You’re staring at a bank statement. It’s messy. The numbers don’t match what’s in your head, and quite honestly, the "available balance" on your mobile app is a lie because that check for the plumber hasn't cleared yet. This is why people still use Excel. It’s not about being old school; it’s about control. But here is the thing: most people mess up the checkbook formula in excel by making it way more complicated than it needs to be, or worse, they use static numbers that break the moment they delete a row.

Excel is basically just a giant calculator that remembers things. If you’re still manually adding and subtracting every time you buy a coffee, you’re defeating the purpose of the software.

The Simple Math That Everyone Overthinks

Let's get real for a second. At its core, a checkbook is just an running total. You start with a number. You add deposits. You subtract expenses. That’s it. But in a spreadsheet, you need a formula that "drags" correctly.

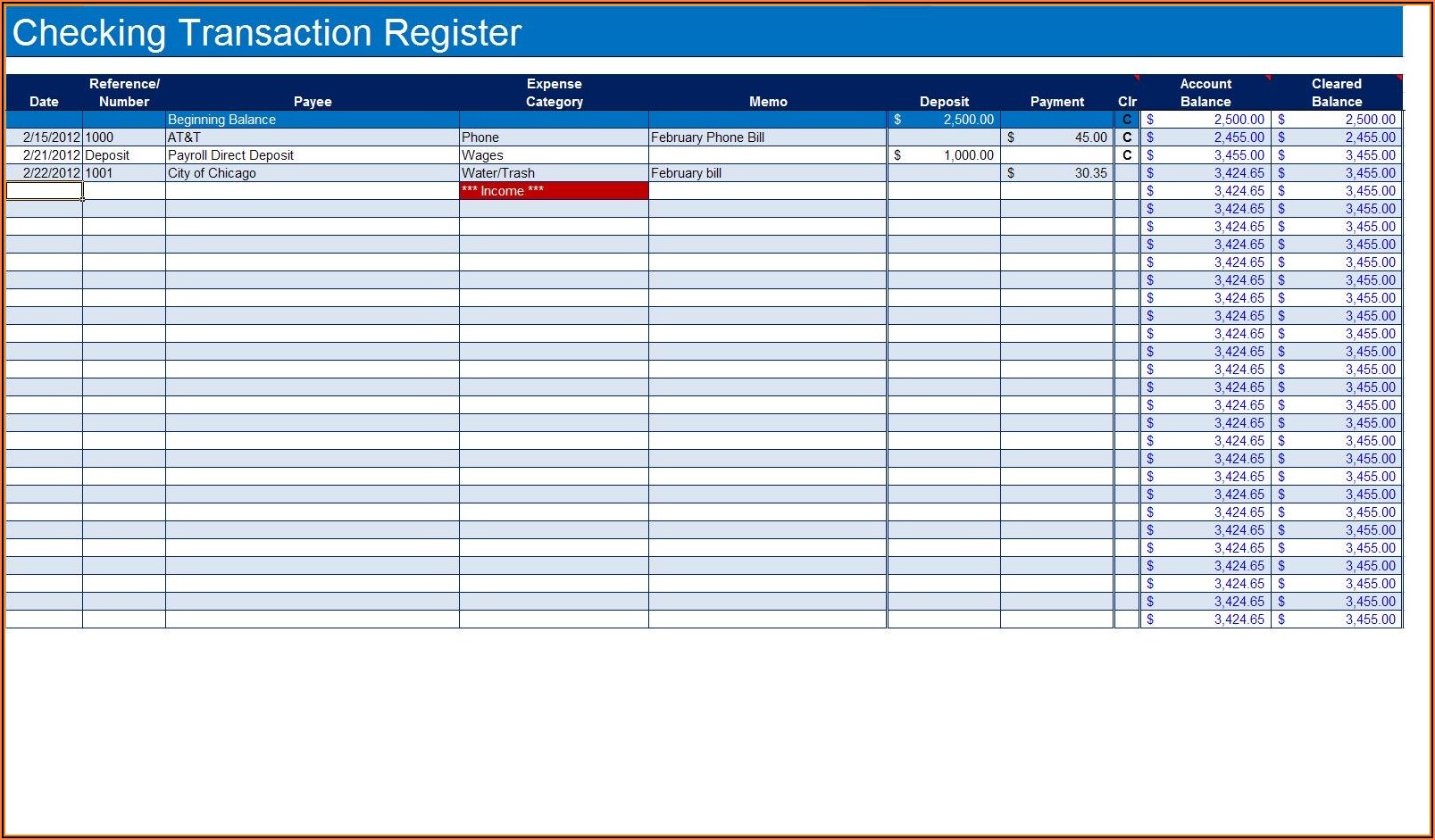

The most common mistake? Putting the starting balance in the same column as your transactions. Don't do that. It makes the math clunky. Instead, imagine your spreadsheet has headers: Date, Description, Withdrawal, Deposit, and Balance. Your starting balance should sit alone in the Balance column, let's say in cell E2.

The magic happens in cell E3. You’re going to tell Excel: "Take the balance from right above me, add any new deposit, and subtract any new withdrawal." It looks like this: =E2+D3-C3.

