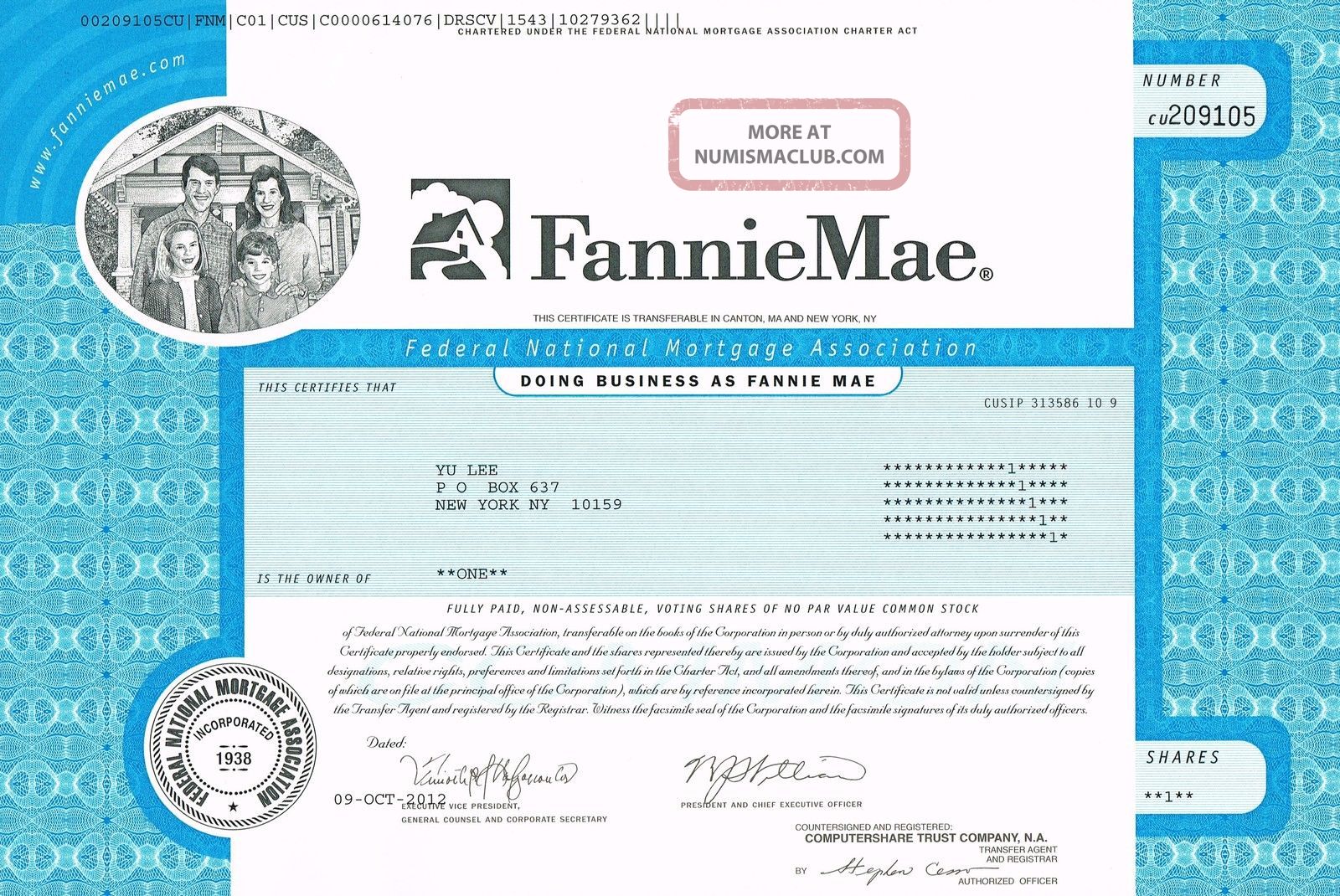

If you’ve spent any time in the dark corners of financial Twitter or scrolled through deep-value investing forums, you’ve seen it. People talking about federal national mortgage association stock like it’s a lottery ticket that’s been stuck in a drawer for fifteen years. It’s Fannie Mae. You know the name. You probably know they’re the reason most Americans can even get a 30-year fixed-rate mortgage. But the stock? That’s a whole different, messy, legally tangled story.

It’s weird.

Fannie Mae and its sibling Freddie Mac basically own the U.S. housing market. They don't lend you money directly—they buy the loans from your bank, package them into securities, and keep the whole machine greased. Without them, the 2008 crash would have been even more of a nightmare. But because of that crash, the government stepped in. They took control. And they never really let go.

The Conservatorship Trap

Since September 2008, the Federal National Mortgage Association has been in "conservatorship." That’s a fancy legal word for the government being the boss. The U.S. Treasury pumped billions into Fannie to keep it afloat when the housing bubble popped. In exchange, they took senior preferred stock and a warrant to buy 79.9% of the common stock.

For a decade, every penny of profit Fannie Mae made went straight to the Treasury. Every. Single. Cent. Investors call this the "Net Worth Sweep." If you bought federal national mortgage association stock (FNMA) thinking you’d get a dividend, you were out of luck. The government was vacuuming up the cash.

Things shifted a bit during the Trump administration. Mark Calabria, who headed the Federal Housing Finance Agency (FHFA), wanted Fannie and Freddie out of government hands. He stopped the sweep. He let them start building up capital. Suddenly, the "zombie stock" had a pulse.

