Honestly, if you ask the average person on the street what the "market" did today, they’ll probably give you a number from the Dow. It’s the ultimate shorthand. But here’s the thing: the dow jones industrial average index history is kind of a mess of weird math, sugar refineries, and accidental survivors. It wasn't built to be the high-tech, real-time beast it is today.

Charles Dow basically just wanted a way to explain the confusing world of 1890s finance to people reading his newspaper. He and Edward Jones—a statistician who probably did a lot of the heavy lifting while Dow did the writing—looked at the chaotic stock prices of the day and decided they needed a single number.

The 12-Company Start and the Sugar-Coated Economy

When the index officially launched on May 26, 1896, it was a tiny club. Just 12 companies. You’ve probably never heard of most of them. We’re talking about American Cotton Oil, Distilling & Cattle Feeding, and U.S. Leather. These weren't tech giants; they were the companies that literally fed and fueled a raw, industrializing America.

One of the weirdest facts? Only one of those original 12 made it deep into the 21st century: General Electric. But even GE isn't invincible. It was kicked out of the index in 2018, which felt like the end of an era for anyone following the dow jones industrial average index history.

🔗 Read more: Barnes and Noble Closures: Why the Big Bookstore Isn't Actually Dying

Why the Math is Actually Pretty Weird

The Dow is a price-weighted index. This sounds boring, but it’s actually a bizarre way to run a multi-trillion dollar indicator. Essentially, the index is calculated by adding up the stock prices of the 30 companies and dividing them by the "Dow Divisor."

In the beginning, the divisor was 12. Simple. Today? The divisor is a tiny fraction—well below 1. This means a $1 move in a high-priced stock like UnitedHealth Group moves the entire index way more than a $1 move in a lower-priced stock, even if the lower-priced company is technically much larger in terms of market cap. It’s a quirk that makes many modern analysts prefer the S&P 500, yet the Dow refuses to die.

The Great Expansion and the 1929 Nightmare

By 1928, the index grew to its current size of 30 companies. This was the "Roaring Twenties," and everyone thought the party would never end. The index hit a peak of 381.17 in September 1929.

👉 See also: Who Owns Whole Foods Market: The Truth About the Amazon Era

Then everything broke.

The 1929 crash is the most famous scar in the dow jones industrial average index history. On Black Monday and Tuesday, the index lost roughly 25% of its value in just 48 hours. People didn't just lose money; they lost their entire concept of reality. It took until 1954—twenty-five years—for the Dow to finally claw back to its 1929 peak. Imagine waiting two and a half decades just to break even on your retirement fund. Brutal.

Crises, Bubbles, and the Modern Era

If you look at the long-term chart, it looks like a mountain range that mostly goes up, but the "mostly" hides some terrifying drops.

- 1987 Black Monday: The Dow dropped 22.6% in a single day. To put that in perspective, that would be like the market losing over 10,000 points in one afternoon today.

- The Dot-Com Burst (2000): After a massive run-up in the late 90s, the index suffered as tech companies with no profits finally imploded.

- The 2008 Financial Crisis: This was the era of the "777-point drop." At the time, it was the largest point drop ever, triggered by the rejection of the bank bailout bill.

Fast forward to the 2020s, and we’re seeing point swings that would have made Charles Dow faint. During the COVID-19 crash in March 2020, we saw several 1,000-point moves in a single day. The recovery was just as wild. By early 2026, the index has been flirting with the 50,000 mark—a number that seemed impossible even a decade ago.

