You're standing at the register, or maybe you're sitting at your kitchen table trying to pay the contractor who doesn't take Venmo. You pull out that little paper book. It feels ancient. For a second, your mind goes blank. Where does the date go? Does the "cents" part need a fraction? If you’re looking for an example cheque filled out properly, you aren't alone. Even in 2026, with digital wallets and instant transfers, the physical cheque remains a stubborn staple of the financial world. It’s the "old reliable" for rent, large deposits, and those weird moments when technology fails.

Writing a cheque isn't hard, but it is precise. One mistake—a messy signature or a mismatched number—and the bank might reject it. Then you’re dealing with late fees or a frustrated landlord.

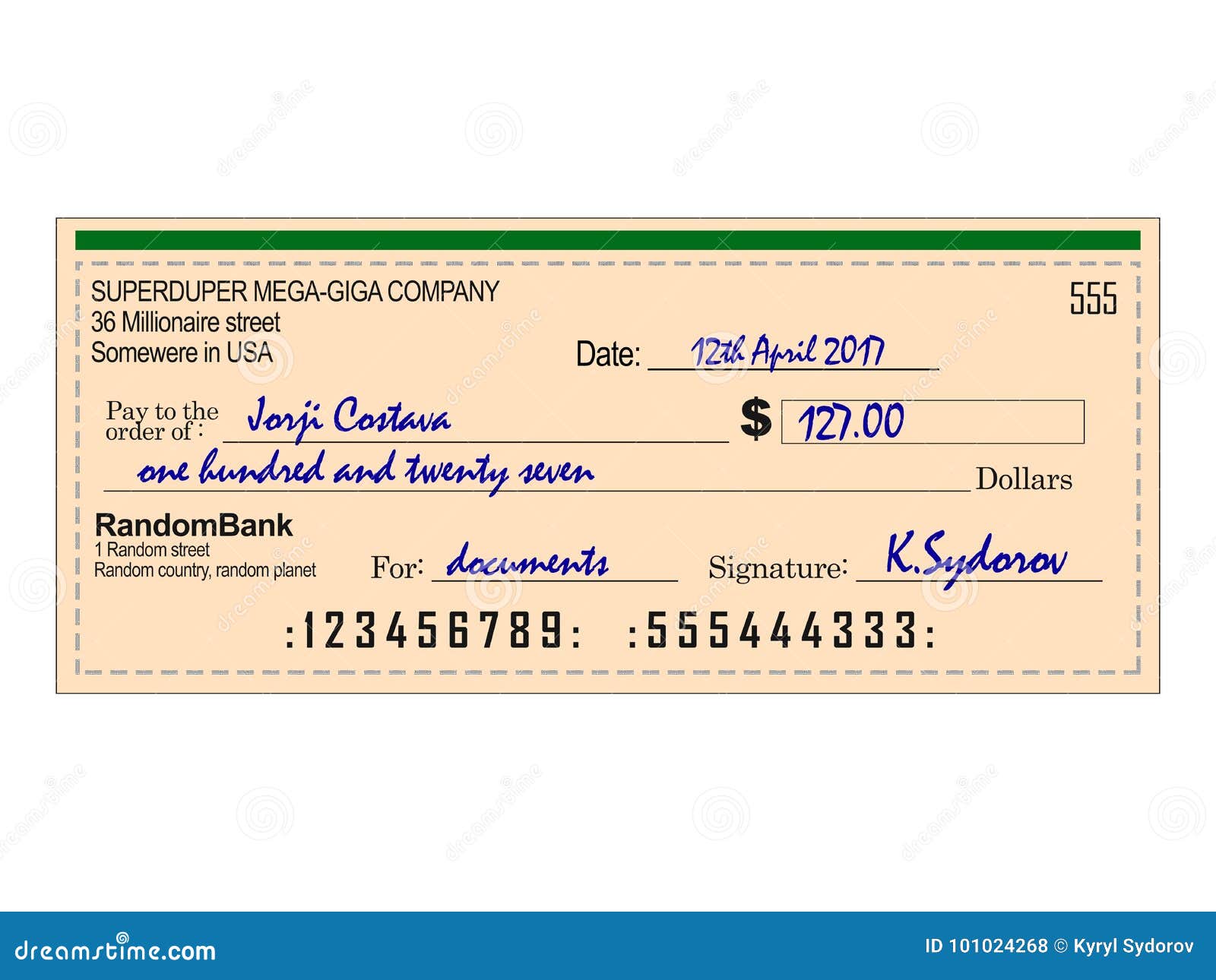

The Visual Anatomy of a Perfectly Written Cheque

Basically, every standard cheque from Chase, Wells Fargo, or your local credit union has six specific zones you need to hit. Think of it like a mini-contract.

- The Date: Top right. Simple, right? But don’t get fancy. Use the current date unless you’ve specifically cleared "post-dating" with the recipient.

- Pay to the Order of: This is where the name goes. Use the legal name. If you're paying "John Doe," don't just write "John." If it’s a business, use the full registered title.

- The Numeric Box: This is the small box on the right. You write the amount in digits here. $1,250.50. Make sure it's clear.

- The Written Line: This is the most important part legally. If the box says one thing and the line says another, the bank usually defers to the words.

- The Memo Line: This is optional but honestly, you should always use it. "January Rent" or "Invoice #402."

- The Signature: Without this, the piece of paper is just a scribble.

