If you’ve ever tried to trade a stack of US greenbacks for "blue notes" in Port of Spain, you know the official number on Google is only half the story.

Honestly, the exchange rate us to trinidad dollars is one of the most misunderstood figures in Caribbean finance. On paper, it looks stable. In reality? It’s a complex game of supply, demand, and "who do you know at the bank?"

The Numbers vs. The Reality

Right now, in mid-January 2026, the official mid-market exchange rate sits around 6.79 TTD to 1 USD.

But here’s the kicker: try walking into a commercial bank to buy US dollars at that price. You’ll likely be met with a polite "we don't have any today" or a strict limit of maybe $200 USD—if you’re lucky.

For most people, the actual rate they experience is the selling rate, which is closer to 6.85 TTD or even higher. If you're using a credit card for an Amazon haul or a Netflix subscription, you’ve probably noticed the conversion hitting your statement at a rate that feels much "heavier" than the one you saw on the morning news.

👉 See also: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

Why is the USD so hard to find?

Trinidad and Tobago uses a managed float system.

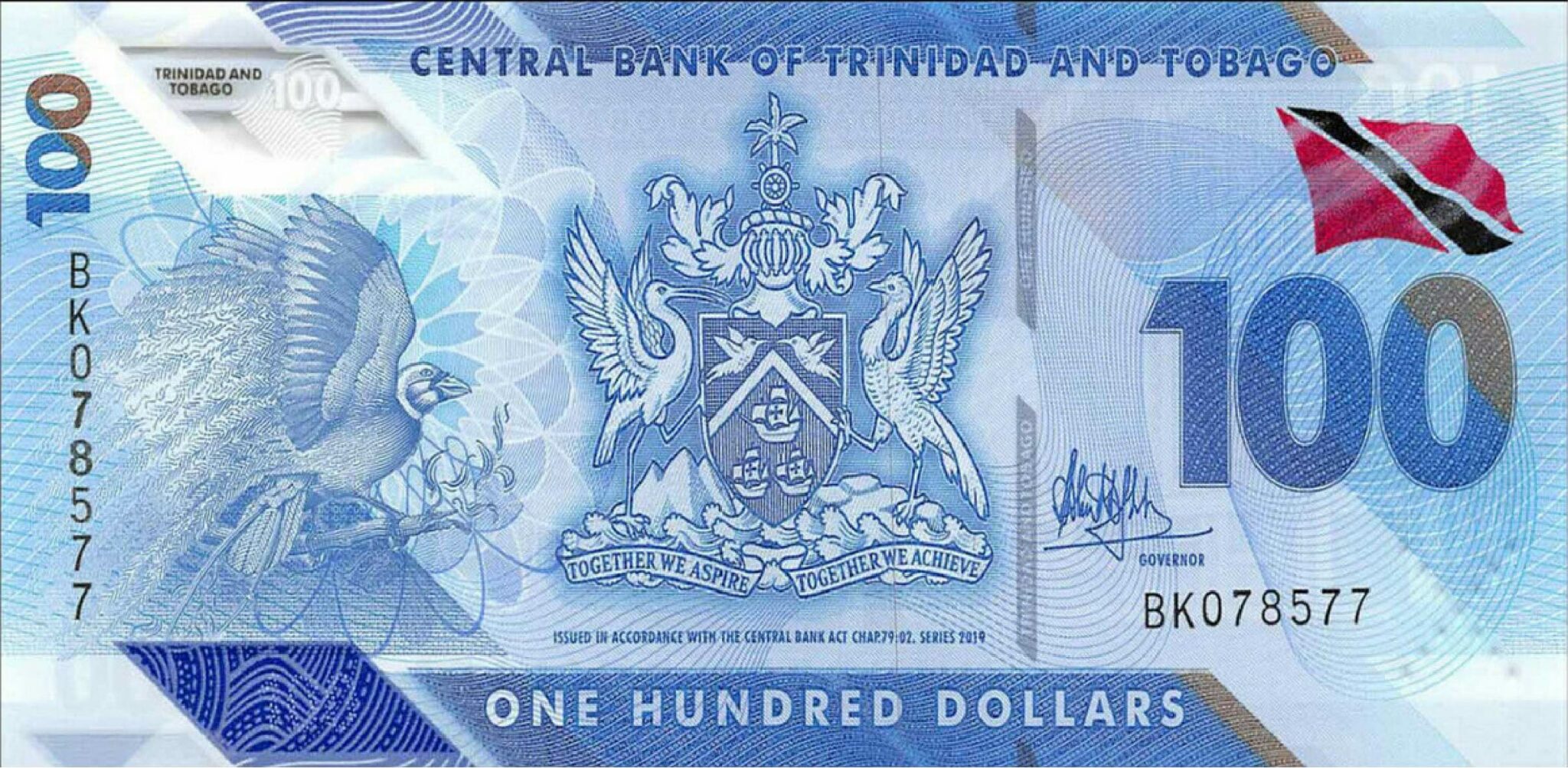

Basically, the Central Bank of Trinidad and Tobago (CBTT) keeps the currency within a very tight range. They don’t want the TT dollar to go into a freefall because that would make everything—from flour to car parts—way too expensive.

But there’s a catch. Because the price of the US dollar is kept artificially "cheap," everyone wants it.

- Energy Slumps: The country’s main source of USD is oil and gas. When production dips or prices wobble, the supply of foreign exchange dries up.

- The Queue: Businesses sometimes wait months to get the US currency they need to pay suppliers.

- Import Obsession: Trinis love foreign goods. We import almost everything, which means we are constantly "bleeding" USD out of the economy.

What Most People Get Wrong About the Rate

A lot of folks think the exchange rate us to trinidad dollars is going to "crash" or "devalue" overnight.

✨ Don't miss: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

Economists like those at the IMF have suggested for years that the TT dollar is overvalued. They’ve argued it should probably be closer to 8-to-1 or even 10-to-1 to reflect the actual market balance.

However, the local government has been incredibly resistant to this. Why? Because a sudden devaluation would be political suicide and would likely cause a massive spike in inflation.

