It’s more like a series of smaller buckets. You fill the 10% bucket first. Then the 12% one. You only pay the higher rates on the dollars that "spill over" into the next level. Understanding the federal tax tables 2024 is basically just learning how to measure those buckets before you pour your hard-earned cash into them.

The 2024 Numbers That Actually Matter

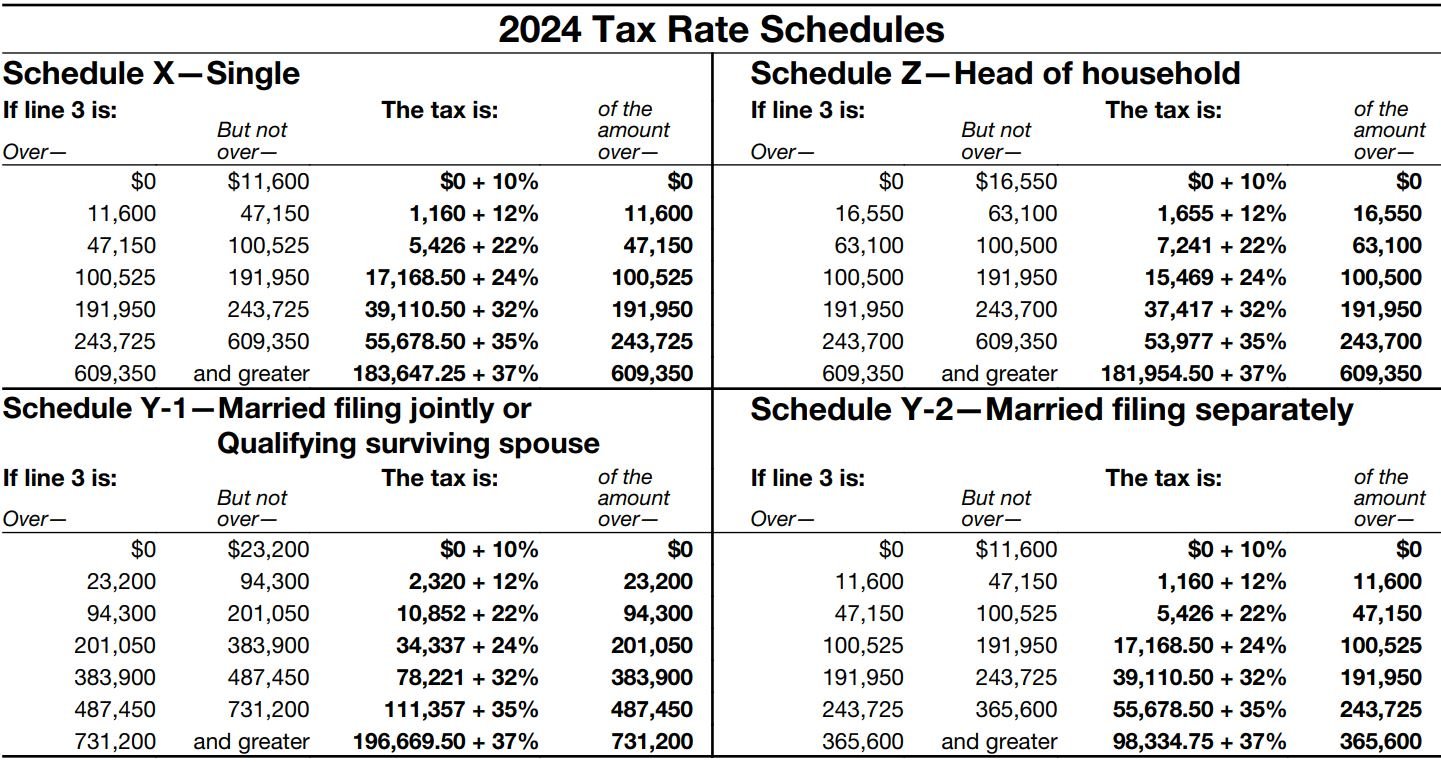

Let's get into the weeds. If you're filing as a single person, that bottom 10% bracket now covers everything up to $11,600. For married couples filing jointly, it’s double that—$23,200. This is the "safe zone" where the IRS takes the smallest bite possible.

Once you climb past that, the 12% bracket kicks in. For singles, this goes from $11,601 all the way up to $47,150. If you’re married, you’re looking at a range of $23,201 to $94,300. Honestly, this is where most middle-class Americans live. It's the "meat" of the tax code.

Then things jump. The 22% bracket is a significant leap. It starts at $47,151 for singles and $94,301 for couples. When people talk about "bracket creep," this is usually the culprit. You get a modest raise at work, it pushes you $1,000 into this 22% territory, and suddenly you feel like you're losing more than you gained. But remember, only that specific $1,000 is taxed at 22%. The rest of your income is still hanging out in those lower 10% and 12% zones.

Why the Standard Deduction Is Your Best Friend

You can't talk about federal tax tables 2024 without mentioning the standard deduction. It's the "free pass" amount. For 2024, it rose to $14,600 for singles and $29,200 for married couples.

Think about that.

👉 See also: Why Toys R Us is Actually Making a Massive Comeback Right Now

If you and your spouse make $100,000 together, you aren't actually taxed on $100,000. You subtract that $29,200 first. Now the IRS only looks at $70,800. That’s your "taxable income." It’s a massive distinction that a lot of people overlook when they're trying to do the math on a napkin at dinner.

The Higher Tiers: Where It Gets Expensive

For the high earners or those with side hustles that took off, the top of the federal tax tables 2024 looks a bit different. The 24% bracket starts at $100,525 for singles ($201,050 for couples).

