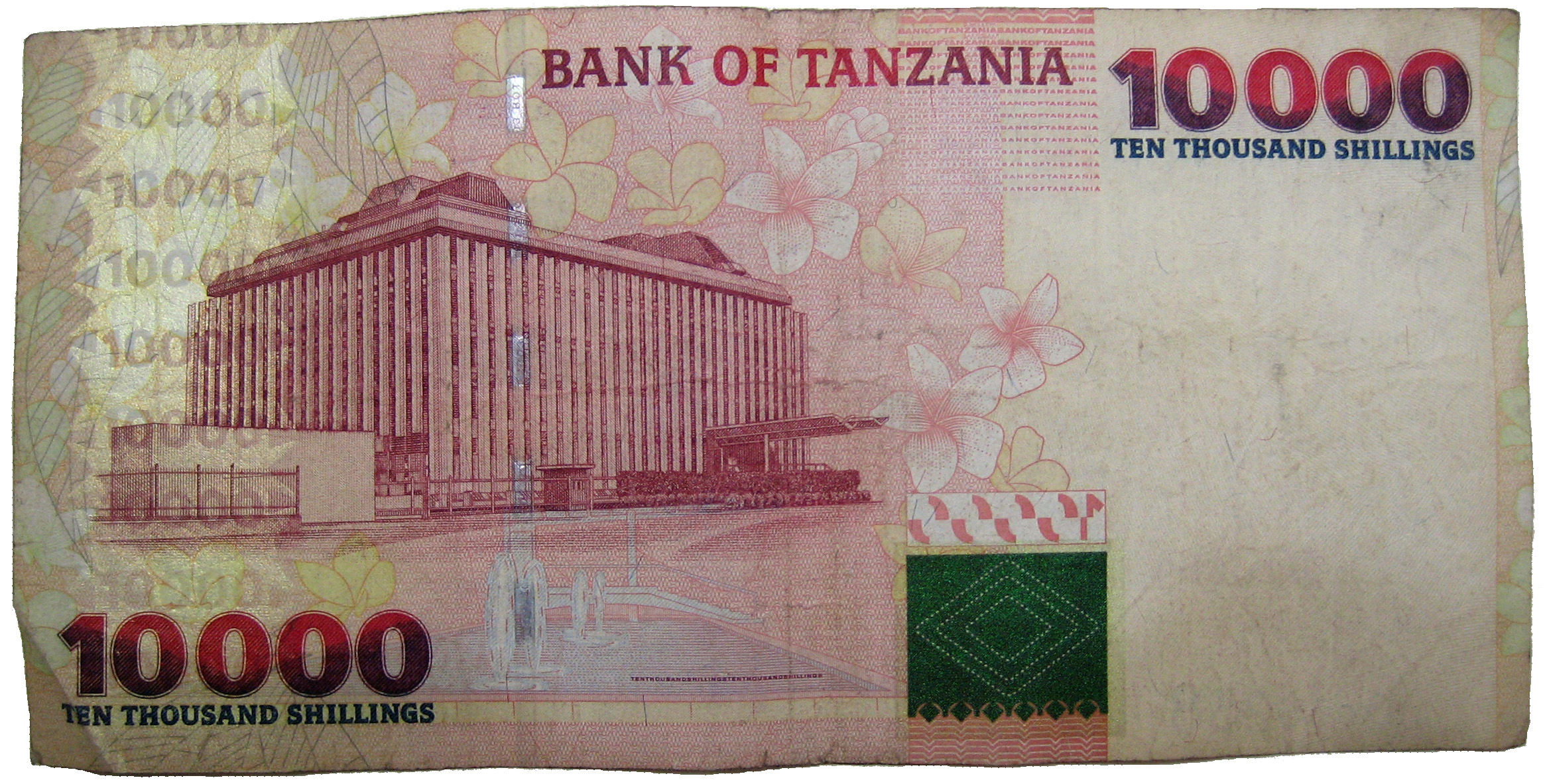

Money is weird. One day you're looking at a conversion rate that feels steady, and the next, you're staring at a chart wondering why your purchasing power just took a nosedive. If you’ve been tracking the exchange rate us dollar to tanzanian shilling, you know exactly what I mean. It’s not just a number on a screen at the Bureau de Change in Dar es Salaam; it’s the heartbeat of the East African economy.

Right now, as of mid-January 2026, the Tanzanian Shilling (TZS) is putting up a surprisingly decent fight against the Greenback. While most currencies in the region have been getting absolutely hammered by a strong Dollar, Tanzania has managed to carve out a pocket of relative stability. But don't let the surface-level numbers fool you. There is a massive tug-of-war happening behind the scenes between the Bank of Tanzania (BoT), global gold prices, and the massive infrastructure projects currently tearing up the landscape from Mwanza to Mtwara.

💡 You might also like: Is Bank Closed Tomorrow? What You Actually Need to Know Before Heading Out

The Real Numbers: What's Happening Right Now?

Let’s get the "official" stuff out of the way. As we hit the middle of January 2026, the exchange rate us dollar to tanzanian shilling is hovering around the 2,510 to 2,550 range. Honestly, if you look back a year, it’s been a wild ride. We saw a dip where it touched 2,400 after some aggressive central bank interventions in late 2025, but it’s settled back into this 2,500 "new normal."

