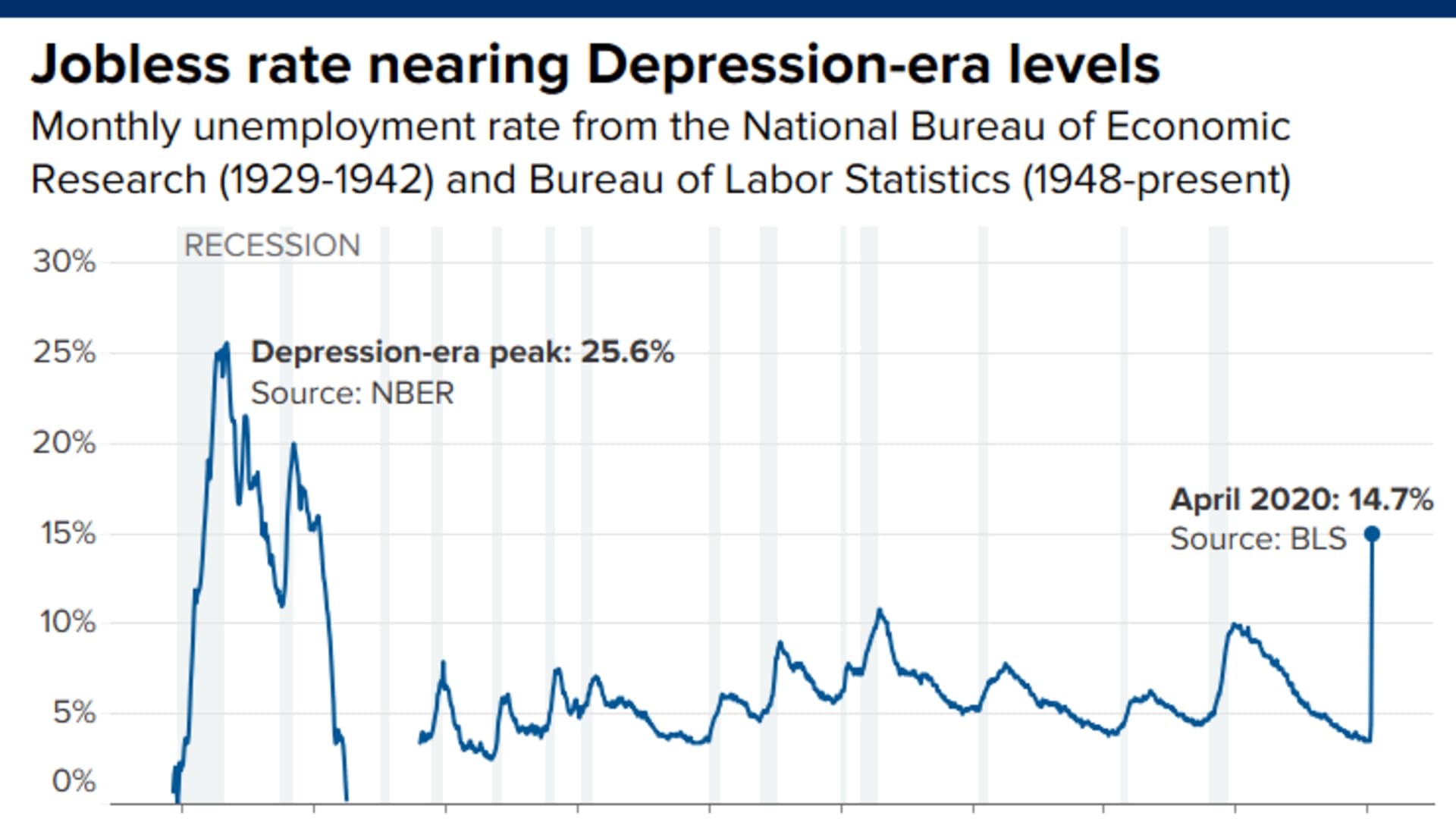

The stock market didn't just "crash" in 1929; it basically vaporized the middle class's sense of security in a few weeks. One day you’re buying a radio on credit, and the next, your boss is locking the factory doors for good. People always ask, during the Great Depression what was the unemployment rate, looking for a single, tidy number. Honestly? It's not that simple. There wasn't even a Bureau of Labor Statistics (BLS) as we know it today tracking these numbers in real-time. Economists had to go back later and piece together the wreckage like detectives at a crime scene.

Most history books will tell you the rate peaked at 24.9% in 1933. That’s the "official" estimate. Think about that for a second. One out of every four people you knew had zero income. But that number actually hides a much darker reality. If you were a Black worker in a city like Atlanta or Norfolk, your unemployment rate was likely over 50%. If you lived in a "one-factory town" that went bust, the rate was effectively 100%.

