Money is a weird thing when you get to the trillion-dollar level. Most of us struggle to balance a checkbook or keep a credit card under the limit, but the U.S. government operates in a totally different universe. If you’ve ever looked at a federal debt chart by president, you’ve probably seen that terrifying line that just keeps going up and to the right. It looks like a mountain range that never peaks.

Honestly, it’s easy to get angry about it. You see one name on the chart and think, "Aha! They’re the one who broke the bank." But the reality is a lot more tangled. It’s not just about who was sitting in the Oval Office; it’s about wars, pandemics, and the simple fact that our economy is way bigger than it used to be.

As of early 2026, the total gross national debt is hovering around $38.43 trillion. That’s a number so big it basically loses all meaning. To put it in perspective, that’s over $112,000 for every single person in the country.

✨ Don't miss: Why the 270 Park Avenue Chase Building in New York is Reforming the Skyline

The "Percentage" vs. "Dollar" Trap

When people argue about which president was the biggest spender, they usually make a fundamental mistake. They compare a billion dollars in 1940 to a trillion dollars today. You just can't do that.

If you look at raw dollars, the recent guys always look worse. President Joe Biden added about $8.4 trillion during his first term. To be fair, Donald Trump also added roughly $7.8 trillion in his first four years. These numbers are astronomical. But if you go back to Abraham Lincoln, he increased the debt by over 2,800%. Why? Because he started with basically nothing and had to fund a literal Civil War.

Basically, looking at the debt as a percentage of GDP (Gross Domestic Product) is the only way to keep your sanity. It tells you how much we owe compared to how much we’re actually producing.

World War II and the Great Drop

For a long time, the "gold standard" for high debt was the end of World War II. In 1945, under Harry Truman, the debt-to-GDP ratio hit about 112%. We were broke from fighting a global war.

But then something interesting happened. From the late 1940s through the 1970s, that percentage actually fell. By the time Richard Nixon left office in 1974, the debt-to-GDP ratio had bottomed out at around 24.6%.

- Truman and Eisenhower: They benefited from a massive post-war boom.

- Kennedy and Johnson: They spent on the "Great Society" and Vietnam, but the economy was growing so fast it masked the borrowing.

- The Low Point: 1974 remains the modern low for U.S. debt relative to the size of the economy.

Since then? It’s been a different story.

The Reagan Era and the Shift in Thinking

In the 1980s, the philosophy changed. Ronald Reagan championed "supply-side" economics. He slashed the top tax rate from 70% to 28% and poured money into the military.

The idea was that tax cuts would spark so much growth that the debt wouldn't matter. It didn't quite work out that way. Under Reagan, the national debt nearly tripled in raw dollars. The debt-to-GDP ratio jumped from about 26% to 41%.

Then came the 90s. Bill Clinton is often cited as the last president to see a decrease in the debt-to-GDP ratio. He actually ran a few years of budget surpluses—meaning the government took in more than it spent. It’s the only time that's happened in modern memory.

The Trillion-Dollar Club: Bush, Obama, Trump, and Biden

The 21st century has been... expensive. Every single president since 2001 has faced a massive "black swan" event that blew up the budget.

- George W. Bush: He inherited a surplus but then 9/11 happened. Between the War on Terror, the wars in Iraq and Afghanistan, and a major tax cut, the debt started climbing. Then the 2008 financial crisis hit right at the end of his term.

- Barack Obama: He walked into the Great Recession. The government had to spend nearly a trillion dollars on the Recovery Act just to keep the floor from falling out. By the time he left, the debt-to-GDP ratio had crossed the 100% threshold.

- Donald Trump: Before the pandemic, the debt was already rising due to the 2017 tax cuts. Then COVID-19 happened. The CARES Act and subsequent relief bills added trillions almost overnight.

- Joe Biden: The spending didn't stop. Between the American Rescue Plan and massive infrastructure bills, the debt hit $31 trillion, then $34 trillion, and now over $38 trillion.

Why Doesn't it Just Crash?

You've probably heard people say the U.S. is going bankrupt for thirty years. Why hasn't it happened?

✨ Don't miss: Finding the Voya 401k customer service number when you actually need a human

The short answer is that the U.S. borrows in its own currency, and the rest of the world still views Treasury bonds as the safest place to put money. Kinda ironic, right? We owe the most money, but people keep lending to us because they trust us more than anyone else.

However, there’s a new problem in 2026: Interest. For a long time, interest rates were near zero. Borrowing was "free." Now, interest rates are higher. We are currently spending over $1 trillion a year just on interest payments. That’s more than we spend on the entire defense budget. It’s like having a credit card where the minimum payment is so high you can’t afford to buy groceries anymore.

Real Data: The Leaders in Debt Growth

If you look at the federal debt chart by president from a purely statistical lens, here are the heavy hitters in modern history:

- Franklin D. Roosevelt: Increased debt by over 1,000% (Great Depression + WWII).

- Ronald Reagan: Increased debt by 186%.

- George W. Bush: Increased debt by 101%.

- Barack Obama: Added roughly $7.6 trillion.

- Donald Trump: Added roughly $7.8 trillion in four years.

- Joe Biden: Added roughly $8.4 trillion in four years.

