It started with a meme, but it’s definitely not a joke anymore. When Elon Musk and Vivek Ramaswamy were tapped to lead the Department of Government Efficiency—cleverly abbreviated as DOGE—the internet lost its mind, mostly because of the crypto tie-in. But beneath the X posts and the Shiba Inu avatars, there is a very real, very massive project underway. We’re talking about the first-ever comprehensive treasury audit musk doge supporters have been clamoring for, and honestly, the scale of what they’re looking at is kind of terrifying.

The United States government is a labyrinth. Most people don’t realize that the Pentagon, for instance, has failed its last six consecutive audits. That’s trillions of dollars in assets that nobody can quite account for. When Musk talks about "the DOGE," he isn't just talking about a coin; he's talking about a fundamental restructuring of how the federal government spends—and wastes—taxpayer money.

Why a Treasury Audit is the Core of the DOGE Mission

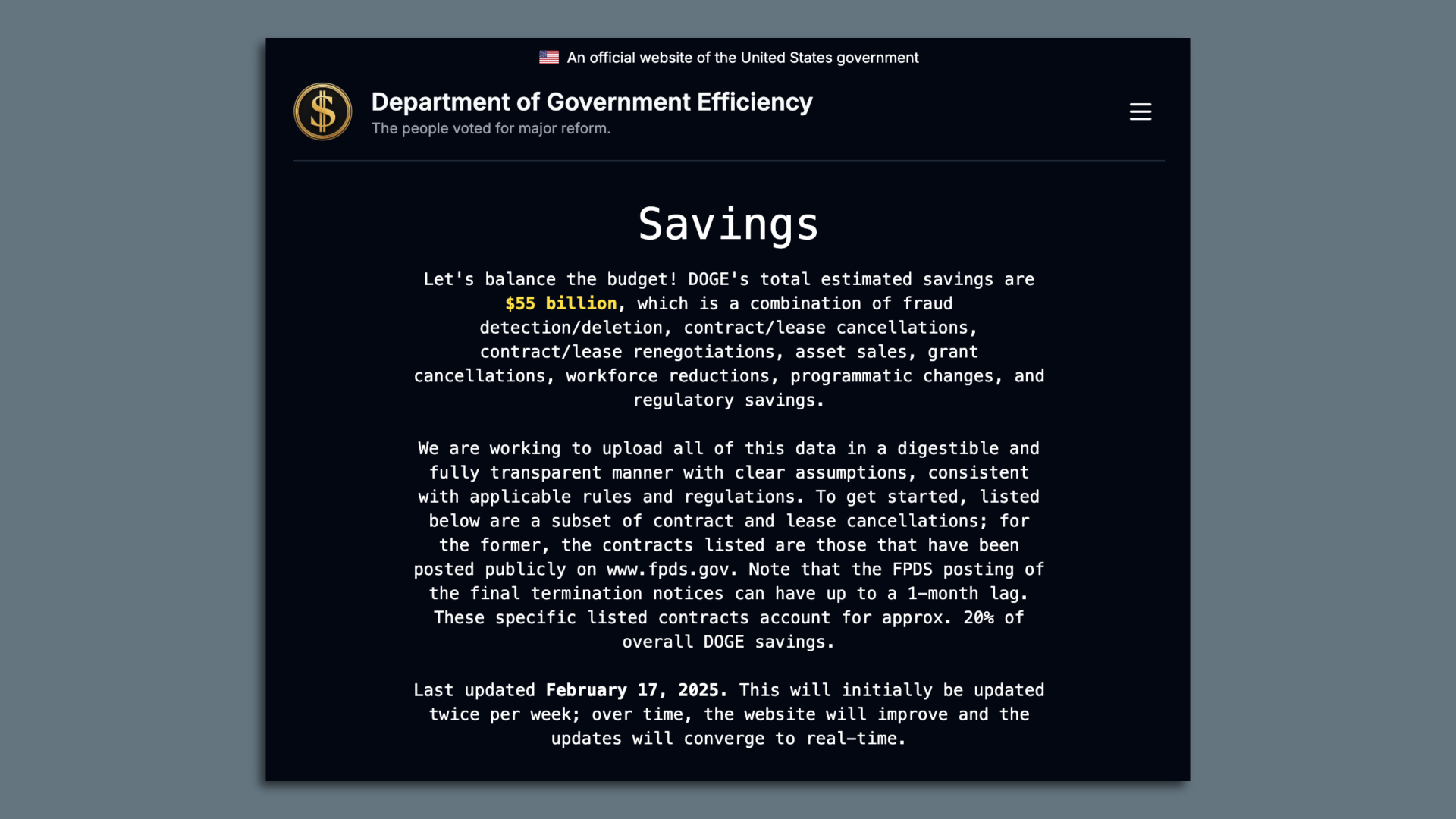

The Department of Government Efficiency isn't actually a formal government agency. It’s an advisory body. That’s a key distinction because it means they don't have the power to just delete departments with a keystroke. However, they have the ear of the President. The goal? Cutting $2 trillion from a $6.5 trillion budget. You can't do that by just "eyeballing" it. You need a granular, deep-tissue treasury audit musk doge leaders can use as a roadmap.

Think about the sheer volume of "improper payments." According to the GAO (Government Accountability Office), the federal government loses roughly $247 billion every single year to payments that shouldn't have been made. That’s checks sent to dead people, duplicate payments to contractors, and funds lost to straightforward fraud. It’s a mess.

Musk’s approach is basically what he did at Twitter, now X, and SpaceX. He looks for the "idiot index." That’s his term for the ratio of the cost of a finished product to the cost of its raw materials. In the context of a federal audit, he's looking for why a specific software contract costs $500 million when a private startup could build it for $5 million.

The Hurdles No One Mentions

It’s easy to tweet about cuts. It’s much harder to actually move the needle when you hit the "Deep State" or, more accurately, the civil service protections that have been in place for decades.