So, we stay in this "grey zone." The rate stays at 6.7x or 6.8x, but the availability is the real price you pay. If you can’t get the money when you need it, is the rate even real?

The Parallel Market (The "Black" Market)

Because banks are so tight with their cash, a parallel market exists.

🔗 Read more: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

You’ll hear whispers of rates like 7.50 TTD or 8.00 TTD for 1 USD in private transactions between business owners or individuals. This isn't just "shady" business; it's often the only way a small business owner can get the stock they need to keep their doors open.

It’s a classic supply and demand problem. When the official "gatekeeper" (the bank) closes the door, people find a side window.

How to Manage Your Money in 2026

If you’re traveling or doing business, you need a strategy. Don't just show up at the airport expecting to buy 5,000 USD on the spot. It won't happen.

- Use Your Credit Card Wisely: Most local banks (Republic Bank, First Citizens, etc.) have strict monthly limits on foreign currency spending. Check your limit before you book that flight.

- USD Accounts: If you earn in US dollars, keep it in a USD account. Don't convert it to TT unless you absolutely have to, because getting it back into USD later is a nightmare.

- Timing Your Buy: If you see the Central Bank has just made a "liquidity injection" (that's when they dump a few hundred million USD into the commercial banks), that is your window to go and ask for your travel allowance.

The 2026 Outlook

Things are looking a bit better than they were two years ago, but we aren't out of the woods.

Natural gas production from the Manatee and Dragon fields is the big hope. If those projects stay on track, we might see more USD flowing into the system by 2027. Until then, expect the exchange rate us to trinidad dollars to remain a "stable" number that feels anything but stable when you're trying to find a few bucks for a trip to Miami.

Your Next Steps

- Check your bank’s specific daily selling rate rather than relying on global aggregators; it’s usually posted on their website or a board in the lobby.

- Reconcile your credit card statements to see the "hidden" conversion fees and taxes (like the 7% online purchase tax) that effectively raise your exchange rate.

- Apply for USD travel allowances at least two to three weeks before your departure date to ensure the bank has the physical cash on hand.