Honestly, most people treat the stock market like a single, giant blob of numbers that goes up or down. You hear it on the news every night: "The market was up today." But which market? If you're looking at the Dow Jones Nasdaq S&P and thinking they all tell the same story, you're missing the nuances that actually move your portfolio.

It's messy.

The Dow might be cruising while the Nasdaq is absolutely cratering. Why? Because they aren't teammates; they’re more like different instruments in an orchestra that sometimes play entirely different songs. If you want to understand where your money is actually going, you've got to stop grouping them together as a single entity.

The Dow Jones: The Grandpa of Wall Street

Let's start with the Dow Jones Industrial Average (DJIA). It’s the oldest. It’s iconic. It’s also, frankly, a bit of a weirdo in the modern financial world. Founded by Charles Dow in 1896, it originally tracked just 12 industrial companies. Now it tracks 30.

Only 30.

📖 Related: 1 USD to TND: Why Your Dollars Go Further in Tunisia (And Why They Might Not)

Think about that for a second. There are thousands of publicly traded companies, but the "Dow" only cares about thirty of them. Names like Goldman Sachs, Microsoft, and UnitedHealth Group. But here is the kicker that trips everyone up: the Dow is price-weighted.

This means a company with a higher stock price has more influence over the index than a company with a lower stock price, regardless of how big the company actually is. If a $300 stock moves 1%, it has a much bigger impact on the Dow than a $50 stock moving 1%. It's an archaic way of doing things that dates back to when people had to do math by hand with pencils.

It’s less of a "market" indicator and more of a "blue-chip temperature check." If the Dow is up, it means the massive, established legacy companies are having a good day. It doesn’t tell you a thing about small businesses, biotech startups, or the latest AI craze.

Why the Dow still gets all the headlines

Tradition is powerful. Most evening news anchors lead with the Dow because it’s a big, recognizable number. When the Dow hits 40,000, it feels like a milestone. But for a professional fund manager? They’re barely looking at it. They know that thirty stocks can't possibly represent the complexity of the global economy.

The Nasdaq: Where the Nerds and Rockets Are

Then you have the Nasdaq. When people say "the Nasdaq," they are usually talking about the Nasdaq Composite or the Nasdaq-100. This is the home of tech. It’s heavy on Apple, Nvidia, Amazon, and Tesla.

If the Dow is your grandfather’s sensible Buick, the Nasdaq is a custom-tuned Tesla Plaid. It’s fast. It’s volatile. It’s exciting until it isn't.

The Nasdaq is market-cap weighted. This is much more logical than the Dow's system. In this model, the bigger the company’s total value (share price multiplied by number of shares), the more it moves the needle. Since the Nasdaq is so concentrated in technology and growth stocks, it’s the ultimate barometer for "risk-on" sentiment.

When investors feel brave and want to bet on the future, the Nasdaq flies. When interest rates rise—like we saw throughout 2023 and 2024—the Nasdaq often feels the most pain. Why? because tech companies often rely on future earnings, and when the cost of borrowing money goes up, those future earnings are worth less today.

The concentration problem

You've probably heard of the "Magnificent Seven." This group—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—has historically dictated the direction of the entire index. Sometimes, 100 stocks are listed, but only five or six are actually doing the heavy lifting. If Nvidia has a bad earnings report, the Nasdaq can bleed even if 80 other companies in the index are doing just fine.

The S&P 500: The Only One That Truly Matters?

If you ask a professional investor which index they actually care about, 99% of them will say the S&P 500.

The Standard & Poor's 500 tracks 500 of the largest companies in the U.S. It covers about 80% of the total value of the U.S. stock market. It’s the gold standard. When you buy a "market index fund," you are usually buying the S&P 500.

It's diversified. You've got technology, sure, but you also have healthcare, energy, consumer staples, and financials. It uses market-cap weighting, just like the Nasdaq, but because it spreads that weight across 500 companies instead of 30 or 100, it’s a much more stable reflection of the actual economy.

The "500" isn't actually 500

Here is a fun fact: The S&P 500 often has more than 500 stocks. Because some companies have multiple share classes (like Alphabet’s Class A and Class C shares), the number is usually closer to 503 or 505. Also, a committee actually picks these companies. It’s not just the 500 biggest. A company has to be profitable over a certain period and have enough liquidity for people to trade it easily.

Breaking Down the Performance Gap

Why do they diverge?

✨ Don't miss: The One Big Beautiful Bill Act: What Most People Get Wrong

Imagine a year where oil prices skyrocket. The Dow and the S&P 500 might stay flat or go up because they have significant exposure to energy companies like ExxonMobil or Chevron. Meanwhile, the Nasdaq might tank because high energy costs hurt tech margins and consumer spending.