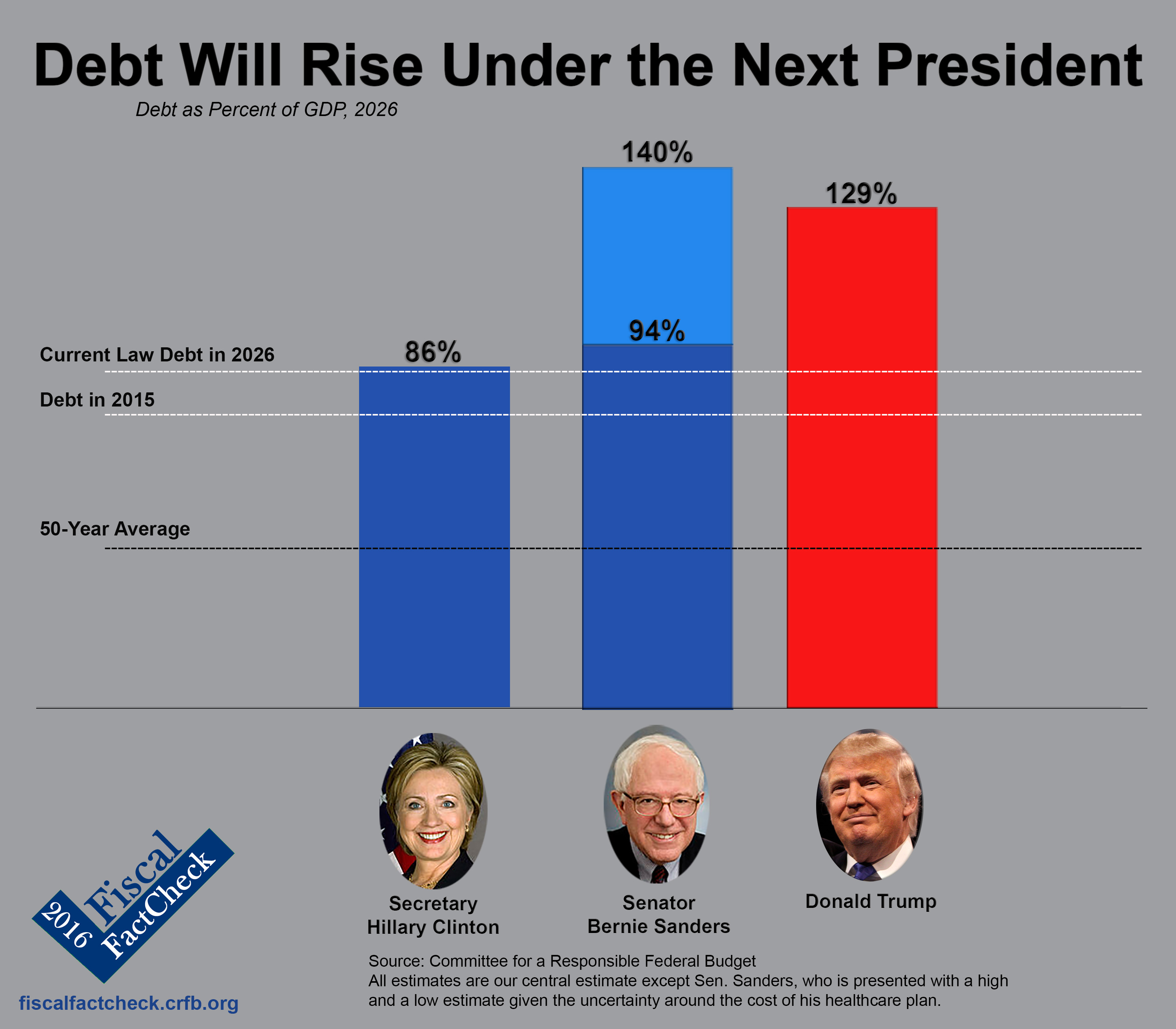

Keep in mind, these numbers are messy. A president might sign a bill, but the money is spent over ten years. Does that debt belong to the person who signed it or the person who was in office when the check cleared? Economists at the Committee for a Responsible Federal Budget (CRFB) spend all day arguing about this.

What You Can Actually Do

The national debt feels like something that happens "to" us, but it actually affects your daily life through inflation and interest rates. If you want to get a handle on where this is going, stop looking at the scary total number and start looking at the deficit.

The deficit is how much we overspend this year. The debt is the pile of all those deficits added up.

Actionable Insights for 2026:

🔗 Read more: Why Maximum Room Capacity 75 Persons Is the Trickiest Number in Event Planning

- Monitor the CBO Reports: The Congressional Budget Office releases a "Long-Term Budget Outlook" every year. It’s dry, but it’s the most honest look at our future.

- Watch the Interest-to-Revenue Ratio: If the interest we pay on the debt starts eating up more than 15-20% of all tax revenue, that’s the "danger zone" for a potential economic pivot or major tax hikes.

- Diversify Your Own Assets: In times of high national debt, the value of the dollar can be volatile. Many experts suggest keeping a mix of stocks, real estate, and perhaps "hard" assets like gold or even Bitcoin as a hedge against long-term currency devaluation.

- Vote on Fiscal Policy, Not Just Soundbites: Next time a candidate promises a new program or a new tax cut, ask: "How is this being paid for?" If the answer is "it will pay for itself," they're usually wrong.

The federal debt isn't going away. It’s a permanent fixture of the American economy. The goal isn't to get to zero—that hasn't happened since 1835—but to get to a point where the debt grows slower than the economy does. Right now, we’re losing that race.

Next Steps for Your Financial Planning:

- Check the current 10-year Treasury yield to see what the market thinks about U.S. creditworthiness.

- Use a personal inflation calculator to see how much your purchasing power has eroded since the last major debt spike in 2020.

- Adjust your long-term savings to account for the likelihood of higher taxes in the 2030s as the government looks for ways to service this $38 trillion pile.