If you’re sitting in Kabul or Mazar-i-Sharif right now trying to figure out the EUR to Afghan Afghani rate, you probably know that the "official" price and the price in your hand are two very different things.

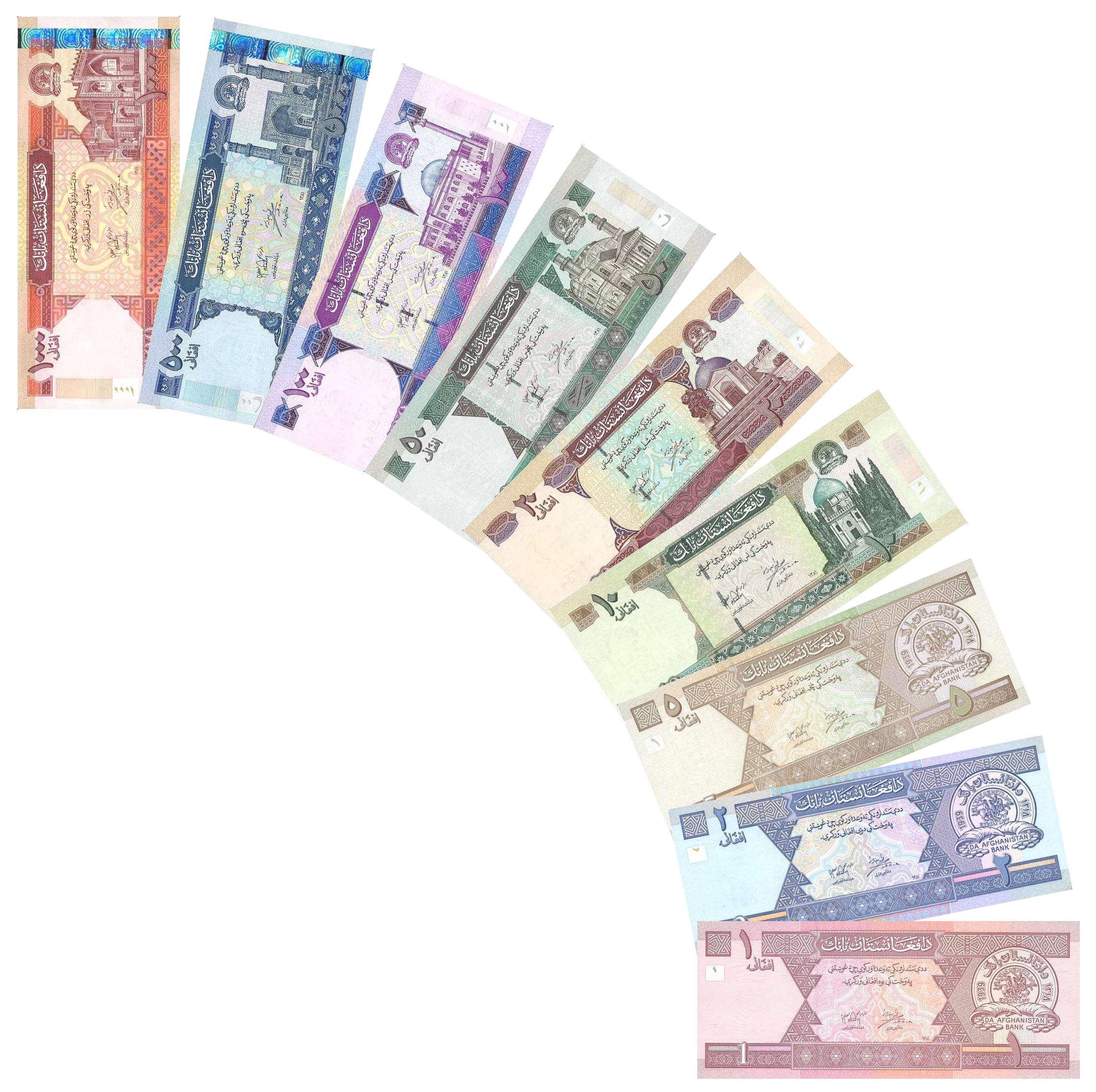

Money in Afghanistan is weird. It’s complicated, honestly. While the rest of the world relies on digital tickers and bank apps, the Afghani (AFN) lives and breathes in the crowded stalls of the Sarai Shahzada.

As of mid-January 2026, the rate is hovering somewhere around 76.05 AFN for 1 Euro. But don't bet your life savings on that exact decimal. In the informal markets, that number flickers like a dying candle depending on whether a shipment of goods just crossed the border or if the central bank decided to auction off another $25 million to keep the floor from falling out.

What’s Actually Moving the EUR to Afghan Afghani Rate?

Most people think exchange rates are just math. They aren't. In Afghanistan, the exchange rate is basically a barometer for how much bread cost this morning and whether the border at Torkham is open or closed.

