Tax season isn't just that frantic week in April anymore. For a huge chunk of the population—freelancers, side-hustlers, and people living off investments—it’s a year-round mental weight. You’ve probably sat there, staring at a spreadsheet or a pile of 1099s, wondering how much of that money actually belongs to you and how much belongs to Uncle Sam. Honestly, trying to estimate income tax return figures feels like trying to hit a moving target while wearing a blindfold. If you guess too low, the IRS hits you with penalties that feel like a personal insult. Guess too high, and you’re essentially giving the government an interest-free loan while your own high-yield savings account sits empty.

It’s a balancing act.

Most people think "estimating" is just for the self-employed, but that's not quite right. If you’ve had a massive windfall from selling stocks, or if you’ve started a "consulting gig" on the side of your 9-to-5, the standard withholding from your paycheck might not be enough. The IRS operates on a "pay-as-you-go" system. They want their cut when you earn it, not twelve months later.

The Math Behind the Madness

Calculating your quarterly payments isn't just about looking at your bank balance and picking a number that feels "safe." You have to account for the Adjusted Gross Income (AGI). This is your total income minus specific deductions like student loan interest or IRA contributions. Then comes the self-employment tax. Since you’re both the employer and the employee, you’re on the hook for the full 15.3% for Social Security and Medicare.

Wait. Don’t panic yet.

You actually get to deduct half of that self-employment tax when figuring your AGI. It’s a small mercy, but a mercy nonetheless. To accurately estimate income tax return liabilities, you generally need to aim for one of two "Safe Harbor" targets. Either pay 90% of the tax you owe for the current year or 100% of the tax shown on your return from the previous year. If your AGI was over $150,000, that "prior year" cushion jumps to 110%.

The IRS Form 1040-ES is the official worksheet for this, but it’s dense. It’s written in a way that makes you feel like you need a law degree to understand a comma. Basically, you take your expected total income, subtract your expected deductions and exemptions, and then apply the tax rates.

Why Your "Refund" is Actually a Failure

We’ve been conditioned to love the big fat check in the mail every spring. But let's be real: a massive refund means you’ve been overpaying all year. You effectively gave the Treasury Department money to play with while you were struggling to pay for groceries or a new set of tires. When you refine your ability to estimate income tax return outcomes, your goal should be to owe nothing and get nothing.

Zero.

That is the mark of a pro. It means every dollar you earned was working for you in real-time.

However, life happens. Maybe you landed a huge client in October that doubled your annual revenue. Or perhaps you sold some Bitcoin at the peak and now you’re looking at a capital gains nightmare. In these cases, your estimated payments need to be adjusted mid-stream. You aren't locked into the number you calculated in January. You can—and should—bump up your Q3 and Q4 payments to avoid that underpayment penalty.

The Penalty Trap

Speaking of penalties, the IRS doesn't care if you were "just a little off." If you owe more than $1,000 at tax time and didn't pay enough throughout the year, they calculate a penalty based on how much you underpaid and how long it remained unpaid. As of 2025 and 2026, these interest rates have hovered at levels that make them more expensive than some personal loans. It’s expensive to be wrong.

Practical Steps to Get it Right

Don't wait until the quarterly deadline (usually April 15, June 15, September 15, and January 15) to think about this.

First, keep a dedicated "Tax Savings" account. Every time a check clears, move 25% to 30% into that account immediately. It hurts. It feels like losing money you never had. But when that September 15th deadline rolls around, you’ll be the only person in the room not sweating.

📖 Related: Highest Paid Content Creators: What Most People Get Wrong About the Money

Second, use technology but don't trust it blindly. Apps like QuickBooks Self-Employed or specialized tax estimators are great for a baseline, but they don't know your specific life nuances. Did you get married? Have a kid? Move to a state with no income tax? These variables change everything.

Third, look at your "Effective Tax Rate," not just your "Tax Bracket." If you're in the 24% bracket, you aren't paying 24% on every dollar. You're paying 10% on the first chunk, 12% on the next, and so on. Understanding the progressive nature of the system is key to making sure you don't over-estimate and starve your cash flow.

Nuances Most People Miss

State taxes are the silent killer. You focus so much on the federal estimate income tax return process that you forget your state might want 5% or 9% too. Some states, like California or New York, have their own aggressive payment schedules and penalty structures. If you live in a high-tax state, your total "withholding" or estimated payments might need to be closer to 35% or 40% of your net income just to stay safe.