It’s easy to think a higher number is always "bad." If you're an exporter selling cashews or gold, you actually kinda like a weaker Shilling because your Dollars buy more local labor and supplies. But for the average person in Kariakoo buying imported electronics or fuel, every tick upward in that exchange rate feels like a punch to the wallet.

The Bank of Tanzania recently kept the Central Bank Rate (CBR) at 5.75%. That's a signal. They aren't panicking. They’re basically telling the market, "We think inflation is under control, so we aren't going to hike rates and choke off growth just to defend the Shilling." It’s a delicate balance.

Why the Shilling Isn't Crashing (Yet)

You'd expect a developing economy with massive infrastructure debt to see its currency crumble. So why is the TZS holding on?

Gold. Lots of it. Tanzania is a gold mine—literally. With global gold prices hitting record highs recently (we’re talking over $4,400 per troy ounce in some projections), the influx of foreign currency from mining exports is acting like a massive shock absorber. When the world gets nervous, they buy gold. When they buy gold from Tanzania, they have to bring in Dollars. This helps keep the exchange rate us dollar to tanzanian shilling from spiraling out of control.

🔗 Read more: AARP Tax Help Phone Number: Why Your Local Library Might Be Your Best Bet

The "De-Dollarization" Push

Back in March 2025, the government got serious about "de-dollarization." They started cracking down on schools, landlords, and businesses demanding payment in USD. You've probably noticed the signs if you live in Arusha or Dar. By forcing people to use Shillings for local transactions, they’ve managed to reduce the "artificial" demand for Dollars. It’s a move that sounds small but has actually been a huge pillar for currency stability.

The Import Headache

Tanzania still imports a ton of stuff. Refined petroleum, heavy machinery for the SGR railway, and even basic consumer goods.

- Oil Prices: Thankfully, global crude has stayed somewhat sane, around $62-$65 a barrel. If that spikes, the Shilling is in trouble.

- Infrastructure: The Julius Nyerere Hydropower Plant and the Standard Gauge Railway are expensive. They require massive amounts of foreign currency to pay contractors and buy materials.

Misconceptions About the "Black Market" Rate

One thing people get wrong constantly is trusting the "Google rate" as the final word. If you go to a bank in Dar es Salaam, you aren't getting that mid-market rate you see on your phone. There is always a spread.

Usually, the "buying" and "selling" rates can differ by 30 to 50 Shillings. If you're moving large sums—say, for a business shipment or a real estate deal—that spread can eat thousands of dollars in a heartbeat. Honestly, some of the smaller, licensed bureaus often give better rates than the big commercial banks, but you've got to be careful with the paperwork. The BoT has been very strict lately about ensuring every cent is tracked to prevent money laundering.

What to Watch for in 2026

If you're trying to predict where the exchange rate us dollar to tanzanian shilling is going, stop looking at just the charts. Look at the weather and the ports.

Agriculture still makes up a huge chunk of the GDP. If we get a bad harvest due to climate variability, food prices go up, and the government has to spend more foreign reserves to import grain. That puts immediate pressure on the Shilling. On the flip side, the tourism sector is booming. Over 2.3 million visitors hit the Serengeti and Zanzibar recently. Those tourists bring "hard currency," which is the best medicine for a flagging Shilling.

👉 See also: Converting 2250 GBP in USD: What Most People Get Wrong About Mid-Sized Currency Trades

Actionable Insights for Your Money

If you are holding US Dollars or Tanzanian Shillings, here is how you should actually handle this volatility:

- Don't "Panic Buy" Dollars: Many people see the Shilling slip by 5 units and rush to buy USD. Often, the BoT intervenes a week later, and the rate stabilizes. Unless you have an immediate need to pay an offshore invoice, wait for the "settle-down" periods.

- Monitor BoT MPC Statements: The Monetary Policy Committee meets quarterly. Their next big move is in April 2026. If they raise that 5.75% interest rate, the Shilling will likely strengthen. If they hold or cut, expect a slow, managed depreciation.

- Hedge for Business: If you're a business owner, look into "forward contracts" with banks like NMB or CRDB. It lets you lock in a rate for a future date so you don't wake up one morning and find your import costs have jumped by 10%.

- Watch the Fed: The US Federal Reserve's decisions in Washington D.C. matter as much as anything happening in Dodoma. If the US starts cutting rates significantly, the "Dollar Index" drops, giving the Shilling some breathing room.

The bottom line? The Shilling is in a "managed float" phase. It isn't going to stay flat, but the days of 10% overnight crashes seem to be behind us for now, thanks to those massive gold reserves and a very protective central bank. Keep an eye on the 2,550 mark—that seems to be the psychological ceiling for the first half of the year.

As the SGR railway project moves closer to full operational status and more electricity from the Nyerere dam hits the grid, the need for expensive fuel imports should drop. This could be the long-term "win" the Shilling needs to stay competitive. For now, stay informed, don't overreact to daily fluctuations, and always check the local bureau rates before making a big move.