You ever stare at your pay stub and wonder where all the money went? It’s a gut punch. You see that big gross salary number at the top, and then by the time you hit the "Net Pay" at the bottom, it feels like someone took a bite out of your sandwich while you weren't looking. Understanding a federal tax paycheck calculator isn't just about math; it’s about knowing why Uncle Sam takes what he takes and how you can actually keep a little more of it.

Most people think of taxes as a flat fee. It isn't. Not even close. The U.S. uses a progressive tax system, which basically means the more you make, the higher the percentage you pay on those top dollars. But even that is an oversimplification. Between FICA, federal withholdings, and those pesky state lines, your paycheck is a moving target.

Why Your Federal Tax Paycheck Calculator Results Feel Wrong

If you’ve used a calculator online and it didn't match your check, don't panic. You aren't necessarily being robbed. Most basic tools forget the nuances of the W-4. Since the 2020 overhaul of the W-4 form by the IRS, those old "allowances" are dead. Gone. They don't exist anymore.

Now, everything is based on specific dollar amounts. If you haven't updated your W-4 in five years, your payroll department is likely using a "legacy" calculation that might be light-years away from your actual liability. This is how people end up with a massive tax bill in April instead of a refund. Or worse, you’re giving the government a massive interest-free loan every month because your withholding is too high.

Honestly, the biggest culprit is the "Standard Deduction." For 2025, that's $15,000 for individuals and $30,000 for married couples filing jointly. A good federal tax paycheck calculator has to account for this immediately. If it doesn't ask you your filing status, close the tab. It’s useless.

The Math Behind the Curtain

Let’s talk about FICA. Federal Insurance Contributions Act. Sounds fancy. It’s just Social Security and Medicare.

Social Security is a flat 6.2% on your income, but only up to a certain point—the wage base limit. For 2025, that limit is $176,100. If you make $200,000, you stop paying that 6.2% on every dollar over that cap. Medicare is 1.45% and it has no cap. In fact, if you’re a high earner making over $200,000, you get hit with an additional 0.9% Medicare tax.

Then there’s the federal income tax itself. This is where the brackets live.

Imagine your income is like a series of buckets. The first bucket fills up at the 10% rate. Once that’s full, the money overflows into the 12% bucket, then the 22%, and so on. When people say, "I’m in the 24% tax bracket," they don't mean they pay 24% on everything. They only pay 24% on the money that fell into that specific bucket.

Common Deductions That Change the Game

- Pre-tax 401(k) contributions: This is the holy grail for lowering your tax bill today. If you put $500 into your 401(k), the federal tax paycheck calculator should show your taxable income dropping by exactly $500. You aren't taxed on that money now. You're taxed when you take it out in thirty years.

- Health Insurance Premiums: Usually, these are taken out "Section 125" style. That means they come out before federal tax, Social Security, and Medicare are calculated. It’s a triple win.

- HSA and FSA: Similar to health premiums, these lower your taxable footprint.

But wait. If you’re using a Roth 401(k), that money is taxed before it goes into the account. Your "Net Pay" will look smaller compared to a Traditional 401(k) even if the contribution amount is the same. People miss this detail constantly.

The 2020 W-4 Shift and Why It Matters Now

The IRS changed the W-4 to be more accurate, but it also made it more complicated for the average person to fill out without a guide. It asks about "Other Income" and "Deductions" outside of the standard one.

If you have a side hustle or dividends, you might want to use your federal tax paycheck calculator to see if you should have extra money taken out. Line 4(c) on the W-4 is your best friend here. It lets you tell your employer, "Hey, take an extra $50 out of every check so I don't owe the IRS $2,000 next year."

✨ Don't miss: Edgewell Personal Care Stock: Why This Boring Portfolio Staple is Suddenly Interesting

It’s about control.

I’ve seen people get a $5,000 refund and celebrate. I hate to be the bearer of bad news, but that's $416 a month you didn't have for groceries, gas, or investing. On the flip side, owing $5,000 because you didn't check your withholdings is a recipe for a panic attack.

