You're lying in bed at 6:00 AM, squinting at your phone screen. The red or green numbers flickering on your favorite finance app feel like they're telling you exactly how your 401(k) is going to behave today. Most people think dow jones futures real time data is a crystal ball. It isn't. It's more like a weather vane in a thunderstorm—it tells you which way the wind is blowing now, but it doesn't mean the storm won't change direction by lunch.

Basically, futures represent an agreement to buy or sell the Dow Jones Industrial Average (DJIA) at a specific price on a future date. Because the stock market has actual opening and closing bells, but the world doesn't stop spinning, futures trade nearly 24 hours a day.

The Midnight Pulse of Wall Street

If you look at the E-mini Dow ($5 index) futures on the Chicago Mercantile Exchange (CME), you’re seeing global sentiment in its rawest form. When a major tech company in Japan reports earnings or the European Central Bank makes a surprise comment on interest rates at 3:00 AM Eastern Time, the futures react instantly.

Markets are interconnected.

When you see dow jones futures real time quotes dropping 200 points before you’ve even had your coffee, it’s usually a reaction to liquidity or overnight news, not necessarily a death sentence for the trading day. Honestly, the volume during these hours is way lower than during the regular session. This means a single large trade can skew the numbers significantly, creating what traders call a "fake out."

Why "Fair Value" Changes Everything

You might see the futures up by 50 points and assume the market will open exactly 50 points higher. It almost never works that way. You have to account for "Fair Value."

🔗 Read more: Enterprise Products Partners Stock Price: Why High Yield Seekers Are Bracing for 2026

Fair value is a calculation that factors in dividends and interest rates. It’s the theoretical price where a futures contract should be trading compared to the current cash index. If the dow jones futures real time price is higher than the fair value, the market is likely to open higher. If it's lower, expect a red start.

Traders often look at the spread between the two. If the Dow futures are up 100 but the fair value says they should be up 120, the market is actually showing relative weakness despite being "green." It's subtle stuff. But it’s the difference between a pro and an amateur.

The Psychology of the Pre-Market Gap

Gaps happen.

A "gap up" occurs when the market opens significantly higher than the previous day's close. This is fueled entirely by the movement in dow jones futures real time during the off-hours.

Think about it this way: if a major economic report like the Consumer Price Index (CPI) comes out at 8:30 AM and shows inflation is cooling, futures will spike. By the time the 9:30 AM bell rings, the "move" has already happened. Retail investors who jump in at the open are often buying the top of that initial surge.

💡 You might also like: Dollar Against Saudi Riyal: Why the 3.75 Peg Refuses to Break

Professional traders sometimes do the opposite. They "fade the gap." If the Dow futures are screaming higher on no real news other than momentum, pros might bet that the market will "fill the gap" by falling back toward the previous day’s closing price once the initial excitement dies down.

Key Players in the Futures Game

Institutional investors don't use futures just to gamble on the direction of the market. They use them for hedging.

Imagine you manage a $500 million pension fund. You’re worried about a geopolitical flare-up over the weekend. You can’t easily sell $100 million worth of individual stocks on a Sunday night. But you can sell Dow futures contracts to protect your downside.

The CME Group is the primary exchange here. They offer different flavors of these contracts. You have the standard Big Dow, the E-mini, and now the Micro E-mini. The Micro E-mini has become incredibly popular because it allows regular people to trade dow jones futures real time with much less capital. It’s one-tenth the size of the E-mini. It changed the game for the "little guy."

Watching the "Big Three" Indicators

If you're tracking dow jones futures real time, you can't look at them in a vacuum. You need to keep an eye on three other things that act as "gravity" for the Dow:

📖 Related: Cox Tech Support Business Needs: What Actually Happens When the Internet Quits

- The 10-Year Treasury Yield: When yields spike, futures usually tank. High rates are the natural enemy of stock valuations.

- The VIX (Volatility Index): Often called the "fear gauge." If the VIX is climbing while futures are flat, trouble is likely brewing.

- The U.S. Dollar Index (DXY): Since many Dow components like Apple and Boeing are massive exporters, a super-strong dollar can actually hurt their earnings, dragging down the futures.

Common Misconceptions That Cost Money

The biggest mistake? Treating futures like a guarantee.