Let's look at a real-world scenario. Say you owe your friend Sarah $125 for a concert ticket. You write her name on the "Pay to" line. In the box, you write 125.00. On the long line below, you write "One hundred twenty-five and 00/100." You sign it. Done.

An Example Cheque Filled Out for Large Amounts

When you're dealing with big money, like a down payment or a car purchase, people get nervous. The stakes are higher. One of the most common questions is how to handle the cents on the written line.

You should always use the fraction method. It's the banking standard. If you are looking at an example cheque filled out for $1,500.75, the written line must read: "One thousand five hundred and 75/100."

Why the fraction? It prevents people from adding extra numbers at the end. If you just write "One thousand five hundred," someone could theoretically add "and ninety-nine" to the end if there's enough space. By using the fraction and then drawing a solid line to the end of the space, you "lock" the cheque.

The Weird Legal Bits Most People Forget

Did you know that according to the Uniform Commercial Code (UCC) in the United States, words prevail over figures? This is a nuance many skip. If you accidentally write $100 in the box but write "One thousand dollars" on the line, the bank is legally allowed to process it for $1,000. It happens more than you'd think.

✨ Don't miss: Price of Brent today: Why the market is ignoring the chaos in Venezuela

Banks have automated systems now that "read" cheques using OCR (Optical Character Recognition). If the machine gets confused, a human teller has to step in. That’s where the trouble starts. If your handwriting looks like a doctor's prescription, you’re asking for a delay.

Security Measures You Can’t Ignore

Let's talk about "cheque washing." It’s a real thing where scammers use chemicals to erase your ink and rewrite the payee and the amount. To stop this, use a gel pen. Gel ink seeps into the fibers of the paper, making it nearly impossible to "wash" without destroying the cheque itself. Avoid standard ballpoint pens for high-value payments.

Also, never leave large gaps. When writing the amount in words, start at the very far left of the line. Once you finish writing "00/100," draw a thick line through the remaining empty space. This is a classic move. It prevents anyone from turning "Fifty" into "Fifty thousand."

Common Mistakes with an Example Cheque Filled Out

- Forgetting the date: It sounds silly, but people do it. A cheque without a date is technically incomplete, though many banks will still process it if they're feeling generous.

- The Signature Mismatch: If you’ve recently changed your name or if your signature has evolved into a single wavy line over the years, make sure it somewhat resembles what the bank has on file.

- Using Pencil: Never. Ever. Use a pencil. It can be erased.

- Scribbling out errors: If you mess up, don't just cross it out and initial it. Most modern banking apps that use mobile deposit will flag a cheque with heavy alterations as "suspicious" and reject it. It’s better to just write "VOID" across the bad cheque and start a new one.

The Rise of the "Voided" Cheque

Often, you aren't actually giving someone money; you’re just providing an example cheque filled out with "VOID" to set up direct deposit. In this case, you don't fill out the amount or the payee. You just write "VOID" in large letters across the front. This gives the employer your routing and account numbers without giving them a live cheque they could accidentally (or intentionally) cash.

The routing number is that nine-digit code on the bottom left. The account number is the string of digits next to it. These tell the world exactly which "bucket" of money to dip into.

How to Handle Different Currency Formats

If you are writing a cheque in a different country, things change. In the UK or Canada, the date format might be DD/MM/YYYY instead of the American MM/DD/YYYY. Getting this wrong can cause a cheque to be "stale-dated" (too old) or "post-dated" (too new) incorrectly. Always check the local preference.

In some European systems, they use commas where Americans use periods for decimals. However, the standard example cheque filled out in the US should always use a period for the cents ($100.50).

What Happens if a Cheque Bounces?

If you write a cheque and don't have the funds, it "bounces." This is officially known as an NSF (Non-Sufficient Funds) event. It’s expensive. Your bank will charge you a fee, usually around $35, and the person you were trying to pay will likely get charged a "returned item" fee by their bank too. They’ll usually pass that cost back to you.

Honestly, it’s a mess. If you aren't sure the money is there, don't write the cheque. Use a cashier's cheque or a money order instead. These are "guaranteed" funds because the bank takes the money out of your account immediately when they issue the paper.

Actionable Steps for Writing Your Next Cheque

To make sure your next payment goes through without a hitch, follow this workflow:

- Use a dark gel pen: Black ink is the gold standard for scanability.

- Double-check the math: Ensure the box and the written line are identical.

- Fill the space: Start your words at the far left and draw a line to the end.

- Record it: Don't just rip it out and forget it. Write the cheque number, date, and amount in your cheque register (that little logbook in the back of your chequebook).

- Wait for the clear: Just because the money left your "available balance" doesn't mean the cheque has fully cleared. It can take 2-5 business days for a cheque to fully resolve between banks. Keep a buffer in your account until you see the transaction move from "pending" to "posted."

Writing a cheque might feel like a relic of the 90s, but doing it correctly is a basic piece of financial literacy that saves you from unnecessary fees and fraud. Keep it clean, keep it consistent, and always use the line to "lock" your amount.

Next Steps for You:

If you have a cheque that was written to you, remember to endorse the back exactly as your name appears on the front. If you're depositing it via a mobile app, most banks now require you to write "For Mobile Deposit Only" under your signature. Failure to do this is the #1 reason mobile deposits get rejected today. Check your specific bank's app for their exact wording requirements before you sign.