Tax season is basically the adult version of waiting for a report card. You’ve worked all year, the government took a chunk of every paycheck, and now you’re sitting there wondering if you’re getting a massive check back or if you’re going to owe the IRS a small fortune. It’s stressful. Most people just want to know the damage early. That's why "estimate my tax return TurboTax" is one of the most searched phrases every January. People want a sneak peek. They want to know if they can afford that vacation or if they need to start tightening the belt.

The reality? Most online calculators are only as good as the data you feed them. If you’re just guessing your income or forgetting that side hustle you started in July, your estimate is going to be junk.

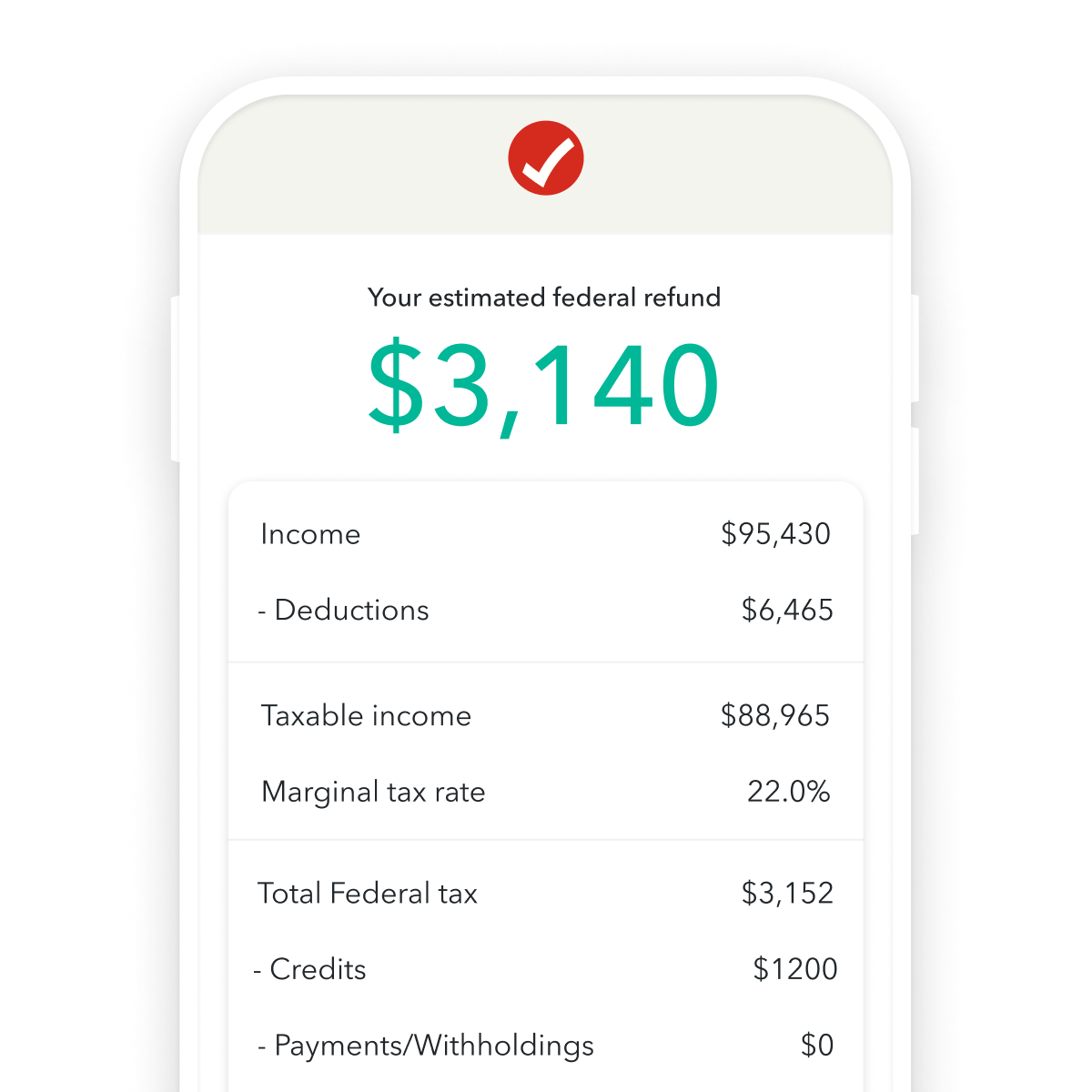

TurboTax offers a tool called TaxCaster. It’s free. You don't have to log in or commit to buying their software just to use the basic calculator. It’s built to give you a ballpark figure, but honestly, it’s not a magic wand. It’s an algorithm based on current tax laws—specifically the updates from the Inflation Reduction Act and adjustments for the 2025-2026 tax brackets. If you use it right, it’s a lifesaver for planning. If you use it wrong, you’re just setting yourself up for a nasty surprise when you actually hit "file."

Why Estimating Early Actually Matters

Money is tight for a lot of us right now. Between inflation and fluctuating interest rates, knowing your tax liability isn't just a "nice to have" thing—it's a survival tactic. If you estimate your tax return with TurboTax early in the year, you have time to adjust. Maybe you realize you’re going to owe $2,000. That’s a punch in the gut, but if you find out in January, you have until April 15th to scrape that cash together.

If you wait? You’re stuck.

There’s also the psychological aspect. We all have that "refund anxiety." You’re staring at your bank account, trying to figure out if you should pay off that credit card or wait for the IRS money. Using a tool like TaxCaster takes the guesswork out of it. It’s not a final legal document, but it’s a roadmap.

The Difference Between the Calculator and the Software

A lot of people get confused here. They think that using the "estimate my tax return TurboTax" tool is the same as starting their taxes. It isn’t. TaxCaster is a "what-if" simulator. You can toggle your income, add a kid, or pretend you sold some stock just to see what happens to your refund. The actual TurboTax filing software is a much more rigid, step-by-step process that requires your actual W-2s, 1099s, and social security numbers.

Think of the estimator as a sketch and the software as the final painting.

