You’ve probably seen the headlines. One day, Elon Musk is the world's biggest taxpayer, cutting an $11 billion check to the IRS. The next, a ProPublica leak claims he paid $0 in federal income taxes. It feels like a glitch in the matrix. How can someone be both a record-breaking taxpayer and, at times, a person who pays nothing at all?

The truth about elon musk tax returns isn't actually a secret, even if the actual documents aren't sitting on a public shelf for us to flip through. Most people think "income" means the money that hits your bank account every two weeks. For the richest man on Earth, that’s just not how it works. Musk doesn't take a salary from Tesla. He doesn't get a Christmas bonus in cash.

Instead, he’s basically "asset rich and cash poor."

When your wealth is tied up in stock, you don't owe the IRS a dime until you sell. This creates a weird paradox where Musk can see his net worth jump by $50 billion in a year and technically have a taxable income of zero. Honestly, it’s a bit of a loophole, but it's a legal one that’s been part of the U.S. tax code for a long time.

The $11 Billion Check and the ProPublica Leak

In 2021, Musk made a big show of his taxes. He tweeted a poll asking if he should sell 10% of his Tesla stock. He said he’d pay more than $11 billion in taxes that year—a record for a single individual. And he likely did. But here is the kicker: he didn't do it just because he was feeling generous.

He had a massive pile of stock options from 2012 that were about to expire. If he didn't exercise them, he’d lose them. When you exercise options like that, the "gain" (the difference between the cheap price you pay and what the stock is actually worth) is taxed as ordinary income.

It was a forced tax event.

💡 You might also like: TT Ltd Stock Price Explained: What Most Investors Get Wrong About This Textile Pivot

Compare that to the 2021 ProPublica report. Using leaked IRS data from 2014 to 2018, the report found that Musk paid a "true tax rate" of only 3.27%. In 2018, he paid $0 in federal income tax. People were furious. They saw it as proof of a rigged system. But from a purely legal standpoint, Musk hadn't sold enough stock or taken enough "income" that year to trigger a bill.

He often borrows money against his Tesla shares to fund his lifestyle. Taking a loan isn't "income," so it’s not taxable. It’s a strategy often called "Buy, Borrow, Die." You buy assets, borrow against them for cash, and hold until you pass away.

Tesla’s Own Tax Mystery

It isn't just Elon’s personal wallet that draws heat. Tesla itself has a complicated relationship with the IRS. In 2024, reports from the Institute on Taxation and Economic Policy (ITEP) showed that Tesla paid $0 in federal income tax despite reporting $2.3 billion in U.S. income.

How?

- Accelerated Depreciation: The government lets companies write off the cost of equipment very quickly to encourage investment.

- Stock-Based Compensation: When Tesla gives employees stock, it gets a tax deduction.

- Loss Carryforwards: Tesla spent years losing money. The IRS lets you use those old losses to "offset" new profits.

Basically, the company is using the rules exactly as they were written. Whether those rules should exist is where the real debate happens.

What Really Changed in 2025 and 2026?

By the time we hit early 2026, the conversation around elon musk tax returns shifted from his personal wealth to his government influence. With the "Department of Government Efficiency" (DOGE) in full swing, Musk wasn't just a taxpayer anymore; he was looking under the hood of the IRS itself.

📖 Related: Disney Stock: What the Numbers Really Mean for Your Portfolio

There was a massive controversy in early 2025 when DOGE officials sought access to the IRS's Integrated Data Retrieval System (IDRS). This system contains the tax returns of every American. Critics, like Senator Elizabeth Warren and Representative Jimmy Gomez, screamed about conflicts of interest. They argued that Musk shouldn't have access to his competitors' tax data—or his own.

A compromise was eventually reached where Musk's team could look at the systems to find waste and fraud, but supposedly couldn't peek at individual returns. Still, the optics were wild. Imagine the man whose tax strategy is the subject of national debate being the one tasked with "fixing" the tax agency.

Why Musk Moved to Texas

You can't talk about his taxes without mentioning the move from California to Texas. California has some of the highest state income taxes in the country (over 13% for high earners). Texas has zero.

By establishing residency in Texas before his 2021 and 2025 stock vestings, Musk likely saved himself billions in state taxes. Critics called it a "tax dodge." Musk called it moving to where things actually get built. Regardless of how you feel, the math is undeniable. Moving a few hundred miles east was probably the most profitable "trade" of his life.

Navigating the Myth of the "Billionaire Tax"