Lately, the Afghani has been surprisingly stubborn. It’s held its ground better than most expected, mostly because Da Afghanistan Bank (DAB) has been playing a high-stakes game of "save the currency." They’ve been injecting massive amounts of US dollars into the market to soak up excess AFN. Since the Euro usually trades against the Afghani through a "cross-rate" (meaning they calculate EUR to USD, then USD to AFN), whatever happens in the US-Afghan relationship ripples directly into your Euro exchange.

✨ Don't miss: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

The Border Factor

Trade is the real engine here. Right now, trade with Pakistan has plummeted by over 50% due to border closures. When trucks stop moving, the demand for foreign currency to pay for imports shifts. Traders are re-routing through Iran and Central Asia. This shift in trade routes creates local pockets of "currency hunger" where the EUR to Afghan Afghani rate might spike simply because a specific group of merchants needs Euros to pay a supplier in Germany or Italy for machinery.

The Aid Paradox

Here is the kicker: Afghanistan is under heavy sanctions, yet it survives on a trickle of humanitarian aid. This aid arrives in cash. Literally, planes landing with pallets of dollars. This influx of "cold hard cash" is the only reason the Afghani hasn't turned into wallpaper. If those flights stop, the Euro will likely shoot to 90 or 100 AFN overnight.

The Difference Between "Official" and "Bazaar" Rates

If you look at the Da Afghanistan Bank website, you’ll see a "Buy" and "Sell" rate that looks very professional. For example, they might list a sell rate of 76.49 AFN.

Go to a street changer (a Saraf), and you’ll get a different story.

🔗 Read more: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

- The Spread: In Europe, a bank might take 1% or 2%. In Kabul, the spread between buying and selling Euros can be massive because the Saraf is taking on a huge risk holding "volatile" paper.

- Physical Condition: This sounds crazy to outsiders, but the physical state of your Euro bills matters. A crisp, new €100 note from 2024 will often get you a better rate than a crumpled, dirty €5 note.

- Liquidity: Sometimes, the market just runs out of Euros. If you're trying to exchange €5,000 at once, you might actually get a worse rate because the dealer doesn't want to part with that much AFN in one go.

Why the Euro is Gaining Ground in Remittances

For a long time, the US Dollar was king. It still is, mostly. But with more Afghans moving to Germany, France, and the Netherlands, the Euro is becoming a staple in the remittance economy.

Families are receiving money through Hawala—the ancient, trust-based transfer system. Since many of these transfers originate in Europe, the EUR to Afghan Afghani rate used by the Hawala dealer is often the most "real" price in the country. They don't use the central bank's rate; they use a rate based on what other dealers are charging in Dubai or London.

Expert Insight: Is the Afghani Artificially Strong?

Honestly, yes. Most economists, including those at the World Bank, agree that the Afghani is "artificially" stable. The Taliban-led government has banned the use of foreign currencies for domestic transactions. You can’t legally buy groceries in Euros anymore.

By forcing everyone to use AFN, they’ve created an artificial demand for the local currency. This keeps the EUR to Afghan Afghani rate lower than it would be in a truly free market. It’s a bit of a house of cards. If the central bank runs out of USD to auction, or if the ban on foreign currency is ignored by the public, the Afghani could devalue rapidly.

💡 You might also like: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

Actionable Tips for Exchanging EUR to AFN

If you’re managing money in this environment, don't just walk into the first shop you see.

- Check the "Saraf" Markets: Sarai Shahzada in Kabul is the heart of the beast. The rates there are the baseline for the rest of the country.

- Monitor the Auctions: Follow the announcements from Da Afghanistan Bank. If they announce a $20 million auction for Monday, the Afghani will likely strengthen on Sunday and Monday. That is a bad time to sell your Euros. Wait for the "dry" periods between auctions when the AFN weakens slightly.

- Avoid Small Denominations: If you're bringing cash into the country, bring €50, €100, or €200 notes. You will almost always get a better rate for larger, cleaner bills.

- Use Hawala for Large Transfers: If you're sending money from Europe, don't bother with traditional bank wires—they often get blocked or stuck in "compliance hell" because of sanctions. Use a reputable Hawala network; they usually offer a more competitive EUR to Afghan Afghani rate anyway because they bypass the formal banking fees.

The situation is fluid. One week the rate is 75, the next it’s 79. In a country where the economy is essentially "unplugged" from the global grid, the best tool you have is local information. Keep an eye on the borders and the central bank's cash vaults; those two things tell you more about the future of your money than any chart ever could.

To stay ahead of market shifts, track the weekly market reports from organizations like ReliefWeb or the official exchange spreadsheets from the Da Afghanistan Bank website, which are updated daily around 10:00 AM Kabul time. Always verify the "Cash" versus "Transfer" rates, as the latter often carries a premium due to the difficulty of moving digital funds in and out of the country.