💡 You might also like: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

How to Get an Accurate Estimate Without Losing Your Mind

If you want the numbers to actually mean something, you need to gather your "ammo" before you start clicking buttons. You don't need every single receipt yet, but you need the big stuff.

- Your last paycheck stub: This is the most important piece. Look at your "year-to-date" gross income and, more importantly, your federal tax withheld. If you don't know how much you've already paid in, the calculator can't tell you if you're getting a refund.

- The 1099-NEC or 1099-K reality: Did you drive for Uber? Sell stuff on Etsy? If you made more than $600, the IRS is going to know about it. You need to estimate your business expenses too, or the tax hit will look way worse than it actually is.

- The "Life Events" factor: Did you get married? Have a baby? Buy a house? These aren't just milestones; they are massive tax levers.

I’ve seen people use these calculators and get a $5,000 refund estimate, only to realize later they forgot to check the box for "Self-Employed." Suddenly, that $5,000 refund turns into a $1,200 bill because of the 15.3% self-employment tax. Don't be that person. Be honest with the tool.

The Common Pitfalls of Online Estimators

Tax laws change. Every. Single. Year. For the 2025 tax year (the taxes you're likely estimating right now), the standard deduction has increased again to account for inflation. For single filers, it's $15,000. For married couples filing jointly, it’s $30,000.

If the tool you’re using hasn’t been updated for the current year, your estimate is worthless. TurboTax is usually the fastest to update their backend, but you still have to make sure you're looking at the version for the correct tax year.

The Salt Tax and Itemizing

A huge mistake people make when they try to estimate my tax return with TurboTax is assuming they should itemize. Since the Tax Cuts and Jobs Act of 2017, the standard deduction is so high that most people—roughly 90%—don't benefit from itemizing things like mortgage interest or charitable donations. If your total deductions don't beat that $15,000 or $30,000 threshold, the tool is just going to default to the standard deduction anyway.

Don't waste three hours hunting for Goodwill receipts if your total "extra" deductions only add up to $4,000. It won't change your refund by a single penny.

Dealing with Side Hustles and the "Gig Economy"

The IRS has been really aggressive lately about tracking digital payments. If you’re using TaxCaster or any other tool to estimate your return, you have to be careful with how you input "Other Income."

