The stock market is a weird beast. You’d think that after hitting a record high of 49,590.20 just a few days ago on Monday, investors would be celebrating. Instead, everyone’s staring at their screens today, Wednesday, January 14, 2026, watching the Dow Jones Industrial Average today drift lower for the second day in a row. It’s not a crash—not even close—but the index edged down 42.36 points to close at 49,149.63.

Honestly, a 0.09% drop feels like a rounding error in the grand scheme of things. But when you look under the hood, there’s a lot of friction.

What’s Dragging Down the Dow Jones Industrial Average Today?

Markets hate uncertainty. Right now, that uncertainty is coming from the big banks. We’re deep into the fourth-quarter earnings season, and the results are... messy. Take Wells Fargo, for example. They missed revenue estimates and saw their stock tumble 4.61%. Even Bank of America, which actually beat profit expectations, fell 3.78% because investors are spooked about rising expenses and a "softer" outlook for interest income in 2026.

📖 Related: Robert Kiyosaki: What Most People Get Wrong About the Rich Dad Poor Dad Author

It’s a classic "sell the news" situation.

There's also this brewing tension between the White House and the Federal Reserve. You've probably heard the whispers about a Department of Justice investigation into renovation budget overruns at the Fed. It sounds like a niche bureaucratic spat, but it’s ratcheting up political pressure on Fed Chair Jerome Powell. Investors are basically worried that if the Fed loses its independence, inflation might come roaring back or rate cuts could get derailed.

The Big Tech Weight

While the Dow is mostly blue-chip industrials, it can't escape the gravitational pull of the tech giants. Microsoft was the biggest laggard today, shaving nearly 70 points off the Dow’s total. Nvidia and Amazon also took hits as the "AI fatigue" we’ve been hearing about finally started to show up in the price action.

- Microsoft (MSFT): Down 2.40% to $459.38.

- Intel (INTC): A rare bright spot, up over 3% because they’ve apparently sold out of their 2026 server CPU capacity.

