You’re standing in a line at a bank in Port of Spain, or maybe you're just refreshing a banking app, hoping the "insufficient funds" for your international subscription finally clears. It’s frustrating. Honestly, the dollar trinidad y tobago (TTD) situation has become more than just a currency exchange rate; it’s a daily conversation at every doubles stand and boardroom across the twin islands.

Most people look at the official rate—hovering around 6.75 to 6.79 TTD per 1 USD as of January 2026—and think that’s the end of the story. It isn't.

🔗 Read more: Euro to Dollar Conversion Rate by Date: Why the Timing of Your Exchange Actually Matters

The reality of the dollar trinidad y tobago is a tale of two markets. There is the rate you see on the Central Bank's website, and then there is the price you actually pay if you’re a business owner trying to restock inventory or a parent paying tuition for a child at a university in Canada or the States.

The Gap Between Official and Reality

Why can't you just walk into a bank and buy US dollars whenever you want?

Basically, the country operates on what’s called a "managed float." The Central Bank of Trinidad and Tobago (CBTT) keeps the exchange rate within a very tight range. They do this by injecting US dollars into the commercial banking system. But the demand for those dollars—driven by our heavy appetite for imported cars, electronics, and even basic food—consistently outstrips what the energy sector brings in.

Think about this: natural gas production has been the lifeblood of the TTD for decades.

Energy exports provide over 80% of our foreign exchange.

When production dips, as it has recently, the supply of USD shrinks.

Economist Marla Dukharan has been vocal about this for years. By late 2025, net official reserves had fallen to around US$4.6 billion. That sounds like a lot, but it represents only about 6.6 months of import cover. In the mid-2000s, we had nine months or more. We are tighter now. Much tighter.

The Rise of the "Gray" Market

When you can't get money from the bank, you go elsewhere. This has led to a persistent parallel market. You've probably heard of people paying 7.50, 8.00, or even more for a single US dollar.

This isn't just "black market" stuff for shady deals. It’s local manufacturers trying to keep their factories running.

It’s retailers trying to ensure there’s cereal on the shelves.

When businesses pay these higher rates, they don't just eat the cost. They pass it on to you. That’s why your grocery bill feels like it’s doing gymnastics every week.

Why the Dollar Trinidad y Tobago Still Matters

You might wonder why we don't just let the currency float freely. If the market wants to pay 8:1, why not let it?

The government’s fear is inflation.

Sudden devaluation would make everything more expensive overnight.

Imagine the price of flour, medicine, and fuel jumping by 20% in a week.

The CBTT's November 2025 Monetary Policy Report showed headline inflation at a very low 0.4%, which they use as a justification to keep the TTD stable. They want to avoid the "shock" that countries like Jamaica or Guyana experienced in the past.

But there’s a flip side.

By keeping the dollar trinidad y tobago "artificially" strong, we actually make it harder for local companies to export. If a local craftsman makes a chair that costs $1,000 TTD, at the official rate, it costs a foreigner about $148 USD. If the rate moved to 8:1, that same chair would cost the foreigner only $125 USD. A cheaper TTD could, in theory, help us sell more "Made in T&T" products to the world.

✨ Don't miss: Eileen Wilder Net Worth: How a Former Pastor Hits Million-Dollar Days

The 2026 Outlook

The January 2026 data shows the CBTT is still holding the line. The Repo rate—the interest rate at which the Central Bank lends to commercial banks—sits at 3.50%. They are trying to balance the need for growth with the need to protect the currency.

Recent moves include:

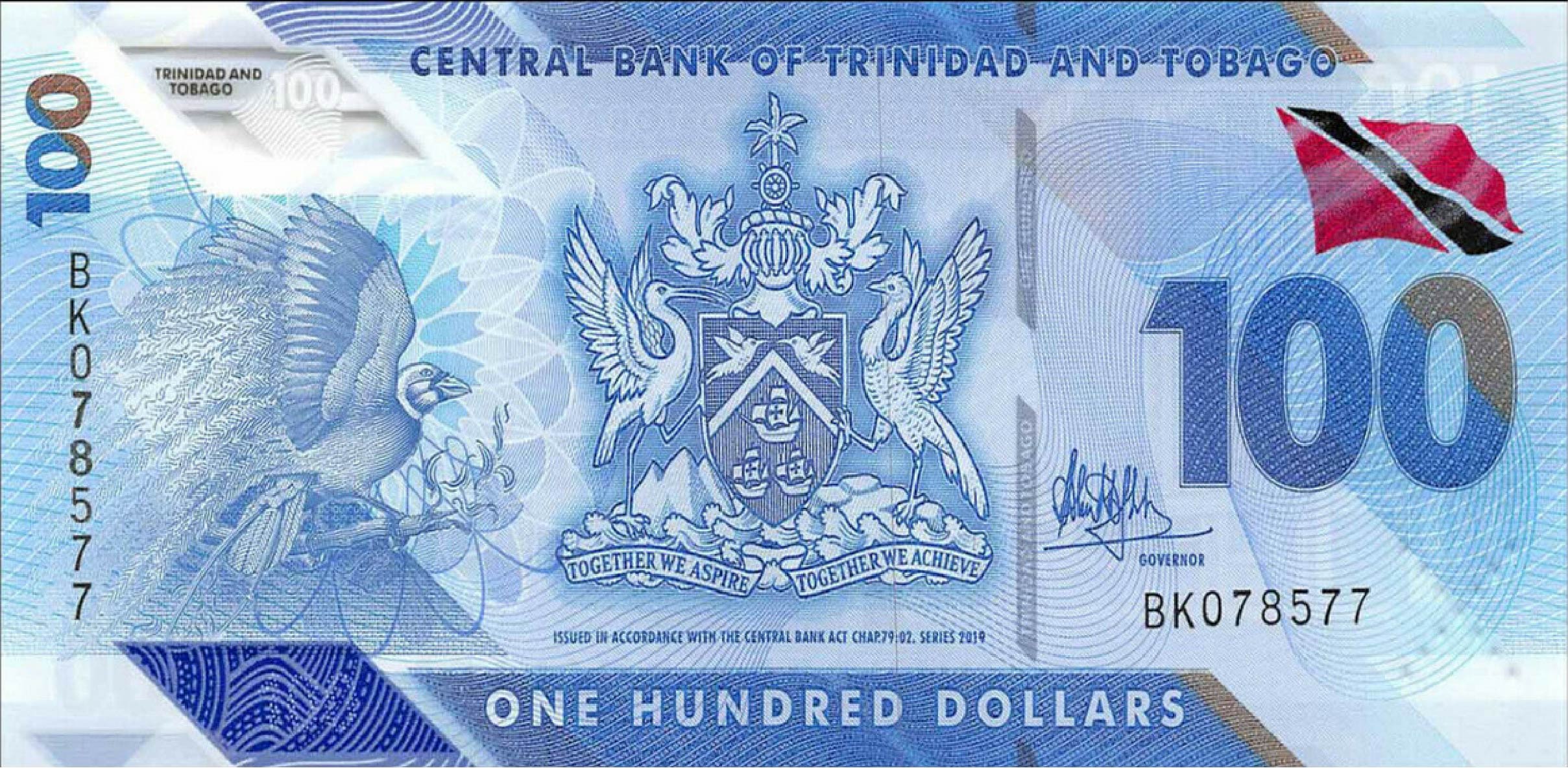

- New Banknotes: The introduction of the Series 2026 banknotes with the updated Coat of Arms.

- Digital Payments: Pushing for "LINX" debit payments at Customs to reduce the reliance on physical cash.

- Incentives for Exporters: Trying to get companies that earn USD to keep it in the local system rather than holding it in offshore accounts.

Honestly, the "forex" problem isn't going away by magic. The 2025/2026 Budget was framed around "Economic Fairness," but the structural deficit remains. We spend more foreign exchange than we earn. It's a simple math problem with a very complex political solution.

What You Can Actually Do

If you’re living with the dollar trinidad y tobago every day, "waiting and seeing" isn't a strategy. You have to be proactive.

First, look at your spending. If you're buying everything from Amazon, you're using up your credit card's USD limit (which many banks have slashed to as low as $2,000 USD per month—or less). Switching to local alternatives isn't just "patriotic"; it’s a way to hedge against the day the limit hits zero.

Second, consider USD-denominated investments. Organizations like the Unit Trust Corporation (UTC) offer USD funds. Even if the interest rate is low, holding the actual currency protects you if the TTD eventually devalues.

Third, if you’re a business owner, look into the EximBank. They have specific facilities for manufacturers to access foreign exchange at official rates, provided they are producing goods for export. It’s one of the few "fast tracks" left in the system.

The dollar trinidad y tobago is in a delicate spot. We are watching the energy markets and the Central Bank’s reserves like hawks. For now, the "peg" holds, but the pressure under the surface is real.

Actionable Steps for Navigating the TTD Market:

- Audit your subscriptions: Cancel those USD streaming services or apps you don't use to preserve your monthly credit card limit.

- Talk to your bank about "Business FX": If you’re importing, don't wait until the invoice is due. Start the application for USD weeks in advance.

- Diversify your savings: If you have the means, look into opening a USD savings account or a local mutual fund that trades in foreign currency to hedge against future shifts.

- Support local manufacturing: Reducing the national demand for imports is the only long-term way to take the pressure off the exchange rate.

The situation is tricky, but understanding the mechanics behind the dollar trinidad y tobago is the first step toward not getting caught off guard when the next policy shift happens. Keep your eyes on the Central Bank's "Monetary Policy Announcements"—the next big one is scheduled for late March 2026. That will be the real indicator of where we're headed for the rest of the year.