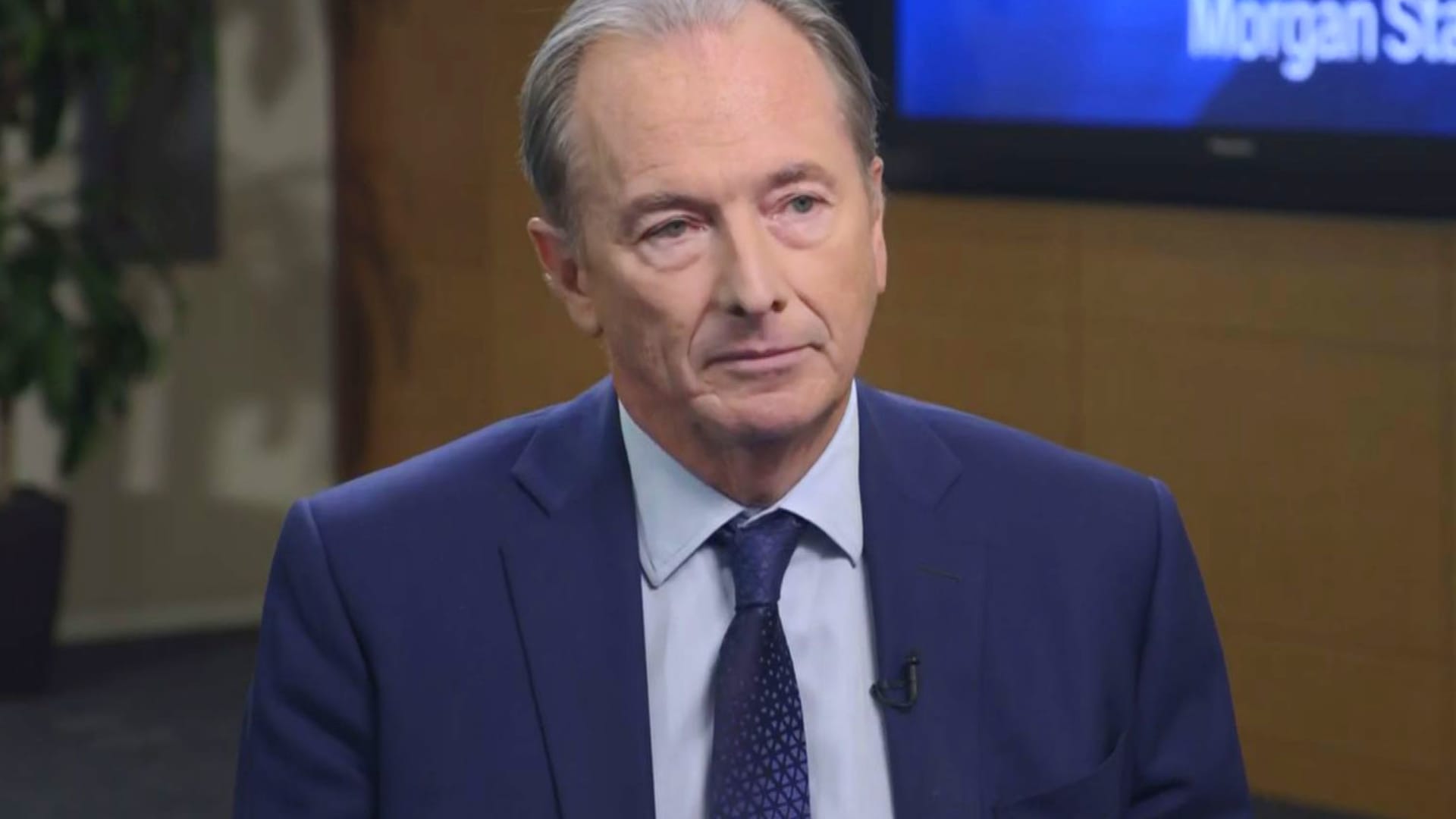

Wall Street usually celebrates the loud personalities, but the real power often sits with the people who have been in the trenches since the late nineties. Eli Gross is exactly that kind of figure. He isn't just a name on a masthead; as the Global Co-Head of Investment Banking at Morgan Stanley, he’s one of the primary architects behind how the firm navigates the messy, high-stakes world of global M&A.

If you’ve been following the shift in banking leadership over the last few years, you know his name came to the forefront in 2022. That’s when Morgan Stanley made a massive internal move, promoting Gross alongside Simon Smith to lead the entire investment banking division. They replaced industry legends Susie Huang and Mark Eichorn. It was a "passing of the torch" moment that signaled a new era for the firm.