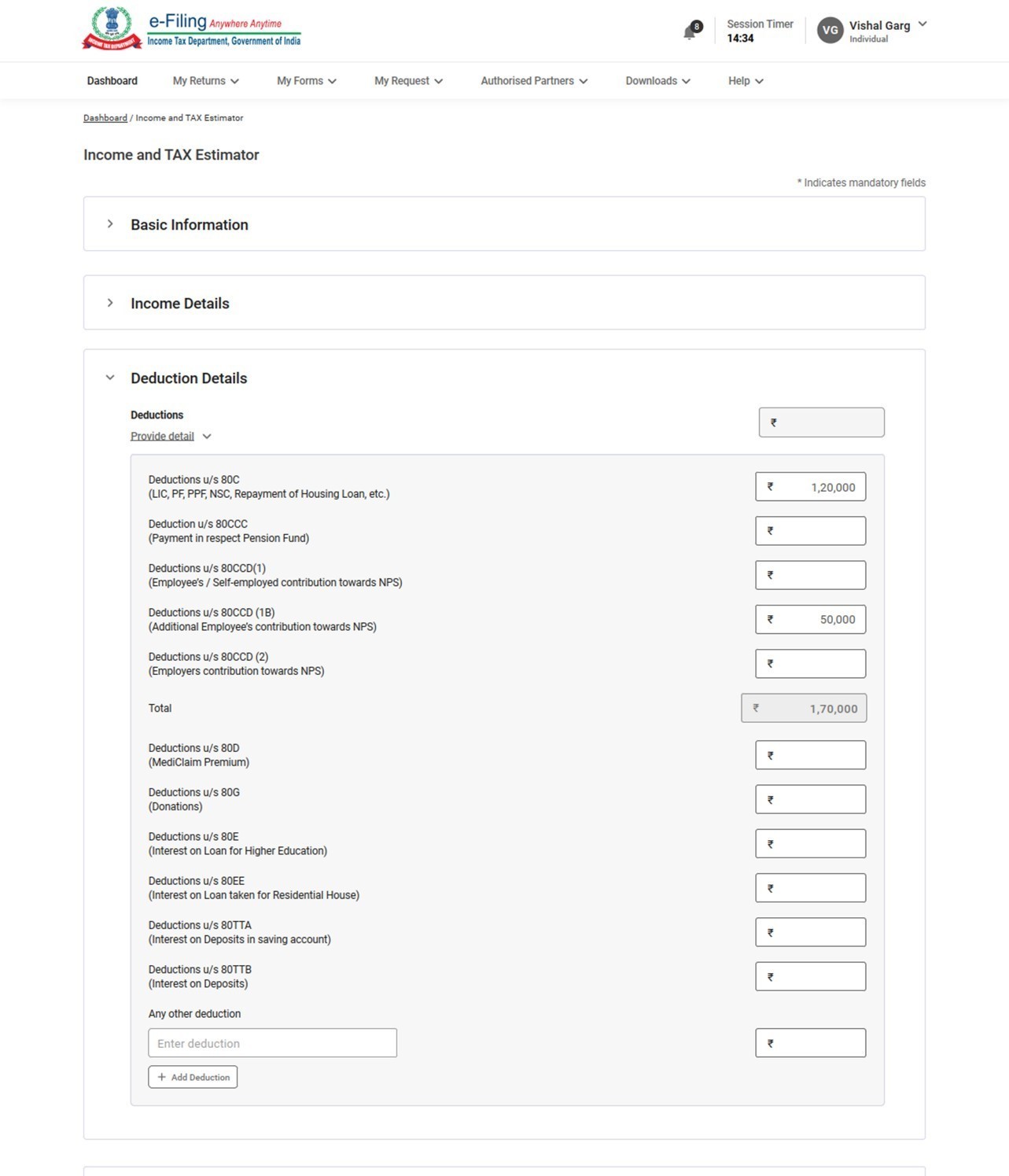

Also, deductions are your best friend, but only if you track them. Every mile driven for work, every software subscription, even a portion of your internet bill if you work from home. These aren't just "perks"—they are direct reductions in the amount of income you are actually taxed on. If you estimate your taxes based on your gross revenue without accounting for these expenses, you are drastically overpaying.

The 2026 Reality

With the shifts in the gig economy and the increasing number of people working remotely across state lines, the "nexus" of where you owe tax has become a legal labyrinth. If you're a digital nomad, you might owe taxes in a state you only visited for three months if you earned money while there. Tracking your location is now just as important as tracking your receipts.

To stay on top of your estimate income tax return obligations, you should:

- Review your year-to-date earnings at the end of every month. Don't wait for the quarter to end.

- Adjust your payments if your income fluctuates by more than 10%. Consistency is rare in the modern economy; your tax payments shouldn't be static if your income isn't.

- Pay electronically through the IRS Direct Pay portal. It provides an immediate receipt. No "lost in the mail" excuses.

- Consult a CPA if your income exceeds $100k from non-W2 sources. At that level, the cost of an accountant is usually lower than the money they save you through strategic deductions.

- Keep a "tax calendar" on your fridge. Missing a deadline by one day still triggers the penalty.

Taking control of these estimates turns a source of anxiety into a standard business process. It’s not about being a math genius; it’s about being disciplined enough to realize that the money in your bank account isn't all yours until the government says so. Be proactive, stay organized, and keep your "Safe Harbor" numbers in your back pocket. That's how you win.