You're looking at your screen, seeing the number 15.00. That’s the official exchange rate for the Eritrean nakfa to USD as of early 2026. It has been that way for a long, long time. But if you’ve ever actually tried to swap currency in Asmara or deal with international remittances, you know that 15.00 is basically a polite fiction.

The reality of the Eritrean nakfa (ERN) is messy. It’s a currency defined by strict control, a massive gap between government rates and street value, and a banking system that feels like it’s frozen in time.

The 15.00 Peg: A Financial Anchor or a Mirage?

Since 2005, the Bank of Eritrea has kept the nakfa pegged to the US Dollar. Specifically, the official rate sits at 1 USD = 15.00 ERN. For the math-inclined, that makes 1 ERN worth approximately $0.0667.

Why keep it so still? The government wants stability. They want to keep the cost of essential imports—like fuel and grain—predictable. If the nakfa were allowed to float freely on the open market like the Euro or the Yen, it would likely plummet.

But there's a catch. You can't just walk into a bank in Eritrea and swap your nakfa for dollars whenever you feel like it. Access to hard currency is tightly rationed. It’s mostly reserved for government projects, state-owned enterprises, and a handful of "priority" importers. For the average person or small business owner, the official rate is something you read about, not something you actually get to use.

The Parallel Market (The "Black Market")

If the bank won't give you dollars, where do you go? You go to the street.

👉 See also: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

The "black market" or parallel market in Eritrea is where the real price of the nakfa is discovered. While the government says a dollar is worth 15 nakfa, the street often says it’s worth 50, 60, or even 100 nakfa depending on the current supply and demand.