Why the Courts Matter More Than the Earnings

If you're looking at Fannie’s quarterly earnings reports to decide whether to buy the stock, you're doing it wrong. Honestly. The numbers are huge—Fannie often makes billions in net income—but the shareholders don't see it. The real action is in the courtrooms.

Lawyers like David Thompson and firms like Cooper & Kirk have been fighting the government for years. They argue the Net Worth Sweep was illegal. They say the government overstepped its authority under the Housing and Economic Recovery Act (HERA).

📖 Related: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

There was a big moment in 2021. The Supreme Court ruled in Collins v. Yellen. It was a mixed bag. The Court basically said the structure of the FHFA was unconstitutional because the President couldn't fire the director at will, but they didn't hand the money back to the shareholders. It was a gut punch for a lot of people holding federal national mortgage association stock. The price tanked.

The Common vs. Preferred Debate

If you’re venturing into this space, you’ll notice two types of tickers. There’s the common stock (FNMA) and a bunch of different preferred series (like FNMAT or FNMAM).

Investors are split. Some think the common stock is the only way to get a "10-bagger" return if the company is ever fully privatized. Others think the preferred shareholders have a much stronger legal claim. If the government ever exits, the preferred holders usually get paid their par value first.

It’s basically a bet on how the "exit" happens. If it ever happens.

- Common Stock: High risk, potentially astronomical reward. It trades for pennies compared to its pre-2008 highs.

- Preferred Stock: A "cleaner" legal argument, but still highly speculative.

Sandra Thompson, the current FHFA Director, has been focused on "safety and soundness." That's regulator-speak for making sure the companies have enough cash to survive another 2008. They are building capital, but the mountain they have to climb is massive. We're talking hundreds of billions of dollars.

The Politics of Housing

Housing is political. Always.

Democrats generally want Fannie and Freddie to focus on affordability. They want lower-income families to be able to buy homes. Republicans often want to shrink the "footprint" of these giants and let private capital take over.

👉 See also: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

This creates a stalemate. To get federal national mortgage association stock back onto the New York Stock Exchange and out of the "Over the Counter" (OTC) pink sheets, the government has to agree on a path forward. They haven't agreed on a path in 16 years.

Is Fannie Mae Actually Undervalued?

By traditional metrics? It’s a powerhouse. It sits at the center of a multi-trillion dollar market. But "value" is subjective when a third party (the Treasury) holds a massive pile of senior preferred stock that sits in front of you.

If the government decided tomorrow to cancel its senior preferred shares and exercise its warrants, the dilution would be insane. Common shareholders would own a tiny sliver of a very large pie. But even that sliver might be worth more than the current stock price. That's the gamble.

Some people, like famous value investor Bill Ackman of Pershing Square, have held positions in Fannie for years. They aren't looking for a 10% gain. They are looking for the "re-IPO of the century."

It’s not for the faint of heart. You have to be okay with the possibility that the stock goes to zero. You have to be okay with waiting another decade for a court ruling or a change in administration.

What Most People Get Wrong

Most people think Fannie Mae is a government agency. It’s not. It’s a Government-Sponsored Enterprise (GSE). It’s a private corporation with a public mission. This "limbo" state is exactly why the stock is so weird.

Another misconception is that Fannie Mae "lends" money. They don't. If you want a mortgage, you go to Quicken Loans or your local credit union. Fannie just buys the loan from them so the bank has cash to lend to the next person. They are the plumbing.

✨ Don't miss: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

Recent Developments in 2024 and 2025

The capital requirements keep moving. The FHFA recently adjusted the "Enterprise Regulatory Capital Framework." Basically, they changed the rules on how much cash Fannie needs to keep in the basement.

The closer they get to their capital goals, the louder the conversation about an exit becomes. But "closer" is relative. They are still billions of dollars away from being "fully capitalized" under the current rules.

Actionable Steps for Navigating This Market

If you are looking at federal national mortgage association stock, don't treat it like a regular tech stock or a dividend-paying utility. Treat it like a legal settlement.

- Read the Court Filings: Don't just read the headlines. Look at the actual opinions from the Fifth Circuit Court of Appeals. That’s where the real news happens.

- Watch the FHFA Director: The person running the FHFA has more power over your investment than the CEO of Fannie Mae.

- Check the Treasury’s Balance Sheet: The senior preferred shares held by the Treasury are the primary obstacle. Watch for any talk of "re-extinguishment" or conversion of those shares.

- Size Your Position Correctly: This is a binary outcome play. It either works big or it doesn't work at all. Don't bet the mortgage on the company that buys mortgages.

The reality of Fannie Mae is that it remains a cornerstone of the American Dream and a headache for the American investor. It's a company that makes billions but technically owns nothing until the government says so. Whether the "administrative state" ever lets go is the multi-billion dollar question.

For now, the stock remains a play on political will and judicial interpretation. It’s a slow-motion drama that plays out in DC office buildings and marble-clad courtrooms. If you're looking for stability, look elsewhere. If you're looking for the ultimate "what if" in the American financial system, you've found it.

Monitor the upcoming 2026 budget proposals and FHFA annual reports. These documents often hide small shifts in language regarding "GSE reform" that signal which way the wind is blowing before the market reacts. Keep a close eye on the secondary market for the preferred tiers, as they often lead the common stock in volatility during legal milestones.

Stay grounded in the data, but never ignore the politics. In the world of Fannie Mae, the two are inseparable.