It’s simple. It works. You click that little green square at the bottom right of the cell and drag it down. Boom. Running balance.

Why the Simple Way Sometimes Fails

But wait. If you drag that formula down 100 rows, you’ll see the same number repeated over and over until you enter a new transaction. It looks cluttered. It's annoying. If your balance is $1,200 and you haven't bought anything else yet, seeing $1,200 listed fifty times down the page is just bad design.

This is where the IF function saves your sanity. You can tell Excel to stay blank unless there's actually data in the description or date column. It makes the sheet look clean. Use something like =IF(ISBLANK(A3), "", E2+D3-C3). This basically says, "If there's no date in column A, don't show me a balance yet."

Building a Bulletproof Ledger

Structure matters more than the formula itself. If you don't set up your "Table" correctly, you'll eventually accidentally delete a cell and your whole balance will shift by $400, leaving you panicking at the grocery store.

- Always use a Header Row.

- Format your "Withdrawal" and "Deposit" columns as Currency.

- Use the "Format as Table" feature (Ctrl + T).

This last point is huge. When you format your data as an actual Table in Excel, the checkbook formula in excel becomes dynamic. If you add a new row at the bottom, Excel automatically copies the formula down for you. You don't have to drag anything. It just knows.

Handling the "Cleared" Problem

Banks are slow. You know this. You spend $50 today, but it might not show up on your official statement until Tuesday. To handle this like a pro, add a "Status" or "Cleared" column.

Some people use a simple "X" to mark transactions that have hit the bank. If you want to get fancy, you can use a separate formula to show two different balances: your "Actual Balance" (everything you've spent) and your "Bank Balance" (only the stuff with an 'X').

To do this, you’d use SUMIF. It sounds intimidating, but it's just telling Excel to only add up the numbers that have that "X" next to them. It helps you reconcile your account in seconds rather than minutes.

The Trouble with Errors and Broken Links

Excel can be fragile. I’ve seen people try to link their checkbook to three other sheets—one for savings, one for a "fun money" budget, and one for their spouse’s spending. This is a recipe for a #REF! error.

If you delete a row in the middle of a manual running balance, the formula below it will break because the cell it was looking at (the one you deleted) is gone. This is why using the Table feature mentioned earlier is so critical. Tables handle row deletions much more gracefully than raw ranges do.

Another tip: Avoid "hard-coding" numbers. If you have a monthly subscription like Netflix, don't just type "-15.99" into the formula. Put "Netflix" in the description and "15.99" in the withdrawal column. You want to see the audit trail. Future you will thank current you when you're trying to figure out why you’re $20 short at the end of the month.

Real World Example: The "Oops" Protection

Imagine you’re tracking a joint account. Your partner forgets to tell you about a $200 ATM withdrawal. You enter it late, but you want to put it in the correct date order.

💡 You might also like: Stick Apple TV Cast: Why Your Phone Won't Connect and How to Fix It

If you aren't using an Excel Table, inserting a row in the middle of your sheet can be a nightmare. You have to copy and paste formulas and hope you didn't miss a cell. With a proper checkbook formula in excel inside a formatted Table, you just right-click, insert a row, type the data, and the running balance heals itself. It’s like magic, but it’s just good data management.

Beyond the Basics: Pivot Tables for the Obsessive

If you really want to know where your money goes, you need categories. Add a column for "Category" (Groceries, Rent, Gas, Impulse Buys).

Once you have a few months of data, you can insert a Pivot Table. In about three clicks, Excel can tell you exactly how much you spent on Starbucks versus how much you spent on actual food. Most people realize they're spending way more on "Misc" than they thought. It’s eye-opening.

Is Excel Better Than an App?

You might wonder why you're doing this when apps like Mint (RIP) or YNAB exist. The truth is, those apps can be restrictive. They try to categorize things for you and often get it wrong. They also struggle with "pending" transactions in a way that can be confusing.

With your own Excel sheet, you define the rules. You decide how to handle transfers between accounts. You don't have to worry about a third-party company selling your data or shutting down their service. Plus, it works offline.

Actionable Steps to Set Up Your Sheet Today

Stop overthinking it. You don't need a 40-minute tutorial. Just do this:

- Open a blank sheet and create these headers: Date, Check #, Description, Category, Withdrawal (-), Deposit (+), and Balance.

- Enter your current bank balance in the first row of the Balance column (Cell G2).

- In the next row down (G3), type:

=G2-E3+F3. - Select your entire header row and the first two rows of data, then press Ctrl + T and check the box "My table has headers."

- Start entering your transactions. The balance will update automatically as you go.

To keep it organized, use Conditional Formatting on the Balance column. Set it to turn red if the value drops below zero. It’s a simple visual cue that prevents overdrawing your account.

Finally, save this file in a cloud drive like OneDrive or Dropbox. There is nothing worse than keeping a meticulous checkbook for six months only to have your laptop die. Being able to update your ledger from your phone or another computer makes it much more likely that you'll actually stick with it.

The goal isn't to have a perfect spreadsheet; it's to have an honest one. When your Excel balance matches your bank's "cleared" balance to the penny, it’s a weirdly satisfying feeling. It’s one of those small wins that makes adulting feel a little less chaotic.