The DOGE team is looking at thousands of federal regulations that they believe are unconstitutional or simply redundant. By performing a rigorous treasury audit musk doge advocates hope to identify exactly where the money stops serving the public and starts serving the bureaucracy. But here's the kicker: Congress holds the power of the purse. Musk and Ramaswamy can recommend cuts until they're blue in the face, but if Congress wants to keep spending on a specific bridge to nowhere in a swing state, the audit might just end up as a very expensive PDF.

✨ Don't miss: Starting Pay for Target: What Most People Get Wrong

Is This About Dogecoin or Government Reform?

Let's address the elephant in the room. The Shiba Inu.

The name DOGE is a blatant nod to the cryptocurrency Musk has championed for years. Every time he mentions the Department of Government Efficiency, the price of Dogecoin tends to twitch. Some see this as a massive conflict of interest. Others see it as a brilliant branding move to get young people interested in boring things like fiscal policy.

But if you look at the actual work being proposed, it’s remarkably technical. It involves:

- Consolidating redundant agencies (did you know there are dozens of different programs across different departments that all do the same thing for "job training"?).

- Implementing "zero-based budgeting," where every department has to justify every single dollar they want to spend from scratch, rather than just getting last year's budget plus a 5% increase.

- Automating the audit process using AI to flag anomalies in real-time.

Musk has often said that the biggest threat to the U.S. is the national debt. We're currently paying over $1 trillion a year just in interest. That's more than we spend on our entire military. Honestly, when you look at those numbers, a treasury audit musk doge led or otherwise doesn't just seem like a good idea—it seems like a survival tactic.

The Human Cost of Efficiency

Critics are rightly worried about what happens when you cut $2 trillion. That’s not just "waste, fraud, and abuse." That’s people's jobs. That’s food inspections. That’s air traffic control.

Vivek Ramaswamy has been very vocal about "deleting" agencies like the Department of Education or the FBI. While that makes for a great campaign speech, the reality of a treasury audit musk doge operation is that it will likely find that many functions of these agencies are legally mandated. You can't just stop doing them without a change in the law.

🔗 Read more: Why the Old Spice Deodorant Advert Still Wins Over a Decade Later

What the DOGE team is really betting on is that there is so much "fat" in the middle management layer of the government that they can cut headcount significantly without hurting the "front line" services. It’s a bold gamble. It’s basically the "hardcore" work culture of Tesla applied to a system that moves at the speed of a glacier.

