You’re probably here because you just realized the IRS doesn't just wait for April to get its cut. It’s a bit of a gut punch. Most people think of a tax refund as a yearly bonus, a little gift from Uncle Sam for being a good citizen, but if you’re self-employed, a freelancer, or a small business owner, the reality of an estimated tax return 2025 is way more constant. It’s basically a pay-as-you-go system. If you aren't sending checks every quarter, the government starts getting twitchy. They want their money while you're still earning it, not months later when you've already spent it on a new laptop or a weekend in Tulum.

Honestly, the term "estimated tax return" is kinda a misnomer anyway. You aren't really filing a "return" four times a year—that's the big paperwork shuffle in April. What you’re doing is making deposits. Think of it like a high-stakes escrow account where the bank can fine you if you underfund it. For the 2025 tax year, the rules haven't fundamentally shifted into some unrecognizable beast, but the thresholds have nudged upward due to inflation adjustments.

Who Actually Needs to Worry About an Estimated Tax Return 2025?

Not everyone. If you’re a W-2 employee and your boss takes a chunk out of every paycheck, you’re likely fine. Your employer is doing the heavy lifting for you. But the moment you step into the "1099 life"—side hustles, consulting, selling vintage clocks on eBay—you're the boss. And the boss has to withhold.

Generally, the IRS expects you to make estimated payments if you expect to owe at least $1,000 in tax for 2025 after subtracting your withholding and credits. This applies to individuals, sole proprietors, partners, and S corporation shareholders. Corporations usually have a lower bar; they generally have to make payments if they expect to owe $500 or more.

It’s easy to mess this up.

Let’s say you had a killer year in 2024. You might assume your 2025 liability will be the same. But if you land a massive contract in June, your previous "safe harbor" estimates might not be enough to keep the penalties away. The IRS essentially looks for you to pay either 90% of your current year's tax or 100% of the tax shown on your prior year’s return (though that jumps to 110% if your adjusted gross income was over $150,000).

The Four Dates You Can't Ignore

Mark these. Seriously. Put them in your Google Calendar with a loud alert.

- April 15, 2025: Payment for Jan 1 – March 31.

- June 16, 2025: Payment for April 1 – May 31. (Notice this "quarter" is only two months? The IRS has its own weird rhythm).

- September 15, 2025: Payment for June 1 – Aug 31.

- January 15, 2026: The final payment for Sept 1 – Dec 31.

If you miss these, the interest starts ticking. It’s not just a flat fee; it’s a cumulative penalty that acts like a reverse savings account where you’re the one losing interest.

How to Calculate This Without Losing Your Mind

You don't need a PhD in accounting, but you do need a calculator and a stiff cup of coffee. You're basically trying to predict the future. You have to estimate your expected adjusted gross income, taxable income, taxes, deductions, and credits for the whole year.

