Stocks are doing that weird thing again. You know, where the headlines look like a crime scene but the actual numbers tell a different story? Honestly, if you just glanced at your phone today, you probably saw "Dow tumbles" or "Bank stocks crater" and figured it was time to hide under the mattress. But let's look at the dow jones averages today with a bit more nuance because the 30-stock index is actually showing some weirdly impressive grit.

As of Wednesday afternoon, January 14, 2026, the Dow Jones Industrial Average is hovering around 48,925. That’s a dip of about 0.1%. Compare that to the tech-heavy Nasdaq, which is currently getting absolutely smoked—down a full 1%—and you start to see the divergence. The S&P 500 is split down the middle, off about 0.5%. Basically, the Dow is the only thing keeping the market from looking like a total disaster.

What’s Dragging the Dow Jones Averages Today?

It’s the banks. There’s no other way to spin it. We’re in the thick of Q4 earnings season, and the big boys are not having a great time. Citigroup (C) and Wells Fargo (WFC) both reported this morning, and the reaction was... well, cold. Citigroup shares dropped 3.4% after a rare earnings miss. Apparently, exiting Russia is still haunting their balance sheet. Wells Fargo fared even worse, sliding 4.6% after missing revenue targets.

Then you have the "Trump Effect" looming over the sector. President Trump’s recent suggestion to cap credit card interest rates at 10% is sending shivers through the financial components of the Dow. JPMorgan (JPM), which already took a hit yesterday, is down another 1% today. When you realize that financials make up a massive chunk of the Dow’s weighting, it’s actually kind of a miracle the index is only down 40 or 50 points.

✨ Don't miss: General Electric Stock Price Forecast: Why the New GE is a Different Beast

The Unexpected Heroes: Chevron and Health Care

So, what’s stopping the bleeding? Energy and defensive plays. Chevron (CVX) is up nearly 2% today. Oil prices are climbing as tensions with Iran dominate the news cycle—WTI crude is sitting right around $60.15 a barrel. When the world gets nervous, people buy oil and gold. Speaking of gold, it just hit an all-time high of $4,650 an ounce. People are genuinely spooked about geopolitical stability, and that’s flowing directly into the "old economy" stocks that live in the Dow.

Health care is also acting as a massive anchor. Johnson & Johnson (JNJ) and Merck (MRK) are both in the green. It’s the classic "risk-off" playbook. If you’re worried about a trade war with China or missiles in the Middle East, you don't buy a speculative AI software startup—you buy the company that makes the Tylenol people are going to need for their stress headaches.

The China Chip War and the Tech Exit

We can’t talk about the dow jones averages today without mentioning why everyone is running away from the Nasdaq and into the Dow’s safer arms. There are reports today that China is telling its local firms to stop using U.S.-made cybersecurity software. That’s a direct hit to the tech sector.

🔗 Read more: Fast Food Restaurants Logo: Why You Crave Burgers Based on a Color

Apple (AAPL) and Microsoft (MSFT) are both struggling, down around 1.4% and 2% respectively. Even Nvidia (NVDA), the golden child of 2025, is shedding about 2% today. Investors are realizing that the "picks and shovels" of the AI revolution are vulnerable to the same old-school trade barriers we’ve seen for decades.

Inflation is "Fine," But Retail is Too Hot?

The economic data we got this morning was a bit of a mixed bag. The Producer Price Index (PPI)—which is basically inflation for the people who make things—came in exactly where everyone expected. That’s good. But then retail sales came in "hotter" than expected.

In a normal world, people spending money is good. In the 2026 "will-they-won't-they" Federal Reserve world, hot retail sales mean the Fed might stay grumpy and keep interest rates higher for longer. Philly Fed President Paulson hinted today that rates are still "a little restrictive," but the market isn't fully convinced we’re getting more cuts soon.

💡 You might also like: Exchange rate of dollar to uganda shillings: What Most People Get Wrong