How the Audit Will Actually Work

So, how do you actually audit the U.S. Treasury? It’s not one big spreadsheet. It’s thousands of disconnected legacy systems, some of which are still running on COBOL, a programming language from the 1960s.

The treasury audit musk doge initiative will likely focus on three primary pillars.

First, they’ll look at "Unobligated Balances." This is money that Congress gave to an agency, but the agency hasn't spent yet. It just sits there. Sometimes for years. We're talking hundreds of billions of dollars. DOGE wants that money back in the general fund immediately.

Second, they are targeting "The Regulatory State." Musk believes that for every new regulation added, two should be deleted. The audit will attempt to put a dollar value on the "compliance cost" of every major federal rule. If a rule costs the economy $10 billion but only provides $100 million in benefit, it's on the chopping block.

Third, they want to tackle "Contractor Overreach." The U.S. government is the world's largest buyer of goods and services. But it’s a terrible buyer. It pays "cost-plus" contracts where the contractor actually makes more money if they take longer and spend more. Musk hates this. His companies almost always use fixed-price contracts. Bringing that logic to the treasury audit musk doge process could save billions on defense and infrastructure alone.

💡 You might also like: Palantir Alex Karp Stock Sale: Why the CEO is Actually Selling Now

Real Examples of Waste

Let’s get specific. In recent years, government audits (the ones that actually happened) found:

- The NIH spent over $400,000 to see if expensive gin tastes better than cheap gin.

- Millions were spent on "social media influence" campaigns in countries most Americans couldn't find on a map.

- The Pentagon once spent $43 million on a single gas station in Afghanistan that should have cost $500,000.

These aren't just anecdotes; they are symptoms of a system that has no incentive to save. When you’re spending someone else’s money (the taxpayers'), you don't care if the gas station costs $43 million. Musk and the DOGE team want to change the incentive structure so that government employees are rewarded for saving money, not spending their entire budget so it doesn't get cut next year.

Practical Steps for Following the DOGE Audit

If you’re trying to keep track of how this treasury audit musk doge project is actually going, you need to look past the headlines and the memes.

- Watch the Federal Register: This is where all the proposed cuts and regulatory changes have to be posted. If DOGE is making moves, it will show up here first in the form of "Notice of Proposed Rulemaking."

- Follow the GAO Reports: The Government Accountability Office is the "watchdog" that’s been doing this for years. They already have a "High-Risk List" of agencies prone to fraud. Compare the DOGE recommendations to the GAO list to see if they’re hitting the real targets or just the politically convenient ones.

- Monitor the "Impoundment" Debate: There’s an old law called the Impoundment Control Act of 1974 that says the President must spend the money Congress gives him. If Musk and Trump try to stop spending money, this will go to the Supreme Court. That will be the real test of whether DOGE has any teeth.

- Look at the Interest Rates: Ultimately, the success of a treasury audit musk doge mission will be reflected in the bond market. If investors believe the U.S. is finally getting its fiscal house in order, the "risk premium" on our debt might go down.

The reality is that auditing the government is a thankless, boring, and incredibly complex task. It's not as flashy as launching a rocket or driving a Cybertruck. But if they can even find 10% of the waste they claim exists, it would be the biggest shift in American governance in nearly a century.

Whether it’s a stroke of genius or a chaotic mess remains to be seen. But for the first time in a long time, someone is actually looking at the receipts. And if you’ve ever seen a government contract for a toilet seat, you know those receipts are wild.

Actionable Insights for the Future

To stay ahead of the changes the treasury audit musk doge might bring, you should take several specific actions. First, if you are a federal contractor, expect a radical shift toward fixed-price contracts and significantly increased reporting requirements; the era of "cost-plus" is likely ending. Second, keep a close watch on the "Schedule F" executive order status, as this will determine how much of the career bureaucracy can be replaced or bypassed by the DOGE team. Finally, diversify your understanding of the federal budget beyond just "discretionary spending"—the real battle for the treasury will happen in the "mandatory" column, which includes entitlements that most politicians are still afraid to touch. Understanding where the audit stops and the politics begins is the only way to accurately predict the economic fallout of these reforms.