The Dow Jones Industrial Average just wrapped up a week that felt a little like a slow-motion car crash. It wasn't a total disaster, but it definitely left investors rubbing their temples.

If you're looking for the quick answer, the Dow Jones Industrial Average closed Friday, January 16, 2026, at 49,359.33, down about 83 points on the day.

But honestly? That number alone tells almost none of the story.

Why the Dow Jones Numbers Today Feel So Weird

We are currently hovering in this bizarre financial "no man's land." On one hand, the Dow is sitting at its fifth-highest close in history. On the other, it just lost 0.29% for the week and has been down for three of the last four trading days.

It’s confusing.

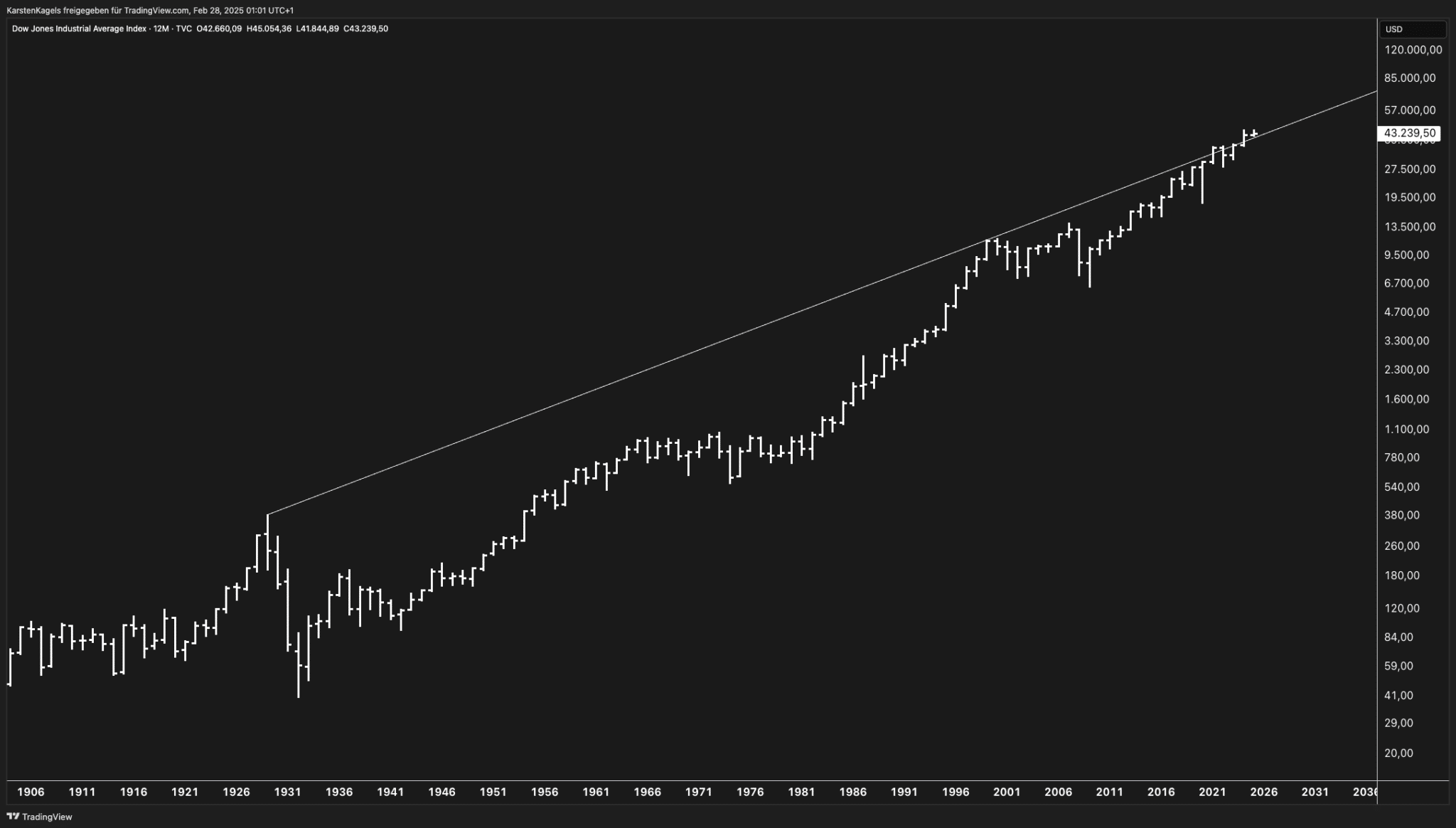

One minute we’re hitting a record high of 49,590.20 (which happened just this past Monday, Jan 12), and the next, everyone is whispering about the "Buffett Indicator" and whether the market is overheating. Basically, the Dow is struggling to find its footing after a massive 2025 run-up that saw it climb 13.5% since Inauguration Day last year.

