You’ve probably seen the line. It starts in the bottom left, wobbles through the middle, and eventually shoots toward the top right like a bottle rocket. That’s the dow stock history chart. People treat it like the pulse of the American heart. If it's up, we’re rich; if it’s down, we’re doomed. Honestly, it’s a bit more complicated—and a lot more interesting—than just a jagged line on a TV screen.

The Dow Jones Industrial Average (DJIA) isn't just a number. It's a collection of 30 massive "blue-chip" companies. But here is the kicker: the chart doesn't actually measure the "market" in the way most people think. It’s price-weighted. That means a company with a $200 stock price has more influence on the chart than a company with a $50 stock price, even if the $50 company is twice as big in total value.

Wild, right?

Why the dow stock history chart looks the way it does

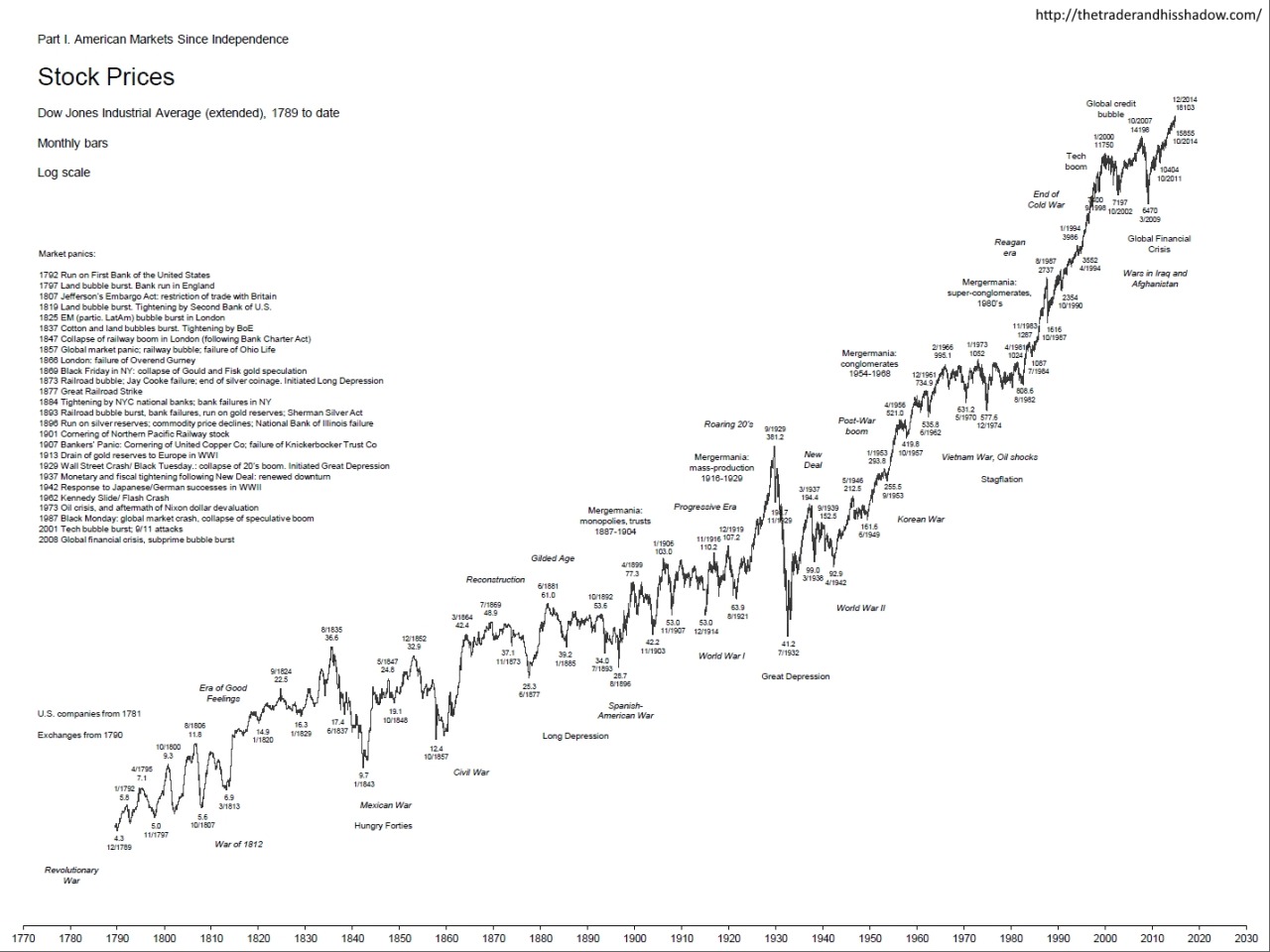

If you look at a chart spanning the last 100 years, the first thing you notice is the 1929 "cliff." It's the stuff of nightmares. Before the Great Depression, the Dow was the darling of the Roaring Twenties. It hit a peak of 381.17 in September 1929. Then, the floor fell out. By July 1932, it had cratered to 41.22.

That is an 89% drop. Imagine losing 89 cents of every dollar you owned.

