Money has a funny way of making people hold their breath. Right now, if you’re looking at the Dow Jones Industrial Average, you can practically hear the collective inhale across Wall Street. As of Friday’s close on January 16, 2026, the Dow sat at 49,359.33.

It’s close. So close.

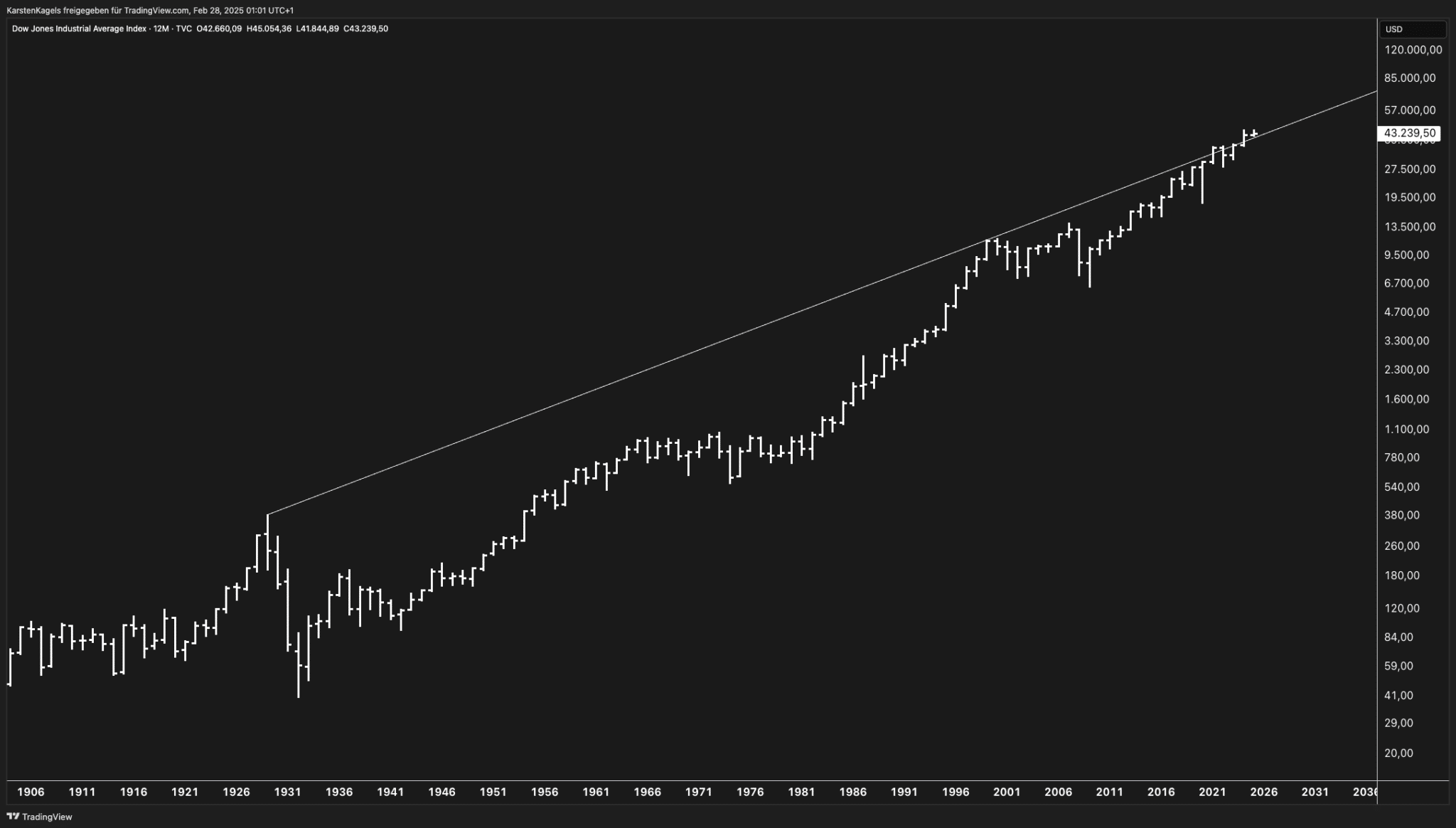

We are less than 700 points away from that psychological mountain peak of 50,000. But if you think this is just a smooth ride to a new record, you haven't been paying attention to the drama behind the scenes. Markets are currently "wavering," as the analysts like to say. Honestly? It’s more like a tug-of-war where nobody is quite sure who has the stronger grip.

What’s Actually Happening with the Current Dow Jones Numbers?

