Money feels weird right now. Honestly, if you've looked at your high-yield savings account or tried to price out a mortgage lately, you’ve probably noticed the numbers aren't moving like they used to. As of mid-January 2026, the federal funds rate is sitting in a target range of 3.5% to 3.75%, with the effective rate hovering right around 3.64%.

It’s a bit of a "Goldilocks" zone—not high enough to crush the economy, but certainly not low enough to make borrowing feel "cheap" again.

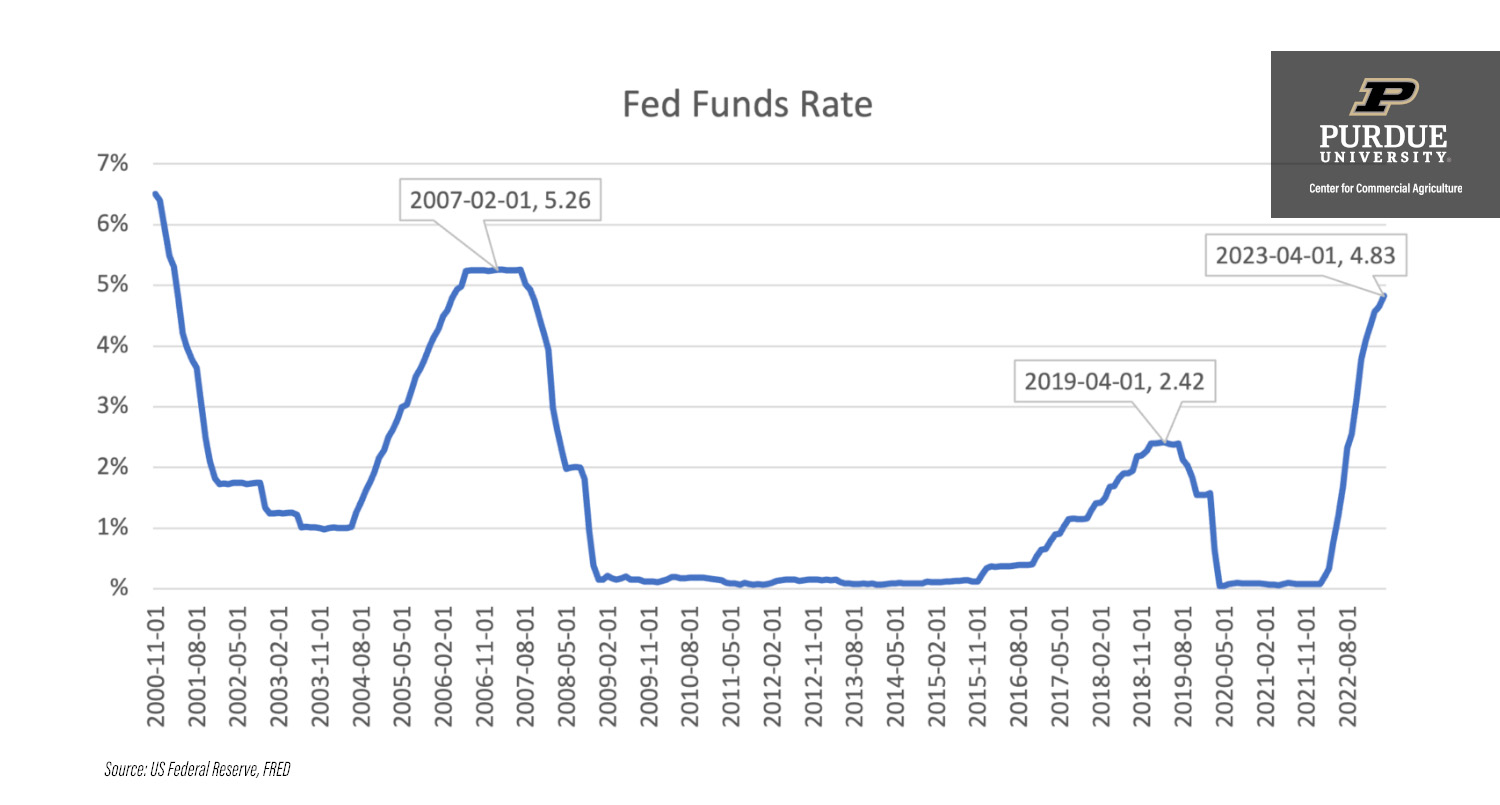

Remember the 0% days? Yeah, those are gone. Probably for a long time. The Federal Reserve, led by Jerome Powell—who has recently been the subject of some pretty intense international support regarding central bank independence—has spent the last year trying to stick a very difficult landing. After three consecutive quarter-point cuts in late 2025, the Fed has hit the pause button.