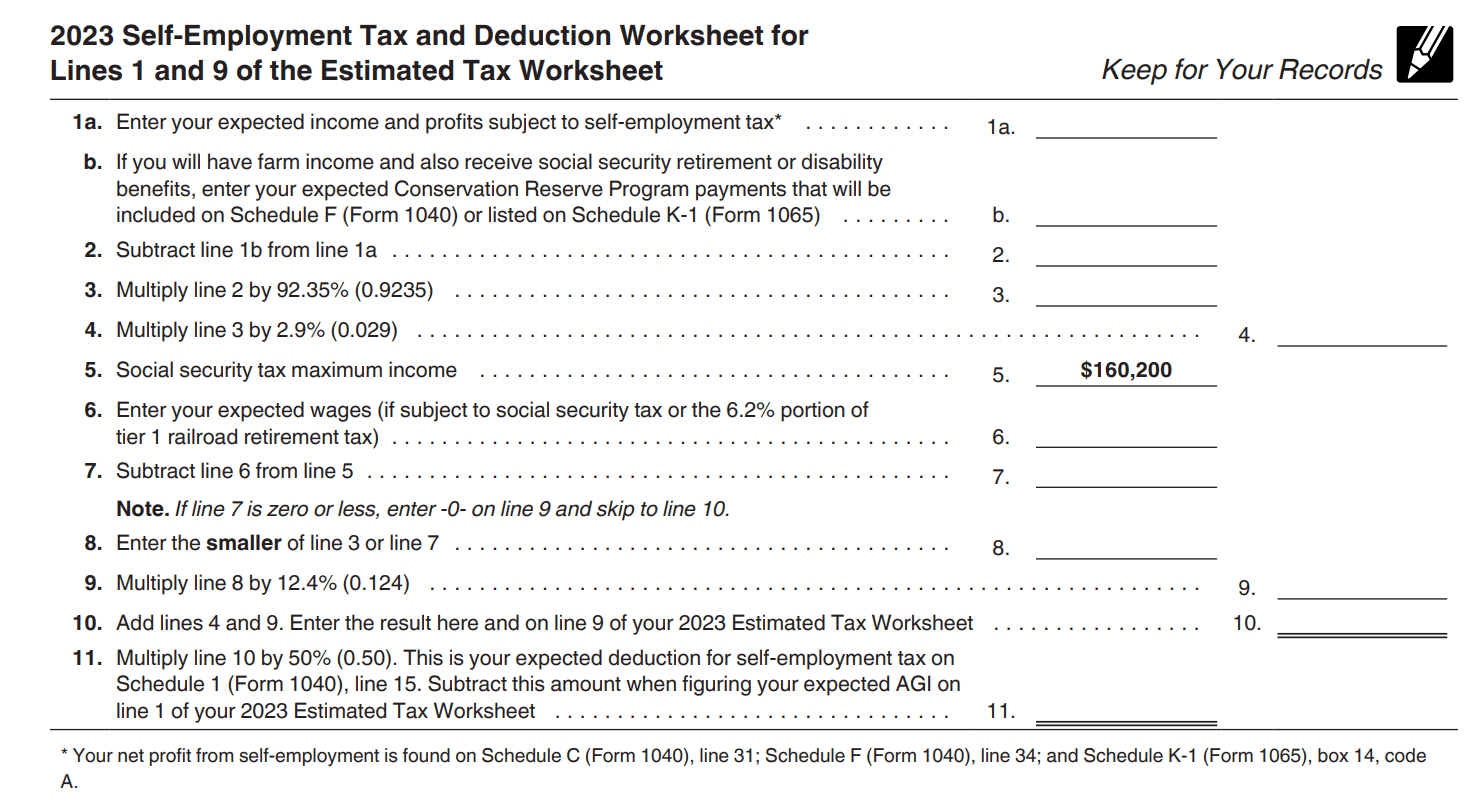

The Form 1040-ES is the official worksheet for this. It’s dry. It’s boring. It’s also incredibly useful. You take your total expected income for 2025, subtract your business expenses (don't forget that home office deduction if you're eligible), and apply the 2025 tax brackets. For 2025, the standard deduction has risen to $15,000 for single filers and $30,000 for married couples filing jointly. That’s a decent chunk of change you don't pay taxes on right off the bat.

💡 You might also like: JPMorgan Asks Hybrid Employees to Return to Office From March: Why the Party is Over

Then there’s the self-employment tax. This is the one that bites. Since you're both the employer and the employee, you pay both halves of Social Security and Medicare. That’s roughly 15.3%. You get to deduct the "employer" half on your 1040, but it still feels like a lot when you’re writing the check.

Real-World Example: The Freelance Graphic Designer

Imagine Sarah. She’s a freelance designer in Austin. In 2024, she made $80,000. For 2025, she expects to hit $100,000 because she just signed a retainer with a big tech firm. If she only pays based on her $80,000 income, she might be safe from penalties under the "100% of last year" rule, but she’s going to have a massive, painful bill come April 2026.

By calculating her estimated tax return 2025 based on the $100,000 projection, she spreads the pain. She pays about $6,000 every quarter. When April rolls around, she might even get a small refund. It’s psychological as much as it is financial.

Common Traps and How to Sidestep Them

One of the biggest mistakes? Ignoring "other" income. Maybe you have a rental property. Maybe you hit it big on some crypto trades. Maybe you have a high-yield savings account that’s actually yielding something for once. All of that counts toward your 2025 tax liability. If you’re only estimating based on your freelance checks, you’re missing the full picture.

Another trap is the "all-or-nothing" mentality. If you miss the April 15 deadline, some people just give up and wait until the end of the year. Don't do that. The penalty is calculated based on how late the payment is. Paying in May is way better than paying in January.

Using the Direct Pay System

Don't mail a check. Seriously, it's 2025. The IRS Direct Pay system is actually surprisingly functional. You can pull money directly from your checking or savings account without a fee. If you use a credit card, they'll hit you with a processing fee that usually outweighs any points or miles you'd earn. Just use the bank transfer. It gives you an instant confirmation number, which is your "get out of jail free" card if the IRS ever claims they didn't get your payment.

The Strategy for Volatile Income

If your income looks like a mountain range—huge some months, zero in others—the annualized income installment method is your best friend. It’s more paperwork, but it allows you to pay more when you make more and less when things are lean.

👉 See also: Mortgage loan calculator with extra payments: How to stop overpaying your bank

Instead of four equal payments, you recalculate your year-to-date income each quarter. If you’re a wedding photographer, you probably make 80% of your money in the summer. Why pay a huge estimate in April when your bank account is dry? Using the annualized method (documented on Form 2210), you can justify smaller early payments without getting slapped with underpayment penalties.

Final Steps for a Stress-Free 2025

Stop viewing taxes as a once-a-year event. It’s a monthly overhead cost, just like your internet bill or your office rent.

- Open a separate "Tax" savings account. Every time a client pays you, move 25-30% of that check immediately. Don't touch it. It’s not your money; you’re just holding it for the government.

- Review your 2024 return. Look at line 24 (total tax). Use that as your absolute floor for what you need to pay in 2025 to avoid penalties.

- Use software, but verify. Programs like QuickBooks or TurboTax are great for tracking expenses, but they can be "dumb" about future projections. Check their math against the actual 1040-ES worksheet.

- Adjust mid-year. If you lose a client in June, don't keep paying the high estimates you planned in January. Recalculate. Keep that cash in your pocket if your projected income has dropped.

- Keep meticulous records. In 2025, the IRS is continuing its push for better digital reporting. If you’re claiming big deductions to lower your estimated payments, have the receipts ready. Digital copies are fine, but "I think I spent $5,000 on travel" won't fly in an audit.

By staying on top of your estimated tax return 2025 payments, you avoid the "Tax Day Hangover." There is no worse feeling than filing your taxes in April and realizing you owe $15,000 that you already spent on a kitchen remodel. Pay as you go, keep the IRS off your back, and keep your business running smoothly.