Looking at a screen full of green and red candles is enough to give anyone a headache. Honestly, most people check the "Dow" like they check the weather—a quick glance at the daily change and then they move on with their lives. But if you actually dig into dow jones charts historical data, you aren't just looking at stock prices. You are looking at a messy, fascinating, and often terrifying map of human history. It's basically the heartbeat of the American economy since 1896.

The Dow Jones Industrial Average (DJIA) started with just 12 companies. Think about that for a second. General Electric was the only one that lasted into the modern era, and even they eventually got booted from the index in 2018. When you scroll back through the decades, you see more than just numbers; you see the rise of the assembly line, the desperation of the bread lines, the post-war boom, and the frantic clicking of the high-frequency trading era. It’s wild.

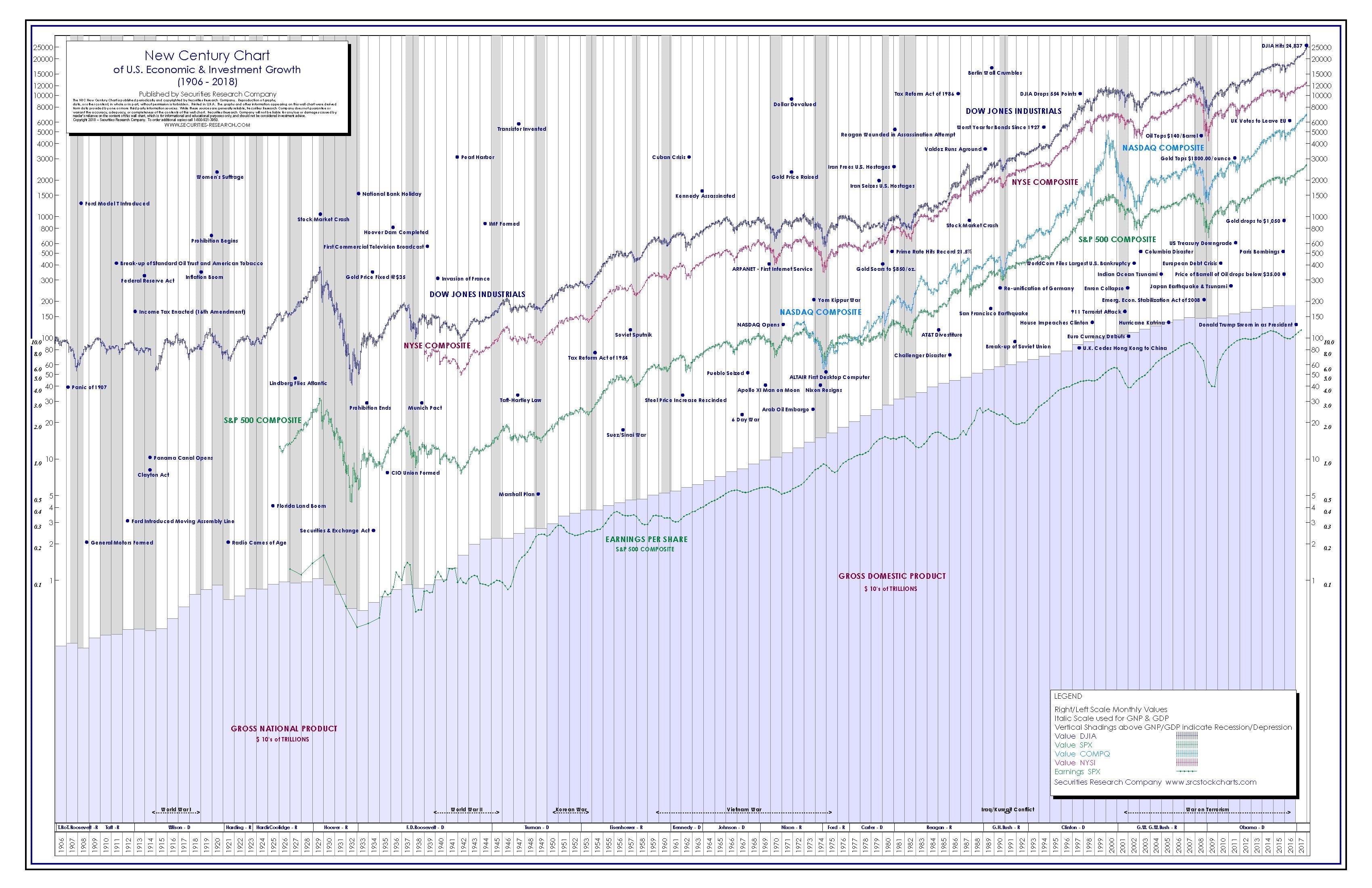

Reading the Story in Dow Jones Charts Historical Data

Most investors get caught up in the "noise" of the last 24 hours. That's a mistake. When you look at the dow jones charts historical timeline, the first thing that hits you is the scale. We’re talking about an index that was under 100 points for a massive chunk of the early 20th century. Today, a 100-point move happens in the time it takes you to brew a cup of coffee.

The 1929 crash is the big one everyone talks about. On "Black Tuesday," October 29, the market fell about 12%. But the real story is the aftermath. It took until 1954—nearly 25 years—for the Dow to claw back to its pre-crash highs. Imagine waiting two and a half decades just to get back to even. That’s the kind of perspective you only get when you zoom out. It humbles you. It makes those 1% daily drops feel like a tiny blip on a very long, very jagged line.

The Great Inflation and the Lost Decade

Everyone loves talking about the 1920s or the 1990s, but the 1970s were a weird, stagnant nightmare for the Dow. From 1966 to 1982, the index basically went nowhere. It would bump up against 1,000, get scared, and fall back down. If you look at the chart from that era, it looks like a flatline on a heart monitor. Except, because of inflation, investors were actually losing money every single year.