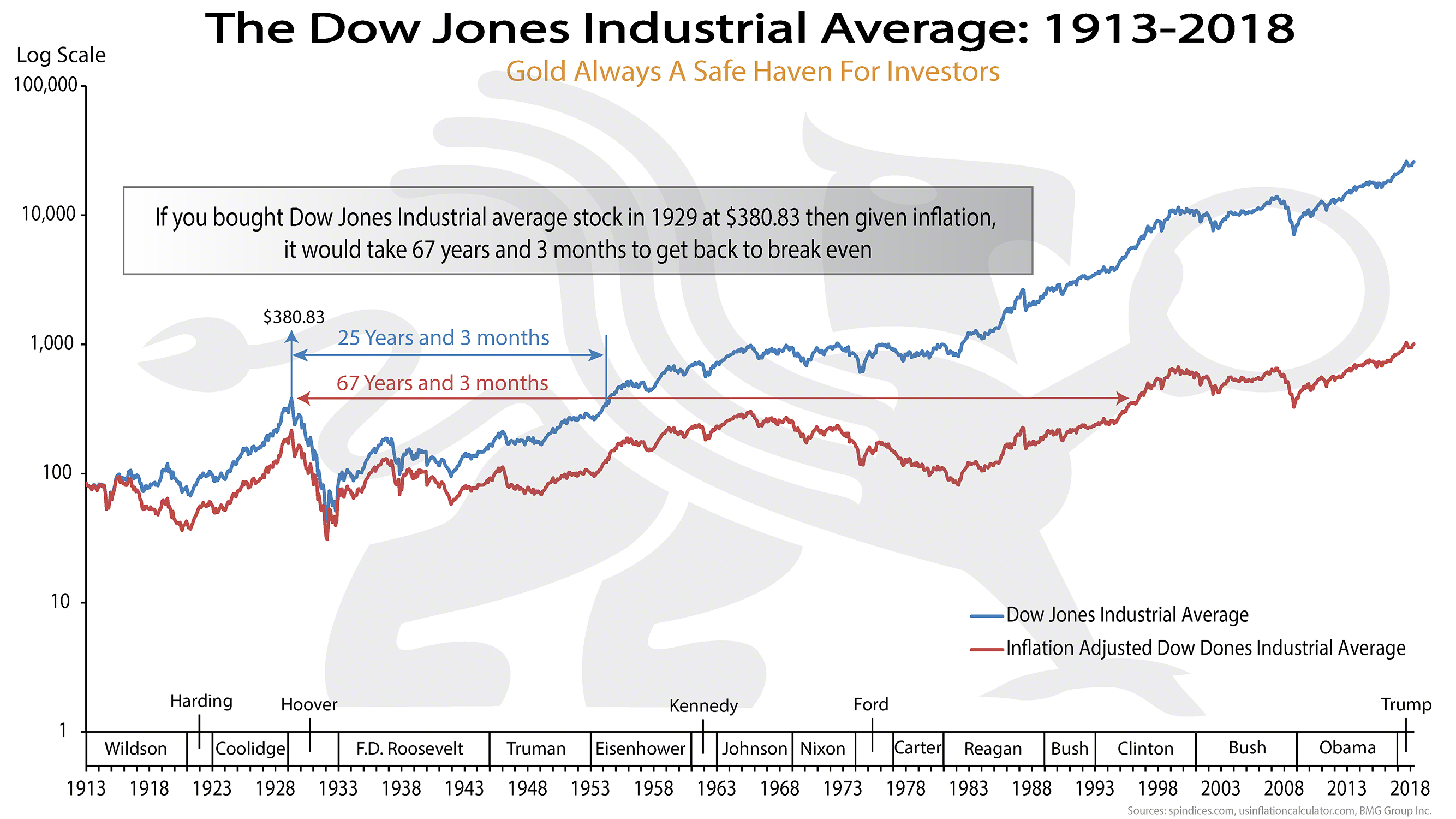

- Gold and Silver: These are absolutely ripping. Gold hit $4,650 an ounce today. When people pile into gold, it usually means they’re nervous about the "paper" economy.

Breaking Down the Numbers

The day was a literal tug-of-war. Out of the 30 stocks that make up the Dow, 16 actually rose while 14 fell. That's a pretty even split, but the ones that fell happened to be the heavy hitters.

IBM and Johnson & Johnson did their best to keep things afloat, contributing about 66 points between them. It wasn't enough to offset the tech slide, though. If you’re looking for a silver lining, the index is still up over 2% since the start of the year. We're only two weeks into January, and the Dow is still within striking distance of that psychological 50,000 mark.

Why Should You Care About a 0.09% Drop?

Usually, a move this small wouldn't make the evening news. But the context matters. We are seeing a massive shift in where "smart money" is going. For the last year, it was all about AI and big tech. Now? People are looking at energy (which was up 2.26% today) and consumer staples.

There's also the "Trump Factor" to consider. Over the weekend, the President suggested a 10% cap on credit card interest rates. That might be great for your monthly bill, but it’s a nightmare for bank revenues. That’s a big reason why Visa and American Express have been among the worst-performing Dow stocks this week.

What Experts are Watching

Most analysts, like those at Charles Schwab and Morgan Stanley, are keeping a close eye on the "risk-off" sentiment. When the Nasdaq drops 1% and the Dow only drops 0.1%, it tells you that investors aren't fleeing the market—they’re just moving into "safer" value stocks.

- Intraday High: 49,195.10 (right after the open)

- Intraday Low: 48,851.98 (around noon)

- 10-Year Treasury Yield: 4.14%

The fact that we bounced off the session lows is actually a decent sign. It shows there are still buyers waiting in the wings whenever the Dow dips below 49,000.

The Road to 50,000

Is the Dow Jones Industrial Average today telling us the bull market is over? Probably not. Most 2026 forecasts, including those from Citi and Deutsche Bank, still have year-end targets between 51,000 and 54,000.

But it won't be a straight line up. We’re likely going to see more of these "choppy" days as the market digests earnings and waits for more clarity on trade policy and those rumored tariffs.

If you're managing your own portfolio, the move right now is less about timing the "perfect" entry and more about watching the sectors that are actually showing strength. Technology is taking a breather. Energy and staples are having a moment.

To stay ahead of the curve, keep an eye on the Goldman Sachs and Morgan Stanley earnings reports coming out tomorrow morning. Since financials make up nearly 28% of the Dow's weight, those numbers will likely dictate whether we claw back today's losses or head further down toward the 48,000 support level. Check your trailing stops and maybe keep a little extra cash on the sidelines—this volatility isn't going away anytime soon.