It took until 1954—twenty-five years—just to get back to where it was before the crash. This is the "lost generation" of the dow stock history chart. But since that recovery, the trajectory has been primarily upward, fueled by the post-WWII boom, the rise of the internet, and massive amounts of central bank liquidity.

The milestones that changed everything

- The 1,000 Mark: It took until 1972 to finally close above 1,000. People celebrated like it was the end of history.

- Black Monday (1987): On October 19, the Dow lost 22.6% in a single day. This remains the largest one-day percentage drop ever. No warning. Just a vertical drop on the chart.

- The 10,000 Milestone: March 1999. The Dot-com bubble was in full swing.

- The 2020 Pivot: During the COVID-19 crash, the index plummeted 3,000 points in one day, only to roar back and cross 30,000 later that same year.

- Breaking 40,000: In May 2024, the index crossed the 40k threshold for the first time, driven by a handful of tech giants and healthcare titans.

Reading the "Bumps" in the road

Most folks look at a dow stock history chart and see a smooth line. Zoom in. It’s actually a series of violent zig-zags. These aren't just random. They are the fingerprints of history.

Take the "Kennedy Slide" of 1962. The Dow dropped 27% in about seven months. Why? Nobody really knows for sure, though historians point to a clash between JFK and the steel industry. Or look at the 1970s. The chart basically went sideways for a decade. Inflation was eating everyone's lunch, and the Dow couldn't catch a break.

Then came the "Nifty Fifty" era, followed by the "Merger Mania" of the 80s. Each of these eras is visible on a long-term chart if you know where to look. The 2008 Great Recession looks like a giant "V" on the chart today, but at the time, it felt like a permanent "L." It dropped 50% from its 2007 highs before bottoming out in March 2009 at 6,547.05.

The components: A revolving door of industry

The Dow isn't the same group of companies it was in 1896. Back then, it was 12 companies, mostly "smokestack" industries like sugar, tobacco, and oil. The only original member that lasted into the modern era was General Electric (GE), and even they were kicked out in 2018.

The chart changes because the math changes. When a company stops being a leader, the S&P Dow Jones Indices committee swaps them out.

🔗 Read more: AMD Stock After Hours: Why the Post-Market Chaos Usually Lies

Recently, we've seen massive shifts. ExxonMobil—once the biggest company in the world—was dumped in 2020. In came Salesforce. Then, in 2024, Nvidia and Sherwin-Williams were added, replacing Intel and Dow Inc. When you look at the dow stock history chart from 2024 and 2025, you are seeing the performance of AI and tech, not the railroads and cotton of the past.

Percentage vs. Points: Don't get fooled

You'll hear the news anchor scream, "The Dow is down 1,000 points!"

Calm down.

In 1929, a 1,000-point drop would have ended the world. Today, with the Dow hovering near 45,000 or 50,000, a 1,000-point move is just a 2% wiggle. It’s a bad day, but it’s not a catastrophe. Always look at the percentage change on the chart, not the raw points. Points are for headlines; percentages are for your portfolio.

What the chart tells us about the future

History doesn't repeat, but it sure does rhyme. If you study the dow stock history chart long enough, you see a pattern of "secular" bull and bear markets. These are long cycles—usually 15 to 20 years—where the market either trends strongly up or stays frustratingly flat.

📖 Related: Why the Toys R Us Abandoned Stores Trend Still Won't Die

We’ve been in a massive bull run since 2009. There have been hiccups, like 2022 when the index dropped about 9%, but the primary trend remains "up and to the right."

Is it a bubble? Some experts, like Jeremy Grantham, have warned of a "superbubble" for years. Others point to the fact that companies today are making more money than ever before. The chart reflects that earnings growth. If companies keep making more profit, the line keeps going up. It’s kinda that simple, and kinda that hard.

Actionable insights for your strategy

Stop checking the daily chart. Seriously. If you are an investor, the daily "noise" on the dow stock history chart is your enemy. It triggers the lizard brain that wants to sell when things go red.

Instead, focus on the "rolling returns." Historically, if you hold the Dow for 20 years, your chance of losing money is effectively zero. The average annual return over the last century is roughly 5% to 6% without dividends, and closer to 10% if you reinvest the dividends.

- Reinvest Dividends: The "price" chart you see on the news doesn't include dividends. If you include them, the 100-year chart looks even more insane.

- Watch the Divisor: The "Dow Divisor" is a magic number used to calculate the index. It changes whenever there’s a stock split or a component change. It currently sits well below 1.0, meaning a $1 move in any stock's price moves the index by more than 1 point.

- Check the "Golden Cross": If you like technical analysis, watch for when the 50-day moving average crosses above the 200-day moving average on the chart. Traders call this a "Golden Cross," and it's often a signal that a long-term uptrend is starting.

To get the most out of this data, start by pulling up a "Logarithmic Scale" chart rather than a "Linear" one. A linear chart makes recent moves look huge and historical moves look tiny. A log chart shows percentage moves accurately over time, giving you a much clearer picture of how the Dow has actually behaved since its birth in the 19th century.