📖 Related: Why Toys R Us is Actually Making a Massive Comeback Right Now

If you’re a freelancer, you aren’t just paying income tax. You’re paying the employer’s share of Social Security and Medicare. This is the "hidden" tax that surprises everyone. When you use an estimator, make sure you’re looking for a section specifically labeled "Self-Employment" or "Business Income." If you just lump it in with your regular wages, the estimate will be off by thousands because it won't calculate the self-employment tax correctly.

Capital Gains and Losses

Did you panic-sell some stocks or crypto this year? Or maybe you finally cashed out of a winning position? Capital gains can swing your tax return wildly. Short-term gains (assets held for less than a year) are taxed at your ordinary income rate, which can be as high as 37%. Long-term gains get a much better deal, usually 15% or even 0% depending on your total income.

The TurboTax estimator lets you plug these in, but you have to know which is which. If you guess, the number you see at the end is just a fantasy.

Strategies for Reducing Your Tax Bill Mid-Year

One of the coolest things about trying to estimate my tax return TurboTax style is that you can play "what-if."

What if you put an extra $3,000 into your 401(k)?

What if you contributed to an HSA?

You can literally see the "Refund" number go up in real-time as you increase your deductible contributions. This is where the tool becomes a strategic asset rather than just a curiosity. If you see that you’re $500 away from a lower tax bracket, you might decide to make a last-minute contribution to a traditional IRA before the April deadline.

Child Tax Credit Nuances

The Child Tax Credit (CTC) is a frequent source of confusion. For the current tax year, the credit is generally $2,000 per qualifying child under age 17. However, only a portion of that is "refundable"—meaning you get it back even if you owe zero taxes. If you’re using an estimator, double-check that you’ve entered your children’s ages correctly. If your kid turned 17 in December, they don't count for the full credit. It’s brutal, but that’s the law.

👉 See also: Price of Tesla Stock Today: Why Everyone is Watching January 28

Is TurboTax Always the Best Way to Estimate?

Look, TurboTax is the big player for a reason. Their interface is slick. It feels like a conversation. But it isn't the only way. The IRS actually has its own "Tax Withholding Estimator" on IRS.gov.

The IRS tool is actually more accurate for people who want to adjust their W-4. It’s not as "pretty" as TurboTax, and it’s a bit more technical, but it’s the gold standard because it’s coming straight from the source. If you’re worried about underpaying and getting hit with a penalty, I’d actually recommend running your numbers through both the IRS tool and TurboTax. If they both give you a similar number, you can probably trust it.

If they are wildly different, you’ve probably entered something wrong in one of them.

What to Do If the Estimate Says You Owe

First, don't panic. Deep breath.

If your estimate shows a big fat zero or a negative number (meaning you owe), you have options. You can increase your withholding at work immediately. By taking an extra $50 or $100 out of your remaining paychecks for the year, you can whittle down that debt.

You can also look into "Above-the-Line" deductions. These are things like student loan interest (up to $2,500), educator expenses, or HSA contributions. These reduce your Adjusted Gross Income (AGI) before you even get to the standard deduction. They are powerful.

Actionable Steps to Take Right Now

- Pull your most recent pay stub. Look at the "Federal Tax" line. Multiply that by the number of pay periods left in the year. That’s your total estimated withholding.

- Go to the TurboTax TaxCaster site. It’s the easiest way to "estimate my tax return TurboTax" without creating an account.

- Input your "must-haves" first. This includes your filing status, number of dependents, and your primary W-2 income.

- Add the "maybes." Plug in your side hustle income, your 1099-INT from your savings account (which is higher these days thanks to better rates), and any stock sales.

- Look at the "Effective Tax Rate." This is more important than the refund amount. It tells you what percentage of your total income is actually going to the government. If that number is higher than you expected, it's time to talk to a pro or look into more tax-advantaged accounts.

- Update your W-4. If your refund is $10,000, you’re giving the government an interest-free loan. If you owe $10,000, you’re going to get hit with penalties. Aim for a refund of $500 to $1,000. It’s the "sweet spot" of financial efficiency.

Estimating your return isn't just about the "free money" at the end of the year. It's about data. It’s about knowing exactly where your money is going so you aren't blindsided in April. Use the tools, but stay skeptical. Verify your inputs, keep your receipts organized, and remember that an estimate is just an educated guess until the IRS accepts your return.