What the Current Federal Funds Rate Actually Does to Your Wallet

So, why should you care about a 3.64% rate? Basically, this number is the "base price" of money. When the Fed sets this rate, it's telling banks how much they should charge each other for overnight loans. That cost then trickles down to you.

If you’re a saver, you’re kinda winning. For years, savings accounts paid basically nothing. Now, even with the recent cuts, many top-tier online banks are still offering APYs in the 3.5% to 4.0% range. It’s a decent place to park cash while the stock market acts moody.

✨ Don't miss: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

But if you’re trying to buy a house, the story is different.

Mortgage rates don't follow the federal funds rate perfectly. They usually track the 10-year Treasury yield. However, they stay in the same "neighborhood." Right now, 30-year fixed mortgages are teetering around 6.1% to 6.3%. That’s a far cry from the 8% we saw a couple of years ago, but it's still double what people were getting in 2021.

The Great 2026 Disconnect

Here is something most people get wrong: they think more Fed cuts automatically mean much lower mortgage rates.

Not necessarily.

The market has already "priced in" a lot of the expected moves. If the Fed stays at 3.64% and the economy stays strong, mortgage lenders might actually keep rates where they are because they aren't worried about a recession.

Why the Fed is Hesitating to Cut Further

Inside the Federal Open Market Committee (FOMC), things are a bit messy.

🔗 Read more: Big Lots in Potsdam NY: What Really Happened to Our Store

There isn't a consensus. In the last meeting of 2025, we saw three different dissents, which is super rare for the Fed. You had Stephen Miran pushing for bigger cuts to help a cooling job market, while others like Jeffrey Schmid were worried that inflation hasn't stayed down long enough.

- Core Inflation: It's still stickier than the Fed wants, hanging out above 2.5%.

- The Job Market: Unemployment is around 4.4%. It's not a crisis, but it's "warm."

- The Growth Surprise: GDP growth for 2026 is actually projected to be higher than originally thought, maybe around 2.3%.

When growth is that good, the Fed usually doesn't feel the need to rush more cuts. J.P. Morgan’s chief economist, Michael Feroli, actually thinks the Fed might not cut at all for the rest of 2026. Some are even whispering about a rate hike in 2027 if things get too hot.

The "K-Shaped" Reality of 3.64%

We're living in two different worlds.

If you own your home outright or have a 2.5% mortgage from 2020, this federal funds rate doesn't hurt you much. In fact, you're probably making more on your bond portfolio or savings than you're paying in interest. You’re on the "upper spur" of the K-shape.

💡 You might also like: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

But if you're a first-time buyer or someone carrying credit card debt, it’s tough. Average credit card APRs are still north of 20%.

Real-World Math: $500,000 Loan

Look at the difference a small shift makes. If you finance $500,000 at an 8% rate (the peak), your principal and interest is about **$3,668**. At the current 2026 forecast of roughly 5.8% (if the Fed-inspired drops continue), that payment falls to $2,935. That’s over $700 a month back in your pocket.

It's a big deal. But we aren't there yet.

What's Next? Practical Moves for Your Money

The "wait and see" approach from the Fed means you should probably have a "wait and see" approach with your big financial moves, too.

- Don't wait for 3% mortgages. They aren't coming back this year. If you find a house you love and can afford the 6% rate, the common advice is to "marry the house, date the rate." You can refinance later if we hit a recession and rates tank, but waiting for a 4% handle might leave you on the sidelines forever.

- Lock in CD rates now. If you have cash sitting around, 2026 might be the last time for a while that you can lock in a 1-year CD at 3.5% or better. As the Fed eventually eases toward their "neutral" target of 3.0%, these yields will vanish.

- Watch the January 28 meeting. While no one expects a move this month, the "language" used by the Fed will be everything. If they sound worried about the labor market, the next cut might come sooner than J.P. Morgan expects.

The current federal funds rate is a signal that the era of "easy money" is officially over, replaced by an era of "normal money." 3.64% is high compared to the last decade, but historically, it's actually quite low. Navigating this means focusing on your own personal "inflation rate"—what you spend vs. what you earn—rather than just waiting for the Fed to save the day.

The best move right now is to audit your high-interest debt. If the Fed is holding steady at 3.64%, your credit card company certainly isn't going to lower your rate out of the goodness of their heart. Target anything with a double-digit interest rate first, because while the Fed is pausing, your interest is still compounding.