Then it scales:

- 32% starts at $191,950 (Single) / $383,900 (Married)

- 35% starts at $243,725 (Single) / $487,450 (Married)

- 37%—the absolute ceiling—hits at $609,350 for singles and $731,200 for married couples.

If you’re in that 37% club, congrats, but also, you're likely spending a lot on accountants. Interestingly, the gap between single and married filers shrinks at the very top. It’s the "marriage penalty" people gripe about. While the lower brackets are perfectly doubled for couples, the top bracket doesn't double. It's a quirk of the law that has survived multiple reforms.

Capital Gains: The Hidden Tax Table

Not all income is created equal. If you sold some stock or a rental property, the federal tax tables 2024 for long-term capital gains are separate.

Most people pay 15% on capital gains. However, if your total taxable income is below $47,025 (single) or $94,050 (married), your capital gains rate is actually 0%. Yes, zero. You can sell appreciated assets and pay nothing in federal tax if your other income is low enough. On the flip side, if you're a high-flyer making over $518,900 (single) or $583,750 (married), that rate bumps to 20%.

And don't forget the Net Investment Income Tax (NIIT). That’s an extra 3.8% that sneaks in if your Modified Adjusted Gross Income (MAGI) is over $200,000 for singles or $250,000 for couples. It’s basically a surcharge on the wealthy to help fund Medicare.

✨ Don't miss: Price of Tesla Stock Today: Why Everyone is Watching January 28

Payroll Withholding: Why Your Refund Might Be Small

A lot of folks get upset when they don't get a big refund. They think they did something wrong.

Actually, a small refund (or owing a tiny bit) means you won. You didn't give the government an interest-free loan all year. The IRS updated the "Circular E" (Employer's Tax Guide) to reflect the federal tax tables 2024, which means your HR department adjusted your withholding automatically.

If you had a major life change—got married, had a kid, bought a house—you need to check your W-4. The 2024 tables are designed to be precise. If your W-4 is from 2018, it’s using an outdated logic. Use the IRS Tax Withholding Estimator. It’s a clunky tool, but it’s the most accurate way to make sure you aren't surprised next April.

Credits vs. Deductions: The 2024 Nuance

People use these terms interchangeably. They shouldn't.

A deduction, like the standard deduction we talked about, lowers the amount of income the IRS looks at. A credit, like the Child Tax Credit, is way more powerful. It’s a dollar-for-dollar reduction in what you owe.

For 2024, the Child Tax Credit remains at $2,000 per qualifying child. The refundable portion—the part you get back even if you owe zero taxes—is $1,700. This is a huge deal for families. If the federal tax tables 2024 say you owe $3,000, but you have two kids, that $4,000 in credits wipes out your bill and hands you a $1,000 check.

Self-Employed? The Rules Change

If you're a freelancer or "1099" worker, the federal tax tables 2024 are only half the story. You also have the self-employment tax. That’s 15.3%.

🔗 Read more: GA 30084 from Georgia Ports Authority: The Truth Behind the Zip Code

When you work a W-2 job, you pay 7.65% for Social Security and Medicare, and your boss pays the other 7.65%. When you're the boss, you pay both halves. You do get to deduct the "employer" half on your 1040, which helps, but it’s a heavy lift.

The Social Security wage base also went up for 2024. It’s now $168,600. Any dollar you earn above that is exempt from the 6.2% Social Security tax. It’s a massive "raise" for high earners that happens automatically once they hit that threshold mid-year.

Retirement Contributions: The Ultimate Tax Hack

Want to pay less? Use the 2024 contribution limits.

- 401(k) / 403(b) limit: $23,000

- IRA limit: $7,000

- Catch-up contributions (age 50+): $7,500 for 401(k)s and $1,000 for IRAs.

Every dollar you put into a traditional 401(k) reduces your taxable income. If you're hovering right at the edge of the 22% bracket, contributing a few thousand bucks to your retirement could keep your income in the 12% bracket. It's one of the few ways the federal tax tables 2024 actually allow you to control your own destiny.

Actionable Steps to Handle the 2024 Tax Year

Don't just wait for your W-2 to arrive next year. The federal tax tables 2024 are live right now, and you can manipulate how they affect you before the clock runs out on December 31.

- Check your last pay stub. Look at the "Federal Tax" line. Multiply that by the number of pay periods left in the year. Does that total align with the brackets mentioned above based on your projected salary? If not, change your withholding now.

- Review your HSA. The Health Savings Account limit for 2024 is $4,150 for individuals and $8,300 for families. These are "triple tax-advantaged." No tax going in, no tax on growth, and no tax coming out for medical bills. It is the single best tax shelter in the 2024 code.

- Audit your "Side Hustle" expenses. If you're doing DoorDash or consulting, keep every receipt. The federal tax tables 2024 apply to your net profit, not your gross revenue. If you made $5,000 but spent $2,000 on gas and equipment, you're only taxed on $3,000.

- Consider a Roth Conversion. If you think you're in a lower bracket this year because of the 7% inflation adjustment, it might be the perfect time to move money from a Traditional IRA to a Roth IRA. You pay the tax now at these 2024 rates, but you never pay tax on that money again.

Tax laws aren't static. They breathe and move with the economy. The federal tax tables 2024 reflect a government trying to account for a high-cost-of-living environment. By knowing where the lines are drawn, you can stop guessing and start planning.

Take a look at your income. Subtract your deduction. Map it to the brackets. That simple exercise usually saves people thousands because it removes the fear of the unknown and replaces it with a strategy.