The Brutal Climb to 25 Percent

When the ticker tape stopped on Black Tuesday, the unemployment rate was sitting at a comfy 3.2%. It was 1929, and things felt fine. Then, the slide started. It wasn't a sudden drop into the abyss; it was a slow, agonizing crawl downward that lasted four years.

By 1930, the rate hit 8.7%. People were worried, sure, but the "experts" kept saying the economy would correct itself. It didn't. By 1931, it leaped to 15.9%. This is when the breadlines started wrapping around city blocks. In 1932, the year Herbert Hoover lost the election in a landslide, it reached 23.6%.

Then came 1933. The absolute bottom.

📖 Related: Oil Market News Today: Why Prices Are Crashing Despite Middle East Chaos

Why 1933 Was a National Nightmare

In March 1933—the same month Franklin D. Roosevelt took office—unemployment likely spiked even higher than the annual average, with some estimates hitting 15 million people out of work. That's a staggering amount of human misery.

- The Steel Industry: U.S. Steel had 224,980 full-time employees in 1929. By April 1, 1933, they had exactly zero full-time workers. Everyone left was part-time, and even they were few and far between.

- Manufacturing: In Michigan, the heart of the auto industry, the unemployment rate didn't just hit 25%. It reportedly averaged over 35% during the worst years because when people stop buying cars, the whole state stops breathing.

- The Dust Bowl Factor: It wasn't just a financial crisis. Nature joined in. Farmers in the Great Plains weren't just "unemployed"; they were literally watching their livelihoods blow away in clouds of topsoil.

What Most People Get Wrong About the Numbers

Here’s the thing: those percentages don't account for "underemployment." If you were a bank manager who lost his job and started selling apples on a street corner for ten cents a day, you weren't technically "unemployed" in some records. You were working. But you weren't making enough to pay a mortgage or feed a family.

There's also a big debate among economists like Stanley Lebergott and Michael Darby about how to count the people working for New Deal programs like the WPA (Works Progress Administration).

Lebergott argued that if the government is paying you to dig a ditch because the private sector can't, you're still technically unemployed from a "market" perspective. If you follow his logic, the unemployment rate stayed in the double digits for the entire decade. Darby, on the other hand, thought that if you have a paycheck from the government, you're employed. It sounds like a boring academic debate, but it changes the "unemployment rate" by 5% to 7% depending on who you believe.

👉 See also: Cuanto son 100 dolares en quetzales: Why the Bank Rate Isn't What You Actually Get

The Long-Term Scarring

We talk about the "rate," but we don't talk about the duration. In 1934, a census in Massachusetts found that 63% of the unemployed had been out of work for more than a year. Imagine not having a paycheck for twelve months straight in a world with no food stamps, no social security, and no health insurance.

You’ve gotta understand the psychological toll. This wasn't a "gap year." This was a decade of wondering if you'd ever be "useful" again. Men would leave the house in suits every morning just to pretend they had somewhere to go, because the shame of that 25% rate was too much to bear.

Why the Rate Finally Dropped

FDR’s New Deal helped. It really did. By 1937, the rate had "dropped" to 14.3%. But then the government got nervous about the deficit and cut spending, leading to the "recession within the Depression." Unemployment shot back up to 19% in 1938.

It took a literal world war to fix the job market.

✨ Don't miss: Dealing With the IRS San Diego CA Office Without Losing Your Mind

By 1941, the rate fell to 9.9% as the "Arsenal of Democracy" started spinning up. Once the U.S. entered WWII, the problem flipped. Instead of too many workers and not enough jobs, we had too many jobs and not enough workers. By 1944, the unemployment rate was a measly 1.2%.

Actionable Insights: Lessons from the 25%

Looking back at during the Great Depression what was the unemployment rate isn't just a history lesson; it's a warning about "structural" versus "cyclical" job loss.

- Diversify your skills: During the 30s, "nondurable" goods workers (like people making food or clothes) kept their jobs much longer than "durable" goods workers (those making cars or machines). In any crisis, the "essentials" survive.

- Watch the "Hidden" Numbers: The official unemployment rate is often the most optimistic version of the truth. Always look at "labor force participation" to see who has given up looking entirely.

- Safety Nets Matter: The reason we haven't seen 25% again—even during 2008 or the 2020 lockdowns—is largely due to the protections (Social Security, Unemployment Insurance) built because of the 1933 disaster.

The Great Depression taught us that the economy is a fragile machine. When it breaks, it doesn't just affect "the market"—it reshapes every single household in the country. We are still living in the shadow of that 25% peak today.

If you want to understand how these numbers compare to modern times, you should look into the "U-6" unemployment rate, which includes underemployed and discouraged workers to get a clearer picture of today's economy.