Why This Matters for Your Portfolio

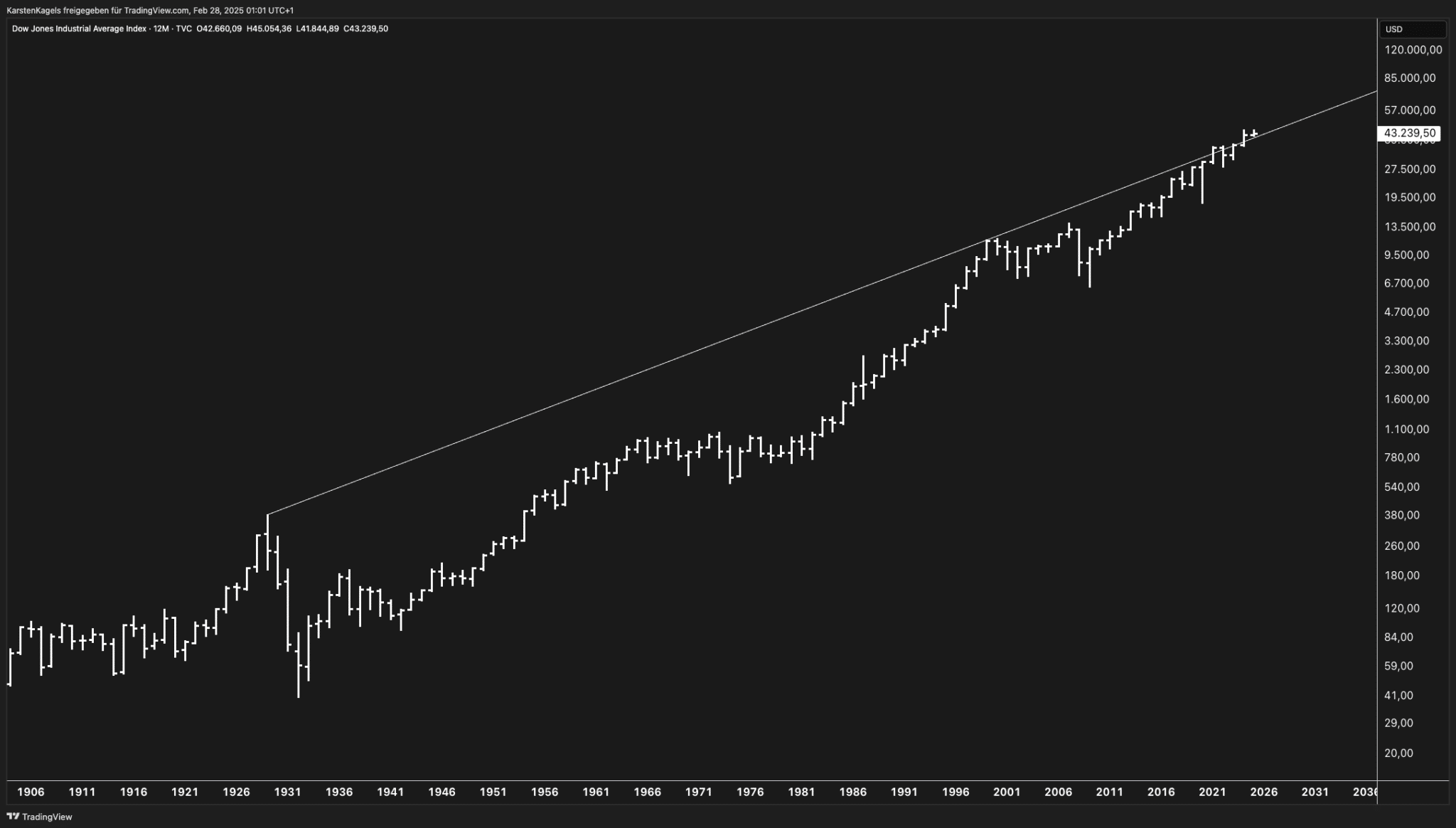

If you're looking at the dow jones averages today and wondering if you should sell everything, take a breath. We’re seeing the first back-to-back loss for the markets in 2026. After the monster run we had in 2025, a little bit of a pullback is actually healthy. It’s what the pros call "digesting the gains."

The real story isn't the 0.1% drop. It's the rotation. Money is moving out of high-flying tech and into "boring" Dow stocks like Verizon (VZ) and Procter & Gamble (PG).

Actionable Insights for the Week Ahead:

- Watch the $48,800 Level: The Dow has strong support here. If it closes below this, we might see a quicker slide toward 48,000.

- Keep an Eye on Gold: With gold at $4,650, the "fear trade" is officially on. If gold keeps rallying while the Dow stays flat, it's a sign that big institutional money is hedging for something messy.

- Bank Earnings Aren't Over: We still have more financials reporting. If the trend of "resilient consumers but messy balance sheets" continues, expect the Dow to underperform the broader market for the rest of the month.

- Ignore the Intraday Noise: The spread between the Dow and the Nasdaq today is over 0.9%. That’s a huge gap. It tells you that the "AI at any price" trade is cooling off, and value is finally having a moment again.

Don't let the red tickers freak you out. The Dow is actually holding the line much better than its flashier cousins. Sometimes, being the "boring" index is exactly what you want when the world feels a little chaotic.

Next Steps for Investors:

Check your exposure to the banking sector. With the 10% credit card interest cap proposal and recent earnings misses from Citi and Wells Fargo, the financial heavyweights in the Dow may face continued pressure. Consider rebalancing toward the energy or healthcare components of the DJIA if you're looking to hedge against further tech volatility.