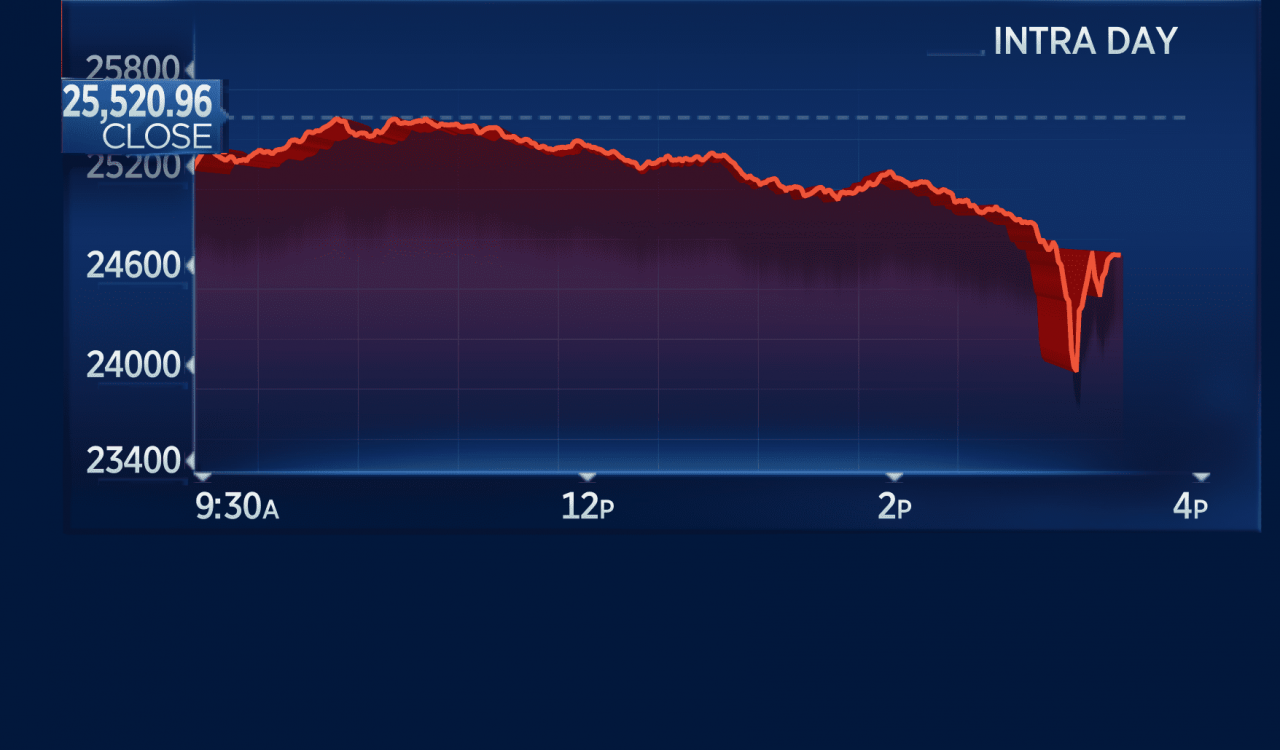

I've seen mornings where the Dow futures were down 400 points at 8:00 AM, and by 10:30 AM, the market was in the green. News breaks. Context changes. Sometimes a "bad" jobs report is actually seen as "good" by the market because it means the Federal Reserve might stop raising rates.

The market's logic is often counterintuitive.

Another mistake is ignoring "Triple Witching." This happens four times a year when long-term options and futures contracts expire simultaneously. On these days, dow jones futures real time data can become incredibly erratic and disconnected from reality because of massive institutional rebalancing. It's essentially a giant game of musical chairs.

How to Use This Data Without Losing Your Mind

Don't refresh the page every thirty seconds. It’s bad for your blood pressure and your bank account.

Instead, look for "Value Areas." These are price levels where the futures have spent a lot of time recently. If the dow jones futures real time price is hovering near a major support level—let's say 38,000—and it keeps bouncing off it, that’s a much stronger signal than a random 50-point jump at midnight.

Actionable Steps for Using Futures Data

- Check the Economic Calendar First: Before you even look at the futures, see if there's an 8:30 AM or 10:00 AM data release (like Jobs, CPI, or FOMC minutes). These events will override any "trend" you think you see in the overnight futures.

- Compare the Indices: If the Dow futures are up but the Nasdaq futures are down, there’s a rotation happening. Money is moving out of tech and into "Old Economy" stocks like industrials and banks. This tells you where the strength is.

- Wait for the "New York Open": The first 30 minutes of the regular session (9:30 AM to 10:00 AM ET) are the most volatile. This is when the "truth" of the futures movement is tested. If the market holds the futures' gains after the first half-hour, the trend is likely real.

- Use Professional Tools: Avoid delayed quotes. Use platforms like TradingView, Thinkorswim, or the CME Group’s own website for actual real-time data. Even a 10-minute delay makes the information useless for active decision-making.

- Watch the "Last Hour" of the Previous Day: Often, how the market closed yesterday dictates how the futures will behave tonight. A "strong close" usually leads to follow-through in the overnight session.

Stop treating the futures like a scoreboard and start treating them like a sentiment gauge. They represent the collective "bet" of global investors before the doors officially open. Use that information to plan your entries, not to panic-sell your long-term holdings.