The Long Game: 25 Years at One Firm

In an industry where people jump ship for a slightly bigger bonus every three years, Eli Gross is an anomaly. He joined Morgan Stanley as an associate in 1998. Think about that for a second. He was there for the dot-com bubble, the 2008 crash, the post-pandemic SPAC craze, and the current high-interest-rate grind.

He didn't just survive; he climbed. Most of his career was built in the Transportation, Logistics, and Infrastructure group. He became the global head of that sector in 2012. If you look at the massive global shifts in shipping, supply chains, and green infrastructure over the last decade, Gross likely had a hand in the financing or advisory of the biggest deals in those spaces.

Why the 2022 Promotion Was a Big Deal

When Ted Pick—now Morgan Stanley’s CEO—announced Gross’s promotion to Co-Head of Investment Banking, it wasn't just about filling a seat. The market was "seizing up," as some analysts put it. Deal volume was dropping because of inflation and geopolitical jitters.

📖 Related: Oil Market News Today: Why Prices Are Crashing Despite Middle East Chaos

Picking a guy who spent years specializing in infrastructure and transportation was a tactical choice. These are "real-world" sectors. They aren't speculative tech plays. They require a deep understanding of physical assets and complex, multi-decade capital structures.

- Global Mission: Gross was tasked with delivering an "integrated investment bank."

- Succession: His rise showed that Morgan Stanley values long-term internal stability over outside hires.

- Risk Management: He sits on the firm's Management Committee and Risk Committee, meaning he isn't just making deals; he’s helping steer the entire ship's safety.

What Eli Gross Thinks About the Current Market

Gross is surprisingly candid for a top-tier banker. In a 2023 interview with Euromoney, he famously admitted, "In a downturn, you cannot squeeze blood from a stone." He’s a realist. He knows that while you can't force deals to happen when the macro environment is garbage, you have to be ready the second the clouds part.

Honestly, his philosophy seems to be about "execution excellence." He talks a lot about how expertise makes the difference in a volatile market. It's not just about having the Morgan Stanley brand on your business card; it's about knowing the specific nuances of a cross-border logistics deal or a massive infrastructure project.

By early 2025, that realist approach started to pay off. We've seen a massive rebound in dealmaking. Morgan Stanley's investment banking revenues jumped significantly, and Gross has been a vocal proponent of the "back-to-basics" approach: connecting best-in-class investment banking with the firm's massive wealth management arm.

👉 See also: Cuanto son 100 dolares en quetzales: Why the Bank Rate Isn't What You Actually Get

The Wharton Connection and Professional Profile

Like many at the top of the food chain, Gross is a Wharton grad. He holds both a bachelor's degree and an MBA from the University of Pennsylvania's elite business school.

But his profile is more than just academic. He’s a frequent speaker at places like the UNC Kenan-Flagler Business School, where he recently did a fireside chat on "Private Capital, Public Markets, and the Path Forward." He’s focused on the long-term trend of companies staying private longer and how that changes the game for banks.

Key Roles and Responsibilities:

- Global Co-Head of Investment Banking: Managing thousands of bankers worldwide.

- Management Committee Member: Influencing the firm’s high-level strategy.

- Institutional Securities Group Operating Committee: Handling the nuts and bolts of the bank’s largest division.

Why You Should Care

If you're an investor or just someone interested in how the world's money moves, Eli Gross is a bellwether. When he talks about a "rebound in dealmaking" on CNBC, the market listens because his group is the one actually writing the checks and advising the CEOs.

He represents the "steady hand" era of Morgan Stanley. The firm has moved away from the "cowboy" culture of the pre-2008 years toward a more integrated, wealth-management-heavy model. Gross is the bridge between the old-school dealmaking muscle and this new, more stable version of the firm.

✨ Don't miss: Dealing With the IRS San Diego CA Office Without Losing Your Mind

Actionable Insights for the Modern Market

Understanding the rise of Eli Gross gives you a few "tells" about where the financial industry is headed.

First, look for stability. The fact that the heads of investment banking are 25-year veterans tells you that Morgan Stanley isn't looking for quick wins; they are looking for institutional memory. Second, watch the integration of wealth and banking. Gross has explicitly stated that matching a top-tier investment bank with a top-tier wealth manager is the priority.

If you are tracking M&A, keep an eye on the sectors Gross knows best: transportation and infrastructure. These "boring" sectors are often the first to show real, sustainable growth when the economy starts to turn the corner. Focus on the players who emphasize "execution" over "hype"—that's the Eli Gross playbook in a nutshell.