Real World Example: The $60,000 Salary

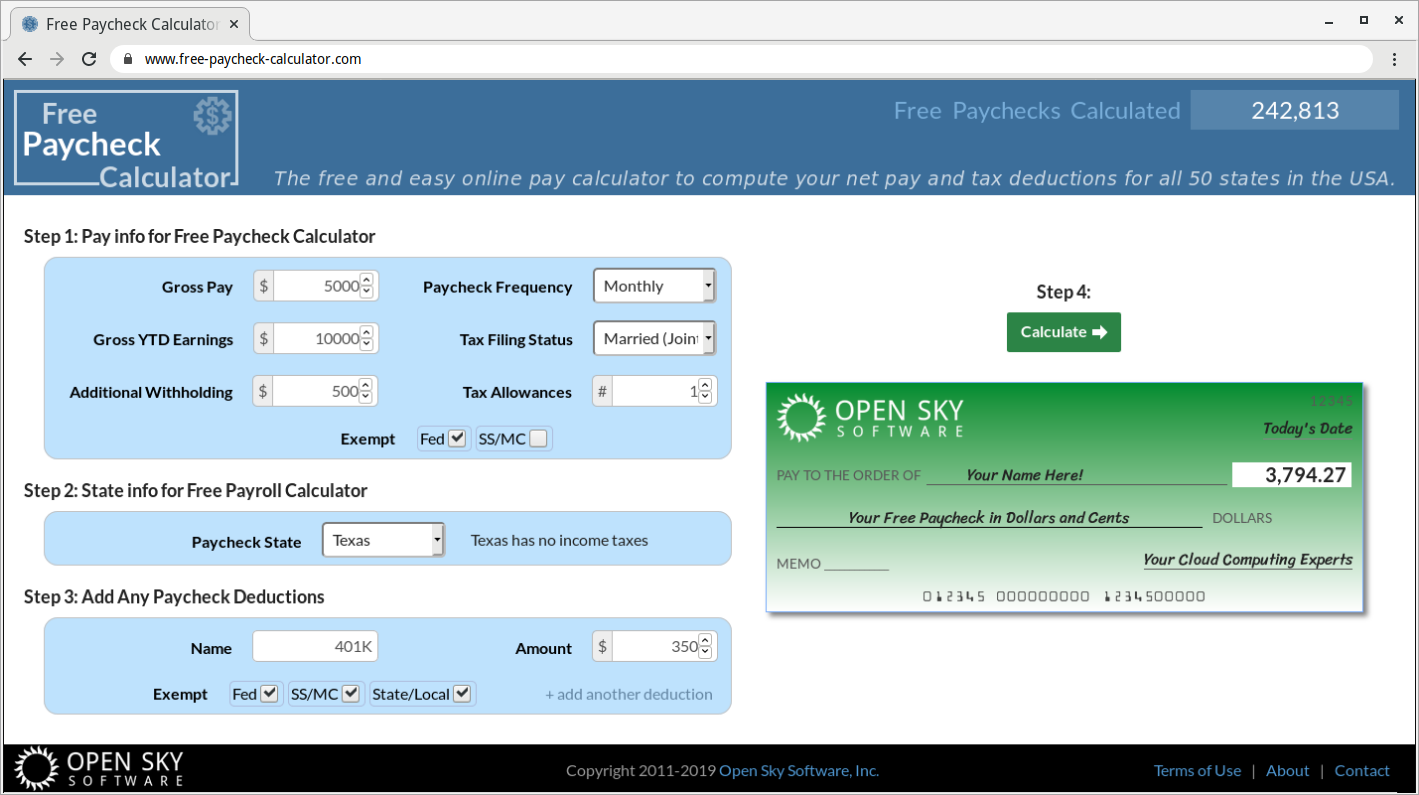

Let's look at a single person in Texas (no state income tax, lucky them) making $60,000 a year.

First, the FICA. Social Security takes $3,720. Medicare takes $870.

Then, the federal income tax. After the standard deduction of $15,000, their taxable income is actually $45,000.

The first $11,925 is taxed at 10%.

The remaining $33,075 is taxed at 12%.

Total federal tax is roughly $5,161.50 for the year.

Divide all that by 26 pay periods (if paid bi-weekly), and you’re looking at about $375 per check in taxes. If your check shows $500 being taken out, something is wrong. You might be listed as "Single" when you're actually "Head of Household," which has a much larger standard deduction ($22,500).

What Most People Get Wrong

The biggest misconception? "If I get a raise, I might take home less money because I'll be in a higher tax bracket."

🔗 Read more: CESC Ltd Share Price: Why This Utility Stock Is Tougher Than It Looks

No. That is mathematically impossible in the US system.

Only the money in the new bracket is taxed at the higher rate. If you earn $1 over the threshold for the next bracket, only that $1 is taxed at the higher rate. You will always, always have more net pay after a raise than you did before, assuming your deductions stay the same.

Also, don't forget the "Taxable Wage Base." Some employers stop taking out Social Security late in the year for high earners. If you notice your paycheck suddenly gets bigger in November or December, that’s usually why.

Actionable Steps to Fix Your Paycheck

Stop guessing.

First, grab your most recent pay stub. Look at the "Federal Withholding" line. Now, go to the IRS website and use their "Tax Withholding Estimator." It is the most robust federal tax paycheck calculator available because it uses the actual IRS logic.

If the estimator says you're going to owe money, or if you're on track for a massive refund you don't want, download a new Form W-4.

Fill out Step 3 if you have kids (it’s a $2,000 credit per child under 17). Use Step 4 if you have other income or want to adjust your withholding precisely. Turn it into your HR department. They are legally required to update it, usually within a pay cycle or two.

Check your "Taxable Gross" vs "Total Gross." If they are the same, you aren't taking advantage of pre-tax benefits like a 401(k) or health savings account. If your company offers a match, you're essentially leaving free money on the table while paying more in taxes than you need to.

🔗 Read more: Income Tax Calculator NC: Why Your Take-Home Pay Might Surprise You

Review your filing status. Life changes—marriage, divorce, a new baby—all change your tax liability. A federal tax paycheck calculator is only as good as the data you feed it. If you’re still filing as "Single" but you got married in June, you’re likely overpaying.

Take ten minutes this weekend. Pull the stub. Run the numbers. It’s your money; you might as well know where it's going before it leaves your hands.