Ever stood outside a locked glass door at 10:00 AM on a Monday, staring at a little plastic sign while holding a stack of checks? It’s a specific kind of annoyance. You checked your phone. The date looked normal. But then it hits you—it’s the third Monday of the month.

Federal bank holidays in the United States are weirdly invisible until they aren't. We call them "bank holidays," but that’s basically shorthand for days when the Federal Reserve pulls the plug on the payment rails. If the Fed is closed, your money stays put. Wire transfers don’t move. ACH batches sit in limbo. It’s a ghost in the machine that still dictates how our digital economy breathes.

Most people think these holidays are just for government workers to get a long weekend. Honestly, it’s deeper than that. These dates are established by Congress under 5 U.S.C. 6103, and they dictate the rhythm of the entire American financial system.

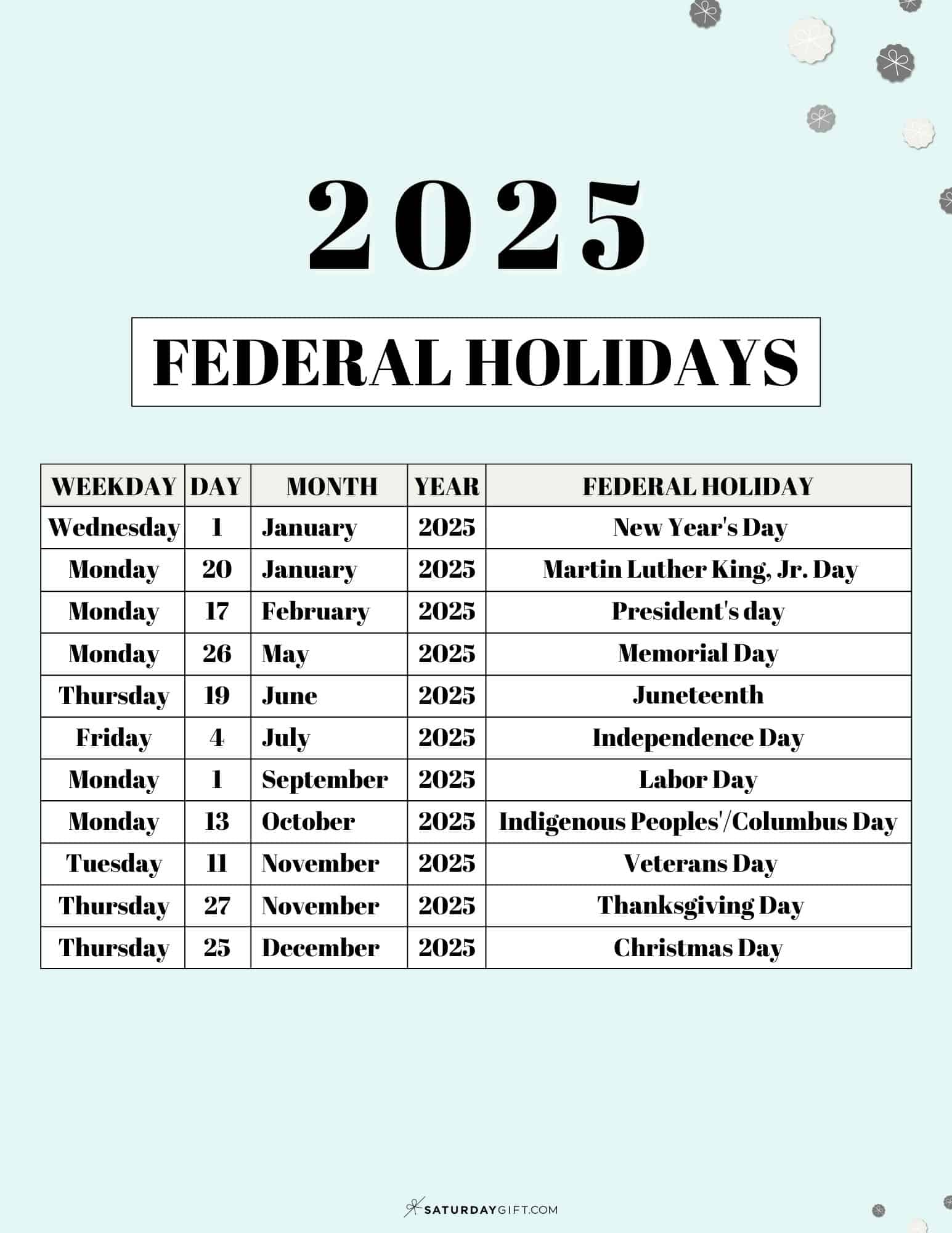

The 11 Days That Freeze Your Cash

There are eleven permanent federal holidays. Some are fixed, like New Year’s Day. Others, like Juneteenth or Labor Day, drift around the calendar.

For 2026, the schedule is a bit of a minefield because of how weekends fall. When a holiday hits a Sunday, the banks usually close on Monday. If it’s a Saturday, they might stay open on Friday, though the Federal Reserve Board of Governors typically observes the holiday on Friday if the office would normally be closed. It’s confusing.

Take New Year’s Day. It falls on a Thursday in 2026. Easy. But then you have Martin Luther King Jr. Day on January 19. That’s a Monday. Every single year, someone forgets MLK Day and wonders why their Zelle or Venmo "instant" transfer to a bank account is taking three days. It's because the settlement layers are dark.

