Money is weird. One minute you're looking at a digital screen in a cafe in Paris, and the next you're trying to figure out why your ten-euro sandwich just cost you twelve quid back home. That's the magic—or the curse—of the exchange rate. If you’ve ever typed euro to pounds converter into a search bar while standing in a checkout line, you aren't alone. Thousands of people do it every single minute. But here is the thing: most of those people are looking at the wrong number.

They see the "mid-market" rate. That's the global "real" price that banks use to trade with each other. It's the "pure" price. But unless you are a hedge fund manager or a central bank governor, you're never getting that price. You're getting the "retail" rate.

Basically, the difference between what Google tells you and what your bank charges you is how they pay for those fancy glass office buildings in Canary Wharf. It’s a spread. A markup. A sneaky little fee hidden in plain sight.

The messy reality of using a euro to pounds converter

Most people think a currency converter is just a calculator. It isn't. It’s a snapshot of a chaotic, 24-hour global shouting match. The Euro (EUR) and the British Pound (GBP) are two of the most heavily traded currencies on the planet. Because the UK and the Eurozone are such massive trading partners, the "Cable" (that’s the nickname for the GBP/USD pair, but it affects the cross-rates too) is constantly vibrating.

Inflation data from the Office for National Statistics (ONS) in London can send the pound soaring. Ten minutes later, a speech from the European Central Bank (ECB) in Frankfurt can knock the euro down. It's a see-saw that never stops moving.

If you use a basic euro to pounds converter on a Sunday, you’re looking at Friday’s closing price. The markets are closed. But come Monday morning at 8:00 AM in London? All bets are off. If you’re transferring a large sum—say, for a house deposit or a car—that tiny decimal shift can cost you hundreds of pounds. Honestly, it’s stressful.

Why the "Google Rate" is a lie for most shoppers

You see a rate of 0.86. You do the math. You think you're getting a bargain. Then you check your banking app and see 0.83. Where did that money go?

✨ Don't miss: How to make a living selling on eBay: What actually works in 2026

It went into the "FX Spread."

High-street banks like Barclays, HSBC, or Lloyds usually bake a 3% to 5% margin into the exchange rate. They don't call it a fee. They just give you a worse rate than the one you saw on your euro to pounds converter. If you use a specialized service like Wise (formerly TransferWise), Atlantic Money, or Revolut, that spread shrinks significantly, sometimes to 0.4% or 0.5%.

Let's look at a real-world scenario. You're moving €10,000.

At a mid-market rate of 0.85, you should get £8,500.

A bank gives you 0.81. You get £8,100.

You just paid a £400 "convenience" fee without even realizing it. That’s a return flight to Tokyo. Or a lot of very expensive cheese.

What actually drives the EUR to GBP rate?

It’s not just random. It’s math, politics, and vibes. Mostly vibes.

- Interest Rates: This is the big one. If the Bank of England raises rates to 5% while the ECB keeps theirs at 4%, investors want pounds. They get a better return on their "safe" money in London. So, they sell euros and buy pounds. The pound goes up.

- The "Trade Balance": If the UK buys more BMWs and French wine than it sells in services or machinery to Europe, there is more demand for euros.