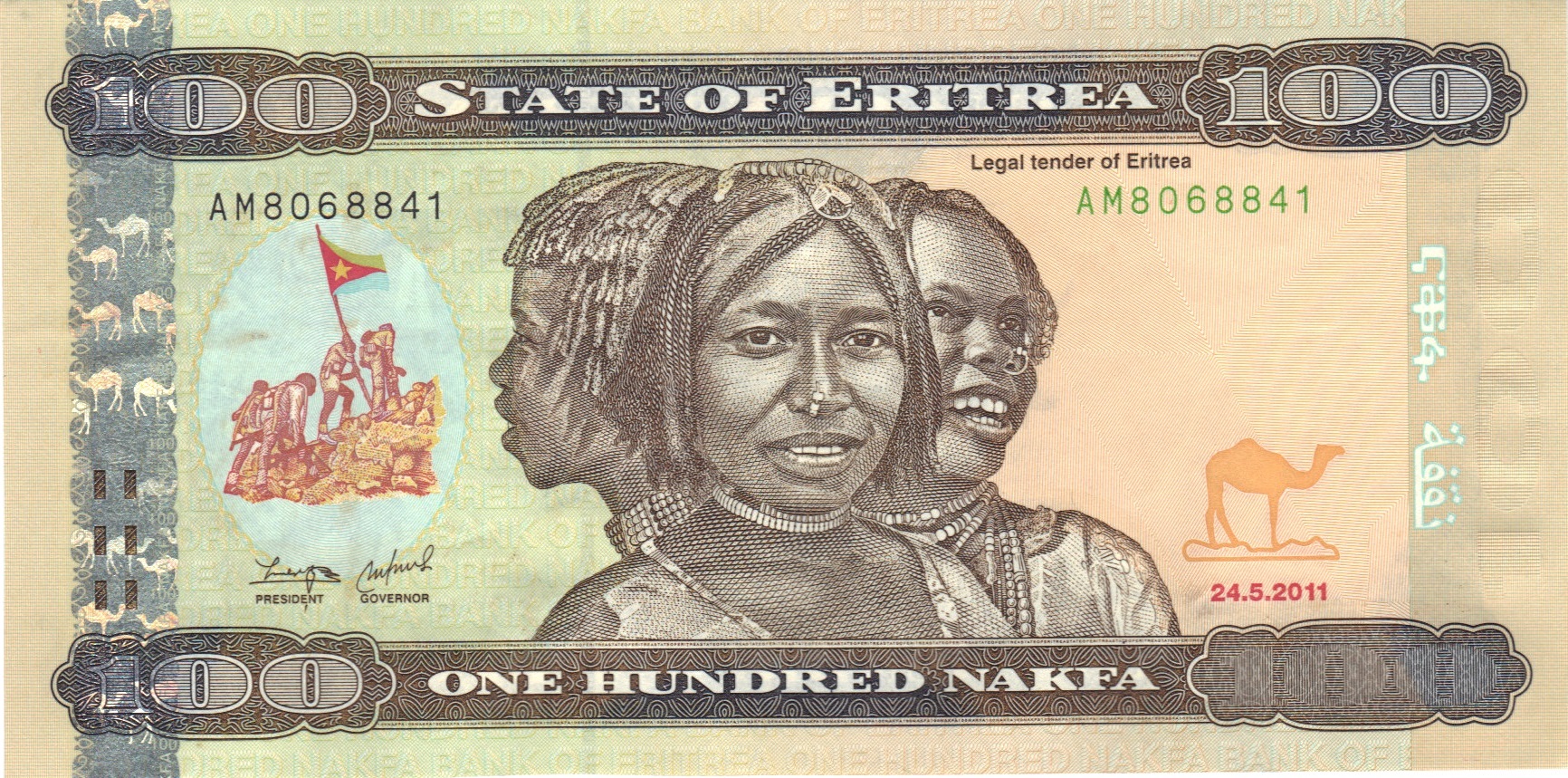

Important Reality Check: Dealing in the parallel market is illegal in Eritrea. The government has, at various times, cracked down hard on "illegal" currency exchange. In 2015, they even issued an entirely new series of banknotes to force people to bring their hidden cash into the banks, effectively wiping out the "under-the-mattress" savings of those who couldn't explain where their money came from.

This gap creates a huge headache for the Eritrean diaspora. If you send $100 home through official channels like Himbol (the state-run remittance service), your family gets 1,500 nakfa. If that same $100 finds its way through unofficial channels, it might be worth 6,000 nakfa. That’s a massive difference in purchasing power for a family trying to buy groceries or pay rent.

Why the Nakfa to USD Rate Matters Right Now

You might wonder why anyone outside of Eritrea cares about this. Honestly, it’s about the mining sector. Eritrea is sitting on massive deposits of potash, gold, and copper.

Companies like the Sichuan Road and Bridge Group (working on the Colluli potash project) deal in millions of dollars. As these projects move toward full production in late 2026, the influx of foreign currency could—theoretically—help the Bank of Eritrea build up enough reserves to finally look at exchange rate reform.

✨ Don't miss: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

The World Bank and African Export-Import Bank have both noted that Eritrea’s "exchange rate misalignment" is a major barrier to growth. Basically, because the nakfa is overvalued at the official 15:1 rate, it makes Eritrean exports (other than minerals) way too expensive for the rest of the world to buy.

Quick Conversion Reference (Official Rates)

| US Dollars (USD) | Eritrean Nakfa (ERN) |

|---|---|

| $1 | 15.00 Nfk |

| $10 | 150.00 Nfk |

| $50 | 750.00 Nfk |

| $100 | 1,500.00 Nfk |

| $1,000 | 15,000.00 Nfk |

Note: These are the mid-market rates used for accounting. You'll likely pay fees that make your actual yield lower.

The Struggle of the Private Sector

Imagine you're a small business owner in Asmara. You want to buy new spare parts for your truck from abroad. You have nakfa, but the seller wants USD.

Since you aren't a high-priority state project, the bank likely won't sell you the dollars at the 15.00 rate. You’re stuck. This is why the Eritrean economy often feels like it's running in place. Without access to foreign exchange, businesses can't grow, and the "dollarization" of the local economy continues—where everyone prefers to hold USD or even Ethiopian Birr over their own national currency.

Is There Any Sign of Change?

There’s been talk. There is always talk.

🔗 Read more: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

International observers often push for a "unification" of the exchange rate. This would mean the government devalues the official nakfa to something closer to the market rate—maybe 40 or 50 to 1. This would be painful in the short term (inflation would spike), but it would arguably make the economy more transparent and attractive to investors.

But the Eritrean government values control above almost everything else. Floating the currency is a risk. It’s a leap into the unknown that they haven’t been willing to take for twenty years.

What You Should Actually Do

If you’re traveling to Eritrea or planning to send money, here are the practical "on-the-ground" facts you need:

- Bring Cash: Credit cards (Visa, Mastercard) are basically useless in Eritrea. There are no international ATMs. Bring crisp, new US Dollar bills.

- Declare Your Currency: When you enter the country, you’ll likely have to fill out a currency declaration form. Keep it. If you want to change money back to USD when you leave, you’ll need to show you changed it legally at a bank or Himbol office.

- Don't Expect Refunds: Changing nakfa back to USD is notoriously difficult. Only change what you know you're going to spend.

- Remittances: If you're sending money to family, compare the official Himbol rates with the risk and reward of other methods. Most people stick to official channels to avoid legal trouble, even if the rate is worse.

The Eritrean nakfa to USD situation isn't just a number on a chart. It’s a reflection of a country trying to maintain total economic sovereignty in a globalized world. Whether that strategy works in the long run is still very much up for debate.

To get the most out of your money, check the latest Bank of Eritrea bulletins or contact a licensed exchange bureau like Himbol directly for today's specific transaction fees. If you're a business looking to invest, consult with the Eritrea Investment Center to understand the latest foreign exchange allocation rules for 2026.