📖 Related: Private Credit News Today: Why the Golden Age is Getting a Reality Check

Then there is Juneteenth National Independence Day on June 19. This is the "newest" federal holiday, signed into law by President Biden in 2021. It took a lot of businesses by surprise the first year. Now, it’s a standard hard stop for the banking industry. In 2026, it lands on a Friday. That means a three-day weekend where no financial progress happens from Thursday night until Tuesday morning.

The Weird Case of Columbus Day vs. Indigenous Peoples' Day

This one is a mess. Federally, it is still Columbus Day. That is how it is listed in the U.S. Code. However, many states and cities have pivoted to Indigenous Peoples' Day.

Banks follow the Federal Reserve. So, on October 12, 2026, the bank will be closed. Your local coffee shop might be open. Your office might be open. But the bank? Dark. This is the holiday that catches the most small business owners off guard. They try to run payroll on Friday for a Monday delivery, and the system kicks it back because Monday doesn't "exist" in the eyes of the clearinghouse.

Why "Bank Holidays" Aren't Just for Bankers

If you're an hourly worker, a bank holiday might just mean the mail is slow. If you’re a treasurer for a mid-sized company, it’s a nightmare.

Let's talk about the ACH (Automated Clearing House). This is the system that handles direct deposits and bill pays. It doesn't run on federal holidays. If you have a bill due on Monday, January 19 (MLK Day), and you send the payment on Friday, it might not "settle" until Tuesday or Wednesday. If your mortgage company is strict, you're looking at a late fee because of a calendar quirk.

👉 See also: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

Real estate is another big one. Closing on a house on a Friday before a Monday federal holiday? Bold move. If the wire doesn't clear by 4:00 PM EST, you aren't getting your keys until Tuesday. You're stuck with a U-Haul full of furniture in a hotel parking lot. I’ve seen it happen. It’s brutal.

The 2026 Federal Calendar at a Glance

- New Year’s Day: Thursday, January 1

- Birthday of Martin Luther King, Jr.: Monday, January 19

- Washington’s Birthday (Presidents' Day): Monday, February 16

- Memorial Day: Monday, May 25

- Juneteenth National Independence Day: Friday, June 19

- Independence Day: Saturday, July 4 (Observed Friday, July 3)

- Labor Day: Monday, September 7

- Columbus Day: Monday, October 12

- Veterans Day: Wednesday, November 11

- Thanksgiving Day: Thursday, November 26

- Christmas Day: Friday, December 25

The Saturday/Sunday Rule

Notice July 4, 2026. It's a Saturday.

When this happens, the Federal Reserve Bank of Philadelphia and others usually stay open on the preceding Friday, but the Board of Governors in D.C. closes. However, for most retail banks like Chase, Bank of America, or Wells Fargo, they will observe the holiday on Friday, July 3.

This creates a "zombie day." Some systems are up, some are down. Generally, if the Fed is closed, consider the day a wash for moving money.

Misconceptions: Not All Banks Follow the Rules

Here is a nuance people miss: Private banks don't have to close.

✨ Don't miss: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

There is no law saying a private business must shut its doors just because it’s Veterans Day. However, they almost always do. Why? Because they can't do any "real" business. If they can't exchange funds with other banks through the Federal Reserve, they are basically just a very secure room full of cash.

Some "retail" branches inside grocery stores might stay open for basic stuff—opening accounts or notary services—but they still can't process your out-of-state check. It’ll just sit in the hopper.

Also, don't confuse federal holidays with state holidays. In Texas, they have "Confederate Heroes Day" (yes, really). In Massachusetts, they have "Patriots' Day." On these days, state offices might close, but the banks—which are usually nationally regulated—stay open. If the Fed is open, the money moves.

What You Should Do Right Now

The smartest thing you can do is look at your payroll and auto-pay schedules for 2026.

Check your November. Thanksgiving is the 26th. If you pay employees on the Friday after Thanksgiving (Black Friday), that’s fine—the banks are open. But if your payroll provider needs two "business days" to process, you have to submit that data by Tuesday, not Wednesday. If you wait until Wednesday, the Thursday holiday eats your processing window, and your team doesn't get paid until Monday. That’s how you lose employees.

Actionable Steps for 2026

- Audit your Auto-Pays: Look at anything scheduled for the 19th or 20th of any month. These dates frequently collide with Monday holidays (MLK Day, Presidents' Day, etc.).

- Buffer your Wires: Never schedule a high-stakes wire transfer (like a home down payment) for the Friday before a long weekend. Technical glitches happen, and if you miss the cutoff, you're dead in the water for 72 hours.

- Check your App’s "Fine Print": Apps like Robinhood or Coinbase often have different "settlement" rules during federal bank holidays. Your "available balance" might look right, but the actual withdrawal to your bank will be delayed.

- The "Friday July 3" Trap: Since July 4 is a Saturday in 2026, many people will assume Friday is a normal work day. It won't be for the financial sector. Plan your July 1st and 2nd accordingly.

Understanding federal bank holidays in the United States isn't about memorizing dates for trivia; it's about knowing when the gears of the world stop turning so you don't get your fingers caught in them. Structure your 2026 finances around these gaps, and you'll avoid the "closed door" panic entirely.