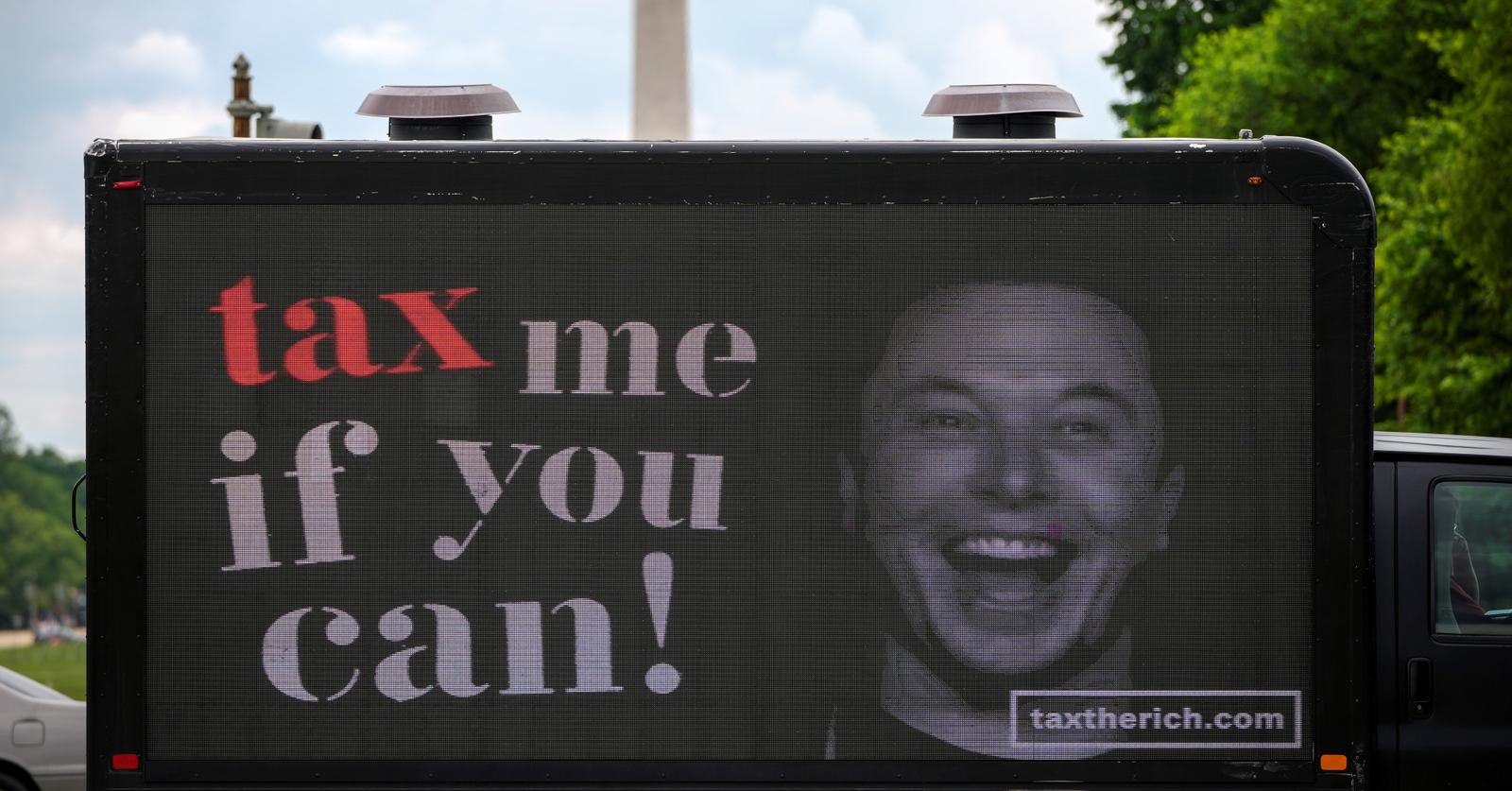

Every couple of years, politicians propose a "Wealth Tax" or a "Billionaire Minimum Tax." The idea is to tax the growth of wealth, even if the person doesn't sell their stock. If that law had existed in 2018, Musk wouldn't have paid $0; he would have paid billions.

But there are massive hurdles to this:

👉 See also: 1 US Dollar to 1 Canadian: Why Parity is a Rare Beast in the Currency Markets

- Valuation: How do you tax SpaceX when it’s private? Who decides what it’s worth today?

- Liquidity: If the stock market crashes, does the government give the billionaire a refund?

- Constitutionality: The U.S. Constitution has specific rules about "direct taxes" that make taxing unrealized gains a legal nightmare.

Musk has been vocal about this. He argues that if the government takes a huge chunk of his ownership every year, he eventually loses control of his companies. To him, his "wealth" isn't a pile of gold coins in a vault—it's his ability to direct capital toward Mars or electric cars.

What This Means for You

You aren't Elon Musk. (Probably.) But his tax saga actually teaches us a lot about how the U.S. system works. It’s a system that prioritizes investment over wages.

If you make $100,000 as a salary, you’re taxed on every dollar. If you make $100,000 because your house or your stocks went up in value, you aren't taxed until you sell. That is the fundamental "unfairness" that the elon musk tax returns controversy highlights.

Actionable Insights to Take Away:

- Focus on Capital Gains: Wealth is built through assets, not just income. Look into long-term capital gains, which are generally taxed at a lower rate than your paycheck.

- Understand Tax Credits: Just as Tesla uses R&D credits, look into credits available for your own small business or energy-efficient home improvements.

- Location Matters: While you might not save billions by moving states, state-level taxes significantly impact your long-term retirement "burn rate."

- Tax-Advantaged Accounts: Musk doesn't use a 401(k), but you should. It’s one of the few ways regular people can mirror the "growth without immediate tax" strategy that billionaires use.

The story of Musk's taxes isn't just about one guy being rich. It's about a 100-year-old tax code meeting a new kind of digital, asset-heavy wealth. Whether it’s 2021 or 2026, the friction between those two worlds isn't going away anytime soon.

Keep an eye on the "Department of Government Efficiency" reports coming out through the rest of 2026. The findings there might actually lead to the first major overhaul of the IRS since the 90s, for better or worse. Understanding the difference between taxable income and net worth growth is the first step in making sense of the headlines you'll inevitably see next tax season.