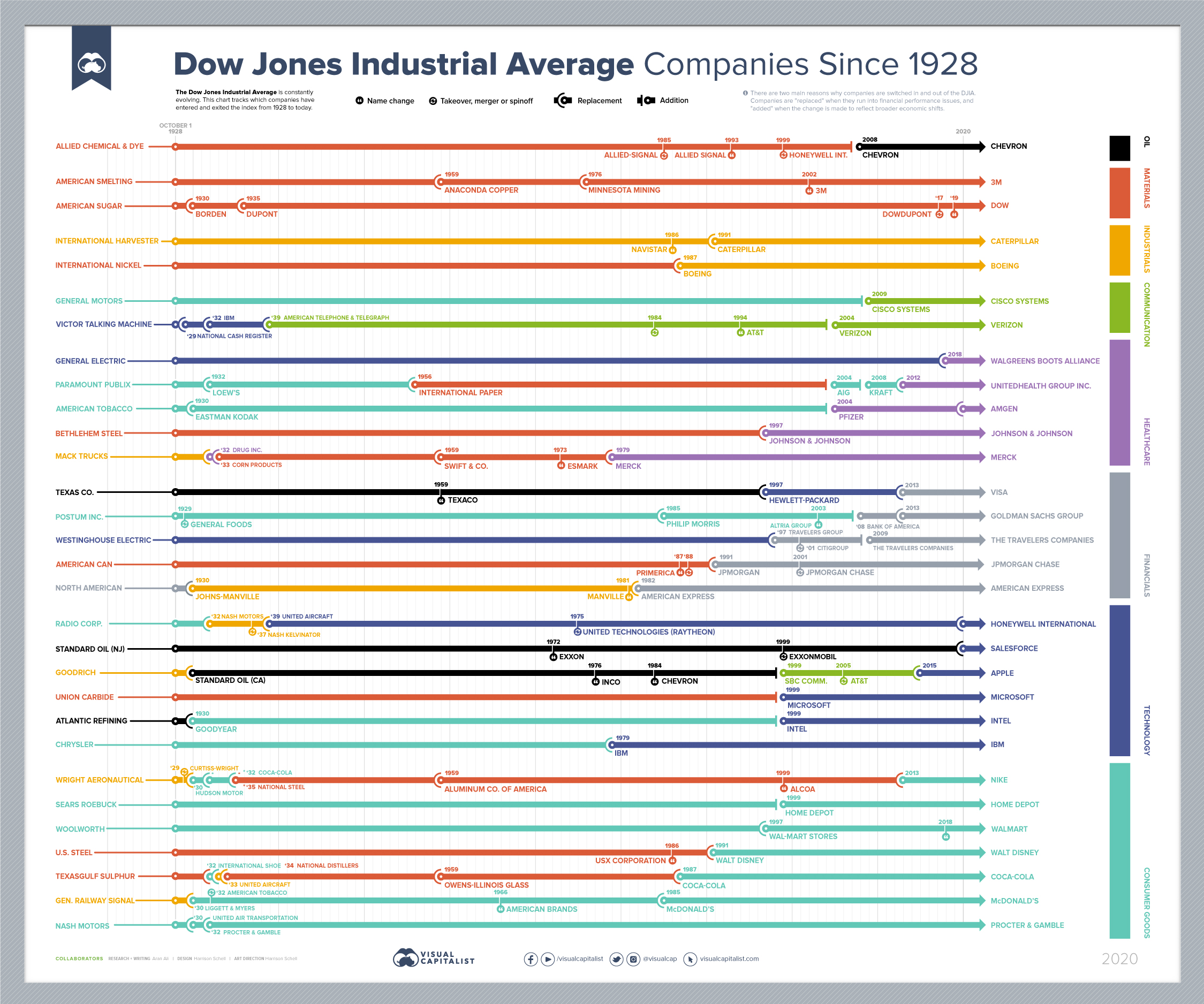

The Changing Guard: Who's in Now?

The "Industrial" part of the name is basically a legacy title now. The index today is dominated by tech and services. Look at the recent additions:

- Amazon (2024): Finally added to reflect the shift to e-commerce.

- NVIDIA (2024): Replaced Intel, signaling the massive shift toward AI.

- Apple (2015): It took way longer than you’d think for the world’s most famous tech company to get the call-up.

Actionable Insights for the Modern Investor

Looking at the dow jones industrial average index history isn't just a trip down memory lane; it tells you exactly how the American economy is being reshaped in real-time.

Watch the Weighting Remember that the Dow is price-weighted. If you’re tracking your portfolio against it, keep in mind that a few high-priced stocks (like Goldman Sachs or UnitedHealth) have a disproportionate impact. If they have a bad day, the Dow looks terrible, even if the other 28 companies are doing okay.

Volatility is the New Normal The history shows that "unprecedented" events happen about once every decade. Use the Dow as a pulse check, not a crystal ball. Historical data suggests that while the index can stay down for years (as it did after 1929), the long-term trajectory has survived world wars, pandemics, and the total collapse of the telegraph industry.

Diversification Beyond the 30 The Dow represents 30 massive, "blue-chip" companies. That’s a tiny slice of the thousands of stocks available. It’s great for seeing how the big dogs are doing, but it doesn't tell you much about mid-cap growth or emerging markets.

✨ Don't miss: Finding the Perfect Workout Franchise: What the Industry Insiders Won't Tell You

Rebalancing is Key The committee that manages the Dow (a group of editors from the Wall Street Journal and S&P Global) swaps companies out when they no longer represent the "current" economy. You should do the same. If a company in your portfolio starts looking like U.S. Leather in 1900, it might be time to find your 2026 equivalent of NVIDIA.

Study the past cycles of the dow jones industrial average index history to understand that every "end of the world" crash has eventually been followed by a new all-time high. It’s not a straight line, and it’s definitely not always logical, but it’s the most persistent record of American capitalism we’ve got.