The Friday Breakdown: A Mixed Bag

Friday’s session was a classic example of "sector rotation." That’s just a fancy way of saying big investors are getting bored with tech and moving their money into boring stuff like banks and insurance companies.

- IBM was the star of the show, jumping 2.59% to finish at $305.67.

- American Express (AXP) also had a great day, up 2.08%.

- On the flip side, UnitedHealth (UNH) took a massive 2.34% hit.

When a giant like UnitedHealth drops that much, it drags the whole index down because the Dow is price-weighted. Unlike the S&P 500, where the biggest companies matter most, in the Dow, the stocks with the highest share price have the loudest voice.

The Fed and the "Independence" Drama

You can't talk about the stock market right now without mentioning the Federal Reserve. There’s a lot of chatter—honestly, it’s more like a shouting match—about the Fed’s independence.

Investors are spooked that political pressure might force the Fed to keep rates lower than they should be, which sounds great for your mortgage but is kinda terrifying for inflation.

Stan Choe over at the Associated Press noted recently that this "feud" between the White House and the Fed is part of why the Dow recovered from a nearly 500-point intraday dip earlier this week. People are trying to price in a future where the rules might be changing.

The "K-Shaped" Reality

We’re seeing what economists call a K-shaped market.

One arm of the "K" consists of the winners: companies with actual, tangible earnings like Goldman Sachs and Morgan Stanley. They both reported blowout fourth-quarter earnings this week. Goldman Sachs posted $14.01 per share, crushing the $11.77 estimate.

The other arm? The "expensive" tech stocks that everyone bought into during the AI hype of 2024 and 2025. Those are starting to look a bit shaky. Even NVIDIA (NVDA), the darling of the last two years, slipped 0.44% on Friday.

Is a Pullback Actually Coming?

There’s a metric called the Buffett Indicator. It compares the total value of the stock market to the U.S. GDP. Right now, it’s sitting at about 222%.

For context, Warren Buffett himself has said that when this ratio hits 200%, you’re "playing with fire." The last time it was even close to this high was right before the 2022 bear market.

Does this mean you should sell everything and hide under your bed? No. But it does mean the "easy money" phase of this bull market is probably over.

What to Watch on Monday

When the opening bell rings on Monday, January 19, the market will likely be reacting to:

- Q3 Earnings Flow: We’re still in the thick of bank earnings.

- Geopolitical Jitters: Tensions in places like Venezuela and Iran are keeping oil prices volatile (WTI Crude is currently sitting around $59.80).

- The 49,250 Support Level: Technical analysts like Kelvin Wong are watching this number closely. If the Dow falls below 49,250, we might see a much sharper drop.

Practical Steps for Your Portfolio

Don't let the headlines freak you out. The Dow is still up 2.7% month-to-date. If you’re feeling nervous about these numbers, here’s how to handle it like a pro.

🔗 Read more: Pound Sterling to US Dollar Rate: Why the Rules Just Changed

Stop Chasing Yesterday's Winners

If you missed the 300% run on AI stocks, don't try to jump in now. The market is rotating into "value" stocks—companies that actually make stuff and have reasonable price-to-earnings ratios. Think Industrials and Financials.

Check Your Weighting

Because the Dow is price-weighted, check your exposure to the high-priced stocks. If you own a lot of Goldman Sachs or UnitedHealth, your personal "index" is going to be a lot more volatile than the broader market right now.

Keep an Eye on the 10-Year Treasury

The yield is currently around 4.19%. If that starts creeping back up toward 4.3% or 4.5%, it’s going to put a lot of pressure on stocks. High yields make "safe" bonds more attractive than "risky" stocks.

Wait for the "Catch-Up" Data

Because of the government shutdown late last year, we are still waiting on some delayed economic reports like retail sales and industrial production. Expect the market to be extra jumpy as these reports finally hit the wires through the end of January.

The Dow isn't "broken," it's just breathing. After the vertical climb we've seen, a little sideways movement is actually healthy. Just keep your eyes on those support levels and don't get distracted by the daily noise.

Next Steps for You:

Check your portfolio's exposure to the "Big Three" Dow components—Goldman Sachs, UnitedHealth, and Microsoft. These three companies alone account for a massive chunk of the index's movement. If you find you're too concentrated in one, it might be time to look into diversifying into mid-cap or small-cap stocks, which have actually been outperforming the Dow lately as investors look for more room to grow.