This is a crucial lesson in historical analysis: price isn't the same as value. You’ve got to account for what that money could actually buy. Experts like Jeremy Siegel, author of Stocks for the Long Run, often point out that while the nominal price of the Dow might stagnate, dividends are the secret sauce that keeps long-term investors afloat during these sideways grinds.

Deciphering the Modern Era: 1987 to Now

October 19, 1987. "Black Monday." The Dow lost 22.6% in a single day. One day! If that happened today, we're talking about a drop of thousands of points in a few hours. Looking at the dow jones charts historical view of 1987, it looks like a sharp cliff. But here’s the kicker: by the end of the year, the market was actually up.

🔗 Read more: Amelia DeLuca Delta Managing Director Sustainability 2021: Why It Was the Turning Point

That's the power of the bounce-back.

The 1990s changed the game entirely. Technology wasn't just a sector anymore; it became the engine. The Dow crossed 10,000 in 1999, a milestone that felt impossible just a decade prior. Then the dot-com bubble burst. Then 9/11 happened. Then the 2008 financial crisis. Each time, the chart looks like it's falling into an abyss. And each time, it eventually climbed out and reached a new peak.

It’s almost rhythmic.

You see these massive drawdowns—30%, 40%, even 50% during the Great Recession—and they look permanent at the time. Headlines scream about the "death of equities." But the chart shows a different reality. It shows resilience. It shows that as long as companies keep innovating and people keep buying stuff, the trajectory tends to lean up and to the right, even if the path is littered with wreckage.

The Role of Composition

People forget that the Dow is a price-weighted index. This is kinda weird, right? It means a stock with a $300 share price has more influence than a stock with a $50 share price, regardless of how big the company actually is. When you analyze dow jones charts historical movements, you have to realize the index itself changes its skin.

- In the early days, it was all railroads and steel.

- Then came the automakers and oil giants.

- Now, it’s dominated by tech heavyweights like Microsoft and Apple, alongside financial titans like Goldman Sachs.

The Dow is basically a ship that replaces its planks while it's still sailing. By the time you look at the chart 20 years later, it’s a completely different vessel. This is why comparing 1920 to 2026 is a bit like comparing an ox cart to a SpaceX rocket. They both get you somewhere, but the mechanics are totally different.

Why the Logarithmic Scale Matters

If you look at a standard linear chart of the Dow over 100 years, the early part of the century looks like a flat line, and the last ten years look like a vertical wall. It’s misleading. To actually understand the growth, you have to use a logarithmic scale.

On a log chart, the move from 1,000 to 2,000 (a 100% gain) looks the same as the move from 20,000 to 40,000. It levels the playing field. Suddenly, the "huge" gains of recent years look a lot more like the historical norms. It helps take the emotion out of the numbers. You realize we aren't in some unprecedented bubble every single time the market hits an all-time high; we are just following a compounding curve that has been in place for over a century.

Volatility is the Price of Admission

There's no such thing as a smooth line in finance. The dow jones charts historical record is a testament to volatility. We’ve had World Wars, pandemics, assassinations, and cold wars. The 2020 COVID-19 crash was one of the fastest drops in history, followed by one of the fastest recoveries.

The chart shows that volatility isn't a bug; it's a feature.

If there was no risk, there would be no return. Investors who "panic-sell" when they see a sharp downward spike on the chart usually miss the vertical recovery that follows. If you missed just the ten best days of the market over the last few decades, your total returns would be cut in half. That is a staggering statistic. The historical data proves that time in the market is almost always better than timing the market.

👉 See also: How Many Stimulus Checks Were There? What Actually Happened and Why It Matters Now

How to Use These Insights Today

So, you’ve spent some time staring at the long-term trends. What now? You can't trade the past, but you can certainly learn from it.

First, stop obsessing over the "all-time high." The Dow spends a surprising amount of its life near all-time highs. It’s supposed to go up over time. If it didn't, nobody would invest in it. Seeing the index at a record level isn't a sign of an immediate crash; it's a sign of a functioning economy.

Second, look for the "drawdowns." Historical charts show that a 10% correction happens roughly once a year. A 20% "bear market" happens about every seven years. If you know these are coming, you don't have to freak out when they arrive. You can treat them like a seasonal storm instead of the end of the world.

Third, pay attention to interest rates. When you overlay interest rate cycles on dow jones charts historical data, you see a clear relationship. When the Fed cuts rates, the market usually cheers. When they hike them to fight inflation—like in the early 80s or 2022—the market tends to struggle. It’s a tug-of-war between the cost of borrowing and the growth of earnings.

Practical Steps for Your Portfolio

Don't just be a spectator of history. Use the data to build a sturdier strategy.

- Audit your timeframe. If you need your money in two years, the historical volatility of the Dow suggests you shouldn't have it all in stocks. If you have twenty years, the history says you'll likely be fine despite the inevitable crashes.

- Check the "yield." The Dow isn't just a price; it’s a collection of companies that pay you to own them. During flat periods in the chart, those dividends are your best friend. Look at the "total return" version of the chart, which reinvests dividends, to see the real power of the index.

- Embrace the "sideways." History shows the market can go nowhere for years. Use these times to accumulate more shares. When the breakout eventually happens—and history says it will—you’ll want to have as many "seats" as possible.

The Dow Jones is more than a number on the evening news. It’s a record of every innovation, failure, and recovery we’ve ever had. When you look at a historical chart, don't just look for a trendline. Look for the moments where the world felt like it was ending, and then look at what happened next. The line kept going. It usually does.