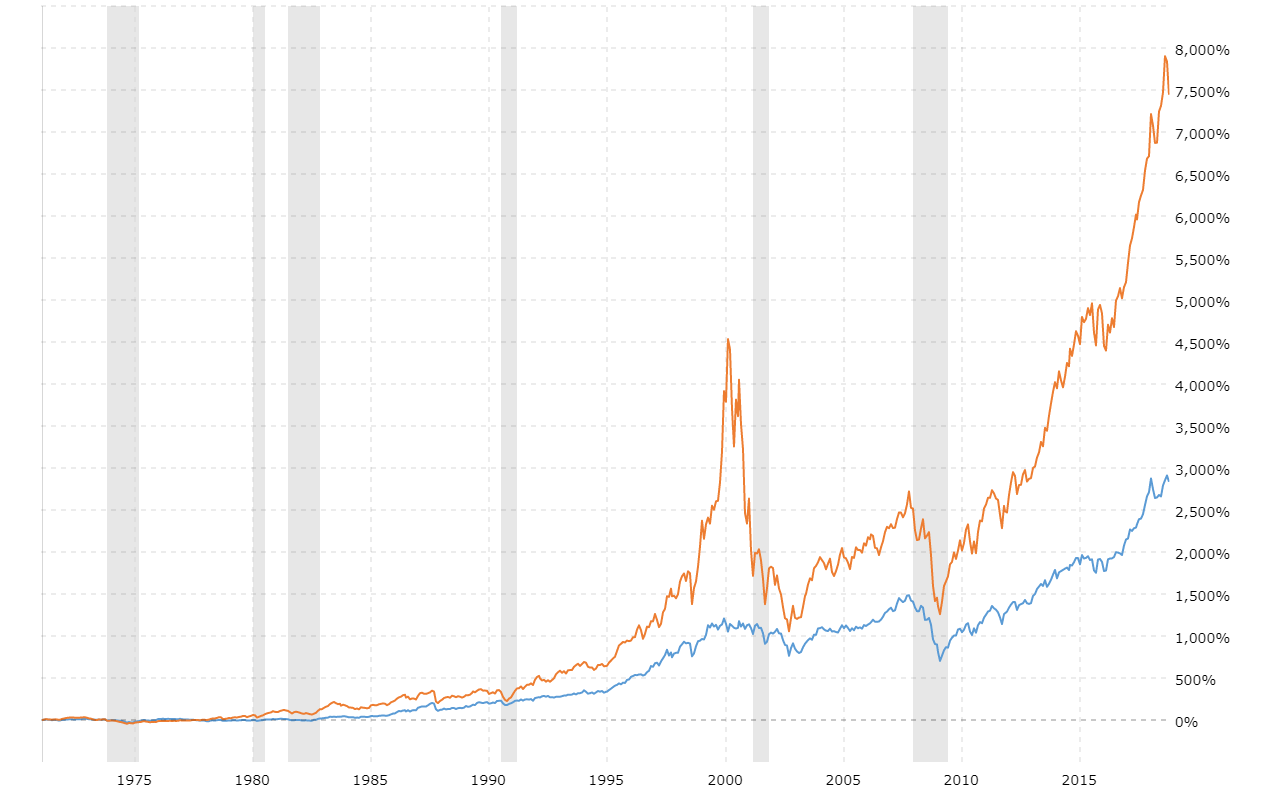

Or look at 2022. The Nasdaq fell over 30% because of rising interest rates. The Dow only fell about 9%. If you only watched the Dow, you thought it was a rough year. If you only watched the Nasdaq, you thought the world was ending.

Understanding the Dow Jones Nasdaq S&P relationship requires looking at the sectors.

- Dow: Heavy on Industrials, Financials, and Healthcare.

- Nasdaq: Overwhelmingly Technology and Consumer Discretionary.

- S&P 500: A balanced mix of everything.

What Most People Get Wrong About "The Market"

The biggest mistake? Comparing your personal portfolio to the wrong index.

If you own a bunch of boring, dividend-paying utility stocks, don't get depressed when the Nasdaq is up 3% and you’re only up 0.5%. You aren't playing the same game. Conversely, if you're holding high-growth AI stocks, comparing yourself to the Dow is pointless.

Another misconception is that these indices represent the "U.S. Economy." They don't. They represent the biggest corporations in the U.S. The "economy" includes small businesses, the housing market, and employment data. Sometimes the S&P 500 goes up precisely because companies are cutting costs—aka firing people. The stock market is not the economy.

How to Actually Use This Information

Stop checking the price of the Dow every morning. It’s a legacy number that doesn't provide much signal anymore.

Instead, look at the "Spread" between the Nasdaq and the S&P 500.

If the Nasdaq is significantly outperforming the S&P, it means the market is in a speculative, growth-heavy phase. Investors are chasing returns and are willing to take risks. If the S&P is outperforming the Nasdaq, it usually means money is flowing into "defensive" sectors like consumer staples (toothpaste and toilet paper) or healthcare. It’s a sign that people are getting nervous.

Watch the "Equal-Weighted" S&P 500

If you really want to be an expert, look up the ticker RSP. This is the S&P 500, but every company is given the same weight (0.2%). When the regular S&P 500 (SPY) is doing much better than the equal-weighted version, it means only a few giant companies are propping up the market. That’s usually a sign of a fragile rally. If the equal-weighted index is rising, it means the "breadth" is good—most companies are actually healthy.

Actionable Steps for Your Portfolio

Don't just watch the numbers change color on your screen. Use the differences between the Dow Jones Nasdaq S&P to make better decisions.

- Identify your Benchmark: If you are a conservative investor, compare yourself to the S&P 500. If you’re aggressive, look at the Nasdaq-100 (QQQ). Stop using the Dow as a yardstick.

- Check the "Breadth": Use a tool like Barchart or Finviz to see how many stocks are actually hitting new highs. If the S&P 500 is at a new high but only 40% of stocks are above their 200-day moving average, be careful.

- Rebalance based on Sector Rotation: If the Nasdaq has run up 20% in three months while the Dow has stayed flat, it might be time to take some profits from your tech winners and move them into the "boring" sectors that have been ignored.

- Ignore the Daily Noise: A 1% move in the Dow sounds like a lot (hundreds of points), but it’s just a normal day. Focus on the weekly and monthly trends of the S&P 500 to see where the "smart money" is actually moving.

The "market" is a collection of different stories. The Dow tells you about the giants of the past, the Nasdaq tells you about the hopes for the future, and the S&P 500 tells you the reality of the present. Learn to read all three, and you'll stop being surprised by volatility.