On Friday, the Dow dipped about 83 points. That’s a tiny 0.17% move, basically a rounding error in the grand scheme of things, but the vibe was heavy. Why? Because the "Trump Trade" of 2025 is hitting a messy patch of reality.

The big news shaking the floor right now isn't just earnings; it’s the Federal Reserve. There is a massive amount of uncertainty about who is going to lead the Fed once Jerome Powell’s term is up. President Trump recently hinted that Kevin Hassett—who everyone thought was a lock for the job—might stay in his current role at the National Economic Council instead.

Suddenly, the market is scrambling.

Investors hate surprises. When the name "Kevin Warsh" started floating around as the new frontrunner for Fed Chair, bond yields spiked. The 10-year Treasury note hit 4.23%, its highest level since September. When yields go up, stocks usually feel the squeeze. It makes borrowing more expensive for companies, and it makes those "safe" bonds look a lot more attractive than risky stocks.

The Winners and Losers Under the Hood

You can't just look at the big number and get the whole story. The Dow is a "price-weighted" index of 30 massive companies. If one of them trips, the whole index feels it.

- IBM and American Express: These were the weekend heroes, gaining over 2% each.

- Salesforce (CRM): This one took a beating, dropping nearly 2.8%. People aren't exactly thrilled with the latest updates to their AI Slackbot.

- UnitedHealth (UNH): Down over 2.3%.

It’s a mixed bag. On one hand, you have the AI hype still fueling chipmakers like Nvidia and Intel. On the other, you have traditional blue chips struggling with the reality of "sticky" inflation.

The 50,000 Milestone: Hype vs. Reality

Everyone wants to see the Dow hit 50,000. It’s a clean, round number. It looks great on a headline. But some experts, like John Rogers from Ariel Investments, are sounding the alarm. Rogers is actually predicting a recession by the end of 2026, suggesting the Dow could retrace as much as 15% to 20%.

That’s a scary thought when you're sitting at all-time highs.

The argument is basically that we have a "two-tier" economy. If you’re wealthy, you’re spending money on cruises and tech. If you’re the "average" consumer, you’re getting hammered by high living costs and credit card interest rates that the administration is threatening to cap at 10%.

🔗 Read more: Exchange Rate Dollar to New Zealand: What Most People Get Wrong

Diane Swonk over at KPMG is a bit more optimistic—she thinks we’ll dodge a recession—but even she sees the Dow potentially ending the year lower, maybe around 43,000.

Why the Next Few Weeks are Critical

We are right in the thick of the Q4 2025 earnings season. JPMorgan Chase already kicked things off with a bit of a thud—shares dropped 4% after they reported a revenue miss.

When the "biggest bank in America" warns about "potential hazards" and "elevated asset prices," people listen. Jamie Dimon, the CEO, basically told everyone to stay vigilant. He’s worried about geopolitical tensions (Iran and Greenland are the big ones right now) and the fact that inflation just won't go back to that 2% sweet spot the Fed wants.

Deciphering the Inflation Data

Last week’s Consumer Price Index (CPI) came in at 2.7%. That’s... okay. It’s not great, but it’s not a disaster. It matched expectations.

The problem is that it’s not moving down anymore. It’s stuck.

This "sticky inflation" means the Fed is stuck, too. They can’t just slash interest rates to boost the market if prices are still rising. Most analysts think the chances of a rate cut in January are basically zero.

- Watch the Fed leadership: The moment a name is officially nominated, the market will react.

- Keep an eye on Tech earnings: Apple and Intel report at the end of the month. If they miss, the Dow’s 50,000 dream might have to wait until summer.

- The 10-year yield: If this keeps climbing toward 4.5%, expect a broader sell-off in the Dow.

Actionable Insights for Your Portfolio

So, what do you actually do with the current dow jones numbers?

First off, don't FOMO into the 50,000 hype. Markets often stall out right before they hit those big "round number" milestones. It's like a psychological ceiling.

If you're looking for where the "smart money" is moving, keep an eye on the "Great Rotation." We’re starting to see money flow out of those over-valued Big Tech names and into small-cap companies or defensive stocks like Smucker Co. (SJM) that tend to hold up when the economy gets weird.

Also, diversify into "real" assets. Gold is hitting record highs (near $4,600 an ounce) for a reason. Investors are using it as a hedge against the Fed drama and potential trade wars.

Next Steps for You:

Check your portfolio's exposure to the "Magnificent Seven" tech stocks. If you’re too heavy there, consider rebalancing into some of the Dow’s under-valued industrials or financials before the next round of Fed announcements. Keep a close watch on the 48,000 support level—if the Dow breaks below that, the "correction" everyone is whispering about might actually be here.