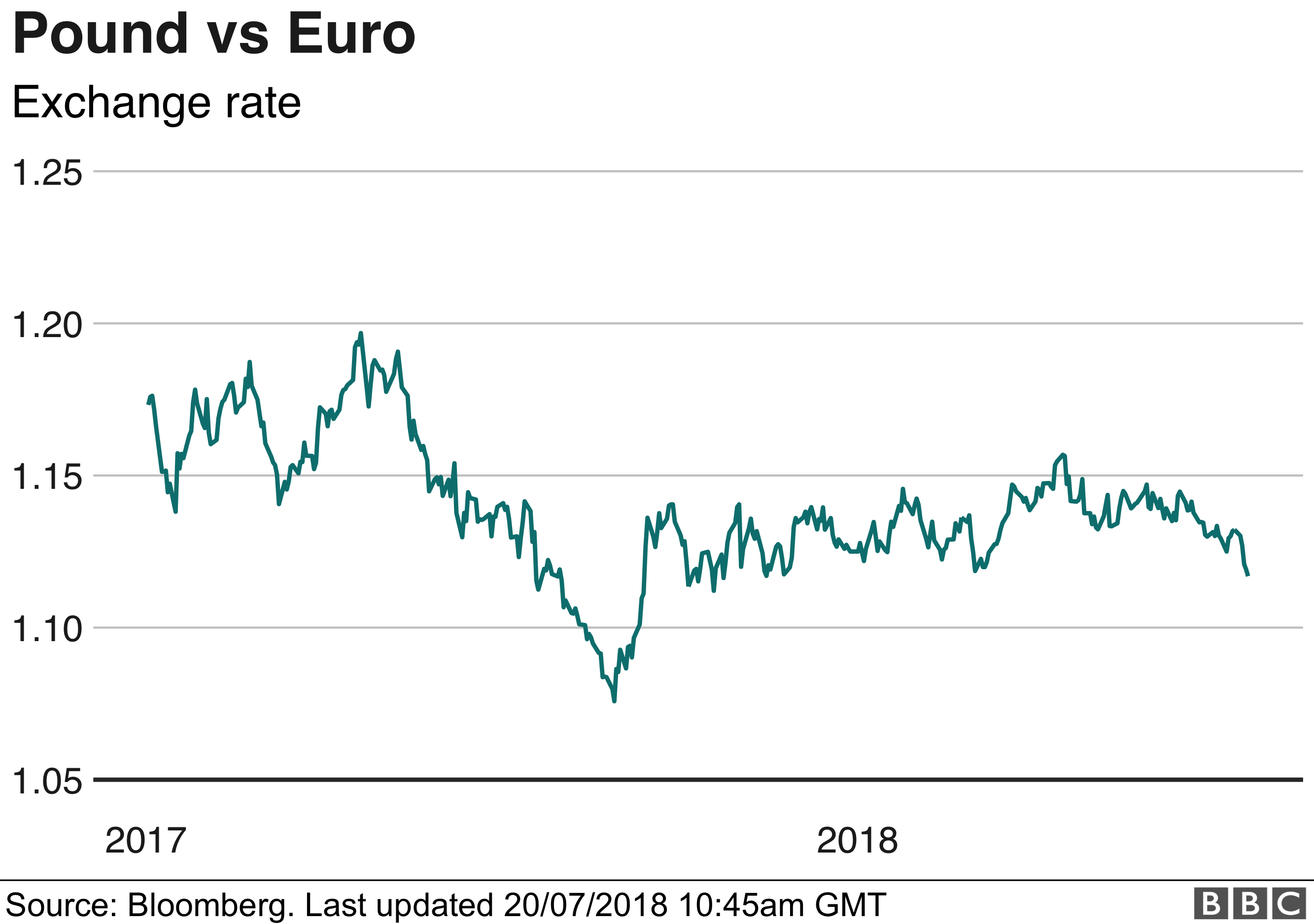

- Political Stability: Remember the Brexit years? The pound was like a roller coaster with a broken brake line. Every headline about a "deal" or "no deal" sent the euro to pounds converter into a frenzy.

Even now, post-Brexit, the "Trade and Cooperation Agreement" (TCA) keeps things complicated. We see fluctuations based on how well the UK economy is "decoupling" or "re-coupling" with European supply chains. It’s a constant tug-of-war.

Don't trust the airport kiosks

Seriously. Just don't.

🔗 Read more: How Much Followers on TikTok to Get Paid: What Really Matters in 2026

If you are standing at an airport looking at a physical euro to pounds converter screen, you are in the "Danger Zone." Travel money booths at Heathrow or Charles de Gaulle have the worst rates in the world. They know you're desperate. They have a captive audience. Their "Zero Commission" signs are a total marketing trick. They just hide the 10% or 15% fee in a truly terrible exchange rate.

If you need cash, use an ATM. Even with a small foreign transaction fee, you’ll usually come out ahead compared to those neon-lit kiosks.

How to use a euro to pounds converter like a pro

If you want to actually save money, you need to change how you look at the numbers. Don't just look at the "now." Look at the "trend."

Many modern converters allow you to set "Rate Alerts." This is the secret weapon of the savvy traveler or the business owner. If the rate is currently 0.84 but you know it’s been 0.86 recently, you can set an alert. The app pings you when the pound weakens or the euro strengthens to your target.

You should also look for "Forward Contracts" if you're doing big business. This is where you "lock in" a rate today for a transfer you’re making in three months. It’s basically insurance against the world going crazy.

- Check the mid-market rate first. Use Reuters or Bloomberg for the most "honest" number.

- Compare the "Landed" amount. Don't look at the rate; look at how many pounds actually hit the destination account after all fees.

- Avoid weekends. Spreads often widen on Saturdays and Sundays because banks want to protect themselves against "gap" openings on Monday morning.

The psychology of the "Conversion Trap"

There is a weird psychological thing that happens when we convert currency. We tend to "anchor" to old prices. If you remember the pound being worth €1.40 (back in the mid-2010s), you'll always feel like you're getting a bad deal today when it's hovering closer to €1.15 or €1.20.

💡 You might also like: How Much 100 Dollars in Ghana Cedis Gets You Right Now: The Reality

This leads to "Dynamic Currency Conversion" (DCC) traps. You’re at a restaurant in Rome. The waiter brings the card machine. It asks: "Pay in EUR or GBP?"

Always choose EUR. If you choose GBP, the restaurant's bank chooses the exchange rate. And guess what? They aren't choosing the rate that favors you. They are using their own internal euro to pounds converter with a massive markup. By paying in the local currency (Euros), you let your own bank or card provider handle the conversion. Unless you have a truly ancient, predatory credit card, your bank’s rate will be better than the Italian restaurant's third-party payment processor.

Actionable steps for your next transfer

Stop overpaying. It's your money. Here is exactly what to do next time you need to flip your Euros into Sterling.

First, download a dedicated currency app. Don't rely on a quick browser search if you're moving more than fifty quid. Apps like XE or OANDA provide historical charts that show you if the current rate is a "peak" or a "trough." If the graph is at a six-month high for the pound, it's a great time to buy pounds with your euros.

Second, get a multi-currency account. Digital-first banks allow you to hold both currencies simultaneously. You can convert the money when the rate is favorable and just let it sit there until you need to spend it. This removes the "timing" stress entirely.

Third, if you’re a business owner, look into "Limit Orders." You can tell a broker, "I want to sell €50,000, but only if the rate hits 0.87." The trade executes automatically while you're asleep. It takes the emotion out of the transaction.

Finally, always read the fine print on "Free" transfers. Nothing is free. If there's no "fee," the "cost" is buried in the exchange rate. Grab your euro to pounds converter, check the mid-market rate, and if the gap is more than 1%, keep walking. There's always a better deal if you know where to look.